ShutterOK/iStock via Getty Images

Energy Transfer (NYSE:ET) has been our largest position at High Yield Investor this year, helping to fuel our massive outperformance of the S&P 500 (SPY) year-to-date and since the inception of our portfolio back in 2020.

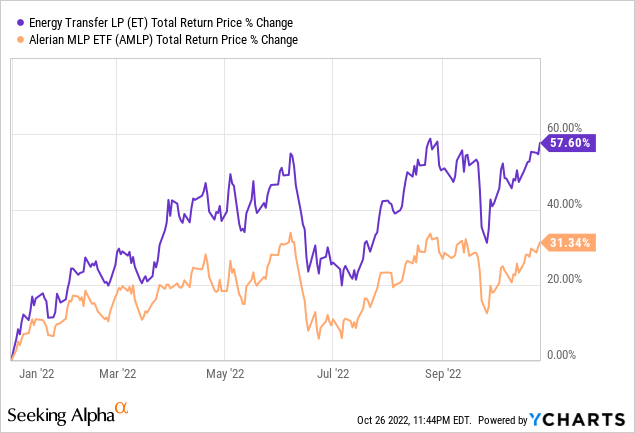

While the strong environment for energy and the midstream sector has certainly had something to do with ET’s strong year, it has actually significantly outperformed the broader midstream (AMLP) sector as well:

The biggest reason for this has been the simple fact that ET has hiked its quarterly distribution by an astonishing 70%+ over the past year. In this article, we will discuss the ramifications of this astonishing distribution growth and our outlook for ET units moving forward.

Energy Transfer’s Distribution Hikes In The Past Year

The Q3 2021 distribution was $0.1525 per unit, on par with the level announced back in Q3 2020 when the distribution was halved due to headwinds and uncertainties associated with COVID-19 lockdowns and soaring supply from Saudi Arabia and Russia. It was the fifth and turned out to be the final distribution paid out at that level.

Every quarter since then – fueled by rising inflation, soaring energy prices in the wake of Russia’s war in Ukraine, a reopening global economy, strong fundamental performance at ET, aggressive deleveraging of the balance sheet, and growth projects coming online – ET has increased its payout level handsomely.

On January 25th, 2022 – a mere two weeks after we spoke with ET on behalf of High Yield Investor members and discussed (among other things) their prospects of hiking the distribution aggressively moving forward – ET declared a $0.1750 quarterly distribution, a 14.75% sequential increase. Then on April 26th, 2022, ET declared a $0.20 quarterly distribution, a 14.3% sequential increase. On July 26th, 2022, ET declared a $0.23 quarterly distribution, a 15.0% sequential increase. Finally, on October 25th, 2022, ET declared a $0.265 quarterly distribution, a 15.2% sequential increase.

As management stated in its press release:

The distribution per unit is more than a 70 percent increase over the third quarter of 2021 and is a 15 percent increase over the second quarter of 2022. This distribution increase represents another step in Energy Transfer’s plan to return additional value to unitholders while maintaining its target leverage ratio of 4.0x-4.5x debt-to-EBITDA. Future increases to the distribution level will be evaluated quarterly with the ultimate goal of returning distributions to the previous level of $0.305 per quarter, or $1.22 on an annual basis, while balancing the partnership’s leverage target, growth opportunities and unit buy-backs.

This means that ET still has an additional 15.1% upside in store for its quarterly distribution in the near future. If it continues its recent pace of quarterly distribution hikes, it should get there by next quarter already, meaning that its 2023 distribution should at the very least be at its previous $1.22 annualized level, though further distribution growth beyond that has not been explicitly ruled out.

The Forward Outlook For ET Units

In addition to the recent growth pace strongly indicating that the next quarterly payout will be at its pre-cut level of $0.305, another reason to believe that this will happen is simply that ET is in great financial shape to do so and has little to no reason not to. As we detailed in our recent article, A Deep Dive Into Energy Transfer’s Debt Maturities:

ET’s expected free cash flow generation over the next half decade should be sufficient to fully redeem upcoming maturities while still providing sufficient cash flow to fund the fairly substantial capital expenditures budget and fully funding the restored distribution level.

This puts ET in remarkably strong financial condition as it means that ET has little to no dependency on the capital markets as we enter a period of increasingly challenging capital market conditions for midstream businesses. ET should be able to fully meet all of its debt and equity obligations for the foreseeable future without having to depend on the interest of bond or equity investors.

Between its increasingly clean balance sheet and its massive cash flow generation (it is expected to generate $2.61 in distributable cash flow in 2023, more than twice its pre-cut annualized distribution of $1.22), ET should be able to easily pay out a normalized distribution indefinitely and frankly could increase it even more beyond that if it so chooses.

On top of the rosy outlook for the distribution and the strength of the balance sheet, ET also continues to trade at a very compelling valuation relative to its own history and its investment grade midstream MLP peers:

| MLP | EV/EBITDA | EV/EBITDA (10-Year Average) |

| ET | 7.87x | 11.28x |

| EPD | 9.28x | 12.79x |

| PAA | 9.26x | 10.76x |

| MPLX | 9.51x | 12.34x |

| MMP | 10.89x | 14.64x |

The one big risk to further distribution growth beyond the $1.22 annualized level is the fact that ET leadership – led by their aggressive empire-building founder, largest unitholder, and Chairman – does continue to talk profusely about investing aggressively in new acquisitions and growth projects. As we noted in a previous piece, management said on its latest earnings call:

[We] expect our strong coverage and balance sheet strength to allow us to further prioritize growth within our capital allocation strategy…We also continue to evaluate opportunities in the petrochemical space, which would include developing a project along the Gulf Coast as well as potential M&A opportunities.

Kelcy gave us the directive that we need to step in to petchem, we certainly are doing that…from an M&A perspective, anything that’s for sale, we’ll take a look at pretty much like anything in the industry

If ET does indeed invest aggressively in acquisitions like this, it will likely have to at least temporarily freeze its distribution at $1.22 per year while pouring any extra capital into paying off maturing debt and/or funding acquisitions and growth project capital expenditures. After all, management stated on its latest distribution press release that its “ultimate goal” is reaching the $0.305 quarterly payout level, implying that it currently has no plans to grow beyond that point in the future.

Investor Takeaway

It’s always a great day when your largest position’s distribution rises by 15.2%, especially when the unit price remains deeply undervalued and further meaningful distribution growth appears to be in store for the near future. As a result, we remain very bullish on ET units and continue to hold it as our largest position at High Yield Investor.

That said, we do not expect ET to continue its current aggressive pace of distribution hikes once it hits the $1.22 level, and instead expect management to pivot back towards ET’s old ways of aggressive spending on growth CapEx and acquisitions. Will this time work out better than before? Time will tell, but we believe the balance sheet and valuation give them plenty of margin of safety.

Be the first to comment