Kimberly White

The Thesis

Emerging markets, for the next 50 years. That’s the thesis. In a world full of wealthy developed markets, laden with debt and excess, emerging markets are growth story we want and the growth story we need. Speaking to CNBC in March, the bond king, Jeffrey Gundlach, said an emerging markets investment “is one you want to invest for your grandchildren’s college education.” That’s the runway here.

EM countries have just a sliver of the GDP per capita that the United States enjoys. The growth runway as they join the modern world is enormous. The internet’s connected our world to a knowledge bank like we’ve never seen before, weaponizing the next generation of EM entrepreneurs. Along with this, the world continues its trend toward capitalistic societies, which started back in the 1700’s with legendary economist Adam Smith. We’ve seen economies like Singapore and South Korea explode onto the world stage after adopting Adam Smith like economics. This is just the beginning.

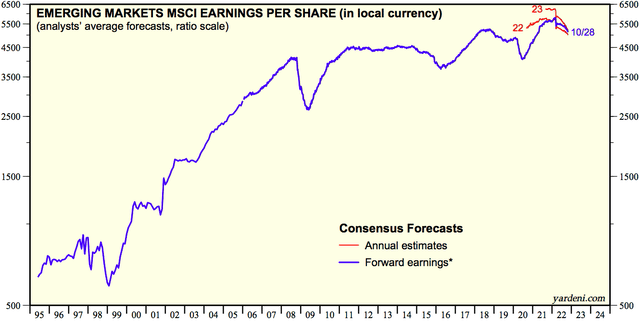

Even as the S&P 500 hits peak profit margins, emerging markets earnings have outgrown the S&P 500’s since 1995:

MSCI Emerging Markets EPS (In Local Currency) (Yardeni)

In local currency, EM earnings grew at 7.5% per annum over this period versus the S&P 500’s 6.5% per annum growth. In our opinion, you can expect this outperformance to continue almost indefinitely. While the S&P 500’s been the best performing index of the past 100 years, many forget that America too was once an emerging market that adopted capitalism and saw its population and capital markets grow. Today, the U.S. is the wealthiest nation in the world, much like Great Britain was 1901.

In the decade ahead, we see returns in the range of 13% per annum for the iShares MSCI Emerging Markets ETF (NYSEARCA:EEM), Vanguard FTSE Emerging Markets ETF (NYSEARCA:VWO), and iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG).

Dalio And Burry – Bullish

As the Chinese market crumbled even further following the reappointment of Xi Jinping, The Big Short’s, Michael Burry chimed in:

While short-term headwinds swirl, Ray Dalio remains bullish on China’s long-term future. The Hang Seng hitting 1997 levels and trading at a PE of 7 is another indication of just how insane this sell-off has become. Dalio believes China will one day surpass the U.S. in GDP. This only makes sense as China boasts a population more than 4x the size of the United States.

We see three huge catalysts for Chinese equities, which make up a large portion of the assets in VWO, EEM, and IEMG:

- The reopening of China’s economy following COVID-19 restrictions is not a matter of if, but when.

- A winding down of the war in Ukraine and fears surrounding Taiwan could be just around the corner.

- The PCAOB audit of Chinese companies like Alibaba (BABA) has come to a close. Delisting risks may soon be off the table.

- China knows the importance of innovation and foreign investment in its economy and is beginning to signal policy support.

While Ray Dalio certainly isn’t bullish on equities as a whole, he’s recently indicated some places to be bullish about:

“I think the opportunities are going to come in different regions. That, as we look at the world, we have to recognize that there are bright spots and there are less bright spots, and places like emerging Asia, places such as Singapore and Vietnam and Indonesia and places like that are bright spots. India, I think, is going to be a brighter spot.”

