Matt Winkelmeyer/Getty Images Entertainment

After being almost a year in the making, AT&T (NYSE:T) and Discovery have announced that their long-awaited historic deal has been finally closed on Friday. Almost eleven months after John Stankey and David Zaclav announced that Warner Media and the telecom will be parting ways, shares of the now two companies began trading independently this week.

A beginning of a new journey for both companies, we are confident that the deal unlocked value both ways, with the two entities clearly showings signs of incompatibility from the get-go. AT&T’s attempt to build up a conglomerate, clearly disliked by the market, has now been officially abandoned. The company now has a chance to do what it does the best as a slimmer and more importantly a significantly deleveraged telecom. Warner Bros Discovery (WBD) embarks on a new journey as one of the largest pure-play entertainment entities in the business.

Why was the deal a bad idea in the first place?

Timer Warner remains one of those assets that seems to have a terribly difficult time staying under one roof for a prolonged period of time. Its history is a long and dramatic one. That is a common trait that is shared with AT&T, whose turbulent history almost became synonymous with the history of the United States capitalism. That is possibly why some might have believed the two will stay under the same roof for a longer period of time. However, this has not come to be.

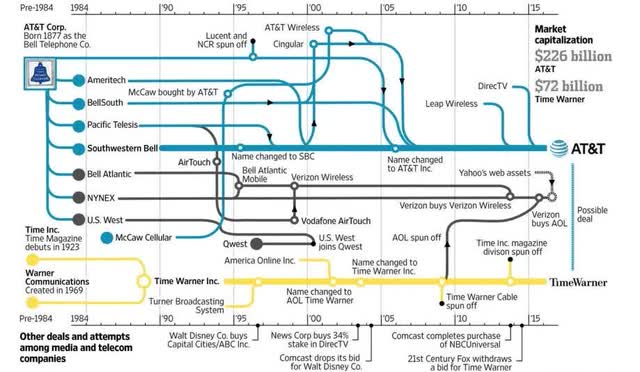

AT&T and TimeWarner History (Wall Street Journal)

A business started in 1877 as the original Bell Telephone Co turned into the great phone monopoly of AT&T, found itself broken up by the government in 1984, and has since slowly reconstituted itself as the massive oligopoly of the modern United States telecom industry. At the same time, Warner sucked up Time Inc to become Time Warner, merged with AOL in history’s most popular business punchline, un-merged, spun off Time Inc again, and is now being swallowed by AT&T while AOL is now part of Verizon(VZ).

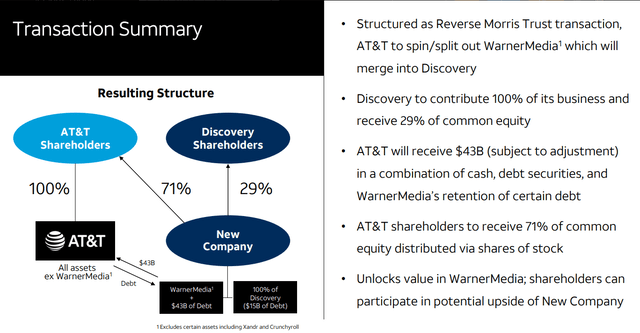

The deal was initially announced all the way back in May of 2021 when John Stankey and David Zaslav surprised investors around the world, announcing that AT&T’s Warner Media assets are set to merge with Discovery in a Reverse Morris Trust transaction. The initial announcement came as a huge surprise considering the telecom fought hand over fist to acquire Time Warner only years before. Now it was supposed to unwind AT&T’s $85 billion purchase of Time Warner.

Merger Structure (AT&T and Discovery Merger Presentation) One of the major and rather unexpected downsides of the then AT&T and Time Warner acquisition was the inability of investors and analysts alike to adequately assign value to premium Time Warner assets such as HBO or Warner Bros, which as a result of the deal got buried under the unattractive valuation of AT&T’s legacy business. The market has clearly shown that it was more than willing to assign high-end valuations to the fast-growing streaming and media empires of Netflix (NFLX) and Disney (DIS), which are now the main WBD competitors. While shareholders of both rivals enjoyed years of lucrative capital appreciation, shareholders of AT&T were faced with consistent stagnation, decline, and disappointment throughout the years.

