Alexandros Michailidis

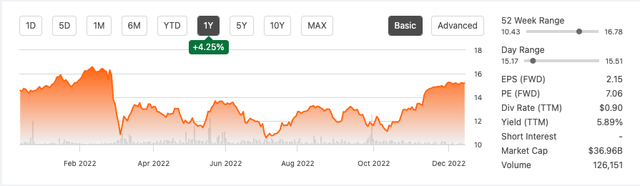

Engie SA (OTCPK:ENGIY) is a French utility provider with a market cap of $36.548 billion, an attractive price-to-earnings ratio of 5.93 and is trading well below its estimated price target of $19.34. Over the last year, investors have not seen exceptionally high returns, although, over the previous six months, the stock has increased by 20.63%.

Year stock price trend (SeekingAlpha.com)

Amidst an energy crisis that has pushed Europe into transitioning to alternative solutions, ENGIY has come out on top. The company has been operating all its diverse infrastructure at high utility rates, delivering strong top and bottom-line results through its integrated and flexible mixed energy model, generating cash for reinvestment, maintaining a healthy balance sheet and high liquidity. I have compared Engie to the top three US-based utility companies in terms of market share, and the results show that ENGIY is hugely undervalued and is growing at a rate well above its larger peers. There is a lot more upside potential. Although investors should be wary of the wide number of geopolitical factors with the potential to impact operations, I recommend that investors take a bullish stance on this company that is on its way to a record-breaking year.

Overview

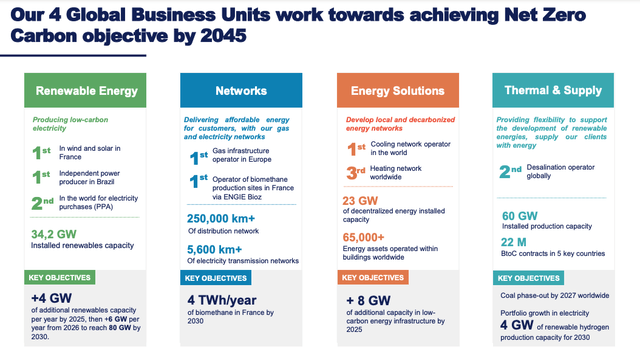

ENGIY, founded in 1946 in France, operates across seventy countries, serving over twelve million utility contracts to millions of diverse customers. Over the years, the company has been disinvesting fossil fuels and investing in renewable energy sources. According to a BloombergNEF ranking, it was the world’s second-largest clean energy provider in 2021. It has recently partnered with LNG supplier Sempra Energy and increased its solar and battery storage by 6GW. It focuses on four critical business units: renewable energy, gas and electricity networks, energy solutions and thermal and supply.

Global Business Units (Investor Presentation 2022)

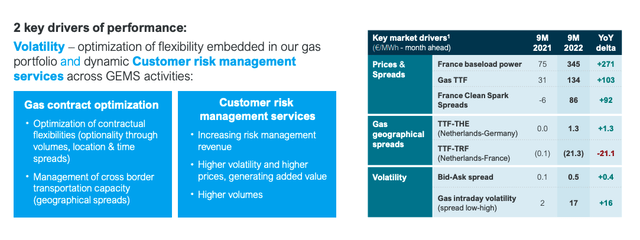

The company has experienced incredible growth this past year, and two significant factors have led to this, namely flexible contracts, which can adjust with volatility, clearly present in its gas portfolio and secondly, and its customer risk management services which have led to higher prices and higher volumes of energy usage. Below we can see a comparison between Q3 2021 and Q3 2022, along with the YoY delta.

