JHVEPhoto/iStock Editorial via Getty Images

Autodesk (NASDAQ:ADSK) is an industry leader that has seen its valuation drop significantly in the past few months. As we begin to enter the middle portion of this new business cycle, high-quality companies with high margins and returns on capital are likely setting up to outperform going forward. As a result, we are bullish on Autodesk at these levels.

Quality-Factor Investing During the Mid-Cycle

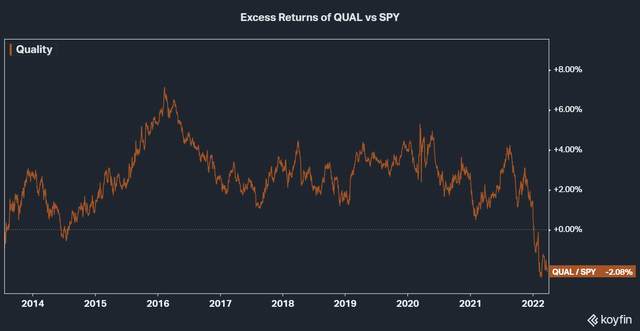

In the world of finance, investors like to break down stocks into groups called factors. These factors include value, growth, momentum, and quality, to name a few. The iShares MSCI USA Quality Factor ETF (QUAL), which we will use as reference in this article, defines quality as having a high return on equity, stable year-over-year earnings growth, and low financial leverage.

Below is the relative performance of QUAL versus the SPDR S&P 500 Trust ETF (SPY) beginning when we entered the mid-cycle of the previous business cycle:

As we can see from the chart above, quality outperformed the S&P 500 during most of the expansion. This is likely because as the initial boom of a new cycle begins to wear off, investors begin to move money into stocks that can maintain consistent growth and profitability throughout all business conditions.

However, we can also see that quality is currently underperforming due to the recent sell-off we’ve experienced in the past few months. As a result, quality stocks may be in a prime position to outperform from this point on. Since Autodesk is a holding in the QUAL ETF and has also seen a large decline in price, it both qualifies as a quality stock while being positioned to likely outperform as well.

Autodesk is an Inflation Hedge

Given that the company’s products, such as AutoCAD, are an industry standard, it is unlikely that users will turn towards other products. This is especially true since the software is difficult to learn and very time-consuming. The products of competitors are also difficult to learn, thus, creating a hurdle that most are unwilling to overcome.

As a result, Autodesk has strong pricing power, which it can use to pass on the cost of inflation to customers. It also helps that competitors have pricing power for the same reasons and will likely pass on costs to customers as well. This further reduces the incentive for customers to switch from one product to another.

In addition, since the company doesn’t sell physical products and has very low capital expenditures, it won’t be plagued by supply chain issues. The low CapEx requirements minimize the cost of reinvestments in physical properties, plants, and equipment that have been skyrocketing due to increasing commodity and input costs.

The same applies to companies that need to hold inventory. However, there is the added disadvantage of having to tie up more cash into larger and more expensive inventory purchases in order to shield themselves from potential future supply chain issues. In addition, since the cost of inventory is much higher today, companies will need to either absorb the costs or pass them on to consumers.

The issue might be that the price increases of these products will be much more noticeable to consumers. However, for Autodesk, it is likely that the price increases won’t need to be as dramatic as those of most other companies.

ADSK Stock Valuation

In our previous Autodesk article, we had placed a price target of $336 per share based on a discounted cash flow analysis. Thankfully we sold near our price target because, interestingly enough, Autodesk topped out at $344 before falling back down.

Nonetheless, that valuation was based on the market conditions and expectations that were present back in June of 2021. Since then, market conditions and expectations have changed, and the assumptions will need to be changed. However, we will approach the valuation differently this time.

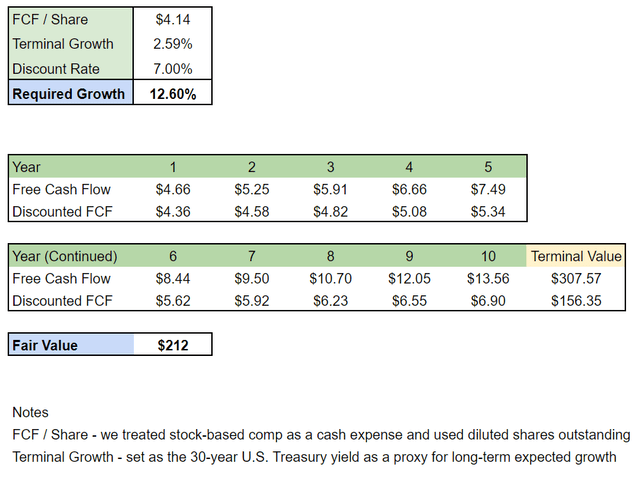

Instead of forecasting, we will reverse engineer the discounted cash flow to determine what growth rate is required under current market conditions to justify the current price. The results are as follows:

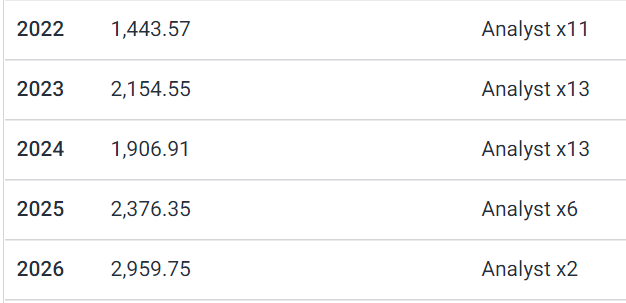

As you can see above, the company requires a compound annual growth rate of 12.6% over the next 10 years to be considered fair value under current market conditions. Analysts’ projections for free cash flows are as follows:

Simply Wall Street

With free cash flow from the last 12 months at $1.475 billion, this equates to a CAGR of 14.9%: (2959.75/1475)^1/5 – 1

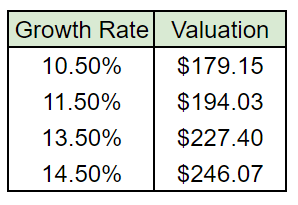

Since analysts are expecting growth of 14.9% over the next 5 years, it’s likely that Autodesk will exceed the required growth of 12.6% over the next decade. Below is the valuation with various growth rates:

Image created by the author

However, a few things are important to note. To begin with, our assumptions are very conservative because we treat stock-based comp as a cash expense. It’s worth mentioning that this expense was much higher as a percentage of free cash flow in 2021 than in previous years due to the stock’s performance. It’s possible that it will revert back to a lower percentage going forward.

In addition, we used diluted shares outstanding to calculate free cash flow per share. It’s possible that not all those dilutive shares will be granted. Lastly, we assume that the free cash flow will grow at only 2.59% after 10 years. We believe that it will take Autodesk longer than a decade to achieve terminal growth.

Therefore, given the conservative nature of our assumptions, we think a price target of $250 per share is reasonable.

Final Thoughts

Autodesk is an industry leader that we believe is well-positioned for outperformance going forward. It has macroeconomic tailwinds that are typical of quality stocks once entering the middle portion of a business cycle. Furthermore, it has the pricing power to hedge against inflationary pressures.

In addition, its recent decline presents investors with an opportunity to buy an excellent company at a good price. As a result, we are bullish on the stock and have initiated a new position.

Be the first to comment