There is a popular saying that “Most generals are born after a battle” and in hindsight, it is not that difficult to pick apart why the then $85 billion deal did not work out in the end. While it is not easy to quantify the acquisition’s direct benefit to the telecom’s legacy operations, it is now safe to conclude that the deal failed them in gaining an edge over competitors such as Verizon or T-Mobile US (TMUS). To make matters worse, even without something appealing as WarnerMedia, the rivals were selling at higher-end valuations throughout the period, with investors clearly taking a disliking to AT&T’s idea of building a media conglomerate.

Why should you keep the WBD shares?

We will begin the analysis by taking a look at AT&T’s best dividend in years, the Warner Bros Discovery distribution. Here is an explanation as to why the distributed shares could be quite more valuable than what the market would assume right now, and why most AT&T shareholders would be better off keeping on to their WBD distribution. Our full detailed analysis on the matter can be read in our Warner Bros Discovery article.

Warner Bros. Discovery’s content library can be easily compared to its main competitors in both quality and quantity. In fact, it brings so much to the table that some of them might grow increasingly displeased with this merger over time. The deal itself created a worthy competitor that is by design going to trade blows with the likes of Netflix and Disney, rather than combined with the lower end of the spectrum, the likes of Amazon Prime, Apple+, or Paramount+.

WBD Content Library (Deviant Art)

It is not difficult to see how a company with such a deep content portfolio as WBD would be becoming more successful as the years progress. The content portfolio as shown in the infographic below displays the true potential and the meaning of this merger. The portfolio covers a very wide selection of content, ranging from some of the greatest cinematic achievements on one end (LoTR, HP, GoT, etc.) to some of the “low intensity” content suitable for your average Sunday family gathering (TLC, Food Network, Discovery, etc.).

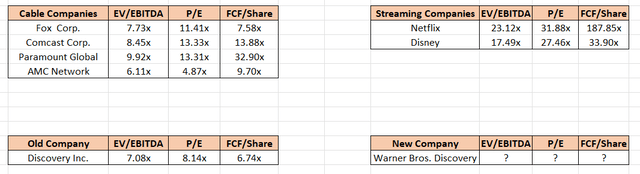

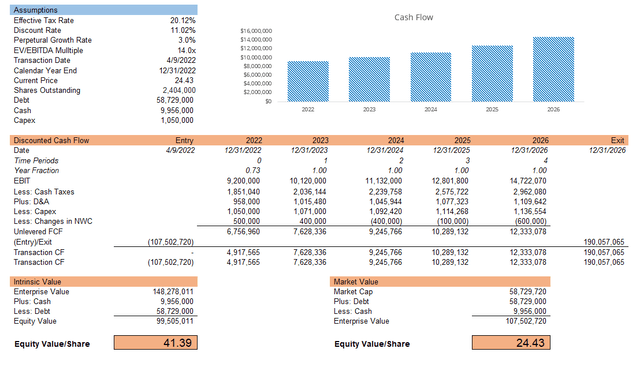

Estimated Valuation (Author Spreadsheet) The main investment thesis here is that the current intrinsic value of the now Warner Bros. Discovery got buried beneath the rubble of AT&T’s poor decision-making, damaged reputation, and the broader unappealing nature of their legacy telecom business. The CEOs, Stankey and Zaslav have put it well, the deal “simply unlocks value”. Once Warner Bros. Discovery starts trading on the market as a stand-alone combined company next week, investors will finally have a proper chance to assign a more appropriate valuation to the new steaming and media behemoth. During the process, Warner Bros. Discovery’s valuation will slowly move from legacy cable operators such as Fox (FOXA), Paramount (PARA), AMC (AMCX), or Comcast (CMCSA) towards more attractive valuations of their new rivals.

