ArLawKa AungTun/iStock via Getty Images

CoreCard (NYSE:CCRD) used to be known as Intelligent Systems, it’s a sophisticated payments processor that shot to fame by landing the Apple/Goldman Sachs credit card business a couple of years ago.

That they were able to win such a whale as a small and relatively obscure card processor testifies to the sophisticated services they offer which form the basis of their competitive advantage (which we discussed here).

Apple/Goldman Sachs formed 71% of their business in Q2 and investors got a little concerned when Apple announced it was going to do its own payment processing, but this turned out to apply to future products.

Nevertheless, the company hasn’t been able to snare another whale yet, although that doesn’t mean they haven’t had success contracting new customers.

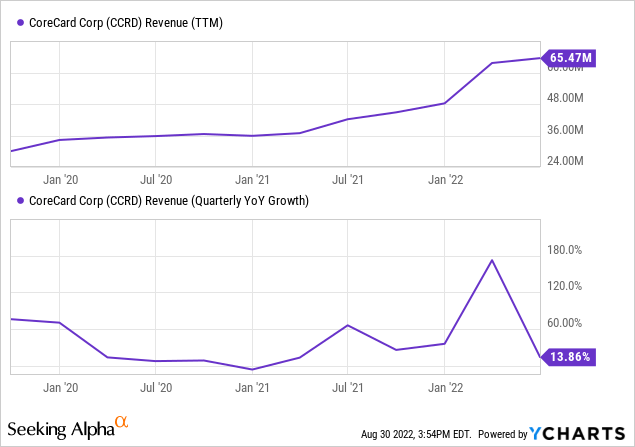

Growth

There is of course a lot of growth also from the Apple card:

Growth and margins are lumpy as very high margin license revenue come in at discrete times when Apple reaches a new tier of card customers. They did so in Q2 (with $1.8M of additional license revenue) and are expected to do so again in Q4.

While management prides itself of not having lost a customer due to competitive reasons, there are nevertheless some losses due to special circumstances.

Revenue from Wirecard, the German fintech company has lapped out (it was $600K in Q2/21), and Goldman Sachs bought customer GreenSky, and the vertical portion of the revenue will likely be discontinued.

Kabbage, a significant customer of the company, sold its business to American Express although CoreCard keeps the legacy customers, at least for now. But there was also good news (Q2CC):

We are working on launching a new program with an existing customer, Cardless on a co-branded card with American Express. Once live, we will have a direct connection with American Express, similar to what we have with Visa and Mastercard today, and we will be able to process other customers who want to use the American Express network.

This could open additional doors for customers on the American Express network, CoreCard already works with Visa (V) and Mastercard (MA).

As it happens, even without that in place yet, the company is already launching a card with the American Express logo as American Express is starting to work with processing partners, among which CoreCard itself (Q2CC):

But the Cardless program that we’ll be using for the Amex card will be processed by CoreCard. We have several other programs lined up for going live either late this year or early next year. And a couple of those are with Amex logo.

They also have deals with the likes of Deserve, a complementary program manager for several cards for which CoreCard does the processing (Q2CC):

Deserve has many things CoreCard does not have, such as customer service, and they offer other services that compete with what we offer. But they’re very good and very knowledgeable in the credit space, particularly in origination, and they provide great value in the card issuing chain. Together, we’re pretty formidable as we can do the more complex credit offerings that many of their customers want.

They are not in the habit of naming their customers in PRs, that’s up to their customers, but they did mention a few of these during the CC, like AmerisourceBergen (ABC), Gemini and PEX.

Growth (19% in Q2) came close to its 20-25% long-run target, at least if one excludes the Wirecard revenue from Q2/21. If you also exclude Apple, growth was 30% so they do generate quite a bit of new business.

Growth will likely continue as they are onboarding new customers with multiple implementations in progress.

The company is also hiring a lot of trainees in order to lay the groundwork for the ability to accommodate another big customer. They are also working on a next-generation platform (whilst still improving the present one).

