gesrey

Co-produced by Austin Rogers

Peak Inflation: Real Or Just The Boy Who Cried Wolf?

Austin here. I feel the need to out myself as the person writing this part, because I’ve argued before that inflation had peaked or was about to peak and been wrong. Well, here we are again. I think inflation has peaked or is about to peak.

Is it real this time, or am I just the boy who cried wolf too many times?

Let’s look at the data, then you can decide. Suffice it to say, though, that more and more economists and experts are starting to predict that inflation is beginning to cool.

This is in large part because there are multiple signals that a recession, or at least an economic slowdown strong enough to cool inflation, is ensuing. Here are three:

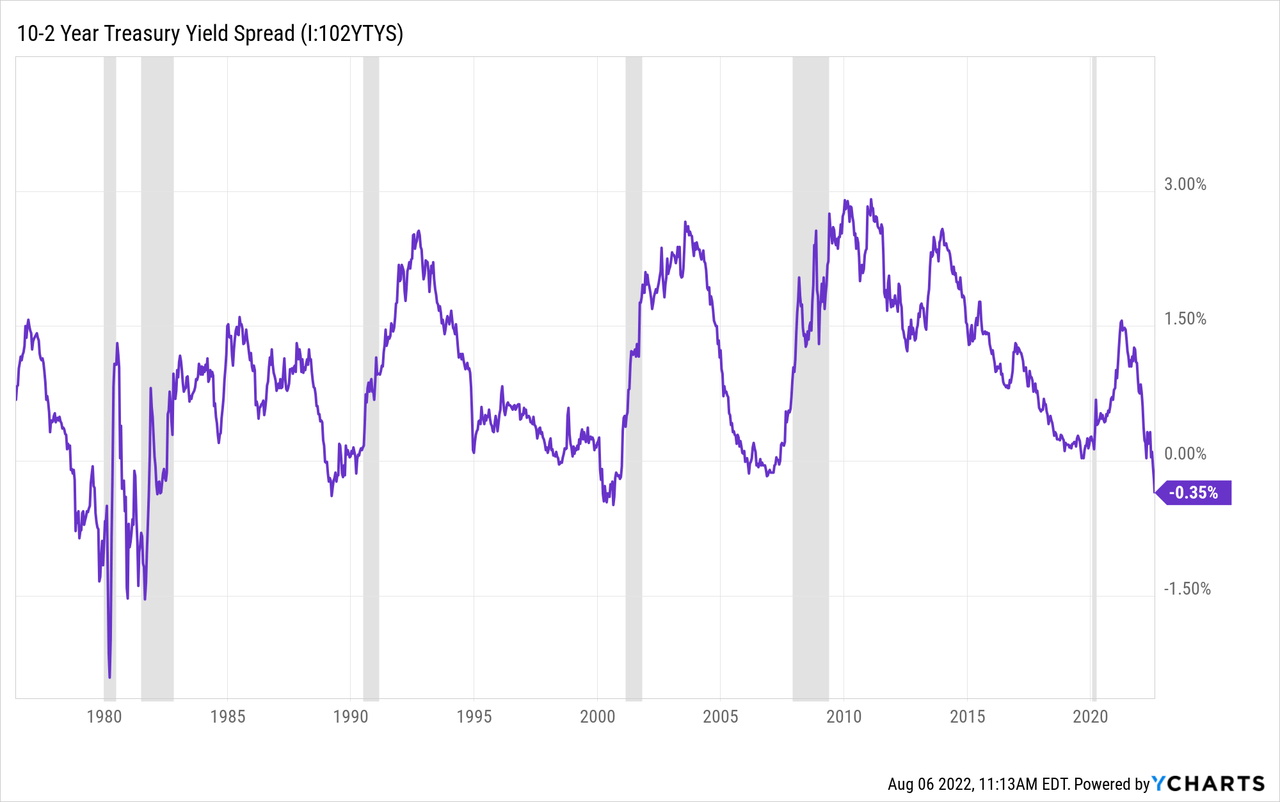

1. Inverted Yield Curve.

An inverted yield curve, wherein the 10-year Treasury rate falls below that of the 2-year Treasury rate, has historically been a very reliable indicator of an oncoming recession in the next 6-18 months.

