Marc Bruxelle/iStock via Getty Images

I have a significant chunk of my regular brokerage account invested in Enterprise Products Partners (EPD) and Magellan Midstream Partners (MMP), two MLPs with juicy yields. I have talked about each extensively in past articles, and each time I write an article on either, I typically see at least one comment asking about my opinion on Energy Transfer (NYSE:ET). I am familiar with the company as it was one of several options that I did closer research on last year when I started looking at energy and the midstream sector in particular. After several requests to write an article, I figured it was high time that I write an article on Energy Transfer.

Investment Thesis

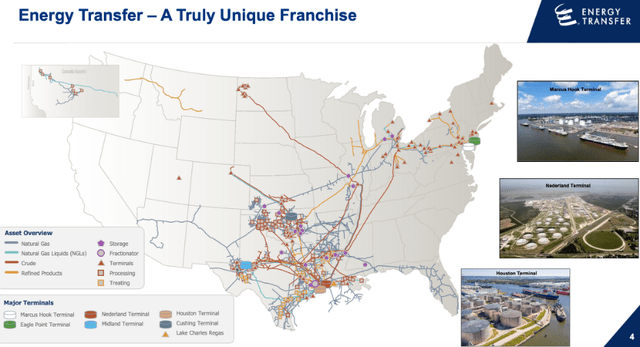

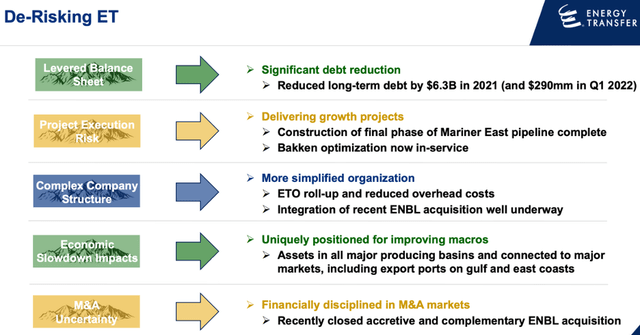

Energy Transfer is one of the largest MLPs available to investors today. They have pipelines covering large chunks of the US and they are expected to continue to grow in the future. The company has paid off over $6B in debt in the last year or so, but the balance sheet still carries a lot of leverage with over $48B in long-term debt. The company has solid insider ownership around 12%, which should bolster the bull case by aligning management with unitholders.

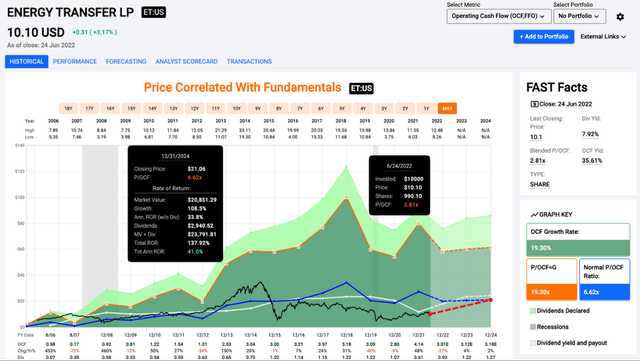

Investors looking for current income can collect a 7.9% yield, and I think some degree of multiple expansion is likely. Units currently trade below 3x cashflows, which is less than half of the average multiple. The low multiple is driven by several factors, including a distribution cut in 2020. They have raised the distribution a couple times since then, but I still prefer other MLPs as a more reliable source of income.

A Summary Of The Business

Energy Transfer is one of the largest pipeline networks in the US. 90% of revenues are fee based, so they aren’t as exposed to commodity price fluctuations as the typical energy company. With a market cap of $31B and significant cashflows, many investors think that units are a steal at the current price.

Energy Transfer Footprint (energytransfer.com)

Energy Transfer has improved their position significantly in the last couple years. Below are some of the steps they have taken to improve the long-term outlook for unitholders. They closed the Enable acquisition and have taken several other steps to improve the business. The most important change in my opinion is significantly delevering the balance sheet, reducing their long-term debt by more than $6.5B in 2021 and the first quarter of 2022. Long term debt still sits at a rather hefty $48.8B (at the end of Q1), but things are moving in the right direction for now.

Business Improvements (energytransfer.com)

They do have solid insider ownership at ~12%, which is another reason that management should perform in the best interests of unitholders in the future. However, with a distribution cut in 2020 and a couple of other bumps along the way in the recent past, investors seem to be consistently frustrated with management. That might be one of the reasons for a valuation that is lower than other large-scale peers.

Valuation

Energy Transfer is certainly looking cheap right now near $10 a unit. After bouncing off lows near $5 in the last couple years, units have recovered significantly, but still trade at a large discount to the average cash flow multiple of 6.6x. Units currently trade at 2.8x cash flows, and some investors are expecting significant returns driven by the large distribution and multiple expansion.

Price/Cash Flow (fastgraphs.com)

I think the cheap valuation is driven by three main factors. The first is the perceived quality of management. Investors in Energy Transfer have been frustrated with the management for several years, and I have seen articles and comments lamenting the “I want to acquire someone” attitude of management. The second is the large debt load. While MLPs typically carry a large chunk of debt on their balance sheet, Energy Transfer has proven in the past that they carried too much leverage and investors paid the price with a distribution cut. The last part of the cheap valuation is likely due to the distribution cut in 2020. I can certainly understand why MLPs that have maintained their distributions through rough economic times earn a higher multiple than competitors with a cut.

The Distribution Cut

The company’s distribution cut in 2020 is the main reason I stayed away from Energy Transfer. When I was evaluating the midstream sector, I was attracted by the resilient nature of the business model and the large distribution yields. Energy Transfer cut the quarterly distribution from $0.31 to $0.15. In the last couple quarters, they have hiked a couple of times, to $0.18 and most recently $0.20. Bullish investors expect the hikes to continue, and I tend to agree with them. The setup is much better for the company in the coming years than it was in 2020 (obviously), and they have paid down a significant chunk of the debt on the balance sheet.

Units currently yield 7.9%, which is a juicy distribution by any measure. If they continue to hike in the coming years, yield on cost could be well over 10%. However, I will be sticking with my current investments in the MLP space because I trust the managements of EPD and MMP more than Energy Transfer’s. While they have been acquisitive in the past, and I tend to agree with management that the large players that consolidate the industry will survive and thrive in the long run, I don’t think the quality of the business, or the management is on the same level as EPD or MMP. That is why I currently have no position, despite the cheaper cash flow multiple and the possible price appreciation being larger than other MLPs in the same sector.

Conclusion

Energy Transfer is an attractive investment in the midstream sector of the US. The yield is just under 8%, which is bound to attract income investors. While the distribution cut in 2020 frustrated investors, they have raised it a couple times since then and I think distribution growth is likely to continue in the next couple years. Shares are cheap under 3x cash flows and well below the 6.6x average multiple.

Investors should keep an eye on the debt levels, but that has been heading in the right direction over the last year and I would expect that to continue. I have chosen to invest in Enterprise Products Partners and Magellan Midstream Partners for the reliable distributions and higher quality management teams. The potential upside for Energy Transfer might be higher, but I am already very overweight in the midstream sector, which is why I have chosen to remain on the sidelines with Energy Transfer.

Be the first to comment