Tero Vesalainen/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to discuss the state of the broader equity market, primarily in the United States. This review will take us through recent performance, the underlying factors for that performance, and why I feel investors need to be patient going forward. I have locked in some profit over the past few weeks, amplifying both my cash position in addition to shifting resources to other developed, non-EU markets. I will explain the justifications for these moves in this review.

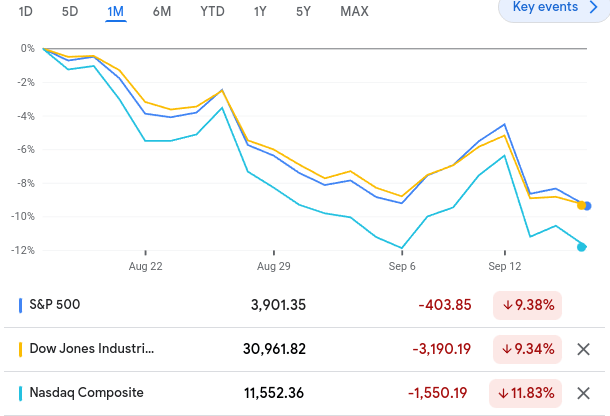

To begin, I want to note this is a follow-up to my last macro-piece. Readers may remember I exhibited a bit of a cautious tone in my August article. Over the past month, we have indeed seen the major indices see some pressure, so that outlook was vindicated:

1-Month Performance (Google Finance)

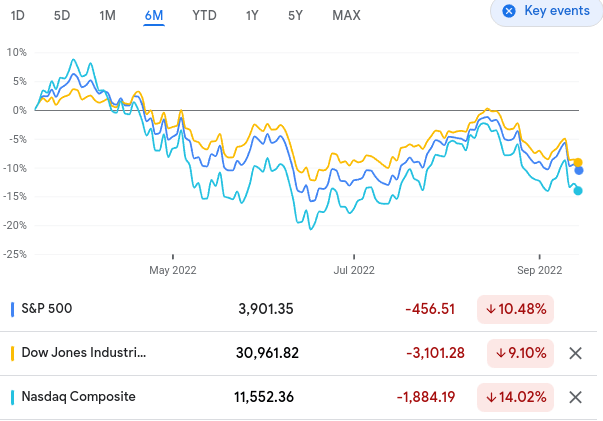

While we have seen a bit of weakness over last few months, the interesting point to reference is markets have moved off their lows. Despite the heavy losses in the current week, we see the all three indices are above their low points this calendar year:

6-Month Performance (Google Finance)

Clearly there was a bit of an upswing recently, only to see most of those gains evaporate with the release of August CPI figures. This gave me the chance to give an updated look on the market, and I am going to use this review to paint a more balanced view on equities. I personally see continued volatility ahead for the remainder of the year. This means I will be taking some profit when I see gains, and I will also be on the hunt for value/beaten down days, because ultimately there are positive forces at work here too.

I will touch on some of the push-pull factors influencing the market in this review, with a focus on ways investors can position themselves going forward.

American Households Doing Their Part

Let’s start with getting an understanding of why markets have been rising of late. One obvious reason is that they were quite beaten down – so a rebound was only a matter of time to some degree. But the good news is there were other supporting factors besides just cheaper stock prices.

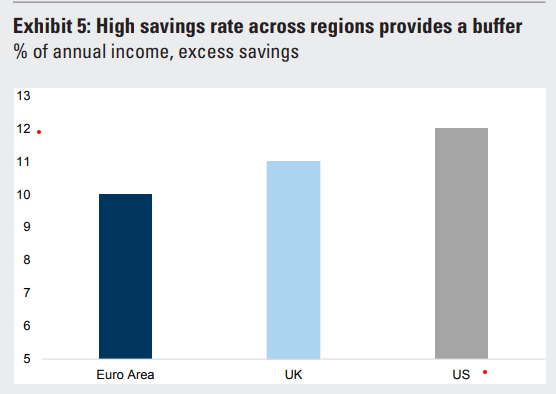

One area in particular is the U.S. consumer/household. This is an area that has been under pressure in 2022 – driven primarily by rising interest rates and high levels of inflation. The good news is that developed markets were positioned fairly well to withstand these developments. The U.S. in particular had a very high level of savings (as a percentage of income), but so did Europe. This has been critical to the resilience of retail sales figures here and abroad, despite ever-escalating prices:

High Savings Rates – Selected Developed Markets (Goldman Sachs)

Of course, inflation and higher borrowing costs are impacting the ability of households to save. So this metric will not remain as elevated going forward without real gains in employment and wages. But it does support the idea that consumer spending remained robust for a valid reason – consumers have pent of savings to spend.

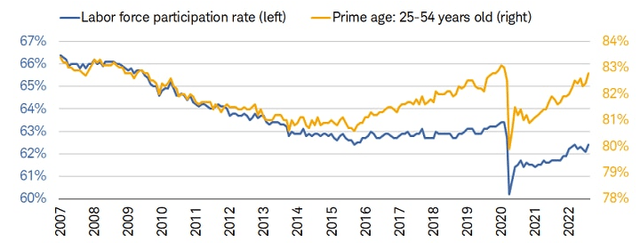

On that note, we should also remember the employment picture in the U.S. continues to improve. While we may have already hit recessionary territory on by a measure of economic growth, the same cannot be said for the labor market. Unemployment remains low and the one major thorn in the side of this backdrop – a shrinking labor pool – has finally started to reverse course. This is evident by the fact that labor force participation has been rising, especially among those in their prime working years:

Labor Force Expansion (Charles Schwab)

What I am trying to convey here is that there are bright spots to be found, especially domestically. American households went into this economic slowdown on a relatively strong financial footing – home values have risen, wages are up, and saving rates have surged during the pandemic. Further, more people are working and overall labor participation is rising. This bodes well for consumer spending and general confidence. That can lead to stock gains if other stars align.

**This discussion is a positive for net-long equity positions broadly, such as the Vanguard S&P 500 ETF (VOO), or the Invesco S&P 500 Equal Weight ETF (RSP), among others. But it is also a positive for consumer discretionary plays, such as the SPDR S&P Retail ETF (XRT).

U.S. (And Other Developed Markets) Are Faring Better Than Europe

My next topic is more broad and it speaks to America’s relative attractiveness. What I mean by this is that this attribute is not necessarily good, but it makes American companies more investable by comparison. That is sometimes just as important.

What I am referring to here is the problems in Europe, driven primarily by military conflict between Russia and Ukraine. As my followers know, this has led me to take a hands-off approach to most of the Euro-zone when it comes to portfolio allotment. At this moment, I favor looking outside U.S. borders for diversification, and I do favor developed markets. This would normally lead me to some exposure in central and western Europe via Germany, France, etc. But, in this climate, I am focused on developed markets outside the EU, along the lines of Canada, Australia, and to a lesser extent the U.K. and Ireland.

There are a number of reasons why I feel this way. In fairness, European stocks have been beaten down quite a bit. So a lot of the pain is probably baked into share prices. But what worries me now is they have been participating in the broad rally over the last few weeks. That tells me the market is starting to ignore the risks facing the continent and it is not a good time to start buying in.