Today, the 10-2 Treasury yield curve is about as inverted as it was prior to the recession of the early 2000s.

YCHARTS

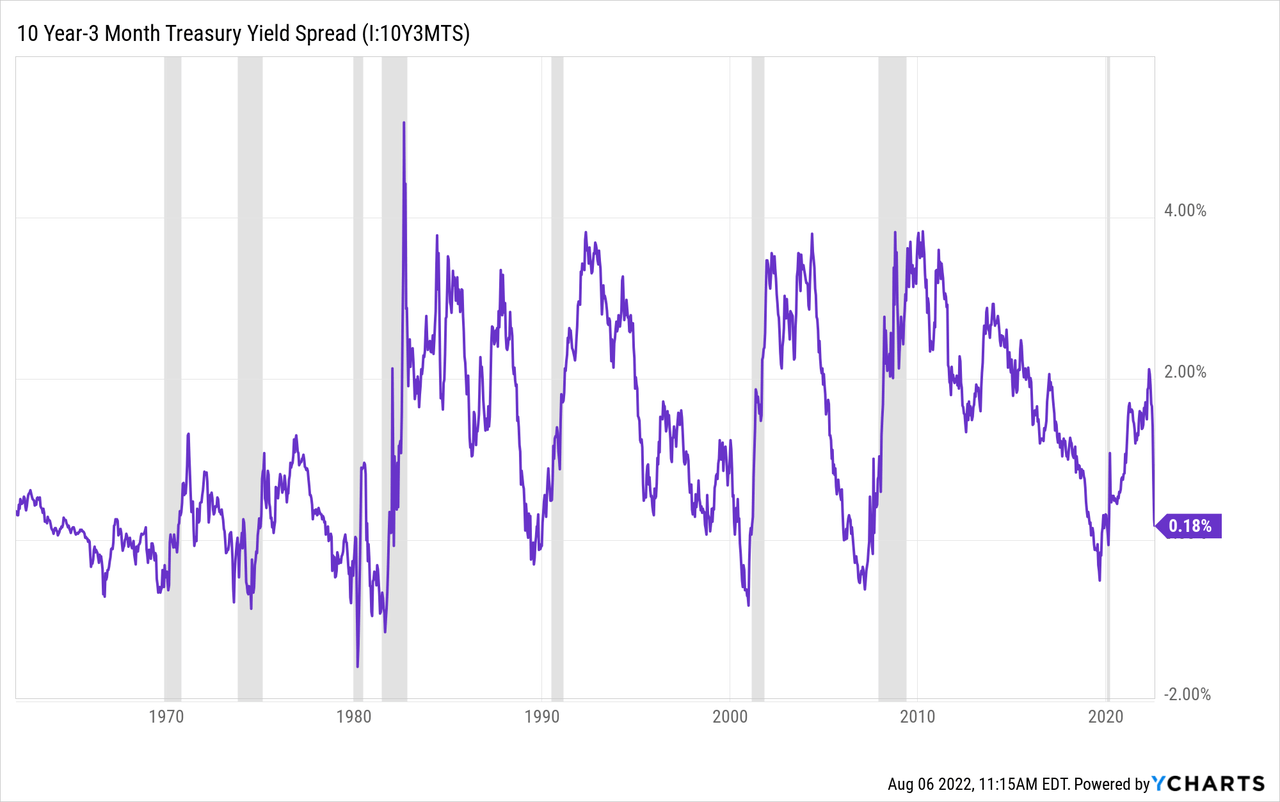

A perhaps more reliable indicator of recession is the 10-year minus 3-month yield curve. This spread also has an excellent track record of predicting recessions after inversion, and typically recessions follow much sooner after inversion. As of this writing, the 10-year Treasury rate is still 18 basis points above the 3-month rate, but the spread has been rapidly compressing in recent weeks.

YCHARTS

At this rate, the 10-year/3-month yield curve should be inverted in a matter of weeks, which would then be predictive of a recession beginning a few months to about a year in the future.

