Spencer Platt/Getty Images News

The Thesis

A terrible outlook often leads to a fantastic buying opportunity. And, according to JPMorgan’s CEO, Jamie Dimon, the outlook is certainly terrible. In early August, Dimon said:

“What is out there? There are storm clouds. Rates, QT, oil, Ukraine, war, China. If I had to put odds: soft landing 10%.”

While Jamie Dimon continues to sound the alarm bell, his stock trades at just 10.5 times normalized earnings. Meanwhile, the S&P 500 trades at 21x peak earnings. JPMorgan Chase (NYSE:JPM) is an extremely resilient and durable business that’s withstood the test of time. In fact, its constituents have been around for more than 200 years, spanning the Civil War and the Great Depression. JPMorgan Chase said:

“We trace our roots to 1799 in New York City.”

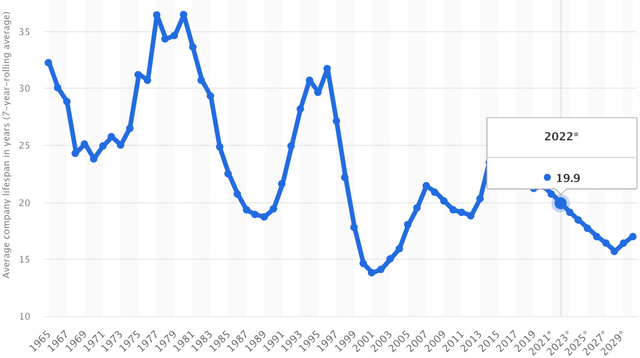

Meanwhile, the average lifespan of an S&P 500 company is just 20 years:

Average Lifespan Of S&P 500 Companies (Statista)

In a nutshell, if you’re looking to purchase enduring cash flows, that can span a century’s time, look no further than JPMorgan Chase. If you’re looking to buy the fleeting cash flows of today’s frothiest tech stocks, buy the S&P 500, or better yet, the Nasdaq. We believe this enormous difference in the duration of cash flows is why 25% of Warren Buffett’s portfolio remains in financials. The world is underweight.

What’s In The News

First off, the U.S. economy is still humming along. In a recent interview, Jamie Dimon said consumers are still spending 10% more than they were last year. Consumers are now spending more on experiences like travel and dining out. But, is Dimon expecting this elevated consumption to continue? He said, “I wouldn’t count on it.” Consumers are burning off the last of their stimulus induced savings as we head into a higher interest rate environment. So, isn’t that bad for banks? Well, loan losses are bad for banks, but higher interest rates and lower deposits could actually benefit the banks.

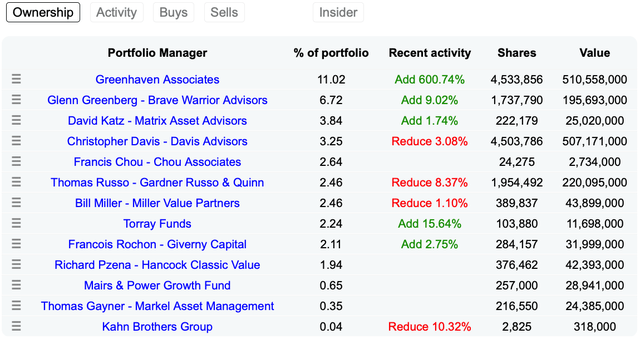

Moving on to recent 13f filings, we can see who’s been buying and who’s been selling JPM in the past quarter:

13f Ownership – JPM – Q2 2022 (Dataroma)

Our main takeaway here is that almost everyone is underweight, with JPM representing less than 4% of their portfolio. As famed investor Howard Marks has said many times, to outperform the crowd, you have to do something different than the crowd. We’re overweight JPMorgan Chase, let’s see why.

A Detailed Look At Earnings

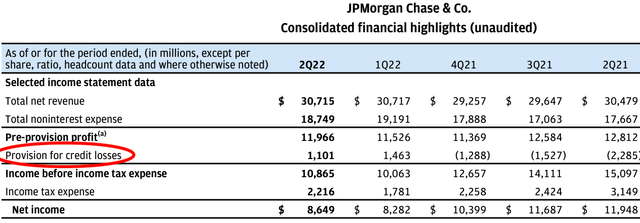

Okay, so first off, let’s cover the elephant in the room, and that’s why JPM’s earnings have declined. This time last year, JPMorgan Chase was reversing loan loss provisions. This year, they’re increasing them, a direct hit to the bottom line. Basically, JPM is accounting for the potential of future defaults. Here’s a look:

