Anetlanda/iStock via Getty Images

Over 6 years after going public, Camping World Holdings (NYSE:CWH) still trades at the same levels as the IPO. The company has expanded the business and built up the profit margins, but the downside of covid pull forwards has investors fading the stock. My investment thesis is ultra Bullish on the RV leader after his period of normalizing demand at higher levels.

Difficult Times

Only a month ago, Camping World reported quarterly numbers with statements regarding solid sales in April and into early May. According to data, RV sales dropped 31% in April and Baird predicted another 20% dip in May.

Camping World only reported Q1’22 results on May 4, so the numbers appear to contradict the commentary provided by CEO Marcus Lemonis on the earnings call:

As we head into the core selling months for our company, we are pleased with revenue trends in April and through today, and we’re going to continue to monitor closely those factors that affect our industry, our consumers and your investment. As part of that investment, our commitment is to grow profitably.

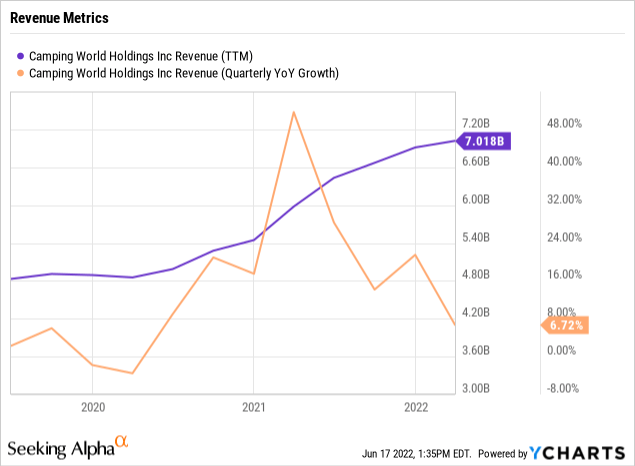

Anyone just needs to look at the revenue metrics from the last 3 years to see how Camping World saw a massive demand surge during the start of the selling season in 2021. After an initial plunge in demand in 2020, consumers quickly figured out that the best vacation option during covid shutdowns were outdoor activities with a prime focus on recreational vehicles, or RVs, where families didn’t have to interact with other families.

The company saw growth surge to over 50% in Q1’21 and the key summer selling season saw a couple of quarters of nearly $2 billion in sales from strong growth on top of a great 2020 summer. Camping World saw TTM sales grow from below $5 billion in 2019 to over $7 billion now.

The chart is clear that an adjustment is needed to account for the irrational sales pull forward. A lot of consumers bought an RV for the first time in the last couple of years limiting the supply of new first-time buyers and probably contributing to a build up in used inventory this year.

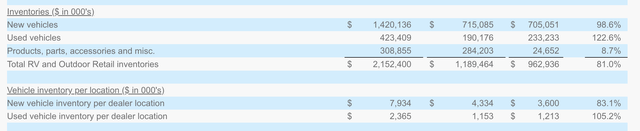

Even worse, while the whole world was still facing supply constraints, Camping World suggested inventories started Q2’22 back at normal seasonal levels. At the end of March, inventories were $2.15 billion, up over $0.36 billion from just the $1.79 billion at the end of 2021.

The vehicle inventories were $1.8 billion, a nearly doubling of the levels from last Q1. Camping World added 14 locations in the year to reach 179 RV dealerships plus 10 additional RV service and retail centers, so some growth was warranted.

As mentioned, the new and used vehicle inventories were up over 100% with the parts inventory only up 9%. Even the vehicle inventory per store was up strong at 83% for new vehicle inventory and 105% for used vehicle.

Source: Camping World Q1’22 earnings release

If one goes back to Q1’20, total inventories were only $1.44 billion, though the amount was down from $1.62 million in Q1’19 before any of the covid impacts. Camping World only had 147 RV dealerships in Q1’19. Looking at the inventory per store, the inventory was $8.0 million each compared to over $10.3 million now.

The company told a story of inventory at more normal levels now, but the RV industry leader appears to have far more inventory this year. The new vehicle inventory per store is up ~10% to $7.9 million while the used inventory has tripled from $0.8 million to $2.4 million.

Camping World has intentionally built up the used inventory to build up a resale market and provide more opportunities for consumers to trade up from a towable to a motorhome over time. The management team is sharp, but the inventories appear too high for a scenario where sales are down 20% to 30% compared to last year. Due to the huge sales ramp last year, sales down 20% in Q2’22 would equate to a more normal level.

Let The Shoe Drop First

At $22, the stock gets very interesting, but the first shoe needs to drop. Analysts have Camping World earning nearly $5 in 2022 with a minor dip in 2023 to $4.58 per share.

Any investor will love owning a stock at 4x to 5x earnings, but the revenue targets are flat this year. The industry numbers suggest Camping World is due for a huge revenue decline here.

When combined with the higher inventory levels, the stock is too risky to load up just yet. The company plans to whittle down the inventory levels as the peak selling season occurs during the summer months. Assuming all goes well, investors can probably buy the stock at the current levels. If inventories start to pile up, Camping World heads much lower.

The stock only has a market cap of $2 billion with EBITDA in the $500 to $550 million range based on more normalized numbers from 2020. Once normalized, Camping World is a very interesting investment opportunity. Lemonis has built the business a lot over the last 6 years, yet the stock hasn’t gone anywhere in this long period.

Takeaway

The key investor takeaway is that Camping World is far too cheap here at a market cap of $2 billion, but the cyclical RV market likely faces a tough year ahead. Investors should wait for the shakeup before buying the RV stock for the long haul.

Be the first to comment