matdesign24/iStock via Getty Images

Energy stocks are brutally beaten up today. So where to next?

In our update last week titled, “Where Are Energy Stocks Headed Now?” we wrote the following:

What happened this week in energy stocks is a classic blow-off technical pattern. Sudden and large reversals like this usually signal a trend shift in the medium-term (3-4 months). As a result, while fundamentals might be trending bullish, we are likely headed lower/sideways for a while on energy stocks. During this time period, please do not be frustrated at the lack of price participation in energy stocks in relation to oil. It’s not supposed to make sense, so don’t try to make sense out of it.

Since then, the market has pushed energy stocks even lower, with some names like Baytex retracing as much as ~40% from the recent highs. For most investors, the most important question to ask is, “have fundamentals changed enough to justify the price move?” The answer is no, because oil prices, while weak, only dropped from $117 to $103. On a fundamental basis, nothing has really changed. But more often than not, the most important question won’t answer the issue of why this is happening right now.

In our report last week, we noted that the market has shifted. For starters, inflation expectations have started to drop following the Fed rate hike announcement of 75 basis points. In my view, this was a game-changer because now the market is starting to buy into the thesis that the Fed can fend off inflation.

For a lot of institutional investors, energy stocks weren’t bought on the attractiveness of free cash flow yields or dividends. If you really think they bought it on FCF yields, I have a bridge to sell you. Instead, energy stocks were used as a form of inflation protection for the portfolio in case things got worse. This is a reason why energy stocks perpetually traded at a discount to implied oil price because no one really bought it purely on fundamentals.

Now looking at it from this perspective, the moment the Fed announced the rate hike, and when investors started to take the Fed more seriously (on its efforts to fight off inflation), investors began dumping energy stocks.

The higher interest rates will also eat into global growth, so the end result was lower bond yields and lower growth projections. This is why tech stocks have rallied since the Fed hike announcement. Why do you think ARKK is up ~9% this week while energy stocks are down some 25%? Do you think it’s fundamentals driving this? No way.

But my job is not to argue with the market. My job is to figure out what the market is trying to tell me, adjust my risk accordingly, and navigate the portfolio through these tough times. The market is always right, so trying to fight it is a fool’s game. Instead, we can figure out what it’s trying to tell us, understand it better than the market itself, and find out where the market is headed next.

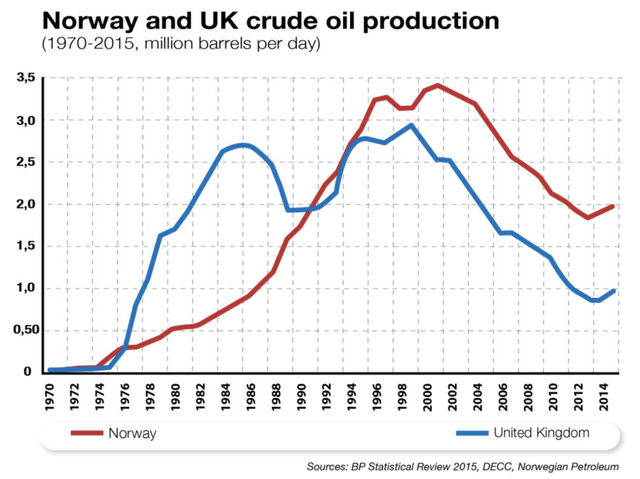

So now if you believe the market is buying into the thesis that inflation will be quashed, I strongly disagree with that conclusion. The Fed doesn’t print commodities, so a structural supply shortage in commodities won’t be resolved just because the Fed raised interest rates. In the 1970-1980 period, a lot of people attribute Volcker’s success to fighting off inflation by jacking up interest rates to double digits. But how come no one talks about the fact that the North Sea started to become a meaningful part of the global supply equation?

BP

Structurally higher oil prices in that 10-year period allowed non-OPEC production to flourish. So while the Fed rate hike during that time period dampened demand a bit, the real solution was higher global oil supplies, which according to our analysis won’t be coming anytime soon in the near future.

Where to next?

Over the next few months, things are going to be tough for energy investors. Oil prices are going to remain high thanks to a bullish physical market and low absolute oil inventories. Energy companies are going to make a lot of cash and dividends will increase. But the share prices, because of the market perception, will likely be stuck forcing people to become ever more aggravated.

