imaginima

Over the last couple of weeks, I covered a couple of other companies in the midstream sector, Enterprise Products Partners (EPD) and Magellan Midstream Partners (MMP). I own both and plan to keep it that way for a long time. Another MLP that I’m bullish on, but don’t own, is Energy Transfer (NYSE:ET).

Investment Thesis

Energy Transfer is one of the largest networks of pipelines in the US and recently reported solid Q2 results. The company continues to expand its already impressive network. The valuation remains cheap, even after a solid start to 2022 as units have returned over 30%. Shares trade at 3.2x cash flows, which is about half of the normal valuation. They also hiked the distribution for a third time in 2022, which puts the yield at 8% if there aren’t any further hikes. Given recent history and management’s stated desire to hike the distribution back to pre-COVID levels, I think that the yield will likely be higher in 12 months.

The Business

Energy Transfer continues to digest the acquisitions from the last couple of years, and I wouldn’t be surprised if they continue their acquisitive ways in the next couple of years. They are also growing organically, which should help the long-term results. One of the projects I would keep an eye on is the Lake Charles LNG export terminal. It’s a major project for the company, and once it is up and running, it could help Energy Transfer for years to come.

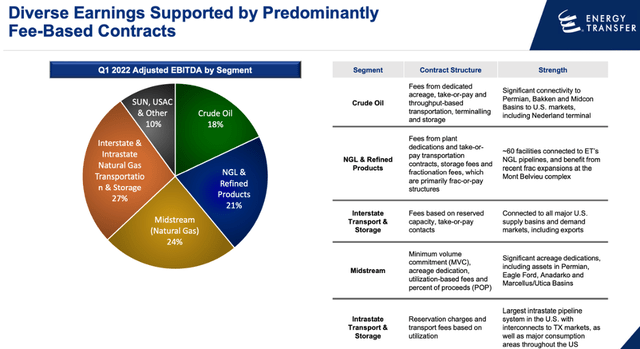

Business Mix (energytransfer.com)

Energy Transfer has a well-diversified stream of earnings and isn’t overexposed to one piece of the pie. They have built a business that should be able to perform well over the next decade, no matter what happens with the broader economy or markets. You can also pick up units at a steep discount, which could lead to impressive returns for long-term investors.

Valuation

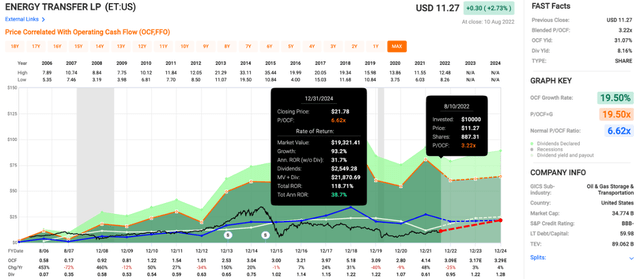

Energy Transfer remains one of the cheapest options in the midstream sector. While units have run significantly in 2022 and are up over 30% YTD, units are still undervalued in my opinion. Shares trade at 3.2x cash flows, which is about as cheap as you can find in the MLP space. It is about half of the average 6.6x multiple. All it would take is a little bit of multiple expansion from here, and we could easily double-digit returns.

Price/Cash Flow (fastgraphs.com)

I have seen several other Seeking Alpha authors comment that they expect units to head for $20 sooner rather than later. Based on the valuation, growth, and growing distribution, I tend to agree. With hindsight being 20/20, I should have been buying units when they were stuck around $5 or $6. Future distribution hikes should continue to support the unit price as Energy Transfer works its way back to the pre-COVID distribution.

Another Quarter, Another Distribution Hike

While the distribution cut was the main reason I stayed away from Energy Transfer over the last couple of years, they are well on their way to remedying the 50% cut in 2020. They hiked the distribution for a third time in 2022 with a 15% hike from $0.20 a quarter to $0.23. They still have some work to do to get back to the pre-COVID distribution of $0.305, but I think we will see it happen in 2023 or 2024 at the latest.

Energy Transfer also has fairly large insider ownership at approximately 12%, which should motivate management to continue hiking the distribution. There weren’t any buybacks in Q2, but they still have $880M remaining on the current buyback program. Management has stated in the past that they are still looking for acquisitions, but if I were a unitholder of Energy Transfer, I would prefer more buybacks, especially at these valuations.

Conclusion

Some of you might be wondering why I haven’t been buying units of Energy Transfer as this is my second bullish article on the company. The first is that I trust the management teams of Enterprise Products Partners and Magellan Midstream Partners more. They haven’t had to cut the distribution, and they don’t have a history of questionable acquisitions. The other reason is simply portfolio weights. I’m already very overweight in the midstream sector (which has been great this year compared to the rest of the market) but adding Energy Transfer would make my portfolio too concentrated in one sector.

Energy Transfer would be my next choice in the midstream sector, and there are a lot of reasons to be bullish on the future of the company. They have an impressive asset base and continue to grow, and the best part is the cheap valuation. At 3.2x cash flows, I think the risk/reward is highly skewed to the upside and all it would take for double-digit returns is a little bit of multiple expansion. If you are an income investor looking at the midstream sector, Energy Transfer might have the most upside of any large company out there. You also get paid to wait, with a juicy 8% distribution that should continue to grow, and we should see a return to the pre-COVID distribution sooner rather than later. So, while I won’t be buying units of Energy Transfer, I’m still bullish on the company and its future.

Be the first to comment