While it is true that both Amazon (AMZN) with their Amazon Prime and Apple (AAPL) with the Apple+ are trying to enter the streaming competition, the only real competitors as of now are Netflix and Disney. Furthermore, it becomes rather quite difficult to evaluate the two combined considering streaming is only a minor part of their huge business empire. Also, it is worth noting that both Disney and Netflix have had a very bad run of late and are already trading at somewhat depressed prices.

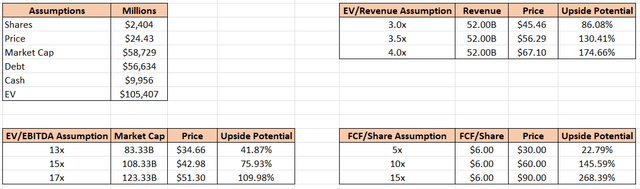

Price Projections (Author Spreadsheet) In regards to the EV/EBITDA assumption, we should see the company generating around $10 billion in EBITDA, depending on how well synergies play out and what the costs of the merger end up being. We know that Netflix sells for 23.12x EV/EBITDA, while Disney trades at 17.49x EV/EBITDA. This is after a period of strong downforce on both stocks, historically the five-year EV/EBITDA median for Netflix is set at 79.73x, while Disney was set at 23.54x. This tells us that Warner Bros Discovery’s fair value should be north of $40 per share.

The FCF/Share projection seems to be breaking our model at first, but as it was stated multiple times in the past, Warner Bros Discovery will become a Free Cash Flow machine. WBD is fundamentally speaking a very strong company and is expected to deliver extraordinary results in this sense. This is probably the best indicator of to what extent the company remains undervalued at this point. Historically, the five-year FCF median for Netflix is set at 189.89x, while Disney was set at 23.54x. According to this, the fair value of WBD should be well beyond $50 per share.

FCF Projection (Author Spreadsheet) Our Free Cash Flow model seems to indicate a potential upside of 69%, placing the fair value per share of the company at $41.39 per share. If the assumptions are correct, Warner Bros Discovery should be to becoming a $100 billion market cap. In the projection, an EV/EBITDA multiple of 14x was assumed, with a 3% perpetual growth rate alongside with assumed low double-digit EBIT growth rate over the next five years.

John Stankey’s new vision for AT&T

John Stankey’s vision for the “new AT&T” is fairly straightforward and simple, the new company’s plan is to become “the best” telecom in the business, not more than that and not less than that. After a couple of years of consolidation, the company is expected to be in great financial shape. It is not a far stretch to believe that investors will take a liking to this new, slimmed-down, and transformed version of AT&T.

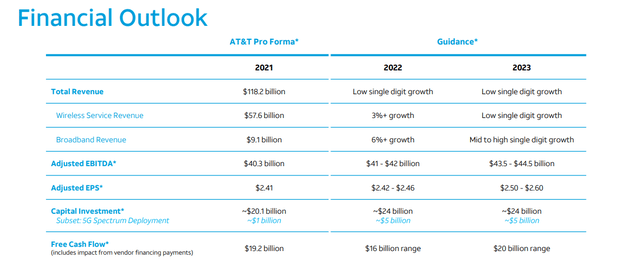

AT&T Financial Outlook (Investor Presentation)

The 2021 revenue for the new slimmed-down company is $118.2 billion, down almost $50 billion from the old $168.86 billion. It is expected to grow in the low single digits. In a similar manner, EBITDA is declining from $56.74 billion to little more than $40.3 billion, around a $16.5 billion cut. Adjusted EBITDA is expected to grow more rapidly over the next couple of years. EPS on the other end is expected to grow to $2.42-2.46 for next year, meaning the company is priced at under 8 P/E given the current market price.

AT&T is expected to ramp up its investment to deploy fiber and 5G and drive sustainable earnings growth. For 2022, AT&T expects capital investment in the $24 billion range. The company expects 2023 capital investment to be similar to 2022 levels and then to begin to taper to the $20 billion range starting in 2024. Free cash flow for the company is expected to stay relatively stable but slightly under $20 billion per year after the spin-off. As a standalone company, AT&T will also continue to pursue its transformation initiatives and sees significant opportunities to optimize its cost structure. By the end of 2023, the company expects to reach $6 billion in run-rate cost savings thanks to its transformation efforts.

