Christopher Furlong/Getty Images News

We have just finished listening to Eni’s Q2 conference call (NYSE:E). It was a good quarter for the Italian oil major and after our analysis of Total’s second-quarter result, we are not surprised. A few months ago, we published a report highlighting the positive news ahead, and today we provide a follow-up analysis of the main events that happened in the quarter.

- First of all, there was a crisis in the Italian Government, which is Eni’s biggest shareholder (with an equity stake of 30.59%). With Draghi’s resignation, Italy (and Europe) lost the only chance to bring the country in safe waters. We expect repercussions in a higher sovereign interest rate and country risk;

- Related to point 1), there is going to be more uncertainty on the superprofit tax on oil & gas energy companies;

- As we already mentioned in a previous publication, Saipem’s capital increase was not a fairy tale and the stock price significantly declined over the period;

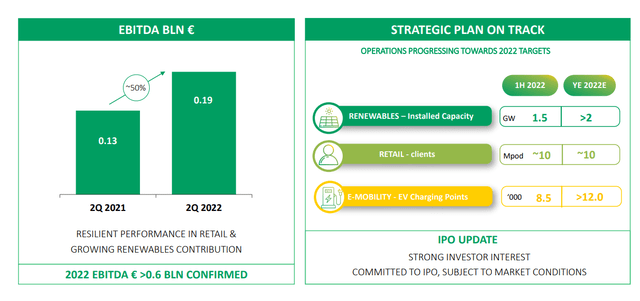

- Plentitude’s IPO was postponed for unfavorable market conditions.

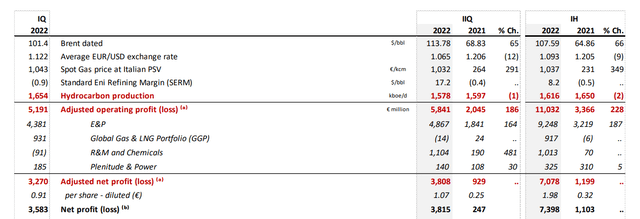

After the negative recap, we can report on the incredible performance achieved by the energy company during the second quarter. Thanks to the surge in gas and oil prices, Eni reported an adjusted operating profit of €5.8 billion, up 13% compared to the first quarter of the year and up 180% year-on-year. This was driven by the exploration & production division with a result of €4.87 billion and by the refining and marketing division which achieved an operating result of €1.1 billion. Going down to the net profit, the company reached €3.8 billion from €929 million in the same quarter of 2021.

As we already mentioned, Eni was able to achieve these numbers thanks to an average Brent barrel price of $113.7, a plus 65% year on year and almost a quadrupled spot gas prices. Hydrocarbon production was slightly below the figures for the same periods in 2021 due to the force majeure shutdowns in Libya, Nigeria, and Kazakhstan.

Conclusion And Valuation

Oil price may have peaked, but it certainly does not look to drop significantly from here unless we get a surprise from OPEC+. Following the revision of Brent price reference, Eni share repurchase was increased by an amount of €1.3 billion to €2.4 billion. Financial guidance was also confirmed.

More importantly, the CEO also recalled what Eni is doing for the national energy emergency. Eni is currently investing “to rebuild gas storage ahead of winter“. “In a context of uncertainty, Eni took rapid action to ensure new gas supply flows. After the agreements with Algeria, Congo and Egypt in the first part of the year, in June Eni entered the North Field East project in Qatar, the largest LNG development in the world,” recalled the Eni’s CEO.

Year to date, Algeria has become the largest gas supplier for Italy offsetting and overcoming the reduced flows from Russia. More in details, the Italian energy conglomerate signed a new contract for onshore gas in the blocks 404 and 208. The new production sharing contract, signed jointly by Eni, Sonatrach, Oxy and TotalEnergies will allow to increase investments in the country. The two blocks are located onshore, in the prolific Berkine basin, in eastern Algeria, an area in which Eni has been present since the 1980s. The new investments will increase the reserves extending their productive life for a further 25 years. At the same time, it will also increase gas production that could become available for export, contributing to the diversification of gas supplies to Europe.

Regarding Plenitude, it remains in Eni’s future plan. In the meantime, the renewable energy arm is delivering record results. Looking at the adjusted operating profit, the division delivered a plus 58% reaching €112 million compared to the last year’s period. The division forecast plan on new renewable capacity was left unchanged, confirming the goal to achieve 2GW of new electricity generation by the year end.

Regarding the valuation, we know that Eni is undervalued, compared to its closest EU peers. This is not a news, it has always been. More in specifics, the company has a higher dividend yield and is currently trading at a lower P/E, FCF yield and EV/EBITDA multiple. Downside risks are equally important to consider, but our view is that the discount depends only by its major shareholder. After the Q2 analysis, we confirmed our positive long-term view for Total.

Be the first to comment