Aranga87/iStock via Getty Images

U.K. fuel cell company Ceres Power (OTCPK:CPWHF) continues to hold technological promise but remains commercially disappointing.

I last covered the name in June, in my neutral note Ceres Power: Positive Progress But Still Pricey, since when the shares have fallen 28%. That takes the one-year movement in the share price to a 67% loss.

Despite that, the company still has a £665m market capitalisation. Given the company’s economics, I see that as high and am changing my rating to “Sell”.

Interim Results Show Progress in the Wrong Direction

The company published its interim results this month.

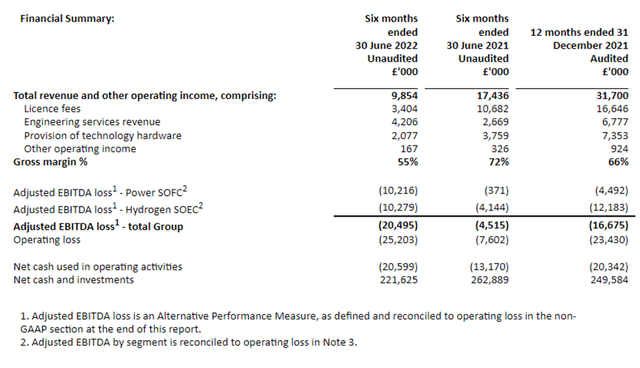

I found them underwhelming. Revenue came in at £9.9m, a decline of 43% from the same prior year period. The operating loss more than tripled to £25m.

The chef executive noted:

“The phasing of revenue in 2022 and early 2023 is highly sensitive to the timing of the establishment of the China JVs, where Ceres, Bosch and Weichai are making good progress towards definitive agreements.”

Be that as it may, the fact is that revenue in the half almost halved compared to the prior year period, which for a company in a growth phase I see as an unpromising development. It concerns me that Ceres’ revenue streams remain insufficiently diversified that the timing of a single contract can make such a difference to its results. Ceres has been listed since 2004, so it is not a young company. The China JV contract is currently expected to be completed in the second half.

For now I do not see liquidity as a concern even if the company continues in its current lossmaking, cash-burning mode. Ceres ended the first half with £222m in net cash and equivalents, which I consider gives it a comfortably liquidity cushion for the short- and medium-term. In the longer term, though, if the company needs to boost its liquidity again in future, I see the risk of further rights issues diluting shareholders as has been the case in the past. The company has continued to increase its share count, most recently in June.

The business continues to show potential despite its first-half revenue decline. In June, Ceres announced that it is partnering with Shell (SHEL) to utilise solid oxide electrolyser cell technology to deliver “high-efficiency, low-cost green hydrogen”. I take that as a further positive sign when it comes to the credibility of Ceres’ technology. However, the technology itself has not been the challenge to date when valuing Ceres, rather it is its ability to commercialise it at scale.

Valuation Looks High

The Ceres share price is now back to where it was in 2020 before investor excitement about its green energy potential surged before subsequently falling back.

At its current valuation, the shares are trading on a price-to-sales ratio of 21 using last year’s sales (or more accurately, revenues). Those revenues were already lower than the prior year. This year has seen revenues nosedive so far, but the second half may be much stronger based on the company’s guidance re contract timing. In its interim results, the company did not provide guidance for the full year. On that basis, I think using last year’s revenue number to calculate the price-to-sales ratio is reasonable and indeed may even be optimistic. Given the company’s unproven business model and stagnant revenue (albeit in the past five years, revenues have grown around fivefold).

With no earnings, there is no way to ascribe a price-to-earnings ratio to Ceres.

So, despite the fall in share price, I continue to see no investment case for Ceres at the current share price. In fact, on the basis that the company is lossmaking, burning cash and trades at a large multiple to revenues, I see the company as overvalued and accordingly downgrade my rating to “Sell”.

Be the first to comment