Photobuay/iStock via Getty Images

Q3 recap and thesis

Energy Transfer (NYSE:ET) released its 2022 Q3 earnings report (“ER”) earlier this month. Its Q3 GAAP EPS dialed in at $0.29. It raked in total revenue of $22.94B, representing a remarkable +37.6% YoY. More importantly and tellingly, the company raised its full-year 2022 guidance again. As its co-CEO, Thomas Long, commented during the ER, the pricing has been running “a little higher than what we had anticipated.” To wit, it adjusted its earnings guidance upward to a range of $12.8B-$13B, about $200M higher than its previous guidance at the midpoint and almost $1B higher at the upper end. Actually, it’s the third time this year that ET has adjusted its guidance upward.

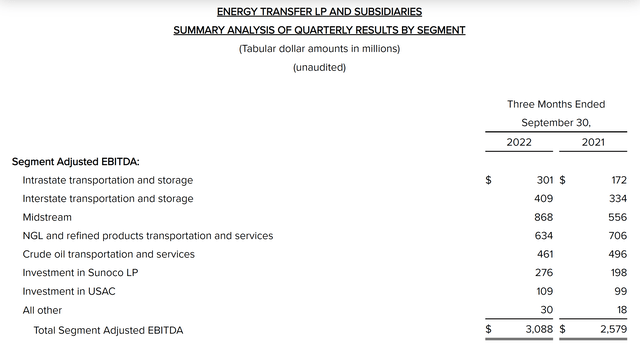

And I won’t be surprised if its actual FY 2002 numbers exceed the guidance given the many strong catalysts ongoing. I see strong profitability drivers across all its core segments: strong volume, robust pricing environments, and its recent acquisition of the Enable Midstream assets. As you can see from the chart below, its adjusted EBITDA from all segments in Q3 (ended September 30, 2022) came in at $3.09 billion, a 20% increase compared to the $2.58 billion for the same period last year.

And all segments are showing strong momentum. Notably, several segments, including intrastate natural gas transportation and storage, Interstate transportation and storage, and midstream all set a new company record in their volumes. To wit, EBITA earnings intrastate transportation and storage reached $301M, a whopping 75% increase YoY. Interstate natural gas transportation EBITDA earnings jumped to $409M, a 22% growth from the $334M a year ago.

Looking ahead, I see the pricing environment and volume staying robust given the demand-supply imbalance in the energy market. As argued in my early articles, I see such imbalance as the result of years of underinvestment, exacerbated by the Russian/Ukraine situation. It is a long-term structural issue in my mind, and I don’t see the imbalance going away anytime soon.

At the same time, ET has plenty of projects to further strengthen its position as the world’s biggest exporter of NGLs (natural gas liquids). Its NGL volume accounts for approximately 20% of the global market. The company has finalized 5 agreements to supply an aggregate of 5.8 million tons of LNG per year from the Lake Charles property. These contracts are indexed to the Henry Hub benchmark plus a fixed liquefaction charge, adding strong and consistent additional revenues. And I estimate them to start contributing to the bottom in the 2025-2026 timeframe.

Thanks to the strong Q3 results and the repeatedly lifted guidance, the stock prices now hover near a 52-week high ($12.2 as of this writing). However, I see good odds for the stock price to push toward ~$20, roughly its 5-year peak level. And next, we will see that a few simple, yet timeless, principles developed by Benjamin Graham indicate at least 70% undervaluation under current conditions, translating into a $20+ fair price.

ET and Benjamin Graham’s Checklist

Benjamin Graham has developed a few simple rules to pick defensive stocks in his classic, The Intelligent Investor. These simple rules are summarized in our earlier article and briefly summarized below:

- Is the company large, prominent, and conservatively financed? The specific metrics to look for are stable financial strength, consistent capital structure, and a long record of continuous dividend payments.

- Especially the dividend record. Graham emphasized countless times the importance of dividend records – for good reasons. In his own words, he thinks “a record of continuous dividend payments for the last 20 years or more is an important plus factor in the company’s quality rating“.

- Has the company demonstrated an adequate level of Earnings Growth in the past? For defensive investors, growth is not the key and “adequate“ is enough. In Graham‘s mind, a minimum increase of at least one-third in per-share earnings in the past ten years is adequate enough.

