Young stockholder exasperated with stock performance of ET and making a scrunchy face.

Studio Grand Web

Introduction

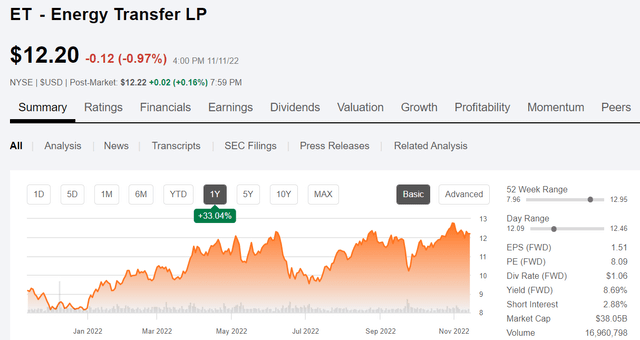

It’s hard to believe it has been a year since we last covered Energy Transfer LP (NYSE:ET). It’s one of the most searched tickers on this platform, with a 140K followers, and generates anywhere from 15-30 mostly favorable articles a month. What it hasn’t done is increase in price much over the last year, although the entire major midstream sector, Enterprise Products Partners (EPD), and Enbridge (ENB) have underperformed as well.

I called ET a bargain in the $9’s last year, and I’m calling it one now in the $12’s. But bargains are only bargains if they go up, and ET has managed to avoid doing that for the last few years, in spite of a profoundly beneficial commodity price backdrop. What’s up?

ET price chart (Seeking Alpha)

There is no question there is unrealized value in this energy giant. The only real question is, will the stock price ever reflect its asset value? I think it will. But then, I am an optimist. I am a “the pit is half full” sort of guy, not a “phooey the pit is half empty, the dump valve must’ve leaked,” sort.

I think there is a pathway toward a share price of $25 for ET in a few years (if not before) and will discuss as we go along. So wipe that pouty, scrunchy-look off your faces, ET shareholders. Things are on the up for this intrepid energy transporter.

The thesis for ET

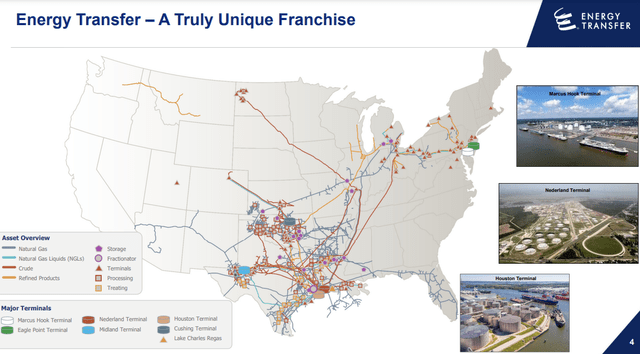

Twelve bucks and change gets you a Unit of ET. What you get for that paltry sum is a piece of the largest natural gas, crude oil, and NGLs transportation storage, and export network in the country. Some 115K miles with the Enable acquisition last year.

ET footprint (“ET”)

Chances are pretty good that ET touched some aspect of your life today. With its gathering, midstream, and large-size trunkline interstate pipelines combined with its early processing hubs in key basins, the extended reach of the company is hard to avoid.

Some investors – the happy ones – are drawn to ET for the yield on its distribution, currently 8%, but recently having been in the 10’s. With its well-funded capital program, and manageable, but attractive distribution on a percentage basis, the company is attractive for just this set of investors.

The rest of us would like some growth along with those distributions! Gas may be the way!

The macro picture for gas

Gas has been on everybody’s mind this year. All over the world. After practically drowning in the stuff a couple of years ago and driving down the price to $1.40 per MCF, all of a sudden it became the prettiest girl at the dance…for a while this year. Natty has topped out so far near $10 MCF. I say so far, as the winter heating season is just getting underway in the Northern Hemisphere. Supplies are tight, although storage levels have improved over the last quarter.

