imaginima

Overview of Energy Transfer LP and my Investment Thesis

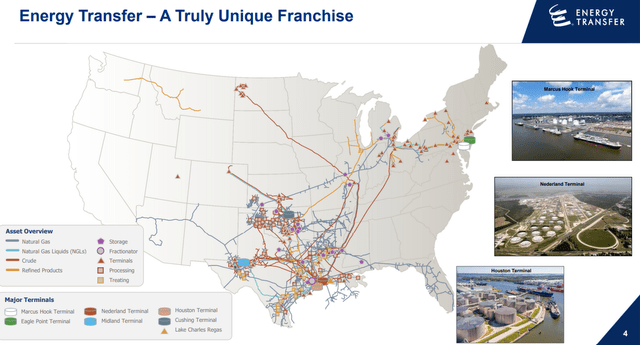

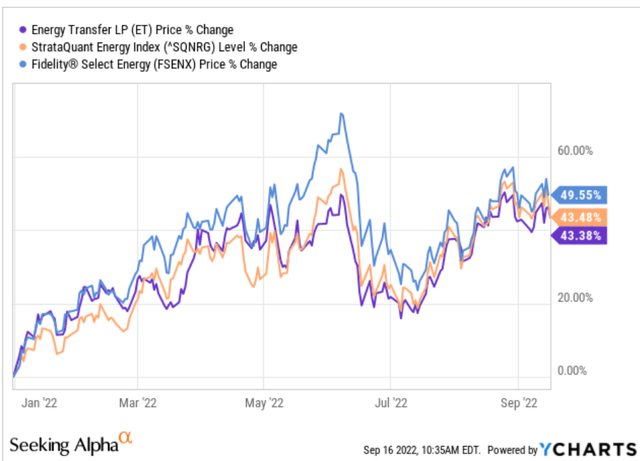

Energy Transfer LP (NASDAQ:ET) has been a strong outperformer in this year’s bear market. With its high volume of recent insider buying activity, this can be another indication of a potential move higher. Energy Transfer is a company that operates as a midstream oil company with terminals mainly in Texas, Louisiana, and a portion of the Northeast. They are a midstream oil company tasked with managing the pipeline and gathering facilities that move the gas from the well (upstream) to businesses and consumers (downstream).

Locations of Oil Terminals and Pipelines for Energy Transfer (September 2022 Investor Presentation)

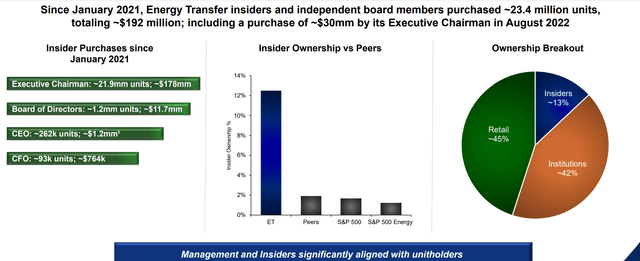

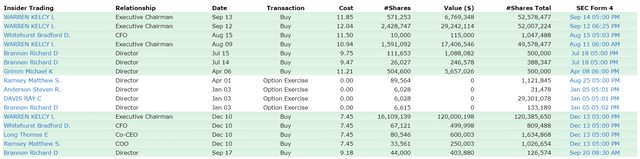

There were significant buys from the CEO, Kelcy Warren, and recent purchases from the CFO Bradford Whitehurst and directors Richard Brannon and Michael Grimm. These purchases have all been in the range of $10-12. Considering that these executives purchased shares earlier in the year at around $7.50/share, which is much lower than current levels, investors might consider some potential for another move higher.

Not only does ET have solid fundamentals/valuation relative to industry averages, but it also pays out a significant dividend, along with this flurry of confidence from the insiders. Given all of this recent buying activity, especially at a high volume, this makes me more confident in potentially investing in ET at these levels. Moving forward in this analysis, I will back my buy thesis with the many strengths I see in this company compared to its peers, as well as some risks to my thesis.