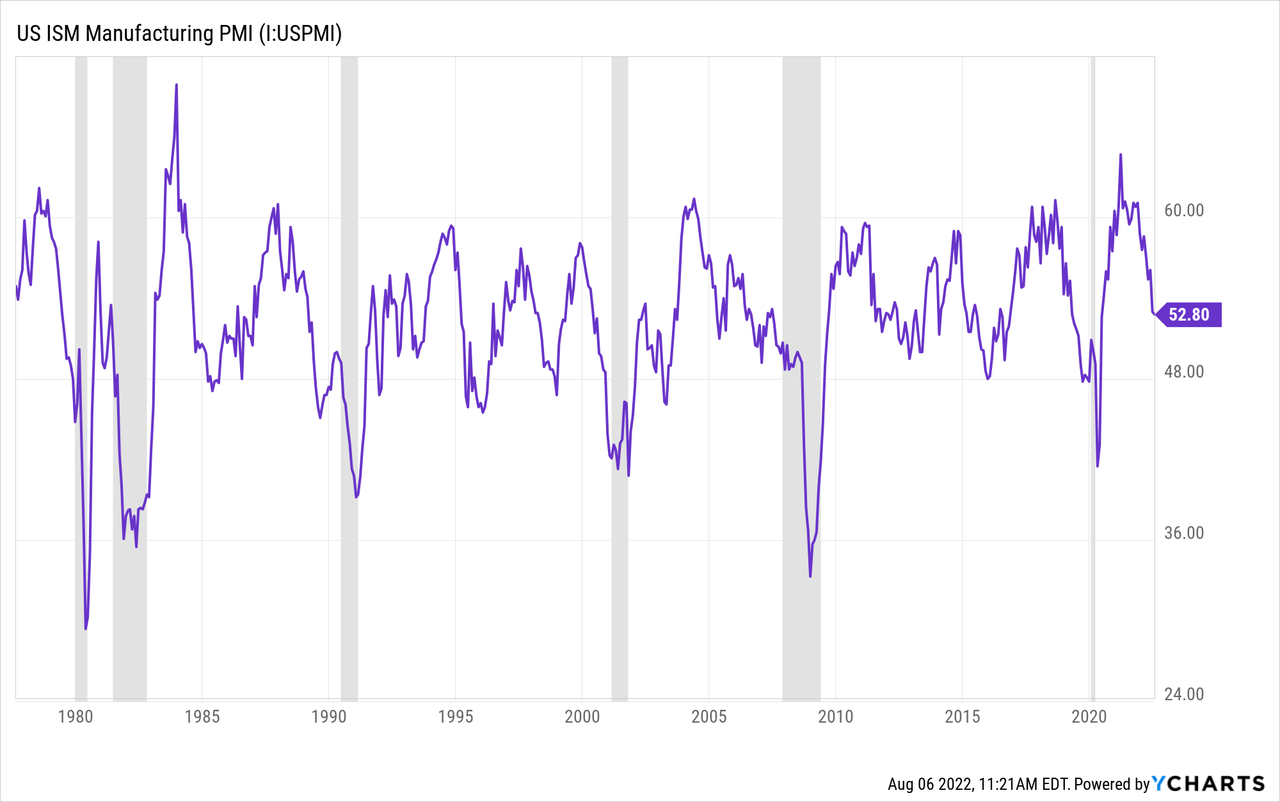

2. Manufacturing and Services Output In Decline

The Institute for Supply Management performs surveys for both the US manufacturing sector as well as the US services sector that gauge the economic health of each.

When the Purchasing Managers Index (“PMI”) is above 50, it means the sector is in expansionary or growth mode. When the index falls below 50, the sector is in contraction or decline.

The manufacturing index often declines sharply prior to recessions, and that appears to be exactly the trajectory that the manufacturing PMI is on today.

YCHARTS

Now, the economy does not go into recession every time manufacturing output slides into contraction. For instance, despite dipping into contraction territory in 2016, 2013, 2003, 1998, and 1995 (just to name five instances), the US economy avoided recession, and manufacturing bounced back.

