Artur Plawgo/iStock via Getty Images

Enlivex Therapeutics (NASDAQ:ENLV) is a clinical stage pharmaceutical company developing a single drug candidate called Allocetra—an off-the-shelf, scalable, and affordable cell therapy which has been designed to reprogram macrophages in order to return them to their homeostatic state. It is currently being tested for life-threatening conditions such as sepsis and solid tumors, both as a standalone monotherapy and in combination with other therapies.

The approach of ENLV is to target macrophages, a type of white blood cell that performs immune system functions such as removing dead cells from the body, engulfing and eliminating intrusive and harmful microbes that have entered the body, and activating other immune system cells.

Sepsis is the body’s extreme response to an infection, whereby chemicals released in the blood to fight infection can trigger extreme inflammation in other parts of the body, potentially leading to organ failure. Like patients suffering from cancer, mortality rates for sepsis patients can be high.

ENLV researchers believe that the macrophages of sepsis and solid tumor patients are out of their normal homeostatic state, and rather than engaging in anti-inflammation, pro-organ restoration, and anti-tumor activities, are instead engaging in pro-inflammation, pro-organ failure, and pro-tumor activities. The goal of Allocetra is to correct this imbalance and return macrophages to their homeostatic levels, which should reduce rates of drug resistance in patients and lead to better rates of disease resolution.

Allocetra is a cell therapy, which refers to the practice of placing new cells into the patient’s body. After collecting cells from healthy donors, ENLV chemically modifies these donor cells using their proprietary process. The intent is to prompt the donor cells to send out an “eat me” signal, which is accomplished by expressing the biomarker phosphatidylserine, commonly known as “PtdSer.” Once the donor cells are placed into the patient’s body, the “eat me” signal attracts the macrophages in the surrounding inflamed area, which then engulf the donor cells. The engulfed donor cells then communicate with the macrophages while inside of them, and reprogram them in order to return them to their homeostatic state. ENLV’s method of communicating with the macrophages is proprietary, and forms the basis of their differentiated mechanism of action.

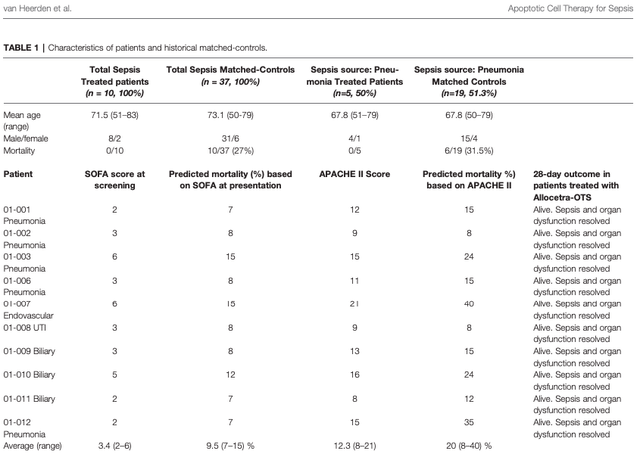

To date, the only results in humans that we have for Allocetra were published on September 30, 2021 in the journal Frontiers In Immunology. As you can see in Table 1 on page 4, of the ten sepsis-treated patients, all of them lived, and their sepsis and organ dysfunction were resolved.

Frontiers In Immunology; 9/30/21; pg 4

It does need to be pointed out that while the control group had a mortality rate of 27% (n=10/37), the phase 1b trial was run using a matched historical control. While this does not necessarily invalidate the results, using a matched historical control group is not as ideal as running a trial with simultaneous control and treatment groups. However, the currently-recruiting phase 2 sepsis trial will be a randomized, placebo-controlled, double-blind study. If the results can be replicated in phase 2, then this should alleviate investor concerns regarding the use of a historical control group in phase 1b.

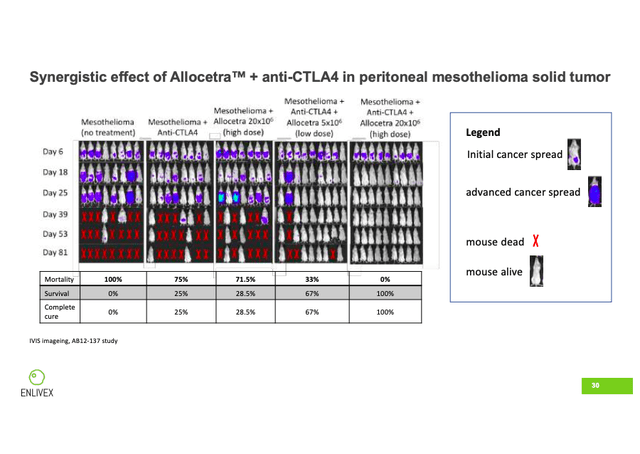

Thus far, all the solid tumor data we have is from animal models. But a quick glance at the results should make the potential impact of Allocetra very clear.

ENLV ran the solid tumor study in mice suffering from mesothelioma, an aggressive and deadly form of cancer that occurs in the thin layer of tissue covering the majority of internal organs. In addition to Allocetra, the study incorporated the immune checkpoint inhibitor anti-CTLA4. The five groups analyzed were: mesothelioma (no treatment), mesothelioma + anti-CTLA4, mesothelioma + Allocetra (high dose), mesothelioma + anti-CTLA4 + Allocetra (low dose), and mesothelioma + anti-CTLA4 + Allocetra (high dose).