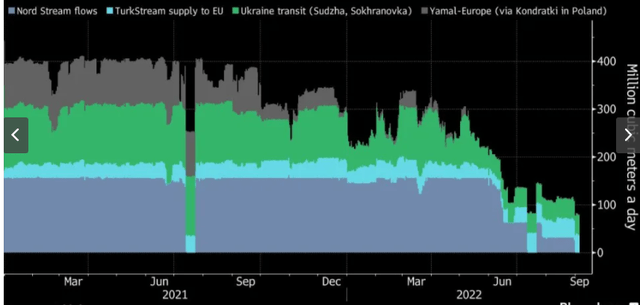

For one thing, the fall and winter seasons are almost upon us and central Europe in particular is facing a natural gas shortage. This has led to concerns over how people are going to heat their homes and has led to a surge in prices across a number of countries. Part of this has to do with the Euro-zone’s reliance on Russia gas and pipelines. As countries have moved to sanction the Russian governments and its officials for the military exploits in Ukraine, Russia has responded by weaponizing its natural resources. Energy flows (especially natural gas) coming from Russia to Europe has dropped dramatically as 2022 has gone on. This could lead to a very real crisis:

Gas Exports To Euro-zone (Yahoo Finance)

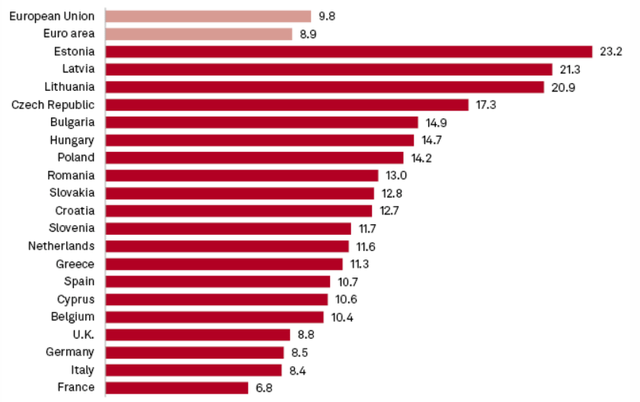

This is without question an issue in isolation. But this is amplified because Europe is already coping with rising prices across the economy. Inflation remains as problematic as ever, with nations closed to the military conflict seeing surging figures. But the trading bloc as a whole is facing an inflationary environment that is just not sustainable:

Europe’s Inflation Problem (European Central Bank)

The conclusion I draw here is that Europe is still an “avoid” for me. I am personally taking some profit on U.S. stocks right now, but my portfolio will remain U.S.-centric. For the limited diversification I do have, I am focused on the other developed markets I mentioned (mostly Canada and Australia). These nations are removed from Europe’s woes, and also have concentrations in other sectors that give my portfolio diversity compared to the Tech-heavy S&P 500 index.

**My international holdings include the iShares MSCI Canada ETF (EWC), the iShares MSCI Australia ETF (EWA), the iShares MSCI United Kingdom ETF (EWU), and the iShares MSCI Ireland Capped ETF (EIRL).

The Fed Is Still Hiking

So far I have talked about some supportive factors in the U.S., as well as why America (and other nations) are relatively better investments than the nations across the Atlantic. Yet, I also suggested remaining “wary” (exercising some caution). So, this begs the question – why?

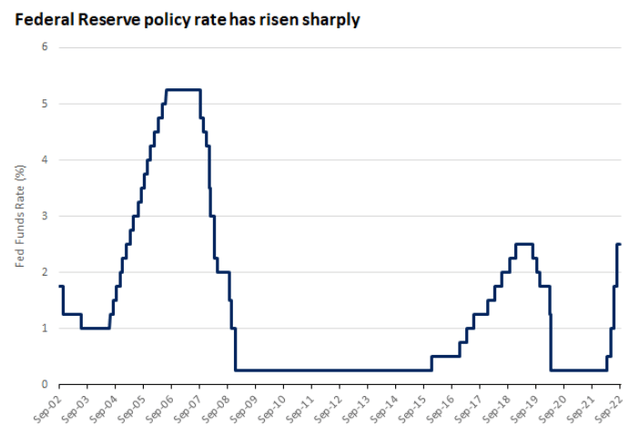

The answer to this also has many facets. One in particular is that interest rates are set to keep rising here at home. While markets have shrugged that off of late, I would not get too complacent. The fact is that the Fed’s benchmark rate is sitting near a multi-year high. If it progresses further, we are very likely to hit restrictive territory because the economy has not faced that challenge in a long time:

Fed’s Policy Rate (Federal Reserve)

Rates are expected to keep on rising, likely with a .75 basis point move later this month at the Fed’s September meeting. The problem here is growth stocks and other riskier assets can feel the pinch from higher borrowing costs, and that presents a very real headwind for earnings and share price multiples.