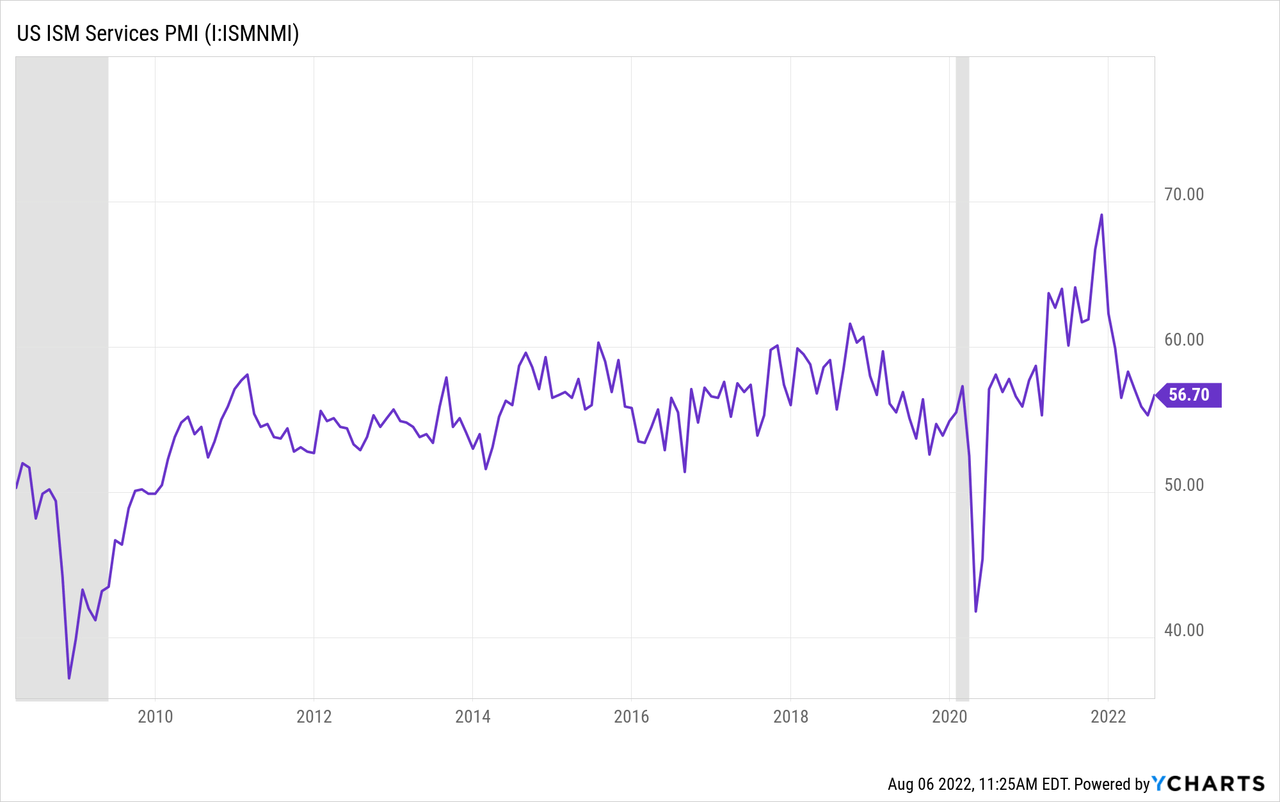

Besides, the US economy is more reliant on its services sector than many other developed nations. Services “output” (if you can call it that) remains in positive/expansionary territory but has pulled back from its euphoric levels in 2021.

YCHARTS

The point is that both manufacturing and services are on downward trajectories, and those trajectories may continue as consumers are forced to cut back on certain spending in the midst of rising prices.