Gas exports from the U.S. are going great guns. The liquefaction trains on this side of the Atlantic are chilling the stuff down to -260F for transshipment to the EU or Asia. Where the process is reversed and good, clean American gas heats the homes or powers the factories of these good folks… and U.S. producers exposed to TTF or JKM pricing are making an absolute killing. There’s a bottleneck or two along the way, but these will be worked out in time as these contracts are decades long typically.

Into this demand, a serendipitous trend is occurring in our leading petroleum basin, the Permian. It is getting gassier. Way gassier, as this SP Global Link shows. This is a function of the reservoirs being drilled starting to veer out of the oil “kitchen” into the gas kitchen. There’s no help for it. So it is indeed a happy circumstance that we have this demand for gas, or there would be a lot of pseudo oil >50 API gravity oil that wasn’t produced.

The LNG catalyst for ET

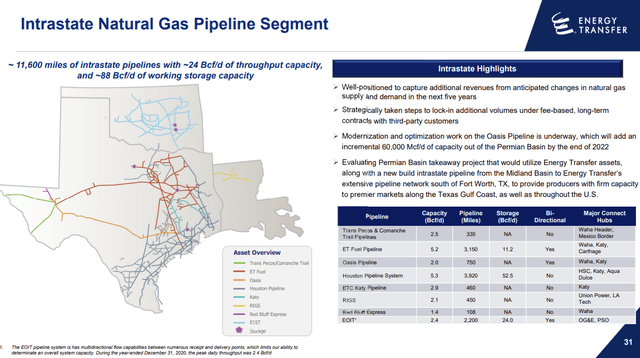

ET through its Oasis Pipeline has 2-BCF/day of export capacity from Permian to its Katy hub. It is in the process of upgrading Oasis to allow carriage of another 60 MCF/D. It is also evaluating a new 42″ line, properly termed the Midland Express a.k.a. as “Warrior,” that would provide Permian takeaway for 2.5 BCF/D, with the hope of reaching FID in early 2023. The calculus for Warrior was impacted somewhat by the spring announcement of the competitor 42″ line, Matterhorn Express reaching FID.

ET’s Intrastate network (“ET”)

My view is that Warrior will achieve FID due to tight capacity currently. This SP Global link shows that takeaway only exceeds production by about 1-BCF/D. Clearly more export capacity is needed at gas production out of the Permian is on the increase.

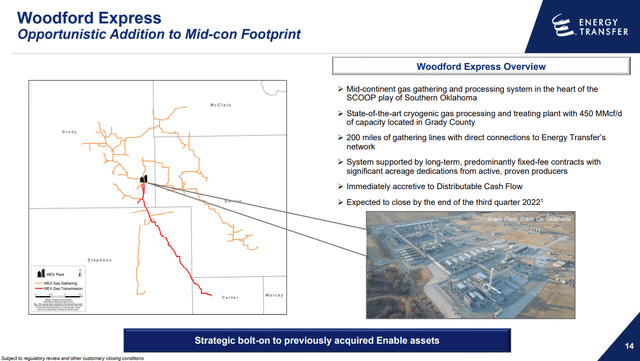

A quick tuck-in acquisition-Woodford Express

The Woodford play in the Anadarko is going nuts right now. As an example, one of the companies we discuss, Devon Energy (DVN), is extremely active in the Woodford citing the great wells and economics in the play. This makes the Woodford Express bolt-on acquisition to the Enable system they picked up last year, extremely accretive and consistent with this overall thesis.