On slide 30 of the company’s September 12, 2022 investor presentation, we can see clearly the encouraging results. By day 81, all eight of the mice in the no-treatment group had succumbed to the cancer. In the anti-CTLA4 group, only two of the eight mice were still alive, which was similar to the result of the high-dose Allocetra group (two of seven still alive). In the combo group of anti-CTLA4 + Allocetra (low dose), six of the nine mice were still alive. And finally, in the combo group of anti-CTLA4 + Allocetra (high dose), not only were all nine of the mice still alive, but all nine had a miraculous 100% cure rate.

Company Presentation; 9/12/22; Slide 30

Any seasoned biotech investor knows that the number of companies that have shown very promising results in animal models that did not translate into the same results in humans are too numerous to count. Thus, these incredible results should be taken with a very large grain of salt. But a 100% survival rate and a 100% cure rate in the mouse model is startling, and clearly shows the synergistic potential of Allocetra when combined with another cancer-fighting agent. At a minimum, the mouse model results are certainly deserving of further investigation.

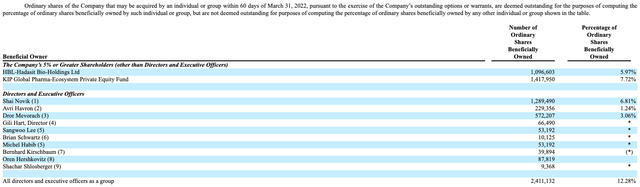

On April 29, ENLV filed their 20-F Annual Report, which shows the number of ordinary shares beneficially owned by company insiders (it needs to be emphasized that the number of ordinary shares beneficially owned includes outstanding options and warrants to purchase ordinary shares). As of March 31, 2022, company insiders owned approximately 12% of the outstanding ordinary shares (see pg. 82), with Executive Chairman Shai Novak owning almost 7% on his own.

Of Mr. Novak’s 1.3M potential shares, about 133K options have an exercise price of $2.69/share, and 174K have an exercise price of $3.66/share, with both exercise prices being below the current share price of about $4.00/share (as of September 29). However, Mr. Novak’s remaining options consist of 145K with an exercise price of $6.22/share, as well as 104K with an exercise price of $12.23/share, with both of these exercise prices being well above the current price.

It would have been preferable if the exercise prices of all options would have been significantly higher than the current share price, as a low exercise price does not create a very high hurdle for management to reach in order to cash out. But for new shareholders at least, this level of potential insider ownership can be seen as a positive.

One thing that investors should certainly like is the offering price of last year’s capital raise.

The $10M offering announced on February 9, 2021 after-hours was for 500K shares at a price of $20.00/share. This came at a 17% discount to the previous day’s close of $24.00/share. However, the stock had closed at $13.05/share on February 2, and after positive COVID data was announced on February 3, proceeded to climb up to $24.00/share over the next few days. Viewed in this light, the offering price of $20.00/share and the 17% discount do not seem so unfair to existing shareholders.

Furthermore, an expanded offering was announced later that same evening on February 9, 2021. The offering was expanded due to overwhelming demand, was also done at $20.00/share, and raised an additional $46M.

They announced second quarter results on August 22, and as of June 30, had cash and cash equivalents of $63M, which management expects to last through 3Q2024. This works out to a quarterly cash burn of about $7M. With Allocetra development still being at such an early stage, it’s very unlikely that they will finance future clinical expenses via debt offerings.

Instead, equity offerings will likely be utilized, as the prospectus filed on April 29 for up to $300M in new ordinary shares, warrants, and units would seem to imply. New equity offerings can be very dilutive to existing shareholders if the offering is done at a considerable discount to the current market price. Unfortunately, this is the main source of funding that early-stage biotechs have available to them. A partnership that involved funding for trials and might eventually lead to a buyout would be ideal, but Allocetra will likely have to be a bit more proven before that occurs. Investors need to be aware of the risk of heavy dilution.

While the COVID business opportunity has been de-prioritized, the early results that Allocetra has shown in both sepsis and solid tumors are very promising. It remains to be seen if the data can be replicated in larger-scale phase 2 and 3 trials. But the data we have available to us thus far is enough to understand the thesis here.

At this point, understanding the thesis for ENLV does not require the precision of a detailed financial model. Both sepsis and solid tumors are multi-billion-dollar global markets. Sepsis is now recognized as the leading cause of death worldwide, and there are no FDA-approved therapies. Cancer continues to remain a scourge on our public health, and though there are approved cancer drugs on the market, their effectiveness can be poor and inconsistent.

For both of these areas of study, then, the need is clear and the level of competition is appealing should Allocetra prove its differentiation. Putting the risk of trial failure aside, biotech stocks may remain stagnant or drift considerably between catalysts. Investors with a shorter time horizon should be aware of this.

Microcap stocks are priced as such for a reason, and the future cost and trial uncertainty that ENLV investors still have to bear are two main reasons why this stock is priced as it is at under a $100M market cap. But if you are looking for a microcap biotech stock that has shown potentially game-changing early results in the life-threatening diseases of sepsis and cancer, you would be hard-pressed to find one more compelling than ENLV.

Be the first to comment