3. Falling Input Costs

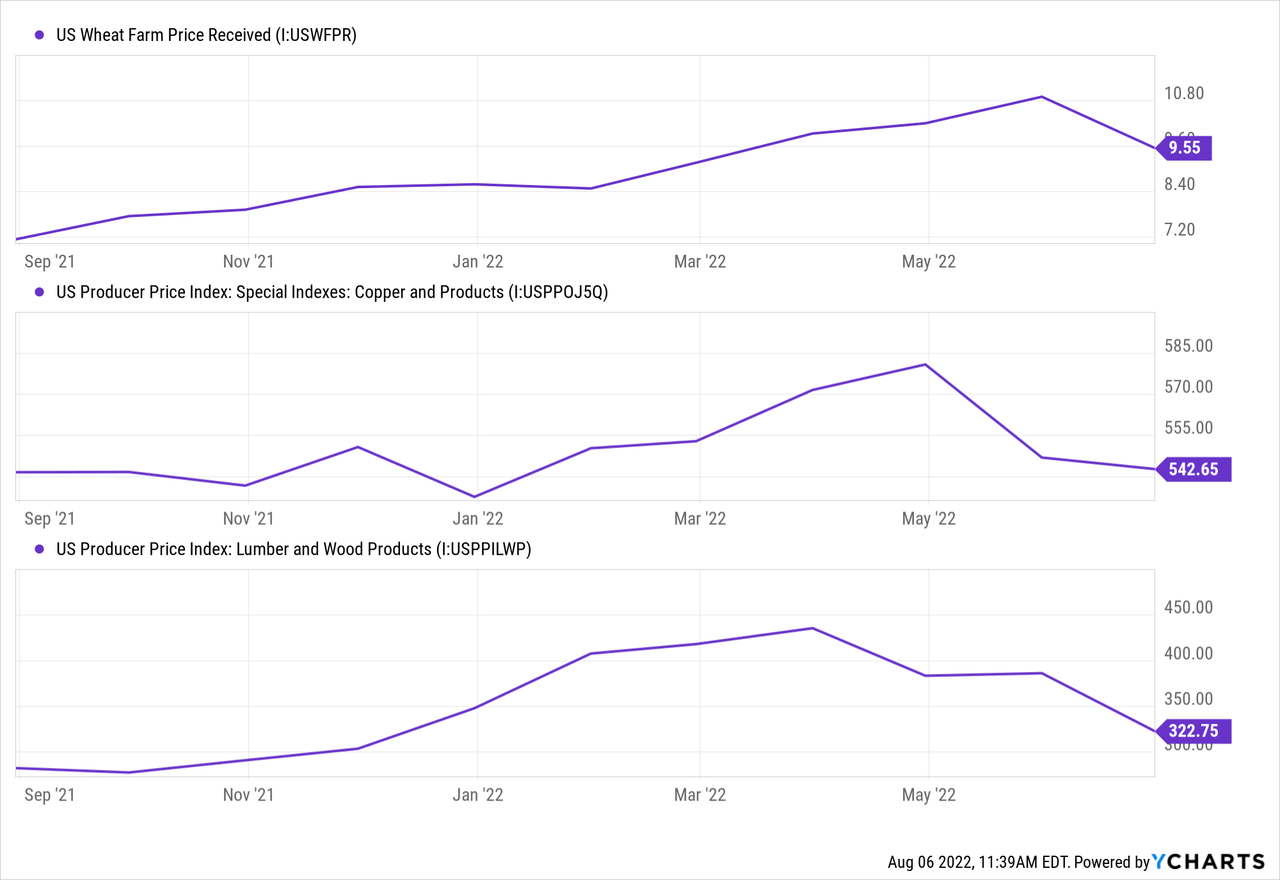

Despite still-rising consumer prices, which tend to rise months after input costs have already spiked, the prices of many basic inputs in the economy seem to have peaked and begun to decline.

Take, for instance, wheat, copper, and lumber:

YCHARTS

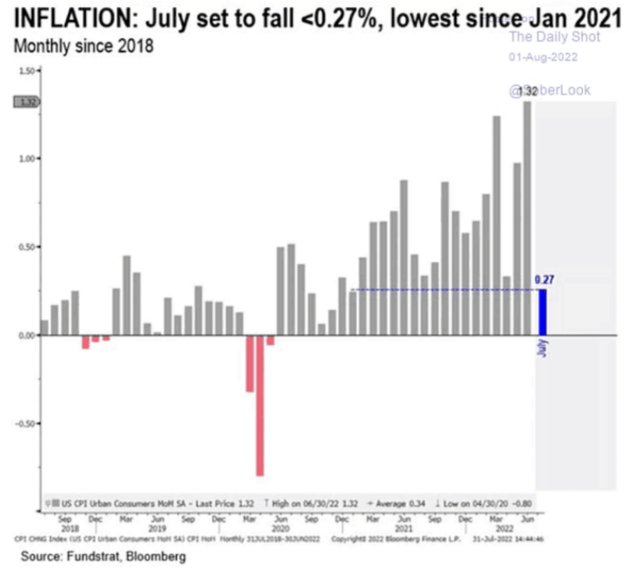

Combining some relief on the input cost side with running into the base effects of year-over-year comparisons, the projection for July’s month-over-month inflation of 0.27% is the lowest in a year and a half.