ET Woodford Express line (“ET”)

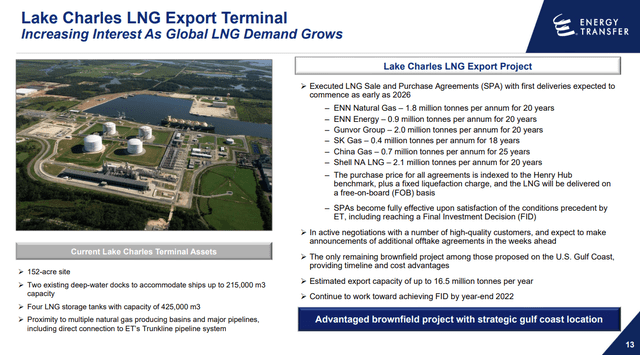

So with the Woodford Express and assuming Warrior becomes a reality and starts shipping gas in 2025, ET will have a 5-BCF/D+ funnel to support the next part of this LNG thesis. That being Lake Charles LNG, a proposed 16.5 mtpa project targeted to begin operations later that year. In addition, there is the Gulf Run 42″ 1.65 BCF/D line that will bring Haynesville gas to Exxon Mobil’s (XOM) Golden Pass LNG with Lake Charles as an alternative. There are still some T’s to cross and i’s to dot on the Lake Charles deal, but it’s not hard to put together ET’s strategy.

ET Lake Charles LNG (“ET”)

This is a cost-advantaged site with 2-existing deep water docks, and 4-425K cubic meter LNG tanks. This is a big savings in time and capital, and when the compression trains are built should contribute materially to ET’s earnings.

Tom Long, Co-CEO of ET, commented on the earnings call in response to an analyst question on the timeline for Lake Charles LNG:

We are making progress on all aspects of the project and we’re now targeting FID by the end of the first quarter of 2023. Upon completion of the LNG project, we expect to realize significant incremental cash flows from transportation of natural gas on our Trunkline pipeline system and other energy transfer pipelines upstream from Lake Charles.

Wait a minute, it sounds like ET is reverting to its old growth at any cost mindset…

OK not so fast. The concern is understood. ET has a history of throwing borrowed money at opportunities. It’s a good part of how a company with a capitalization of $36 bn carries debt of ~$47.4 bn. I used to be very negative on ET for just this reason, but in 2020, Kelcy Warren, the co-founder and Executive Chairman, stepped back and let professional managers take over. There’s no sign this aging billionaire is reneging.

At age 67, in the single-digit billionaire class, you start thinking about things other than quarterly conference calls. Stuff like, should the yacht be 200′ or 250′ long? Van Gogh or Monet in the foyer? Gold or platinum fixtures in the master bath? Bugatti Veyron or Lambo? Dividing up the loot among your heirs to minimize Uncle Sam’s bite. Making a big donation to your Alma Mater to get a building named after you. These are proper contemplations for a man in Kelcy’s position.

Tom Long commented on the financing plan for Lake Charles LNG:

As we have previously stated, we expect to finance a significant portion of the capital cost of this project by means of the sale of equity in the project to infrastructure funds and possibly to one and more industry participants in conjunction with LNG offtake agreements.

We started this piece out with the tightness of gas supply. I think there is an excellent chance of equity participation by companies or countries looking to ensure supply and hedge costs. Ample corollaries abound. Take the DVN deal with Delfin as an example. So, no big multi-billion dollar Lake Charles LNG carry for ET unit holders. I expect further announcements along this line over the next couple of quarters. In my experience when an exec teases something like what Long said, it is code for: talks are underway. Let’s hope so anyway, or a lot of the synergy in the overall plan could slip away.

Risks

For the first time in a long time, it’s hard to think of a lot of outsized risks that could torpedo a $12 stock. Weakness in commodity prices could drive the stock back toward the $9-10 range, but oil has defended the $80 level a number of times this year. Gas has defended $6.00 MCF. These are prices that will keep the E&P’s drilling and sending production to ET for takeaway.

There’s the omnipresent political risk that dogs pipeline companies these days. Could it get worse? Sure, but ET isn’t on a major growth spurt trying to get new projects approved, and I doubt they will be given this “letting off steam” statement at the end of the call by Co-CEO Marshall McCrae:

We have an administration right now that came into this and has put in very hostile administrators at FERC and EPA and SEC to attack our industry, and that’s gone on for a while within this administration, where they’re not allowing new leases, not allowing drilling permits, not allowing or slowing down approval of pipelines. And then what do we do the last few days, we come out and attack our oil and gas producers and say they’re going to be penalized for not producing more. I mean, my goodness, if this doesn’t seem like a sitcom or Saturday Night Live skit, it’d be funny if it wasn’t so tragically sad.