- Finally, are the valuation multiples moderate? As a value investor to the core, he also recommended a series of methods for investors to gauge the price they should pay. And also, being fully aware of the uncertainties in his own method, he emphasized that you should always leave a safe margin of safety.

The remainder of this article will examine ET against each one of these rules.

ET: is it large, prominent, and conservatively financed?

It is simple to answer the first two questions. As aforementioned, ET is the world’s biggest exporter of NGLs, accounting for approximately 20% of the global market. Furthermore, it also owns a diversified portfolio of other energy assets in the U.S, including complementary natural gas midstream, intrastate and interstate transportation and storage assets, crude oil, refined product transportation, and also terminal assets.

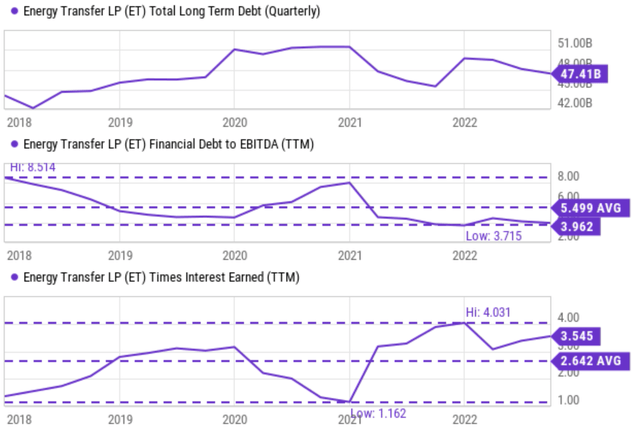

In terms of financial strength, midstream companies are in general more leveraged than the overall economy. However, ET was able to maintain a healthy and stable financial position over the years as you can see from the following charts. The top panel of the chart below shows ET’s total debt. As seen, its total debt has been relatively stable between about $42B to $50B in the past 5 years. More tellingly, its debt/EBITDA ratio currently stands at 3.96x (shown in the middle panel), close to the bottom level in the past five years. As a result, ET’s ability to service its debt is near a peak level in multiyear. Its current interest coverage ratio is 3.55x (the bottom panel), which means that its only needs 28% of its earnings to service its debt. To put things under perspective, its average interest coverage ratio is about 2.64x historically, which it has no problem in the long-run spending even 38% of its earnings to service its debt.

ET: does it have a strong dividend and growth record?

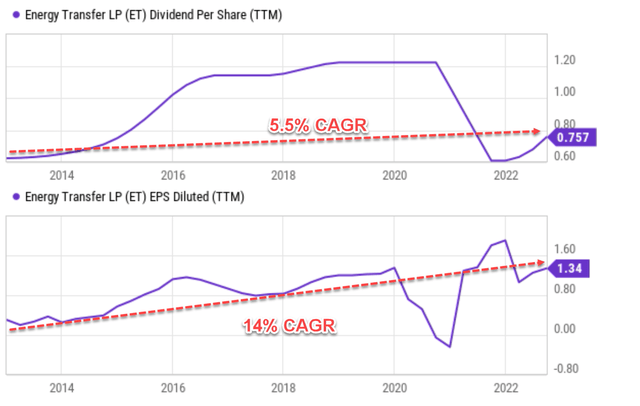

Both are also easy requirements for ET to check off. In ET’s case, it has been a partnership and has been paying out most of its earnings as dividends in the long term. Although it had to cut its dividends during the COVID pandemic as you can see from the top panel in the following chart, overall, it has been growing its dividend payouts at a CAGR of 5.5% in the past 10 years. Its earnings growth rates are even higher as seen in the bottom panel. It has been growing its EPS at a CAGR of a double-digits 14% in the past 10 years.

As mentioned earlier, Graham’s rule involves an increase of at least one-third in EPS in 10 years, which translates into about 2.89% CAGR. Thus, ET’s earning growth, either measured by dividend or EPS, far exceeds this requirement.

Source: author based on Seeking Alpha data.