Annualized, this would be an inflation rate of 3.24%, a marked decline from June’s 9.1% number!

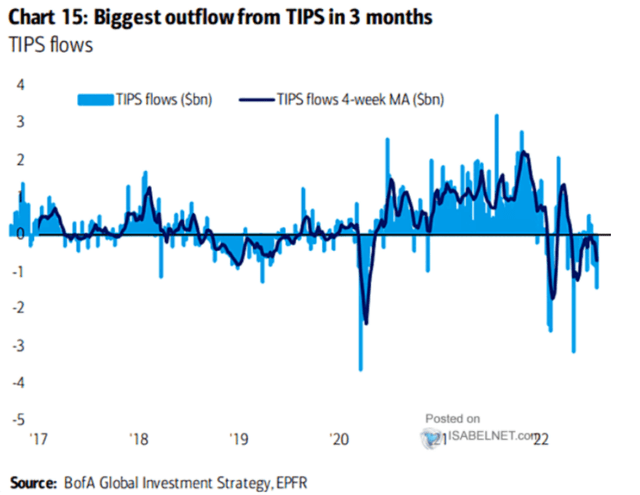

Perhaps this is why investors are fleeing TIPS (Treasury inflation-protected securities) like rats from a sinking ship.

If the TIPS market is any indication, the rising inflation trend is now sputtering to a halt and will soon reverse course.

The bottom line is this:

What Should You Buy Today?

As we explained in a recent Market Alert, a mild to moderate recession may actually be good, on balance, for most stocks. Why? Because recessions have an excellent track record of killing inflation and lowering interest rates, which are the primary concerns of the market today.

But don’t buy just any stocks.

Some perform better than others during recessions. You want to invest in situations where the positive impact of declining inflation and interest rates is greater than the negative impact of a recession.

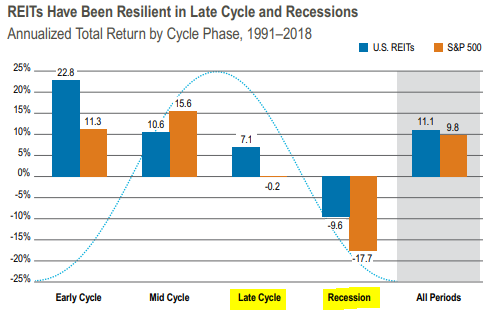

REITs (VNQ) are perhaps the best example of that.

They are by nature resilient to recessions because they earn steady and predictable rental income from long-term leases, and this rental income may not change at all in a recession. Moreover, as interest rates decline, the cap rates of properties may also compress as increasingly many investors seek alternatives to bonds to earn income.

This explains why historically, REITs have been much better performers than regular stocks (SPY) during late cycles and recessions:

Cohen & Steers

But don’t buy just any stocks.

Some REITs are much better than others in today’s environment.

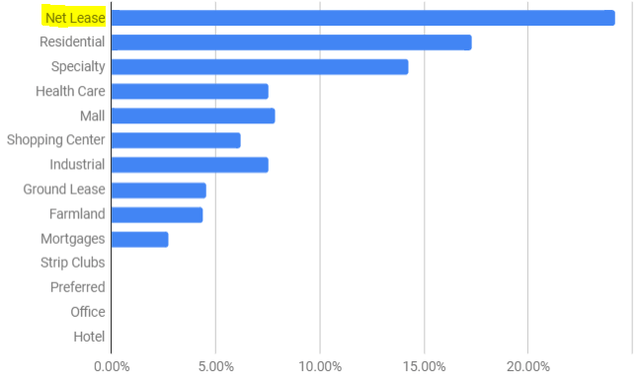

At High Yield Landlord, we are investing particularly heavily in net lease REITs because they earn recession-resistant cash flow from 10+ year-long leases.

Loopnet (CSGP)

Moreover, we think that a cooling of inflation (and thus probably also interest rates) would be particularly good for their performance because their leases typically only have 1-3% annual rent bumps and therefore can’t keep up with high single-digit inflation.

Real (inflation-adjusted) organic rent growth for net lease REITs is deeply negative right now, and it worries the market, but we expect this to change very soon.

