Mario Tama

Thesis

Altria Group, Inc. (NYSE:MO) presented a mixed earnings card demonstrating the impact of the macro headwinds, as inflation hurt consumer spending. However, MO held its July lows firmly, indicating that the market has accounted for these challenges.

Despite a further writedown in its JUUL investment to $450M (down from $1.6B in Q1), the market remains unperturbed. The uncertainty over JUUL carries on, even as the company is still appealing and the FDA continues its “additional review.”

We believe that Altria Group’s operating model remains robust, and the macro headwinds are likely transitory, despite the record inflation print. With the economy showing signs of a “technical recession”, investors should look forward to a lower inflation print, which coincides with easier comps for Altria to lap.

Our price action analysis suggests that MO remains in the Buy zone, even though it’s near-term overbought, following its recent recovery. However, the medium- and long-term signals seem robust, which should undergird its July bottom. As a result, investors can consider layering in and using potential near-term downside volatility to add even more.

Accordingly, we reiterate our Buy rating on MO, with a price target (PT) of $50.

Macro Headwinds Impacted Near-Term Results

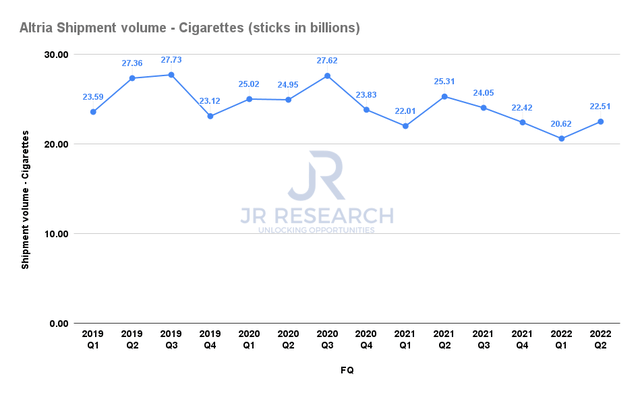

Altria shipment volume (cigarettes) (Company filings)

Altria posted a shipment volume (cigarettes) of 22.51B in Q2, ahead of Q1’s 20.62B but down markedly from last year’s 25.31B. Therefore, the company has undoubtedly experienced the macro headwinds impacting consumer spending. Furthermore, the company lapped challenging comps driven by the COVID pandemic, as Marlboro’s market share normalized. CEO Billy Gifford emphasized (edited):

In the second quarter, rising gas prices and inflation continue to pressure tobacco consumers’ disposable income, resulting in volume declines across the tobacco space. These macroeconomic factors contributed to accelerated cigarette volume declines in the second quarter and first half. If you think about Marlboro’s share, we’re right where we were pre-pandemic. Certainly during the pandemic, as consumers received additional funds, whether that be from government or unemployment or things of that nature, it reinforced Marlboro’s aspirational brand. So Marlboro benefited during that period. Certainly, we’ve given a little bit of that share back and feel satisfied with where Marlboro is. (Altria FQ2’22 earnings call)

But Don’t Fear – Things Will Get Better

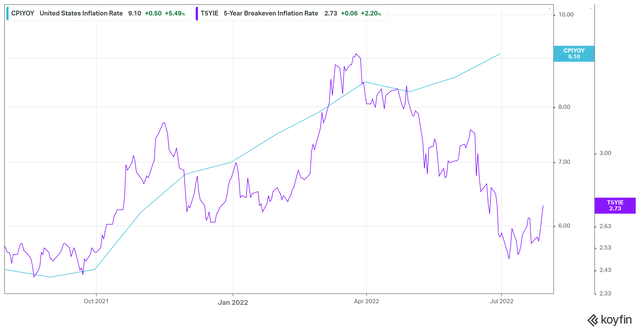

Given the recent CPI print, which showed inflation increasing by 9.1% YoY, some investors have turned increasingly pessimistic. However, we urge investors to consider the market’s forward expectations. The 5Y breakeven inflation rate is now at 2.73%, which suggests that the market expects the record-high CPI to moderate moving forward.

We believe the recent weak US GDP data also reinforced the market’s expectations of lower inflation moving ahead. Credit Suisse (CS) also highlighted in a recent note:

With commodity prices falling and economic data softening, inflation is projected based on both breakevens and economist forecasts to steadily decline over the next 24 months. We believe this will lead the Fed to pivot toward more dovish policy as we move toward the latter part of the year, supporting a continuation of the market’s current rally and factor leadership. – Seeking Alpha

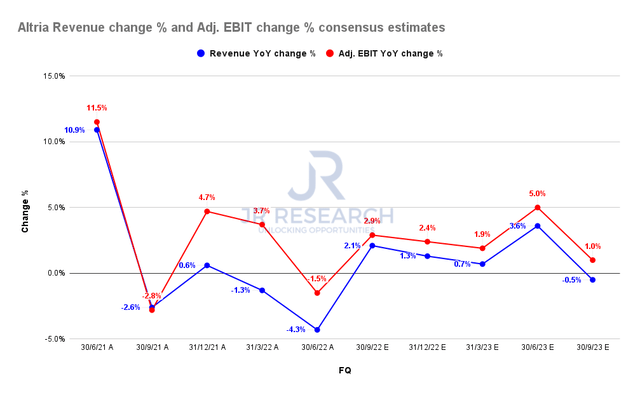

Altria revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) suggest that Altria’s revenue and adjusted EBIT growth should reach a nadir in FQ2 before recovering. However, investors need to adjust their expectations of the level of growth Altria previously achieved, driven by the Fed’s liquidity pump.

Management also maintained its full-year adjusted EPS guidance, which indicates that the macro headwinds are not expected to be structural.

MO’s Price Action Has Also Improved Further

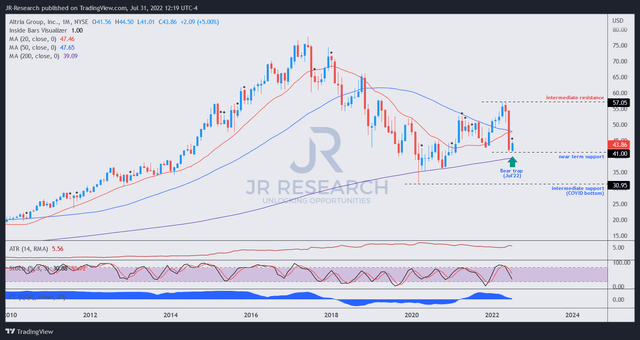

MO price chart (monthly) (TradingView)

Following the completion of July’s trading, we can confirm a validated bear trap (indicating that the market denied further selling downside) on its long-term chart.

Therefore, we are increasingly confident that July lows should hold resiliently, even though MO is technically near-term overbought.

Therefore, investors can consider a short-term retracement first before adding exposure.

Is MO Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on MO, with a PT of $50.

We believe the battering in MO is justified, which improved its valuation markedly. Furthermore, the market underpinned its July lows, despite Altria’s mixed Q2 earnings release. Coupled with constructive price action, we believe the medium-term prognosis in MO is looking increasingly bullish, despite the macro headwinds.

Be the first to comment