Key performance drivers (Investor Presentation 2022)

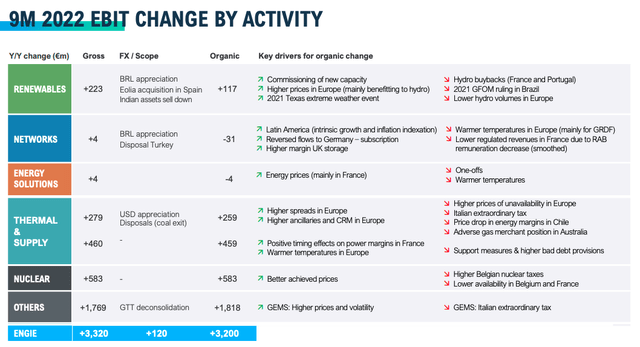

Below is a breakdown of all the events that have positively and negatively impacted the different energy sources that Engie supplies. The critical driver is higher prices and greater demand across all activities.

EBIT by Activity and drivers (Investor Presentation 2022)

We can see the role that the company’s transition into renewable energy has had on its performance this year and its ability to provide much-needed supply, especially throughout Europe amidst the ongoing energy crisis.

Financials and Valuation

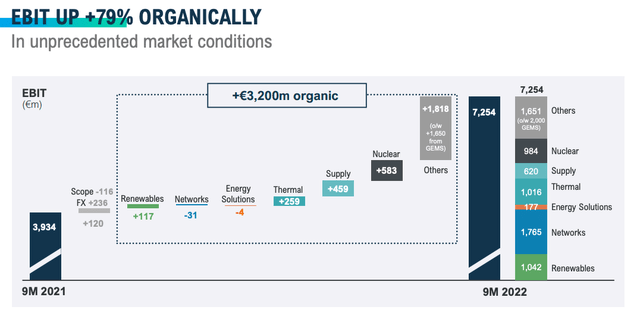

Unprecedented market conditions have led to growth in almost all of ENGIY’s activities, with particular emphasis on global energy management and sales ((GEMS)). The company improved its cash flow from operations, an increase of €3.1 billion and is on track for a record financial year. It has maintained a strong balance sheet and good liquidity of €21.8 billion, including €15.3 billion in cash. Due to the strong performance, the company has upgraded its end-of-year guidance and has reaffirmed its dividend policy.

YoY EBIT growth (Investor Presentation 2022)

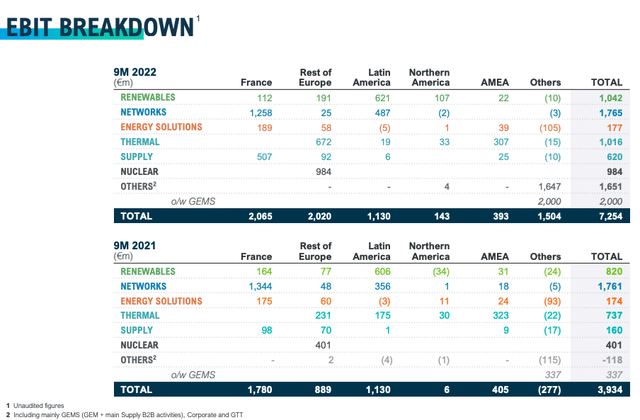

If we look at the EBIT breakdown by region and by activity, comparing Q3 2022 to that of the previous year, we see that total EBIT has increased across every activity. We see a big jump in renewable activity in Northern America from a loss of €34 million to positive results of €107 million. Furthermore, nuclear power has significantly increased to €984 million EBIT.

Geography and Activity EBIT breakdown (Investor Presentation 2022)

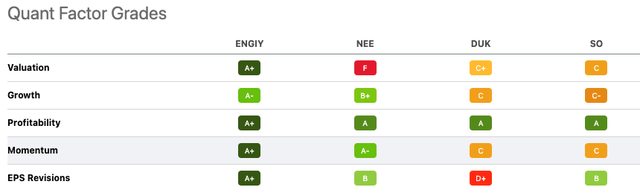

ENGIY has a desirable rating if we take Seeking Alpha’s Quant rating system and compare it to the world’s three largest US-based utility companies. We can see that ENGIY has a better-graded rating on every factor. Specifically, its valuation stands out with an A+ versus an F for NextEra Energy (NEE), holding a market cap of $175.30 billion and a share price of $87.15, a C+ for Duke Energy (DUK) with a market cap of $80.79 billion and a stock price of $103.10 and rating of C for Southern Company (SO) with a market cap of $78.29 billion and a stock price of $71.21.