A moderate valuation

Finally, as also mentioned earlier,

As a value investor to the core, Graham recommended a series of methods for investors to gauge the price they should pay. Here we will examine two of them (the other methods he recommended essentially paint the same picture). First, he recommended the PE for a defensive stock should be around 8.5 plus twice the expected annual growth rate, which I call the Graham PE. Hence, in his mind, a business that completely stagnates should be worth about 8.5x PE.

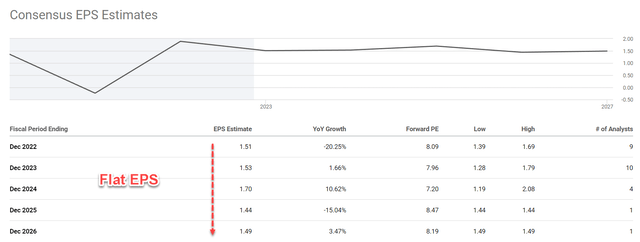

And in ET’s case, consensus estimates project its earnings growth rates to be flat in the next few years ($1.51 in 2022 vs $1.49 in 2026). My view is that these estimates are too pessimistic given the expansion catalysts mentioned earlier and its demonstrated historical growth record just mentioned above.

Source: author based on Seeking Alpha data.

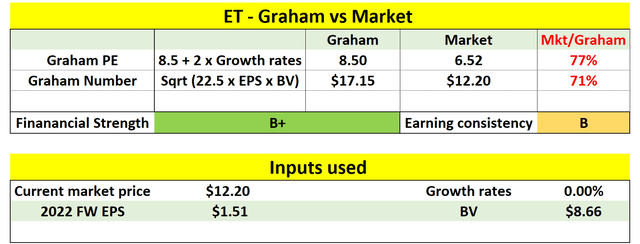

But even based on a 0% growth rate, the Graham PE would be 8.5x (which equals 8.5 + 2 * 0%). Compared to its actual PE of 6.52x, its market valuation is still a 77% discount off the Graham PE.

Of course, Graham is acutely conscious of the uncertainties in his above methods (or any valuation methods). Hence, he also developed other methods to cross-check and estimate the margin of error (or margin of safety). And here let’s check ET’s valuation against another valuation metric, the so-called Graham Number as described below:

In general, Graham cautions against paying a price of more than 15x times earnings or more than 1.5x times the book value (“BV“). However, a PE multiple above 15x could be justified if the P/BV ratio is lower than 1.5x. And vice versa. And as a result, the Graham number considers both the 15x PE limit and the 1.5x P/BV limit. More specifically, the Graham number is the square root of A) 22.5 (which equals 15 times 1.5), B) the EPS, and C) the book value.

The Graham number for ET is analyzed in the table below. All the financials were obtained from Seeking Alpha as of this writing (after the market close on Nov 11, 2022). The Graham number for ET worked out to be $17.15. Compared to a stock price of $12.2, ET is trading at a 71% discount off the Graham number, quite consistent with the Graham PE evaluation.

Source: author based on Seeking Alpha data.

Risks and final thoughts

Finally, investment in ET entails certain risks. It faces the same regulatory risks, geopolitical tensions, and macroeconomic uncertainties as the large energy sector. In addition to these common risks, ET also faces a few risks specific to itself. Its financial strength is rated at B+. It might be stronger than other energy stocks or than its own historical track record. But simply put, a B+ financial strength is not the strongest strength in the grand scheme of things. The energy sector is also notorious for its deep cyclical nature. Combined with the relatively high use leverage, ET has suffered large (or even extreme) volatility risks in the past. For example, historically, its EV/EBITDA ratio has changed from a bottom of about 6x to a peak of 18x in the past 5 years. A 3x valuation swing in 5 years does require investors to have strong nerves. Some of ET’s capital projects are involved in legal battles and the Dakota Access pipeline is a good example, illustrating the regulation and environmental risks just mentioned.

All told, I see strong catalysts across all ET’s core segments going forward. I see the pricing environment and volume staying robust given the demand-supply imbalance. And I further see such imbalance as a long-term structural issue that is not going away anytime soon. Thanks to the repeatedly lifted guidance, its price now hovers around a 52-week high. However, I see good prospects for the stock price to push toward ~$20. A few simple and timeless principles developed by Benjamin Graham point to a 70%+ and a $20+ fair price.

Be the first to comment