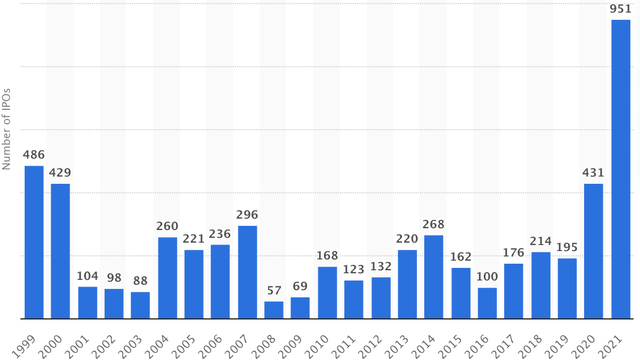

JPMorgan Chase operates a huge corporate and investment bank, which hit a major peak in 2021. The number of IPOs in the United States skyrocketed:

Number Of IPO’s In The U.S. (Statista)

This amount of enthusiasm for U.S. equities is unlikely to continue. Growth in investment banking could struggle, especially in the American market. But, global equity markets are quite depressed. We think JPM’s global investment banking arm has room to run.

Here’s a breakdown of JPM’s revenues by segment (6 months ending June 30, 2022):

| Consumer & Community Banking | Corporate & Investment Bank | Commercial Banking | Total | |

| Revenue (Billions) | $24.84 | $25.48 | $5.08 | $55.40 |

|---|---|---|---|---|

| Percentage of Total Revenue | 45% | 46% | 9% | 100% |

Source: Image created by author with data from JPM’s 10-Q.

JPMorgan Chase has a strong brand, intelligent management, and great products. We expect earnings from its consumer and commercial banking segments to increase over time. Barring defaults, these segments become more profitable as interest rates rise. We expect interest rates to revert to their historical mean, approximately 5%.