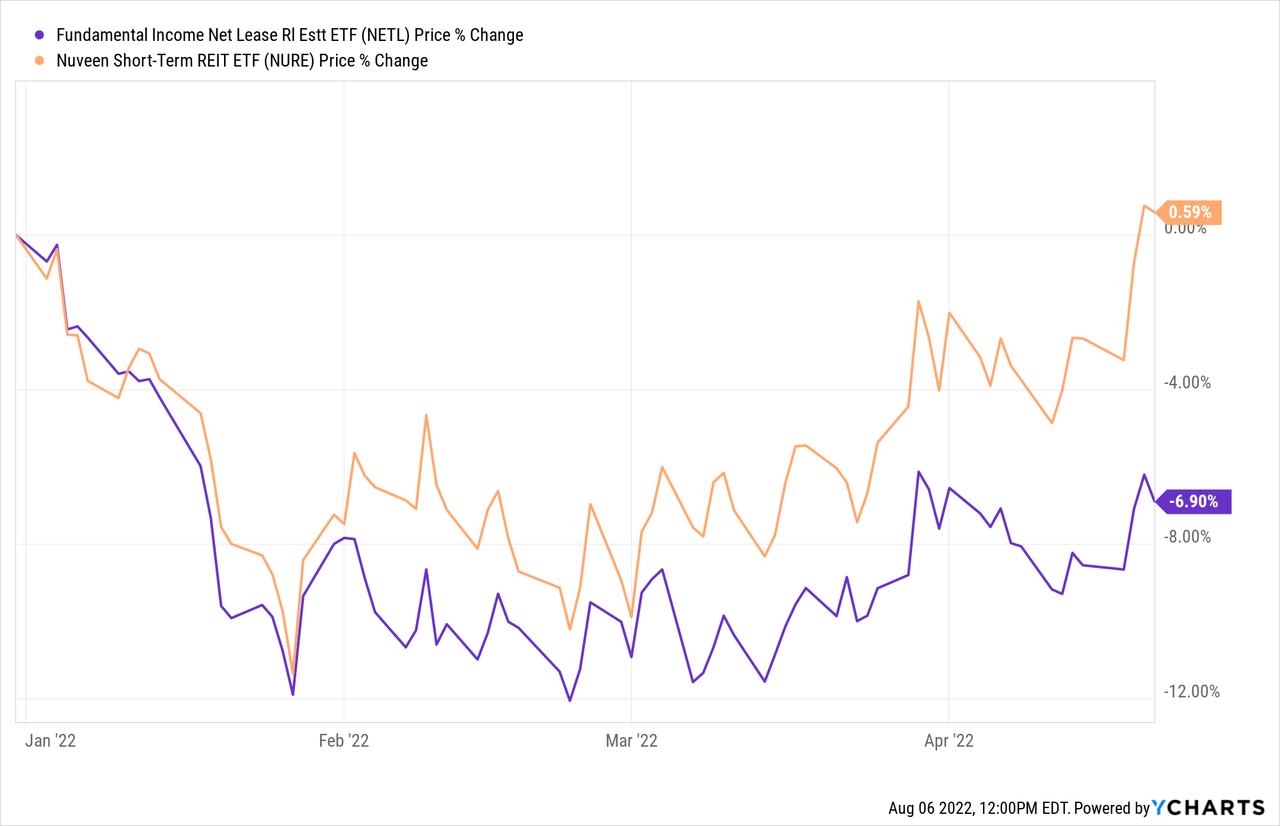

That is why REITs that own properties with short-term leases such as apartments, self-storage facilities, and hotels (orange line below) (NURE) strongly outperformed net lease REITs (purple line) )(NETL) for the first four months of the year as inflation kept going higher with no end in sight.

