Bilanol

Energy Transfer LP (NYSE:ET) is one of the largest midstream companies, with a $40 billion market capitalization and a dividend yield just a hair under 10%. The company has an impressive portfolio of assets and generates massive free cash flow (“FCF”). However, ET also has a massive debt load it’s been reluctant to pay off. Still, it is clear the company has substantial long-term potential.

Energy Transfer Developments

Energy Transfer has an impressive portfolio of assets, and the company is continuing to generate strong cash flow.

Energy Transfer Investor Presentation

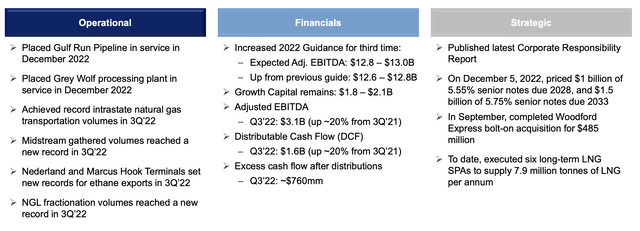

The company has placed several a number of pipelines in service through 2022. That’ll help the company’s cash flow to improve. The company has increased its adjusted EBITDA guidance to $12.9 billion while keeping its growth capital at just under $2 billion, which we wanted to see. The company earned $1.6 billion in 3Q 2022, with FCF up 20% YoY.

The company had $760 million in post-distribution FCF, showing its financial strength as the company has a clear double-digit FCF yield. The company recently priced $2.5 billion of debt at reasonable rates under 6%, but it is clear that interest rates are going up. The company also recently signed some LNG contracts, which will help long-term cash flow.

Energy Transfer Growth Capital

Energy Transfer is continuing to invest in growth and achieve strong yields, although we’d like to see it pay down its debt first.

Energy Transfer Investor Presentation

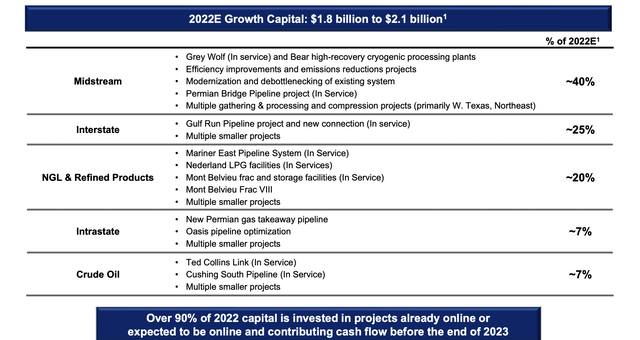

The company is focused on shorter term projects, with more than 90% of its 2022 capital in projects that’re already online or expected to be contributing cash flow over the next year. The company is continuing to build numerous projects that could continue to provide additional cash flow, and we expect a double-digit yield from this capital spending.

We’d like to see the company keep its growth capital spending low without getting carried away.

Energy Transfer Insider Ownership

Investor’s belief in the company is shown through hefty insider ownership.

Energy Transfer Investor Presentation

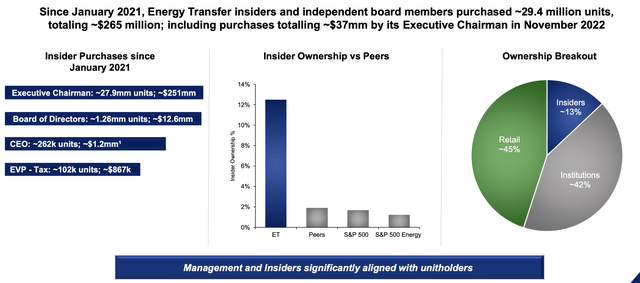

Energy Transfer has substantial insider ownership in the company. The company has double-digit % ownership, much more than its peers, along with substantial insider ownership. The company’s insiders continue to aggressively invest in the company, supported by their dividends, and we expect that to continue for the company.

That insider ownership shows a consistent belief in the company, but it also supports higher dividends over other less-direct shareholder returns.

Energy Transfer Shareholder Return Potential

The company’s discounted cash flow (“DCF”) provides substantial shareholder return potential, however, the company needs to figure out how to allocate capital.

The company’s annualized DCF is roughly $6.4 billion. For a company with a market capitalization of less than $40 billion, that’s a substantial 16% DCF yield. The company’s dividend is 9.5%, leaving 6.5% ($2.6 billion in DCF). The company has $47 billion in long-term debt, costing it several $billion in long-term interest.

We’d like to see the company aggressively pay down its debt, but regardless of how the company spends its cash, we expect substantial shareholder returns. The company’s share price fluctuates, and on dips it is a valuable investment worth paying close attention to.

Thesis Risk

The largest risk to our thesis is Energy Transfer’s substantial debt load that the company has been reluctant to pay off. The company has $10s of billions worth of debt, which is dangerous in a high interest rate environment. That could hurt the company’s ability to drive future shareholder returns, increasing the risk of this investment.

Conclusion

Energy Transfer LP continues to run a leading business, and as the train derailment shows, pipelines continue to have numerous benefits. The company’s assets continue to generate massive cash flow, showing the reliability of their toll road nature and volumes remain strong. However, there are some other disadvantages.

Energy Transfer LP has a massive debt load, which is risky in a rising interest rate environment. Additionally, the company hasn’t been reworking its portfolio for a changing climate environment despite using renewables to power its pipeline operations in some regions. Overall, we think Energy Transfer LP can generate double-digit returns but needs to revamp its business.

Be the first to comment