YTD Performance of ET and Energy Funds (YCharts)

How Energy Transfer Excels Ahead of its Peers Within the Energy Sector

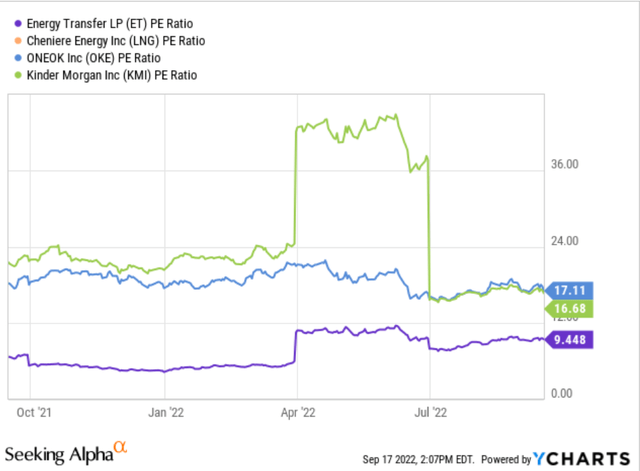

Some peers not only within the energy sector but also in the oil and gas transportation and storage industry include Cheniere Energy Inc (NASDAQ:LNG), Kinder Morgan Inc (NASDAQ:KMI), and ONEOK Inc (NASDAQ:OKE). I will show a comprehensive analysis comparing Energy Transport LP with these competitors and reiterate why I think ET shines above these names. I will use valuation ratios and compare the dividend yields of each peer to get a general comparison of the sector and industry.

Data Provided By (YCharts)

As you can see above, Energy Transfer excels in the price-to-earnings ratio category, with a multiple that is nearly half of its peers’ ratios. Although there has been a slight uptick in ET’s PE ratio due to its outstanding stock performance in 2022, it remains cheaply valued and is given a pretty strong B+ valuation rating by Seeking Alpha. Energy Transfer has done an exceptional job at securing contracts and increasing net income margins, making its valuation appear more attractive. The execution of six long-term liquefied natural gas SPAs to supply around 8 million tons of LNG per year, with first deliveries expected to commence as early as 2026 under SPA terms ranging from 18 to 25 years. This will allow ET to penetrate the midstream market even stronger and enable management to target higher payout yields and deleverage.

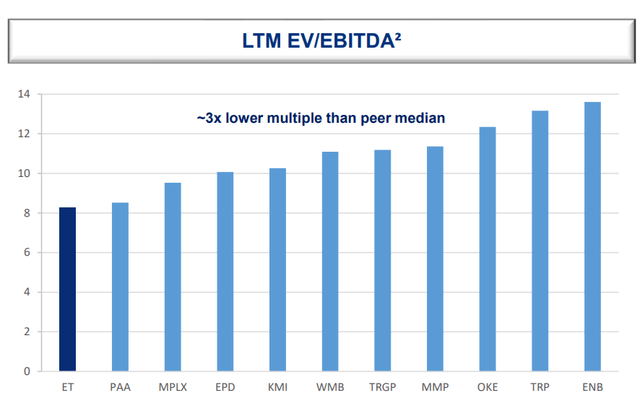

Comparable EV/EBITDA Ratios Across the Energy Sector (ET September 2022 Investor Presentation)

Another metric in which ET is extremely undervalued is its EV/EBITDA multiple. Above, you can see the value Energy Transfer attains when compared to its peers across the industry. ET remains one of the strongest valued companies across Energy using the EV/EBITDA ratio, which illustrates the company’s ability to turn sales into profits reliably. While delivering growth projects, they’ve also been able to significantly eliminate debt from the balance sheets, providing a stronger EV/EBITDA multiple.

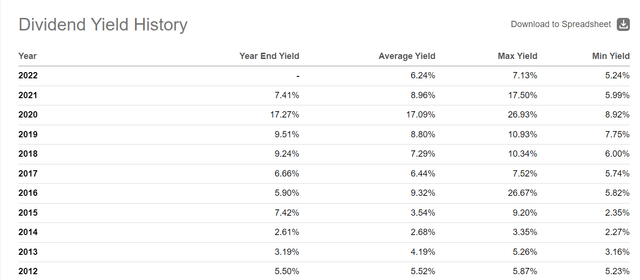

Competitive Dividend Yield

Energy Transfer noted that they now have $1.88 billion in distributable cash flow in Q2 2022, which is up 35% YOY. Because Energy Transfer has been able to bolster its free cash flow recently, they are now focused on increasing the yield again and target anywhere from $.90-1.20/share in annualized yields. This is a significant number considering the present inflation rate in America and all over the globe. ET’s current yield of around 7% offers as an excellent inflation hedge while also providing robust growth strategies in the liquified natural gas space. Average yields have been in a downtrend since 2019; however, the company primarily targeted debt reduction during these times and allocated most of its FCF towards deleveraging its balance sheet.