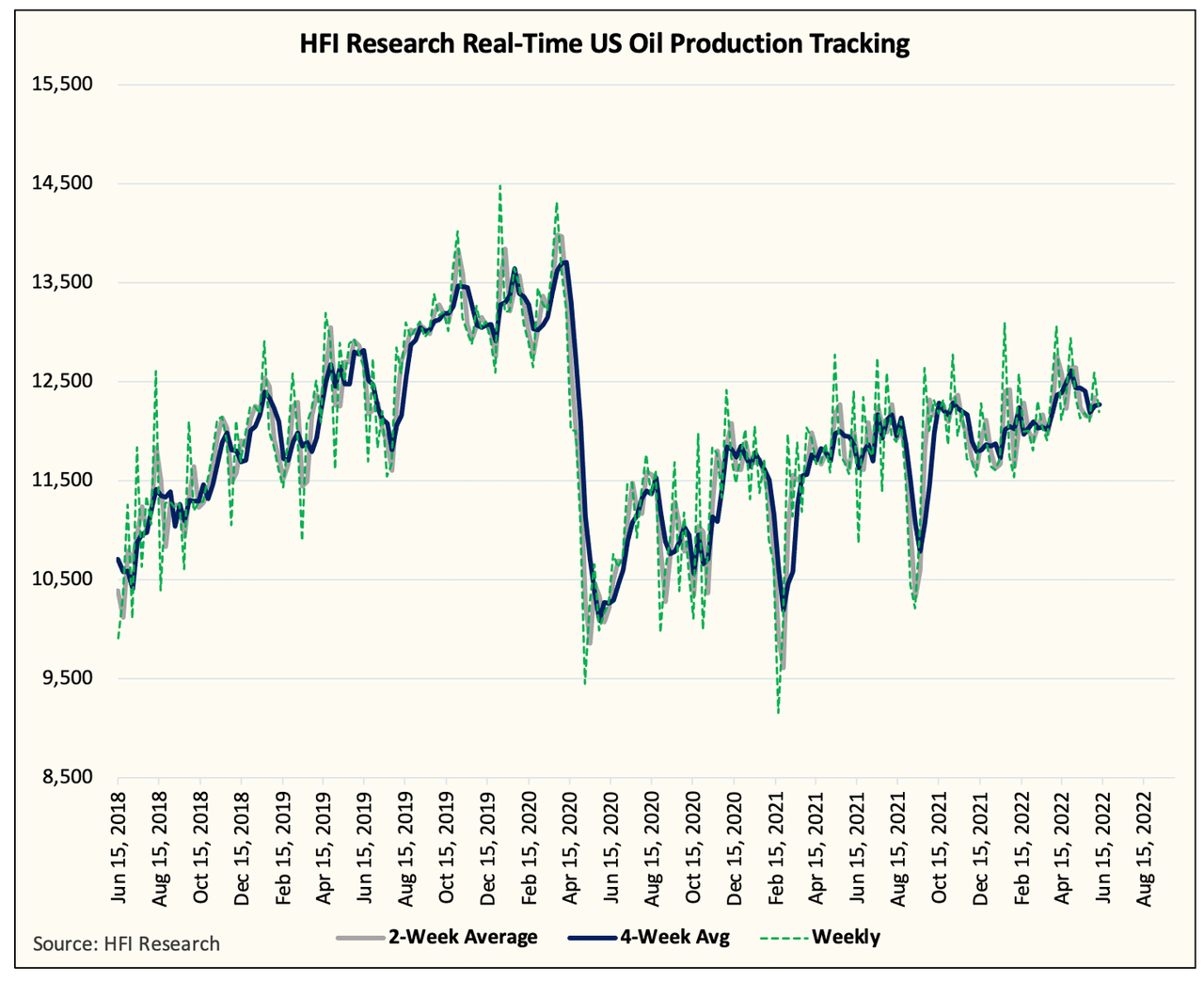

The key, in my view, is to figure out when the market starts to change the tune on the Fed’s ability to fight off inflation. Because the oil market is going to remain in a structural deficit, there is no immediate solution on the horizon. U.S. shale, for all its glory, is not going to be enough to bail us out this time around.

HFIR

As a result, the oil market will stay in a deficit, and the market will realize that persistently high inflation is likely here to stay. Now there is a possibility that the Fed raises interest rates so high as to cause a serious recession. But since it has a dual mandate of full employment and inflation, it’s unlikely that the Fed has the guts to jack up interest rates that much.

The end result is that the market will gravitate back towards energy stocks. Not only will energy stocks during this time period have demonstrated the ability to generate an insane amount of free cash flow, but the associated share buyback and dividend policies will further entice a newer shareholder base.

While investors have to contend with the voting machine characteristics of markets in the short term, it is ultimately a weighing machine in the long run. Companies that generate an asinine amount of cash won’t be ignored for long.

Be the first to comment