deepblue4you/iStock via Getty Images

Political Expedience

The SPR (Strategic Petroleum Reserve) of crude oil held by the U.S. government is now at its lowest level since 1984. The administration has been releasing 1 million barrels a day from the reserve for almost 90 days (as promised), but I expect an extension to last into October to keep the price of gasoline at the pump from rising until after the midterm elections.

To continue beyond that would be foolish, with a war in Europe and the potential for conflict with China over Taiwan. Our government just cannot risk drawing down the SPR further under the current geopolitical conditions. The SPR can be refilled (and should be) during the coming recession.

Once the administration terminates the reserve drawdown program, I estimate that there should be upward pressure on crude oil prices beginning a month or so later. OPEC (Organization of Arab Petroleum Exporting Countries) is cutting back production (at least it announced that it would) and there is mounting pressure from Europe to reduce imports of Russian oil. Oil production in the U.S. is reduced from 2019 levels.

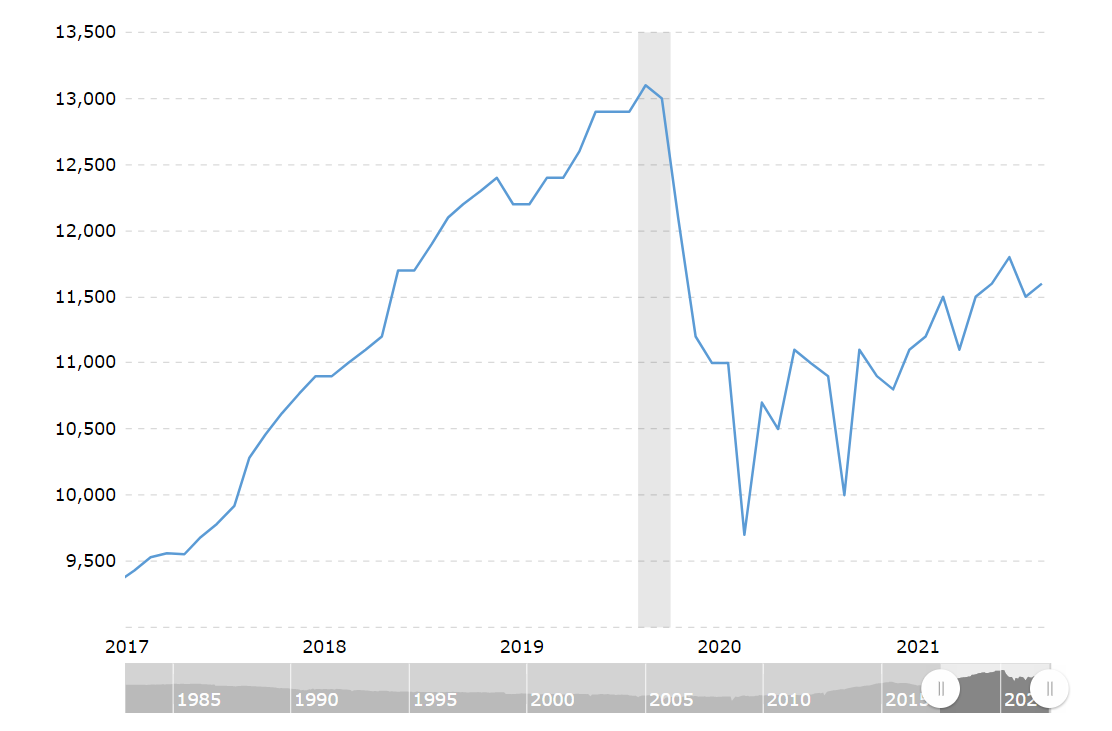

U.S. Oil Production

Macrotrends

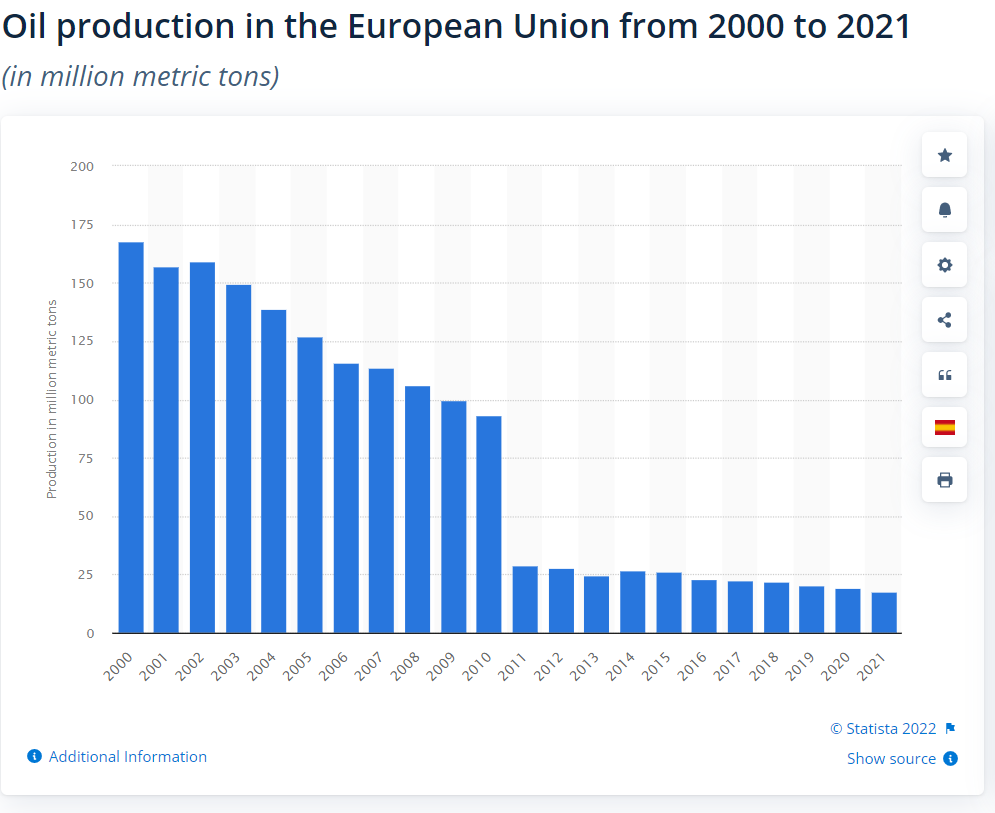

Oil production in Europe is stagnant.

Statista

Demand will remain relatively strong until the global economy falls into recession. The U.S. economy will continue to be buoyant for several more months, propping up demand, while Europe will need to import more from non-Russian sources. Once the 1 million barrels of SPR crude oil per month disappear, demand will outstrip supply until a recession can relieve the pressure.

Demand for Natural Gas will Rise

