- WTI Breaks Consolidation Range to Trade above the 50-SMA.

- US Crude Exports Soar to All-Time Highs.

- Russian Oil Cap and Demand Concerns Linger.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

WTI Fundamental Outlook

Crude Oil finally broke out of its consolidation range yesterday, posting gains of 3% + helped by a weaker US Dollar as well as record US export numbers. Crude exports out of the US rose to 5.1 million barrels a day, the most on record while demand fears out of China halted further gains in the Asian session.

The rally was welcomed following three days of price uncertainty as WTI hovered around the psychological $85 a barrel mark. The consolidation in price of oil could have been a result of the impending price cap on Russian oil to be imposed by the United States and Western Allies. We heard from US Treasury Secretary Janet Yellen who stated a price in the $60 range (based on historical prices) would give the Russians an incentive to keep producing oil. The price cap which is due on December 5 could see gains halted as the uncertainty around supply after the cap is imposed lingers. This remains a contentious issue with the possibility that Russia may cut production as it struggles to find buyers as well as ships to transport oil once the December 5 deadline is reached. An interesting two months lie ahead for global oil prices.

10-Year Historical Prices of WTI Crude Oil

Source: TradingView

As major central banks continue their fight against inflation, we have started to see a slowdown in manufacturing output globally (evidenced by S&P PMI figures) which will no doubt add to the fears around demand. This week has however seen a shift in bets with regards to the Federal Reserve’s peak rate expectations which has seen risk-off sentiment prevail. The Bank of Canada (BoC) surprised with a lower-than-expected hike yesterday following in the footsteps of the Reserve Bank of Australia (RBA) which has added further credence to the theory that we may be approaching a slowdown in the hiking cycle.

Discover what kind of forex trader you are

Next week will be key for markets as a whole with the Federal Reserve policy meeting expected to provide clues as to the tightening cycle and US outlook for the rest of the year. A continued hawkish stance could see gains capped while any dovishness could propel WTI higher.

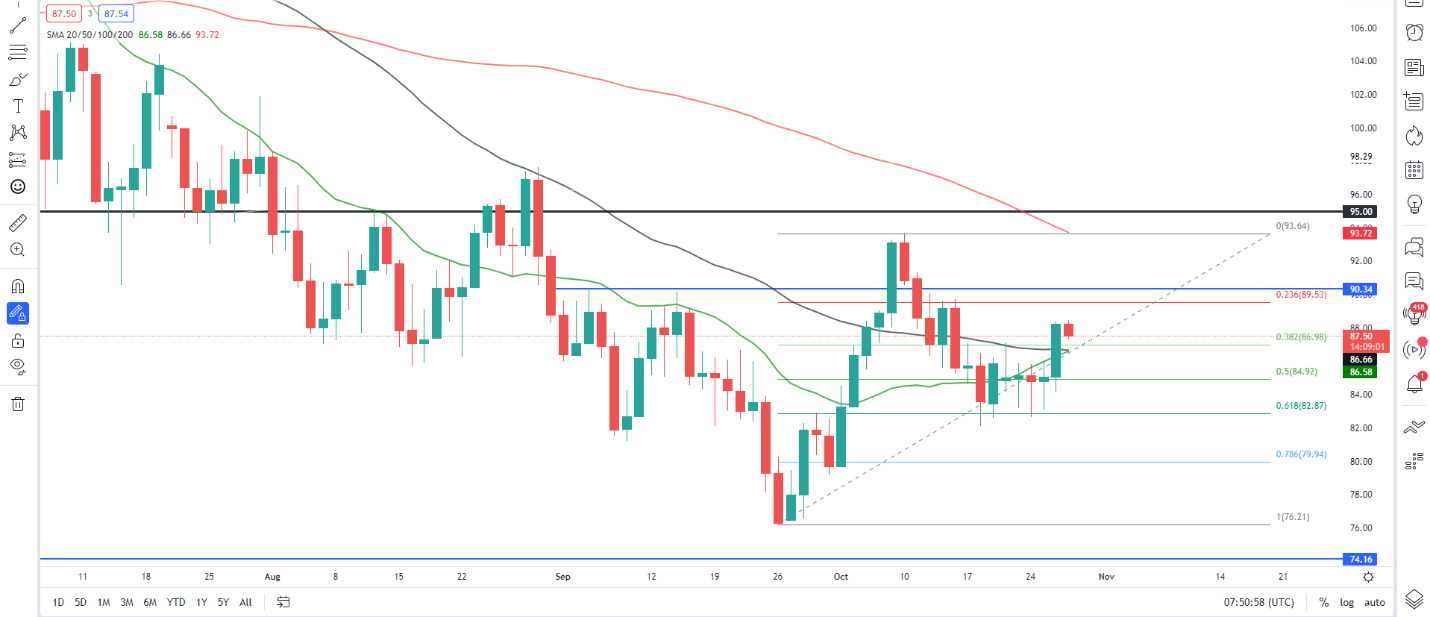

WTI Crude Oil Daily Chart – October 27, 2022

Source: TradingView

From a technical perspective, WTI has broken the recent consolidation range and trades above the 50-SMA. Support has been provided by the 61.8% fib level while the $90.00 psychological level may provide significant resistance. A sustained break above this level could see the price retest the $95 a barrel mark which has remained elusive since the end of August.

Alternatively, any downside move at this stage would need to clear the 20 and 50-SMA first before a daily candle close below the $85 mark could open up further downside potential.

Recommended by Zain Vawda

Get Your Free Oil Forecast

Resources for Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Be the first to comment