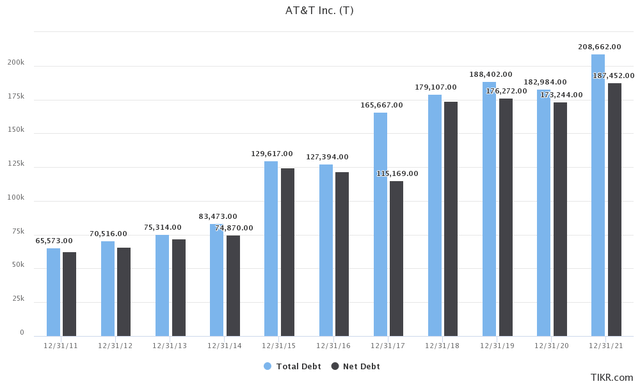

AT&T accumulation of debt (TIKR Terminal)

The most important impact of the Warner Media spin-off is undoubtedly the long-overdue reduction in debt. Reducing the highly inflated balance sheet is increasingly more important given the changes in the macroeconomic environment and could not have come at a better time. AT&T effectively slashed the debt by slightly more than $40 billion through this merger.. The company will likely utilize the synergies that will play themselves out to further reduce its debt and bring the net debt to EBITDA ratio to the 2.5x range by the end of 2023.

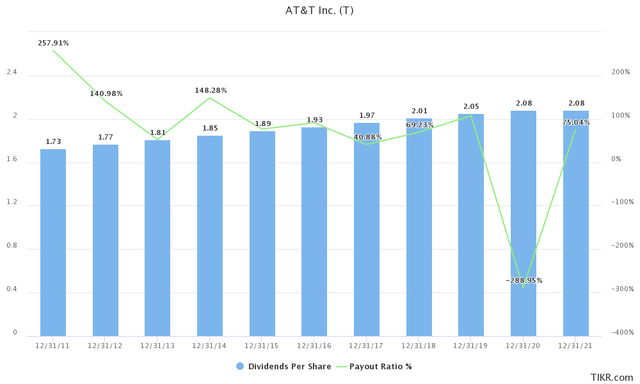

AT&T, prior to the spin-off, had one of the greatest dividend growth stories in history which ultimately made the company into a dividend aristocrat. The company had become beloved by dividend-oriented investors across the world for its high and attractive dividend. However, after several costly and unsuccessful acquisitions, the company started struggling with keeping up the dividend growth story, ultimately being forced to shift its focus over to maintaining the current dividend and deleveraging.

Dividend History (TIKR Terminal)

AT&T is expected to distribute just over $8 billion in cash via annual total dividends to its shareholders after the close of the WarnerMedia-Discovery transaction. This represents a payout of about 40% against expected 2023 free cash flow in the $20 billion range and will position the company’s stock among the best dividend-yielding stocks in the United States — near the top of the Fortune 500. It is highly likely that management will not increase the dividend in the upcoming years unless it falls within this rule.

One of the not so much talked about benefits of John Stankey’s new vision for the company is its approach to buy-back programs. Difficulties surrounding battling the debt and attempting to maintain their dividend obligations have placed the matter of buy-backs. For a company like AT&T, which had high dividend commitments but also strong cash flows, it always made sense to initiate a strong buy-back program.