This point is obvious, but I will explain it to those who have not followed the situation in Europe (in case there is anyone on this boat). Russia has cut off supplies of natural gas to Europe through its Nord Stream 1 pipeline. It could shut down other conduits as well. President Putin (Russia) is playing hardball with his European customers who have become highly dependent upon Russian natural gas for electricity production, heating, and industrial operations. Without it, Europe will be dependent upon other sources around the globe, including the U.S.

But the U.S. EPA (Environmental Protection Agency) recently ordered Cheniere Energy (LNG) to comply with an EPA rule that is being reinstated after an 18-year stay. If enforced by the administration, it would disrupt operations at the largest exporter of LNG in the U.S. just at the time when Europe (and the rest of the world) needs the LNG the most.

Whether or not that disruption occurs, I believe the supply of natural gas will fall short of demand by a wide margin this winter, leading to higher prices (over $10 in the U.S.) and much higher in Europe. Even though the price has fallen recently in Europe, it remains more than double what it was prior to Ukraine invasion. A frigid winter or any supply disruptions could send the price back to record highs again. Nevertheless, supply will be tighter than normal, in Europe. Supplies that previously went elsewhere will now end up in Europe, causing global natural gas prices to rise, even in the U.S.

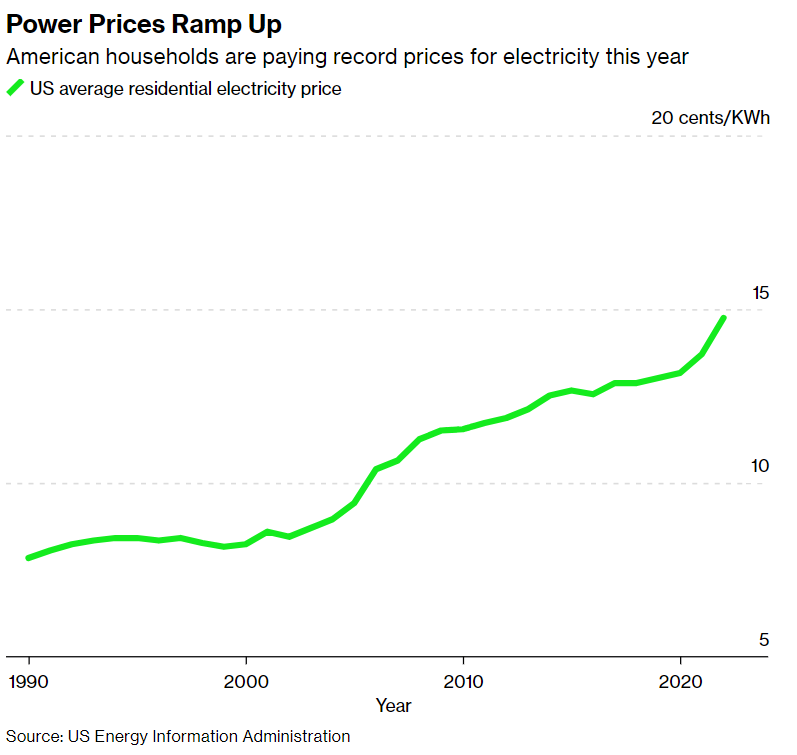

The Cost of Electricity is Rising Faster than Headline Inflation

Electric power prices have risen at the fastest rate in 41 years: 15.8% Y/O/Y (year over year) in August.