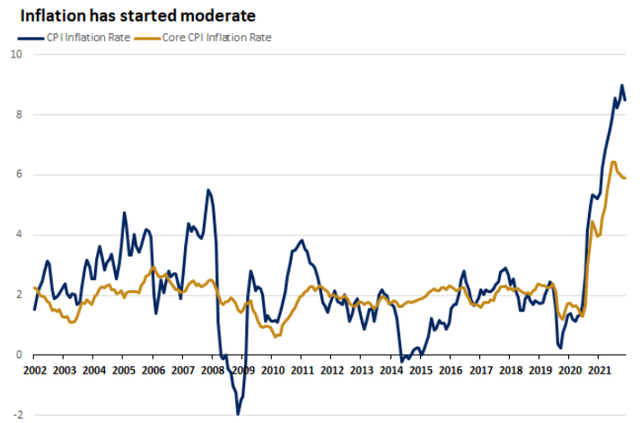

The ongoing challenge here is also that America faces stubborn inflation, along with the rest of the globe. The Fed’s rate hikes have potentially helped inflation finally reach its peak, but we must be remember it remains at unusually high levels:

This is the fundamental issue with where our economy is right now. The Fed has to raise rates to some degree to solve the inflation problem. But in doing so it may create another problem, such as a prolonged recession. This puts the Fed in a tough spot and a “damned if you do, damned if you don’t” situation.

Expanding on these worries is the fact that markets seem too complacent for me. I was buying earlier this year when markets seemed to be reeling with irrational fear. Now, the opposite seems true, which is why I have sold some stocks and moved to a 25% cash position. This is unusually large for me, as I typically have between 5-15% cash for opportunistic buying.

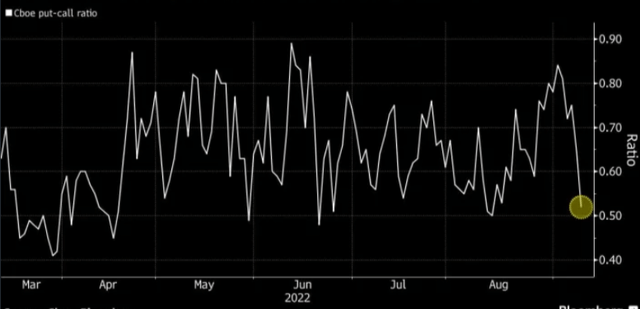

My problem is actually that I see more than just complacency, I see bullishness. This makes me nervous as a contrarian-oriented thinker, and tells me to be wary here. For example, the “put-call” ratio, which measures sentiment in the options market, has taken a big drop in the short-term. This means investors are piling into call options, suggesting a bullish forward outlook:

The thought here is investors are shifting more bullish. This tells me this the time to be less so. The crowd is often a great contrarian indicator, and I’m guessing that will be the case here again.

Bottom-line

This has been a year of ups and downs. Fortunately we have been in an “up” trend over the past few weeks. But this makes me nervous because of all the volatility we have seen. I want to start reducing some exposure to capture profit and buy back in an opportunistic manner. This had led me to divest all Euro exposure, reduce some of my S&P 500 holdings, and raise cash.

In addition to this, I have used some of my capital to buy up muni bonds which have been having a rough year. I also have steered some cash into developed markets outside of central Europe. Finally, I have amped up my exposure to Energy and oil, which is a sector that I believe will have a strong fourth quarter. Given the performance it has already had in 2022, this is not that wild of an assumption. Looking ahead, I am optimistic this playbook will serve me well, and I hope readers find this conversation productive.

Be the first to comment