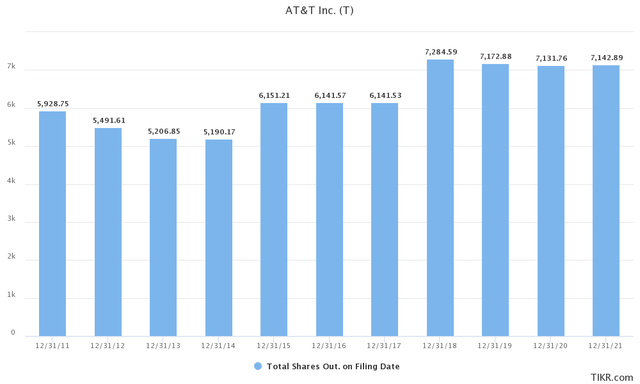

Shares Outstanding (TIKR Terminal)

In essence, each bought back share is one less dividend to pay out on a yearly level. Now, that optionality is back on the table. Hypothetically, with some back-of-the-paper math, a $2 billion buy-back would decrease the outflow of cash by $100 million per year and save the company almost $1.11 billion over the course of the next 10 years, assuming a $1.11 dividend and a $20 per share price.

Re-evaluating AT&T after the spin-off

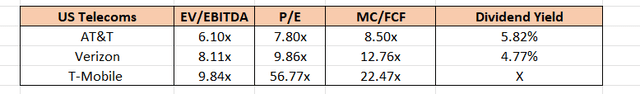

The US telecom oligopoly is ruled by three companies, AT&T, Verizon, and T-Mobile. After the spin-off, AT&T’s legacy business is by far the better value proposition compared to the old company. Based on today’s price of $19.08 per share and given management estimates for 2022, the company is selling at 7.8x NTM P/E. AT&T has an implied MC/FCF multiple of 8.5x for 2022. It will also be selling for roughly 6.1x NTM EV/EBITDA, given the estimated EBITDA of $41.5 million in 2022. The company is currently offering a 5.82% dividend yield.

T-Mobile US is probably not a typical telecom company, given its focus on growth combined with the fact the company is not paying out a dividend. Still, the company looks quite expensive as it sells for 56.77x NTM P/E and 9.84x NTM EV/EBITDA. T-Mobile has an implied MC/FCF multiple of 22.47x for 2022.

US Telecoms (Author Spreadsheet)

The only “real” comparison to AT&T at the moment seems to be Verizon. Post-merger, the two telecom companies are finding themselves to be more similar than ever. Verizon is currently selling for 9.86x NTM P/E and 8.11x EV/EBITDA. Verizon has an implied MC/FCF multiple of 12.76x for 2022. The company offers a 4.77% dividend yield given its current price. The comparable analysis reveals that the company is slightly undervalued as its peers and carries a potential upside.

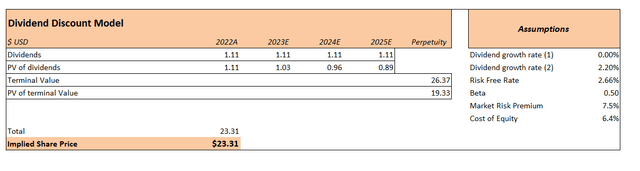

Dividend Discount Model (Author Spreadsheet)

Through our dividend discount model, we have placed the fair price of the new telecom at $23.31 per share given the current environment. We are assuming no dividend growth over the next couple of years and a 2.2% perpetual dividend growth which is in line with AT&T’s historical data. A low correlation to market volatility is also assumed. The model assumes a 22.36% upside potential for AT&T.

Final thoughts

It is becoming increasingly difficult to argue the pure value proposition of Stankey’s new AT&T. We are confident that this historic deal will serve to unlock value on both sides. It is not a far stretch to believe that investors will take a liking to this new, slimmed-down, and transformed version of AT&T. The new dividend, even if cut to $1.11 per share, is much more secure and sustainable in the long-term. With around $8 billion in free cash flow freed up, the company can finally double down on the debt and possibly free up some space for a long-overdue share buy-back program.

As far as the Warner Bros Discovery distribution is concerned, we believe that the company is becoming a behemoth in the streaming and media space that is going to realign in terms of valuations to rivals such as Disney or Netflix. Thereby, we believe that most AT&T shareholders would be smart to hold on to the distribution, rather than treat it as a single special dividend distribution. At these prices, AT&T seems to be a very attractive investment.

Be the first to comment