Management mentioned a ‘couple of hundred’ trainees in India (and another 30 in Colombia), which are significant numbers as they won’t bring in revenue for quite some time (Q2CC):

It takes several years for — to be able to generate good revenue from the training that we give them.

They are even sending over people from India to train the ones in Colombia and other ones to the US for the processing of the Apple card. The hiring will slow down but not entirely stop. The trainees are not (yet) counting in their employee numbers (900+) as they are not yet full-time employees.

Finances

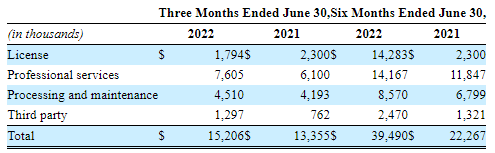

Disaggregating revenues, from the 10Q:

CCRD 10Q

The largest part is professional services, which management argues is repeating revenue. Q3 expectations are for $6.7M-7M in professional services revenue, so a little step back from Q2 but revenue for FY22 is expected to increase 30%+.

Excluding Wirecard, processing and maintenance revenue increased by 26% and professional services revenue increased by 25%.

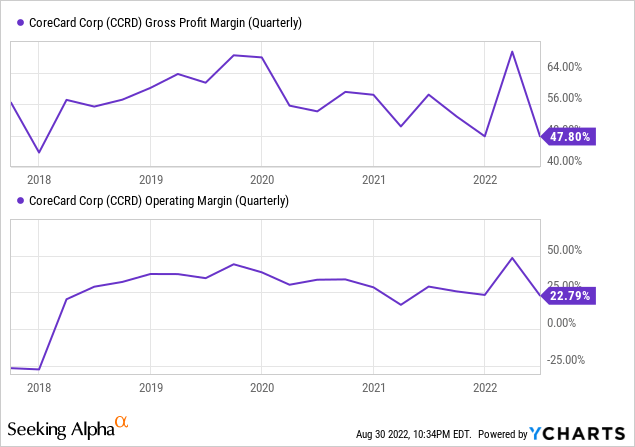

Management doesn’t really look too much at gross margins as these are rather variable quarter to quarter on lumpy license revenue and overtime (line in Q1).

Operational profit is variable for the same reasons and the sequential decline was due to lower license revenue in Q2 and hiring. Income from operations was $3.5M, a decrease of $400K versus Q2/21 on lower license revenue and continued hiring (in Colombia and India).

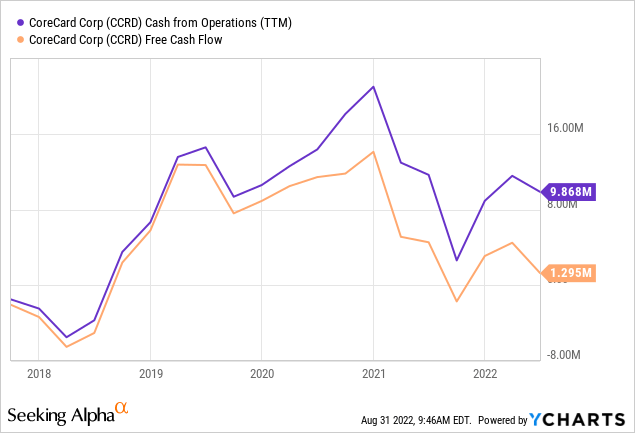

The company also produces positive cash flow, although that has declined considerably since the beginning of last year.

We put this down to hiring and investing in the platform (and the next one), the latter runs at least in part through CapEx, hence the widening gap between operational and free cash flow. Some of the improvements are even paid for by a customer as part of professional services.