Energy Transfer’s Dividend Yield 2012-2022 (Seeking Alpha)

Another significant stride that Energy Transfer has taken toward deleveraging has been using its cash proceeds from its sale of Energy Transfer Canada. They have also utilized most of their free cash flow to target deleveraging before ramping their already excellent yield.

- “In March 2022, the Partnership announced a definitive agreement to sell its 51% interest in Energy Transfer Canada. The sale is expected to result in cash proceeds to Energy Transfer of approximately $272 million (based on the March 31, 2022 exchange rate), subject to certain purchase price adjustments, and to reduce the Partnership’s consolidated debt by approximately $450 million. The transaction is expected to close by the third quarter of 2022.”

- “Energy Transfer generated enough cash to cover its high-yielding distribution by more than three times. That enabled the midstream company to fund its capital program with room to spare, allowing it to continue paying off debt. Energy Transfer retired $290 million of debt in the first quarter, adding to last year’s $6.3 billion in debt reduction. Meanwhile, the company took another step toward improving its balance sheet by agreeing to sell Energy Transfer Canada in a deal that should close later this year.”

Recent Significant Insider Buying From Energy Transfer Executives

The executives at Energy Transfer have recently expressed extreme bullishness towards the stock, with several million dollar + purchases. Especially the CEO Kelcy Warren, buying over $35 million in shares this past trading week. What makes me more bullish on this stock is that these executives listed below have been buying blocks of shares way back before the start of 2022, when the stock was around half the price it is now. The list of recent buys of ET includes:

- $36,011,462 in stock from the CEO on 9/12 and 9/13, bringing Warren’s total stake up to 52,578,477 shares.

- $115,000 in shares from the CFO on 8/9, bringing Whitehurst’s total share count to 1,047,488.

- $1,334,660 shares from Richard Brannon (Director) on 7/14-7/15, increasing his share count to 500,000.

- $5,657,026 in shares from Michael Grimm (Director) on 4/6, taking his share count up to 500,000.

Significant Management Ownership – Continued Buying (Energy Transfer’s September 2022 Investor Presentation)

As noted from the Finviz source below, there have been no insider sales, only buys, showing the attitudes of some of the most important/significant individuals within Energy Transfer LP. The detailed picture above describes the sheer size in volume of the recent insider buys. Insiders hold around 13% of the float, which is a noteworthy amount, as well as the sizeable portion of shares that institutions own. Holding 52,578,477 shares valued at approximately $620,000,000, the CEO owns about 1.67% of the shares, and this number continues to grow exponentially, which is a great sign.

ET Recent Insider Transactions (FINVIZ)

Potential Threats of Investing in Energy Transfer

- Extreme dilution on a 10-year timeframe. It has slowed a bit as of late, but the outstanding share count continues to push higher to cover its debt burden. There were a couple of stock splits in 2014 and 2015; however, this does not account for all the dilutive practices.

- Total debt continues to grow, which poses a threat in an environment of elevated interest rates. Although they target deleveraging and have done a decent job, their high-yielding dividend and soaring interest rates weigh down on ET’s debt burden.

- The dividend yield declined by about 50% from 2019 to 2021 because of its extensive debt, but the dividend yield has started to rise again in 2022. One must consider if they rather have a higher yield or if the company continues to cut the dividend to continue its deleveraging strategy.

- A global push towards clean energy alternatives and penalties on companies in the oil and gas rigging space will likely continue, jeopardizing companies in the oil and gas transportation industry.

Concluding Remarks

Although Energy Transfer LP has a considerable amount of debt which is very unfavorable in a late-cycle economy with generally higher interest rates, I still believe Energy Transfer will be able to deliver a strong dividend and pay off a substantial portion of its debt in the coming years with their free cash flow. Energy Transfer’s executives also have shown significant confidence in owning this stock, with the CEO buying over $35,000,000 in shares this past trading week. The European energy crisis can be a massive opportunity for Energy Transfer. With the gas supply from Russia to Germany being at an all-time low, ET can potentially be a vital part of the deliverance of liquefied natural gas to Europe to solve the energy crisis as a midstream player. Lastly, ET’s dividend yield is desirable to income investors because the current yield nearly matches the inflation rate in the U.S. (CPI of 8.3% YOY), only around 100 basis points below August’s CPI print. The continuation of this elevated yield is a great inflation hedge while also providing investors with growth opportunities, which are rare to come by these days. Ultimately, I see Energy Transfer as a stock with pretty decent short-term upside and a large amount of long-term upside if they can prove to continue operating at elevated margins and allocated FCF towards new growth projects and deleveraging.

Be the first to comment