Quant Factor Grades (SeekingAlpha.com)

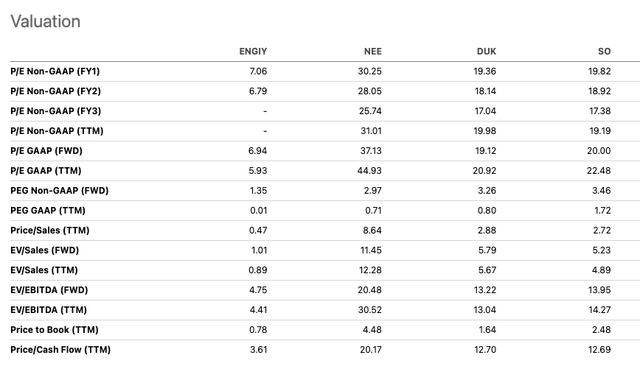

Furthermore, if we zoom into the company’s valuation and growth in the tables below, we can see that ENGIY shines bright on the valuation front relative to its larger peers. It has a low price-to-earnings ratio of 5.93, compared to 44.93 for NEE, 20.92 for DUK and 22.48 for SO.

Relative Peer Valuation (SeekingAlpha.com)

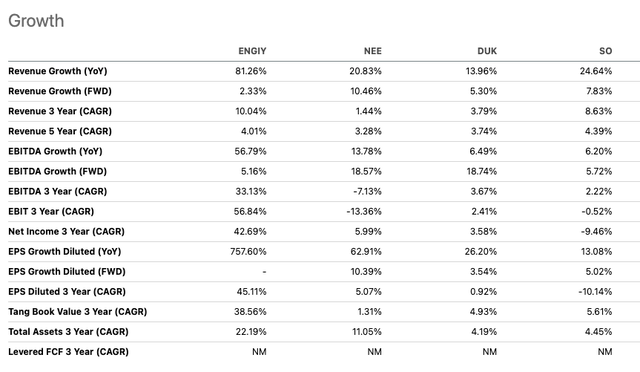

On the growth front, we also see that ENGIY has performed above its peers, with YoY revenue growth of 81.26% and a three-year CAGR of 56.84%.

Peer Growth Comparison (SeekingAlpha.com)

Risks

Several unpredictable variables can impact the company’s performance if we only look at the Ukraine-Russia conflict repercussions, the shutdown of Nordstrom 2 and the yet-to-be-determined future of the nuclear plants that the company has been running in Belgium. ENGIY has been in back-and-forth discussions with the Belgian government about whether it will continue running its operations, as the plants were planned for a definite close by 2025. It has been confirmed that one of the nuclear stations will close by the end of January 2023. However, there is yet to be a clear answer to the future of the others and ENGIY’s position in running the operations. As we saw in the financials, nuclear played an essential part in the company’s financial results. Regulatory changes such as potential windfall tax and the EU government’s attempt to reduce energy bills can play a significant role in the company’s operations in the future, with adverse effects. Furthermore, natural elements such as extreme weather can impact the supply available.

Final thoughts

ENGIY has been producing excellent top and bottom-line results in an unprecedented market. It has invested heavily in a diverse energy portfolio globally and has played a critical part in providing energy during the energy crisis in Europe. If we compare it to the top three utility giants, the company is undervalued and growing well above the average. Although the market is filled with unpredictable variables that could impact future performance, the company is in an excellent position to end a very successful financial year due to its critical role in supplying energy to the European market.

Be the first to comment