YCHARTS

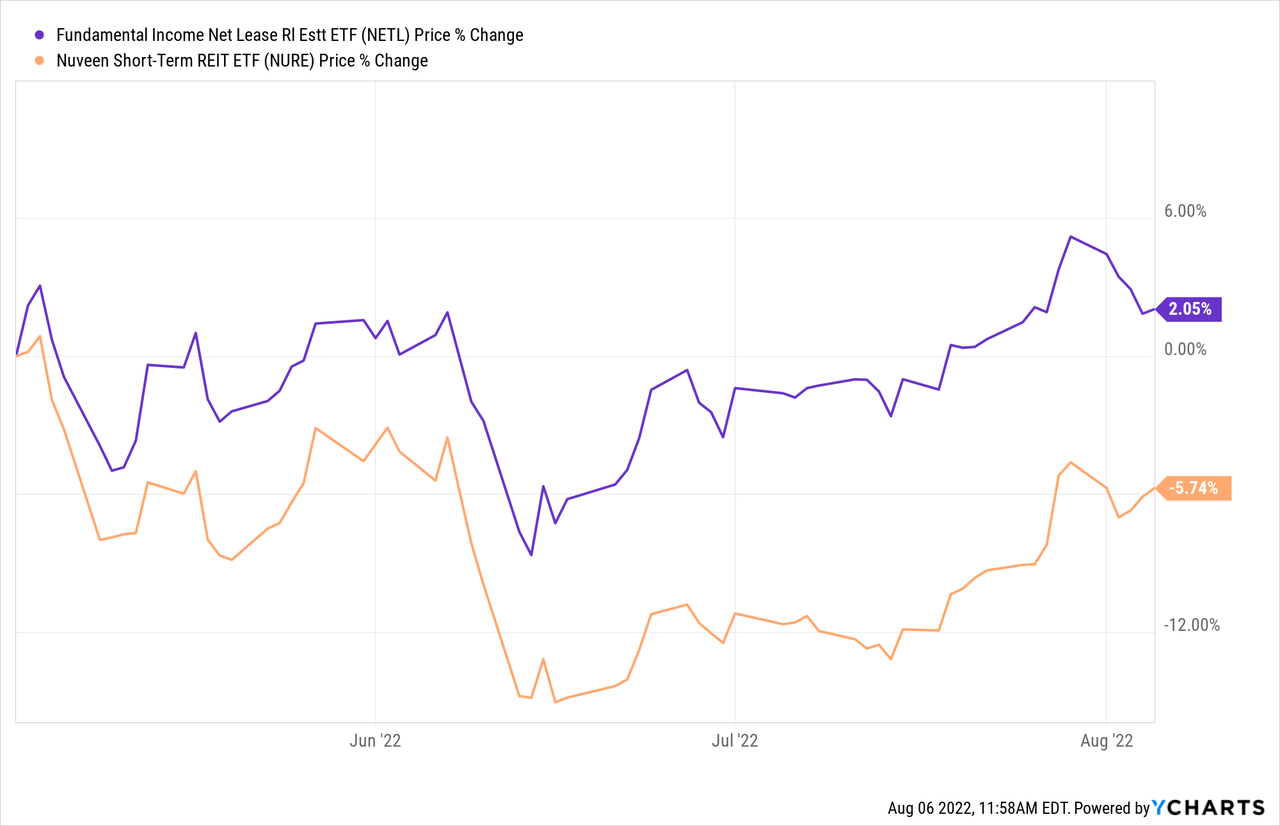

And it’s also why net lease REITs have begun to outperform REITs with shorter term leases over the last few months, as some signs have emerged that inflation is cooling (or will cool soon).

YCHARTS

If inflation does come down from its current 40-year-high levels and brings interest rates down with it, then this outperformance of net lease REITs is likely in its early stages.

A good example that we are accumulating is STORE Capital (STOR).

The REIT shouldn’t be negatively affected by a recession because it earns steady and predictable rental income from properties that enjoy 17-year-long leases and high rent coverage, meaning that even if its tenants suffered a bit, they would still be able to pay their rent.

However, because STOR has limited rent hikes in its leases, its market sentiment has suffered, causing it to trade at a historically low valuation of just 12x FFO and a 5.5% dividend yield.

Prior to the pandemic, STOR traded at closer to 20x FFO and a 3.5% dividend yield, and we think that this was much closer to its true fair value.

The catalyst that the market is waiting for is a cooling of inflation and declining interest rates. If and when we get that, we expect STOR to unlock 50%+ upside, and the beauty here is that while you wait, you earn 5.5% dividend yield, and STOR also continues to grow its cash flow. In 2022 alone, the REIT has guided to grow its FFO per share by 9%, which coupled with the dividend, should result in a near 15% annual return even without any upside from multiple expansions.

That’s why its risk-to-reward is so utterly compelling in today’s market, and there are other similar opportunities among net lease REITs:

Be the first to comment