spooh

As of the time of this writing, the largest holding in my very concentrated 7-stock portfolio happens to be Energy Transfer (NYSE:ET). To say that I am bullish about the company to have 22.2% of my assets in it is an understatement. Recently, performance from the enterprise has been very impressive. But even with shares rising, the stock looks to be incredibly cheap both on an absolute basis and relative to similar players. It is worth keeping in mind, of course, that this picture could change for the better or worse on a dime. And the most likely time for such a change to take place would be during a quarterly earnings release. Interestingly enough, on November 1st of this year, after the close of the market, management is expected to report financial results covering the third quarter of the company’s 2022 fiscal year. Naturally, investors should pay attention to a couple of factors. But so long as nothing significantly changes for the worse, I cannot help but to think that only upside exists for the foreseeable future.

Energy Transfer – A fantastic business at a fantastic price

The last time I wrote an article about Energy Transfer was in early August of this year. In that article, I talked about the financial results that the company reported for the second quarter of its 2022 fiscal year. At that time, I was also celebrating the fact that management had increased guidance for the year from a cash flow perspective. Between this and how cheap shares were, I reiterated my ‘strong buy’ for the company’s stock, reflecting my belief that it should tremendously outperform the broader market for the foreseeable future. And since then, that call has played out nicely. While the S&P 500 is down by 9.7%, shares of Energy Transfer have experienced upside of 11.6%.

Today, Energy Transfer is a true behemoth in its space. The company, for instance, has around 53,500 miles of gathering pipelines for its midstream operations. Its NGL and refined products operations have around 3,600 miles of pipeline, while the crude oil segment of the company boasts approximately 11,300 miles of crude oil trunk and gathering lines. On top of this, the company also owns around 26,900 miles of Interstate pipelines used for natural gas, plus it has 11,600 miles of Interstate pipelines for natural gas as well. Measured in dollar terms, the company could also be described as significant in size. Its market capitalization as of this writing is $36.67 billion, while its enterprise value comes out to just under $100 billion.

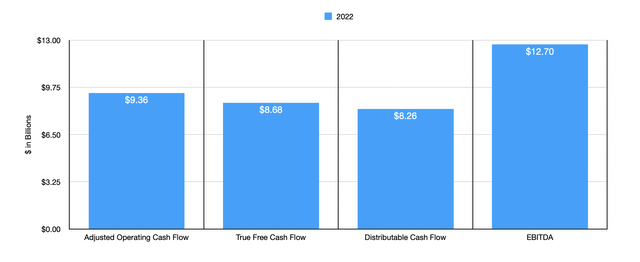

When management last reported financial results covering the second quarter of the 2022 fiscal year, they increased guidance for the business, forecasting that EBITDA during 2022 would come in at between $12.6 billion and $12.8 billion. This compared favorably to the prior guidance of between $12.2 billion and $12.6 billion. Based on those figures, using midpoint guidance as the foundation, I calculated that the company should have adjusted operating cash flow this year of $9.36 billion. This was factored in after making certain adjustments to the cash flow figure to make it more conservative than the GAAP equivalent would have been. Taking out maintenance capital expenditures only, I ended up with ‘true free cash flow’ (cash flow that doesn’t penalize for growth) of $8.68 billion, while distributable cash flow came in at $8.26 billion.

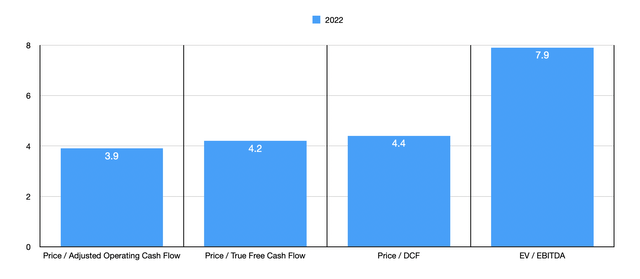

As part of my analysis in the company, I then decided to price it. Using these figures, I calculated that the company is trading at a forward price to adjusted operating cash flow multiple of 3.9. The forward price to true free cash flow multiple would be 4.2, while the price to distributable cash flow multiple would come in at 4.4. Due to the net leverage ratio the company has of 3.76, the EV to EBITDA multiple is a bit higher, coming in at 7.9. But for an enterprise that is as high quality as Energy Transfer happens to be, this still looks low in my book.

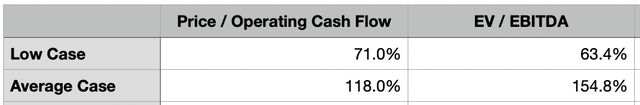

To put all of this in perspective, I then took two of the metrics and looked at five similar businesses in the same way. Using the price to operating cash flow approach, for instance, these companies ranged from a low of 6.6 to a high of 9.9. And using the EV to EBITDA approach, the range was between 9.7 and 15.4. In both scenarios, Energy Transfer was the cheapest of the group. Now to truly see what kind of upside potential, if any, our prospect might have, I then took two different scenarios.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Energy Transfer | 3.9 | 7.9 |

| MPLX (MPLX) | 6.7 | 9.7 |

| ONEOK (OKE) | 9.3 | 11.2 |

| Kinder Morgan (KMI) | 7.5 | 12.9 |

| Williams Companies (WMB) | 9.3 | 12.5 |

| Cheniere Energy Partners (CQP) | 9.9 | 15.4 |

In the first scenario, I decided to average out the trading multiples of its peers. From there, I assumed that a fair value for Energy Transfer would result in the company trading at the average I calculated. Doing this for the price to operating cash flow approach, I calculated implied upside for shareholders from today of 118%. And using the EV to EBITDA approach, upside was even higher at 154.8%. To be more conservative, I then looked at a second scenario where, instead of trading at the average, Energy Transfer would be trading at just the multiple that the cheapest of the five similar firms is trading for. In this case, the price to operating cash flow approach gave upside of 71%, while the EV to EBITDA approach gave upside of 63.4%. No matter how you stack it, the potential for upside for investors is tremendous. And this excludes the prospect of continued accumulation of distributions as time goes on.

Takeaway

Already, management increased guidance one time this year. It’s uncertain whether they will do so again. But investors should pay attention to what management says when they release their financial results, not only when it comes to guidance but also when it comes to the amount of cash flow the company generated during the latest quarter. Given how cheap shares are though, and the quality of the enterprise, I do think that upside potential from here is tremendous. It’s one of the few companies I have identified in this market that I think could double while still looking cheap afterward. Because of this, I am keeping my ‘strong buy’ rating on the firm for now.

Be the first to comment