That doesn’t sound like a guy who is girding for battle with administrators.

Q3, 2022

Energy Transfer reported net income attributable to partners for the three months ended September 30, 2022 of $1.01 billion, a $371 million increase from the same period last year.

Adjusted EBITDA for the three months ended September 30, 2022 was $3.09 billion compared to $2.58 billion for the three months ended September 30, 2021. Distributable Cash Flow attributable to partners, as adjusted, for the three months ended September 30, 2022 was $1.58 billion compared to $1.31 billion for the three months ended September 30, 2021. Debt stood at ~$47.4 bn, down from $48.1 bn in the prior qtr.

The improved results were primarily due to higher volumes across all of their core segments and the impacts of the recent acquisition of Enable Midstream.

- Intrastate natural gas transportation volumes were up 28% and set a new Partnership record.

- Interstate natural gas transportation volumes were up 43%.

- Midstream gathered volumes were up 47% and set a new Partnership record.

- NGL transportation volumes were up 5%.

- NGL fractionation volumes were up 6% and set a new Partnership record.

- Crude oil transportation and terminal volumes were up 10% and 14%, respectively.

Your takeaway

You can’t buy a hamburger for $12 bucks these days. Soon you aren’t going to be able to buy a unit of ET for that price either. Analysts are bullish on ET stock with a buy rating, and price targets that range from $14-$21.

ET is minting cash like it was going out of style. $12-$13 bn in OCF on a forward basis from Q-3. Their OCF multiple is under 7X. For reference competitor, Enterprise Products Partners is trading at 10.5X OCF.

Their capex target of $1.8-2.0 bn annually leaves a lot of room for debt reduction and distribution raises. On the subject of distribution raises, ET’s announced goal is a return to $1.22 per unit on an annual basis, to be achieved sometime in 2023. Tom Long on the possibility of further increases-

So we — I will tell you, at this point, we are planning this quarter by quarter as far as the distribution side of it and looking at it. There’s not been dialogue on anything around the distribution growth or unit buybacks.

We really want to get that leverage target in that 4 to 4.5 range. And we’d be quite happy to get it to the — closer to the 4 range. And we’re going to have some opportunities next year with all the free cash flow that we’re seeing and some of the debt maturities, we’re going to continue to look at that. So we would put that up there higher than unit buyback to get to the lower leverage, but also the great capital projects that we’re talking about.

I would decode the above as saying debt reduction is Priority#1, and applying spare cash to capital projects is Priority#2. However the disconnect between what they are paying out in capex $2-$3 bn annually, and their cash flow of $12-$13 bn suggests that as debt comes into line with their stated goal of 4X, the savings in interest payments-currently ~$2 bn, alone will drive distributions higher.

As I have positioned growth in ET as a future story keyed to the LNG thesis, what might this mean? For reference, Cheniere Energy (LNG), a pure play LNG exporter, exported ~10 MT in Q-3, 2022 and generated $8 bn in EBITDA. Lake Charles LNG is being built to export ~4 MT per quarter…so, can we say $2 bn/qtr in LNG EBITDA? IF that’s the case, the OCF multiple could shrink by half to 3.5X OCF. Just to maintain the current 7X the share price would adjust toward the middle $20’s. There you want growth? ET is giving it to you.

Obviously there’s some “Hopium” built into this SWAG-like thesis. Both Lake Charles LNG and the Warrior Pipeline need to achieve FID for this thesis to hold together, so factor that into any decisions you make regarding ET and the LNG thesis. I don’t think I’ve made a huge stretch here, but this is the oilpatch. Things happen sometimes.

A final note. As an MLP, ET’s payout comes with special IRS filing requirements. Consult your tax advisor in that regard if you are considering taking a position. Or just buy into the Global X MLP ETF (MLPA) and get the proportional exposure to ET without the K-1 headache.

Be the first to comment