EM Currencies Are At Extreme Lows

In a flight to safety, the U.S. dollar recently reached levels of strength not seen since 2001:

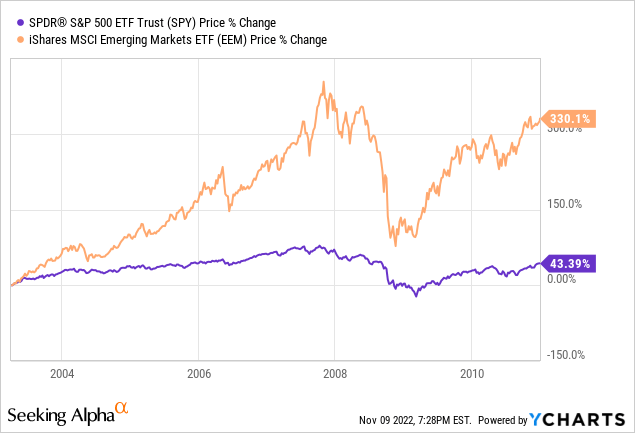

Following 2001, the U.S. dollar fell versus global currencies. The beneficiaries were EM equities, which absolutely destroyed the S&P 500 over the proceeding decade:

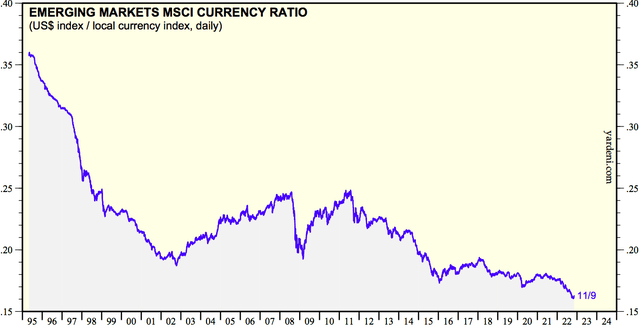

It happened then and it can happen again. Emerging market currencies recently reached 25-year lows against the dollar:

MSCI Emerging Market Currency Ratio – USD / EM index (Yardeni)

Should these currencies revert to the mean, the earnings per share of VWO, EEM, and IEMG, measured in U.S. dollars, will skyrocket. That’s why these moves can be so violent and unexpected, and why everyone should hold some emerging markets exposure.

The Valuations

| P/B | P/E | ROE | CAPE | TTM Yield | |

| VWO | 1.9 | 10.8 | 14.5% | 11 | 3.7% |

| EEM | 1.7 | 10.7 | 15.4% | 11 | 2.9% |

| IEMG | 1.6 | 10.9 | 15.1% | 11 | 4.2% |

| S&P 500 (VOO) | 3.5 | 18.1 | 19.4% | 29 | 1.6% |

The CAPE ratio is worth discussing, sitting at 11x according to the source (My calculations corroborate this figure). Emerging markets are not at a stimulus induced high like much of the developed world. As a collective, these countries have been more conservative with their money creation, effectively borrowing less from their future than many developed nations:

|

Source: Image created by author with data from Trading Economics.

The last five countries on this list account for roughly 75% of the assets in VWO, EEM, and IEMG. VWO excludes South Korea, and thus has higher exposure to China, India, Taiwan, and Brazil.

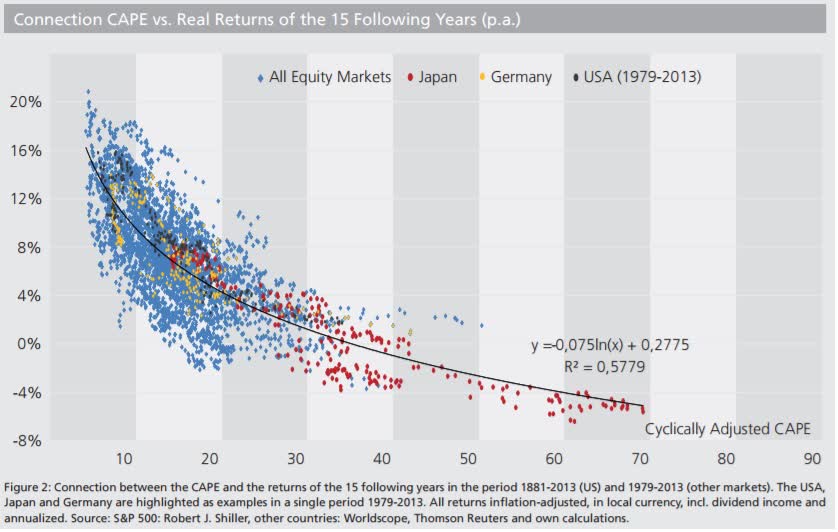

Back to the CAPE ratio, a cyclically adjusted PE ratio of 11x has historically led to inflation-adjusted returns of 10% per annum:

CAPE Ratio Vs. Real Returns (Lyn Alden)

Over the next 15 years, this implies nominal returns of roughly 14% per annum, in line with our expected returns:

| Normalized EPS | Expected Annual Growth Rate | 2032 EPS Estimate | Terminal Multiple | 2032 Price Target |

Annualized Returns (Dividends Reinvested) |

|

| VWO | $3.61 | 7% | $7.10 | 14 | $99 | 13.3% |

| EEM | $3.52 | 7% | $6.92 | 14 | $97 | 12.1% |

| IEMG | $4.29 | 7% | $8.44 | 14 | $118 | 13.6% |

We accounted for management fees in these expected returns and assumed dividend growth of 8.5% for EEM, 7.5% for VWO, and 6.5% for IEMG.

Choosing An EM ETF

There are some quick differences to note between these ETF’s. First off, VWO’s PE hasn’t been reported since Sept. 30th, 2022, while the others are updated daily. Secondly, VWO excludes South Korean equities, which are currently trading at 0.95x book and a PE of 7.5x. Third, while EEM only tracks large and mid-cap companies, VWO and IEMG track both large, mid, and small-caps. And, last, EEM has a much higher management fee at 0.68% versus IEMG’s 0.09% and VWO’s 0.08%.

Risks

First off, there’s been a lot of talk about the political risks in emerging markets. Not only do investors currently fear the reappointment of Xi Jinping, but also the return of Brazilian president Lula. What investors are missing is that Brazil’s economy performed far better during Lula’s presidency from 2003-2011. The Economist recently highlighted some of Lula’s accomplishments:

“4.5% annual (GDP) growth, on average, during his two terms; reduction of public debt from roughly 60% to 40% of GDP; slowing of inflation from more than 12% in 2002 to just under 6% in 2010; an increase in the minimum wage; and 20m Brazilians who escaped from poverty.”

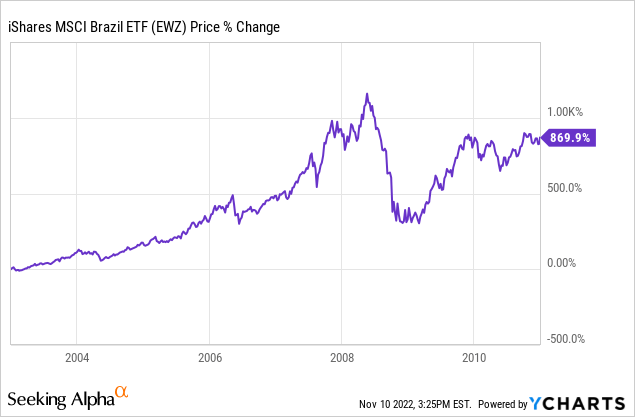

Not only this, but the Brazilian stock market as tracked by the iShares MSCI Brazil Capped ETF (EWZ) absolutely took off from 2003-2011:

Aside from the risk of government interference, there are some other important things to keep in mind:

- Geopolitical risks

- Currency risk

- Share ownership structure

- Economic headwinds

Despite their superior growth prospects, emerging markets have historically traded at a discount to developed markets. To compensate, we applied an additional discount of 20% to the terminal multiples in our valuation.

Conclusion

Emerging markets are a terrific investment for the next 50 years. The structural tailwinds are enormous. As geopolitical stories swirl, the Hang Seng’s trading at 1997 levels, and Brazil trades at a P/E of 6x. All of this while emerging market currencies are at 25-year lows. History has shown that when EM currencies gain, emerging markets absolutely crush the S&P 500. There are huge catalysts for a China rebound. We believe everyone should have some EM exposure, whether it be through a lump sum investment or a dollar-cost-average strategy. Until next time, happy investing.

Be the first to comment