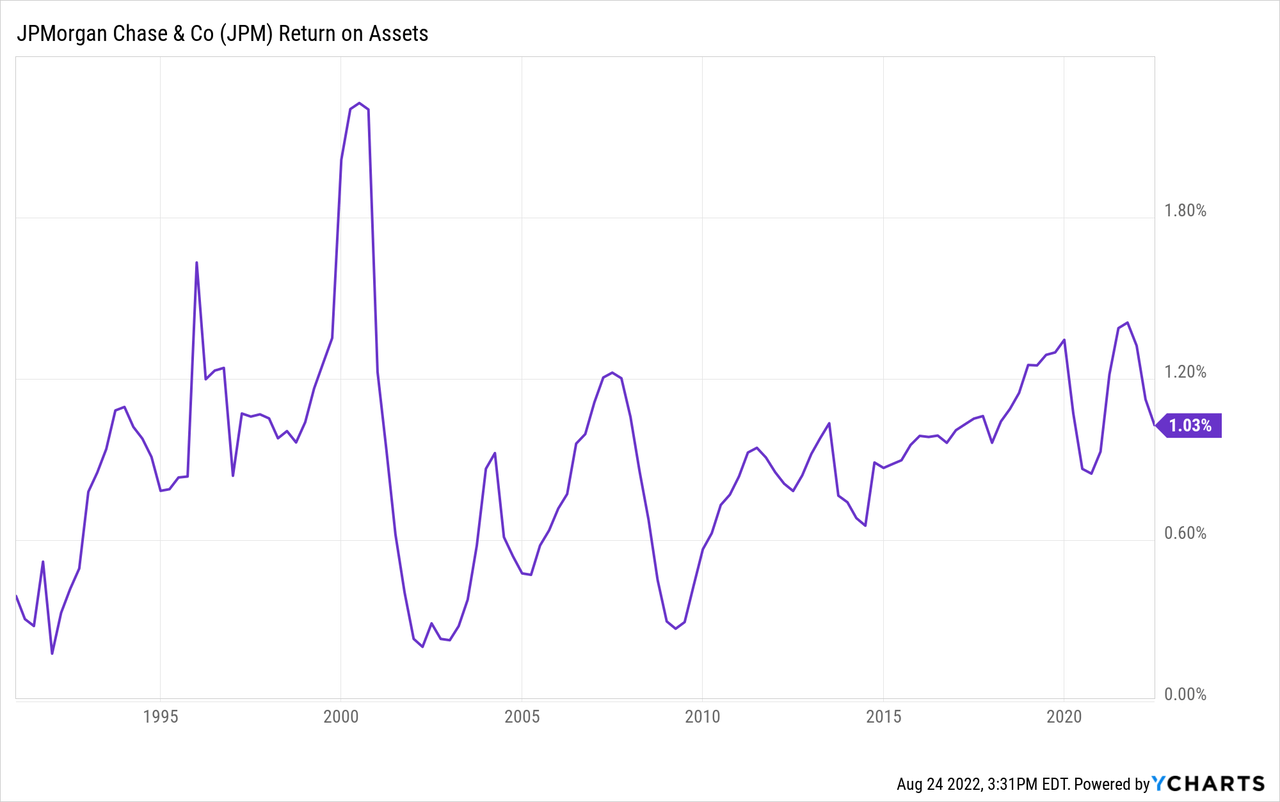

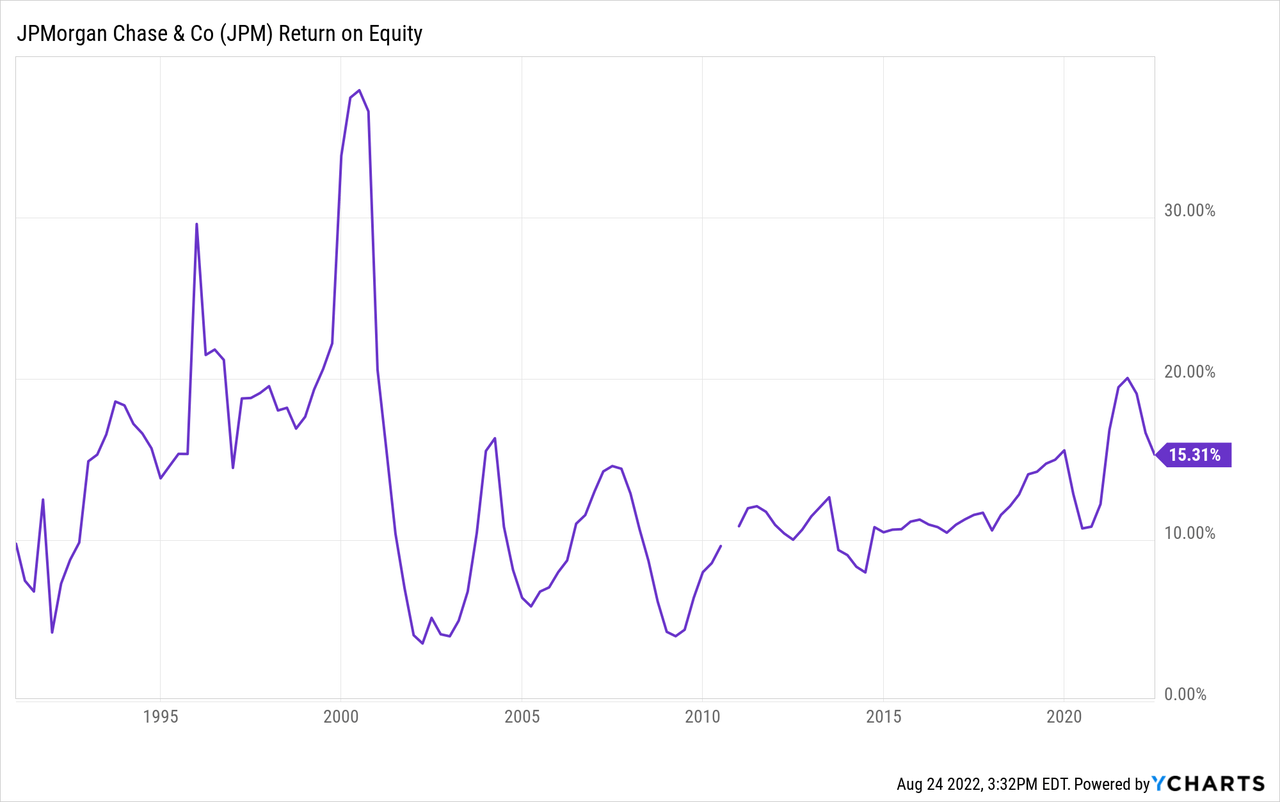

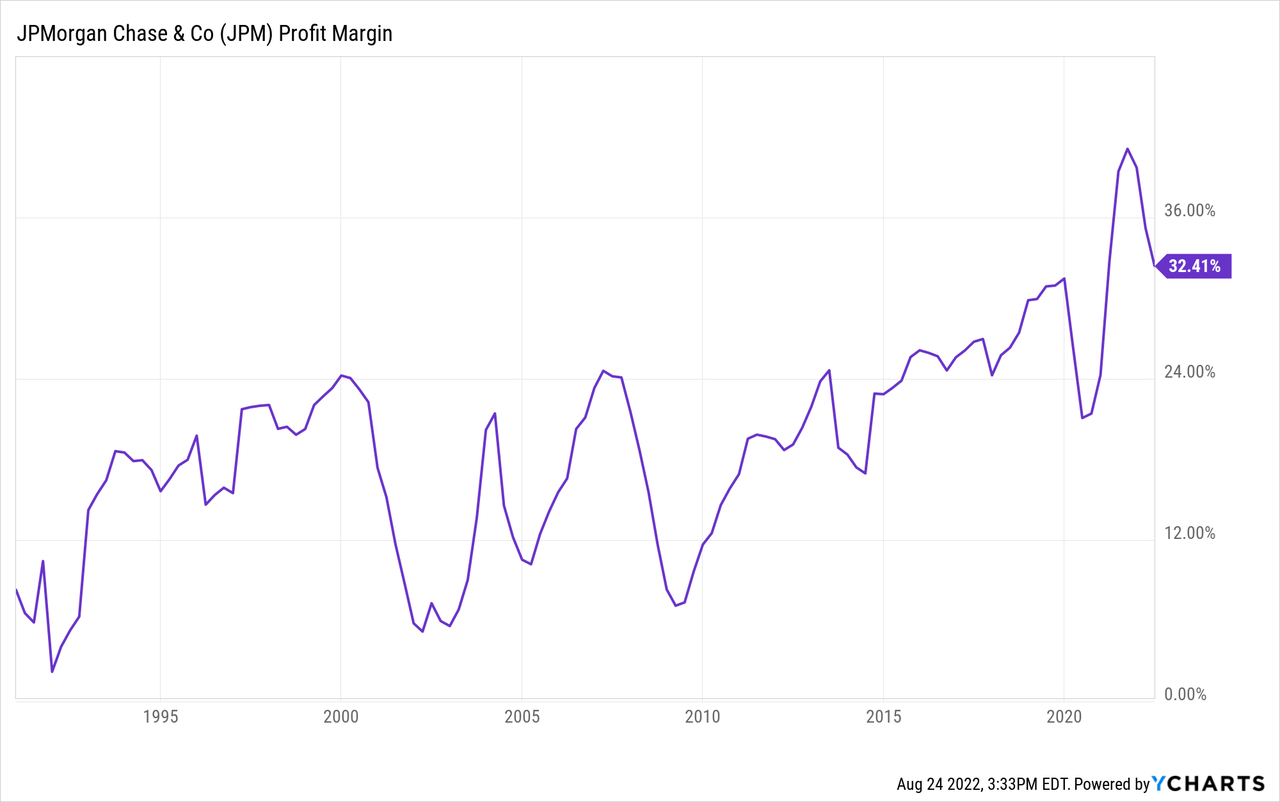

If we look at JPM’s return on assets, profit margins, and return on equity over time, we can get a picture of whether the company is over or under earning:

Normalized Earnings

Versus historical measures, JPMorgan Chase is over-earning on a profit margin basis. But, it’s close to its average in terms of returns on assets and equity. We believe the company’s normalized earnings are around $32.3 billion ($11 per share).

Long-term Returns

Our 2032 price target for JPM is $306 per share, implying returns of 13% per annum with dividends reinvested.

- JPMorgan should be able to grow its normalized EPS ($11 per share) at 7.5% per annum on the back of share buybacks, reduced expenses, and asset growth. This gives you 2032 EPS of $22.70. We’ve assigned a terminal multiple of 13.5x.

The Risks

We believe short-term volatility is not a risk to the long-term investor. That said, the long-term investor carries the risk that the institution deteriorates over time or fails to keep pace with the U.S. economy. JPMorgan Chase has been gaining market share for many years now, but if it saturates the market or consumers choose to do business elsewhere, it could weigh on earnings.

Management must ensure the bank maintains a strong financial position in order to navigate deep recessions. The recent Fed Stress Test was not kind to America’s largest banks, indicating that their net income could turn negative in a worst-case scenario. CNBC reported:

“Under the exam’s hypothetical scenario, JPMorgan was expected to lose around $44 billion as markets crashed and unemployment surged, Dimon said. He essentially called that figure bunk on Thursday, asserting that his bank would continue to earn money during a downturn.”

Nonetheless, Dimon and his CFO, Jeremy Barnum, will be de-risking the company’s balance sheet in the quarters ahead, resulting in a suspension of share buybacks. As of May 20th, 2022, S&P Global gave JPMorgan Chase a credit rating of A+, outlook positive.

Conclusion

We believe short-term pain has created an opportunity for long-term gain when it comes to JPMorgan Chase. Recession news, loan loss provisions, and suspended buybacks have sparked fears around JPM. The company now trades at just 10.5 times our estimate of normalized earnings. With a “strong buy” rating on the shares, we estimate long-term returns of 13% per annum. It appears the whole world is underweight this generational banking institution. JPMorgan Chase and its constituents date back to 1799, spanning the Great Depression and the Civil War. We expect another century of strong cash flows from JPM, which trades at an enormous discount to the S&P 500 despite its longevity.

For more on what makes JPM the world’s greatest banking institution, check out my article: JPMorgan Chase: Buy The Fear.

Be the first to comment