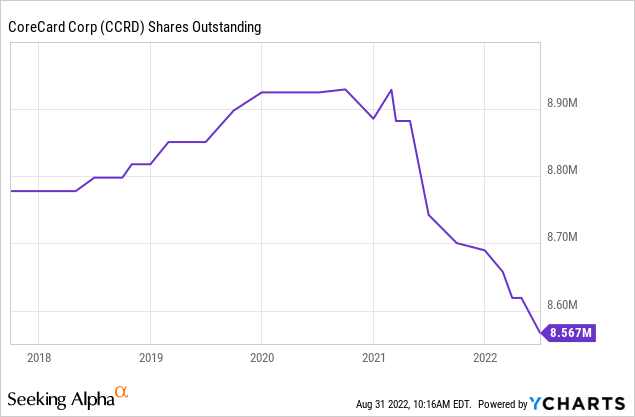

The company has plenty of cash at $21.5M (and no debt) and buybacks have decreased the share count:

Outlook

Management expects at least 30% topline revenue growth in FY22, which is an increase in previous guidance (25-30%). From the Q2CC:

We remain incredibly optimistic about our long-term prospects and believe the investments we’ve made in our infrastructure and in hiring and training new people will continue to yield new customer wins and revenue growth.

And longer-term, as processing revenue increases as part of revenue, operational margins can grow to the 30-40% level.

Valuation

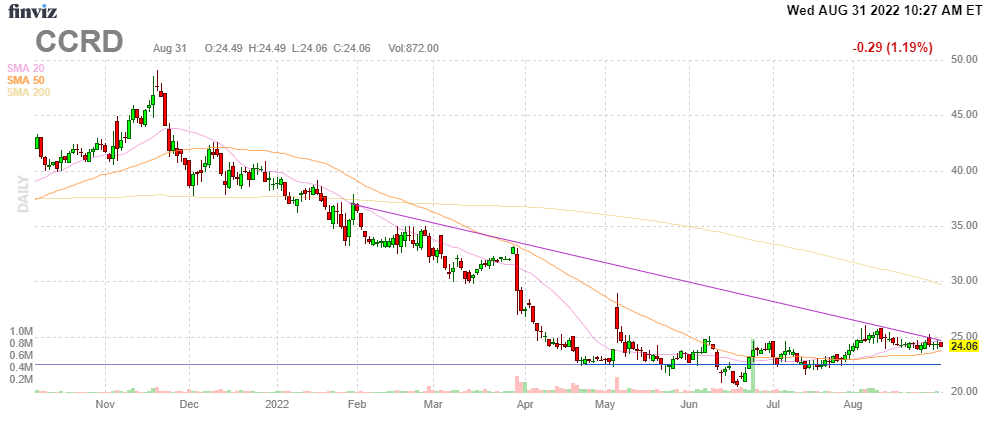

FinViz

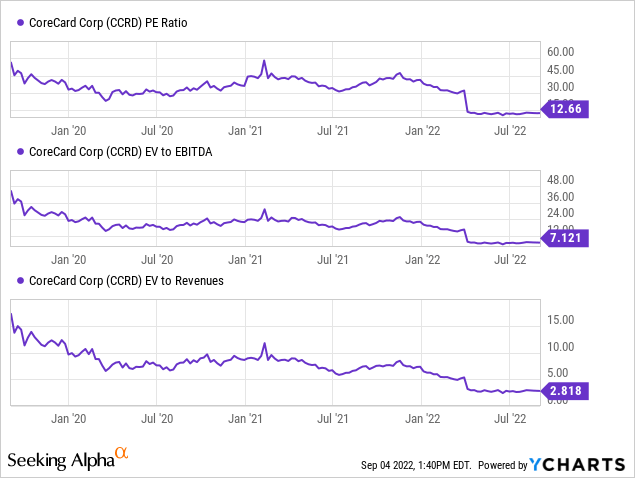

Valuation metrics have become pretty cheap:

Analysts expect $1.79 EPS this year rising to $2.06 next year, which really drives home that the shares are cheap.

Conclusion

- The company keeps on growing and is profitable and cash-generating.

- It also wins new business, although revenues are still dominated by Apple.

- The company has laid the groundwork in terms of infrastructure and hiring to accommodate another big client but they were not drawn to commenting too much on the progress of talks. This isn’t likely to be imminent.

- But the shares are already sufficiently cheap to be attractive even without a big new customer.

- The main risk seems to be processing volumes going down in an economic downturn but this is still a fairly small part of the company’s revenues, so this shouldn’t overly worry investors.

Be the first to comment