Bloomberg

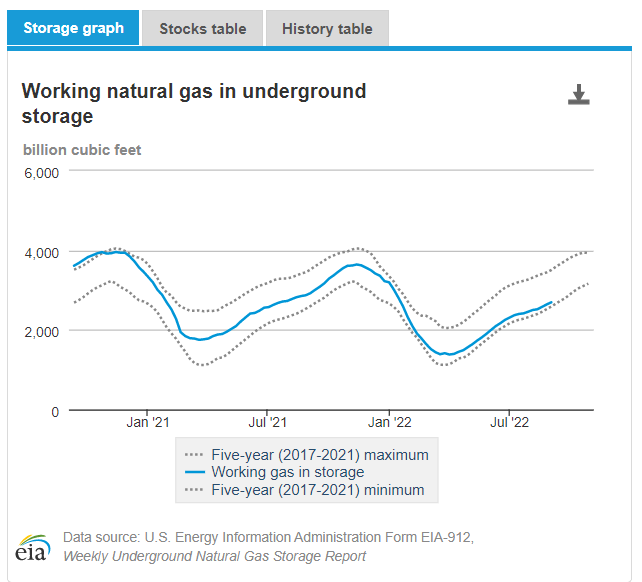

The inflation rate for energy overall was down in August, due to falling gasoline prices, but the average price of electricity rose. Since the beginning of September, the price of natural gas has begun to fall, but frigid winter weather causes the price of natural gas to rise into February, beginning in late December or early January. It is more likely that the price of natural gas will rise this winter because the amount in storage at this time is well below the 5-year average.

Energy Information Agency

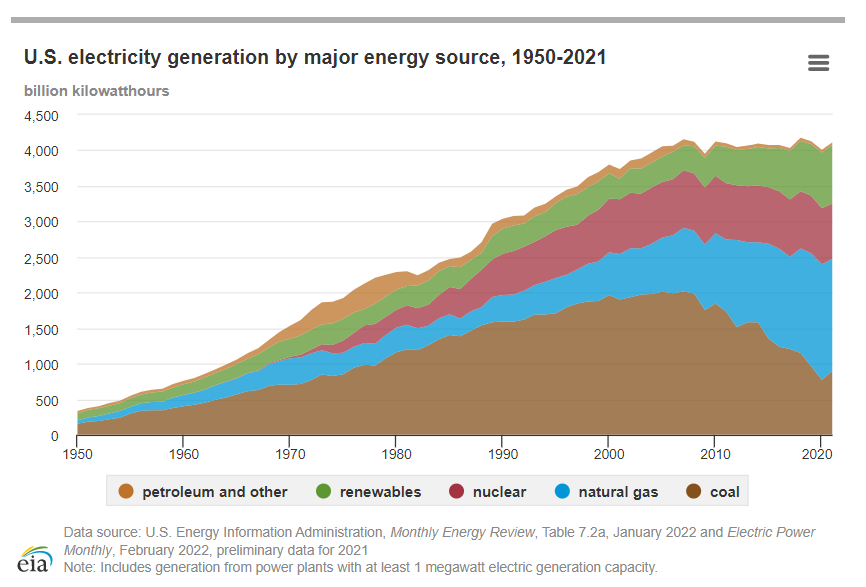

With rising demand from Europe, the U.S. will not be able to replenish its natural gas supplies until at least spring of 2023, if then. So, the upward pressure of natural gas prices will continue. Since natural gas is the primary source of electricity generation fuel in the U.S., the cost to produce electricity will rise along with rates to consumers.

Energy Information Agency

Three ETFs to Consider

How long will it last? There are too many variables to make a reasonable guess. It could be 6 months, or it could be 2 years. If a global recession takes hold, demand will drop, and prices should follow suit. For those wanting to try to trade, you should consider using ETFs such as: First Trust Natural Gas ETF (FCG), iShares U.S. Oil & Gas Exploration & Production ETF (IEO), or Invesco Dynamic Energy Exploration & Production ETF (PXE). I like FCG because it is more focused on natural gas and that, I believe, is where price appreciation is most likely to occur. Each ETF pays a dividend between 1.5% and 2.0%, but trading is not about dividends as much as appreciation.

All three ETFs have had significant runs in 2022, but I expect there is more to come while the war in Ukraine continues.

Be the first to comment