pidjoe

Dear subscribers,

In this article, I’ll show you another undervalued company that, I believe, will make for a good investment in this and even a rising market – I’m talking about Energias de Portugal (OTCPK:EDPFY), or EDP. The company was founded over 40 years ago as Electricidade de Portugal by the Portuguese government. What the government did was to merge 14 former national energy companies. The company then went through another very comprehensive restructuring in the mid-90s, which also included progressive privatization of the business, which is what has been happening over the past few decades.

EDP has a technically appealing institutional shareholding – with 45%, roughly, of the company, owned by a mix of BlackRock (BLK), Qatar, and the China Three Gorges Corporation. The latter tried to make a hostile takeover of the business in 2018 but ultimately failed to do so, rejected in 2019 at the AGM. I don’t see, in today’s geopolitical climate, that there will be a repeat of this attempt, and I consider EDP’s ownership to be not a point against it.

Other relevant M&As include the M&A of Viesgo, which more than doubled its presence in Spain.

This leaves the company with the following fundamentals.

EDP – Plenty To Like About A Portuguese Leader

EDP is an above-average utility with almost 34% in gross margins and a net margin of over 6% in a difficult market. Among its advantages is a significant and now-considered legacy position in renewables. Already back in 2006, the company’s generation was 35% renewables, which was well ahead of any other utility in Europe that wasn’t pure-play renewables.

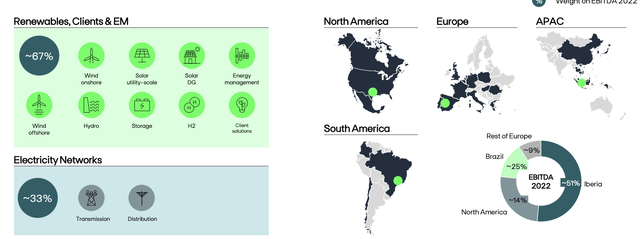

Despite the name, the company has a global presence and now has a 67% play on renewables, clients, and emerging markets, and a 33% network split.

The company has 22 GW of installed capacity, generating an annual EBITDA of €4.5B with a net profit just north of €850M. 13,000 employees and 9M clients make this company one of the most significant in all of Europe. The company still has legacy generation but is expected to be coal-free by 2025, all-green by 2030, and completely net-zero by 2040. From that perspective, I would say the company is either ahead of, or well in line with the overall curve in Europe. The company also expects net income to almost double by 2026E and expects a dividend floor in 2026, which would imply a 5% conservative YoC at this time.

Consolidation is ongoing at EDP.

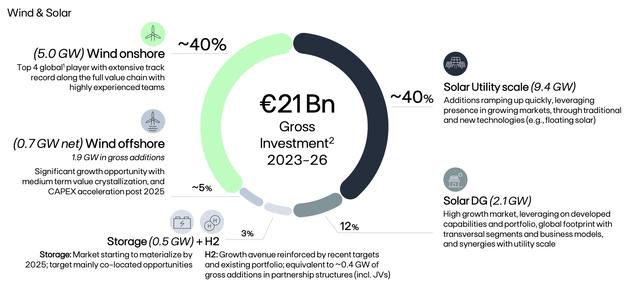

And like many companies, EDP is increasing the investment in the energy transition, with a strong focus on renewable assets in core low-risk markets. Low growth, in other words, but safe growth. This is something I can agree with. Over 80% of the company’s 2023-2026 CapEx is going towards investment in NA and EU, with less than 6% in APAC and around 15% in South America.

Like most utilities, the company’s current focus is on value creation in a very real way, while managing both the interest rate and inflation pressure. Many of the company’s projects are already approved. I’ve been through the various renewable projects, though not yet on an overly detailed level. The majority of them, over 43% are EU-based, with very sensible IRRs where the company can still make a profit and which won’t see the same issues as some we’ve seen in NA for the past few months. EPD averages a 16-year contracted period, with a 220 bps IRR-WACC spread, and this is with current cost numbers. This averages an 11-year average equity payback period. It’s not great, but it’s not terrible.

As I’ve said in previous articles, payback periods for these types of projects are bound to rise. There are short-term supports for renewable projects. The rise in gas prices will support higher renewable PPA, but this can, of course, go down again.

Also, the company is growing its distribution base. As you can see, it’s mostly a Portuguese company, but with significant Spain and some Brazilian assets – more on that later because Brazil may not remain in the company’s ownership or portfolio for long as such.

I would say that the issues in the offshore wind segments have culminated already. We’re not going to see a higher peak of headwinds. These were in 3Q23 and were exemplified, among other things, by completely unsubscribed auctions and project cancellations. However, the picture has already improved, and current auctions are being subscribed and PPA prices for renewables have maintained their levels fairly well. This is another way of me saying that I do not believe the company, or other companies with similar projects, will drop further than we’ve seen.

EDP is the largest weight of renewables in an integrated utility in all of Europe. This could be a problem for some, but I view it as a great advantage. Over 60% of group EBITDA is already renewables, and EDP plans to install another 12 GW of net capacity until 2026E. It’s also the fourth-largest renewables installer in North America, which also exposes it to beneficial tax and other treatments – further potential upsides for the company.

The reasons for the company’s relatively low valuations are several. First off, Portuguese companies are usually not known for high multiples or a lot of international interest. Secondly, the current renewables in Brazil and the way they’re listed and held means that there’s a certain discount related to these holding structures. EDP has already made attempts – several in fact – to buy out the minorities in the Renovaveis company – but it has only been implied successful in terms of deal flow in 2023, meaning the sale is likely to go through in this year 2024. If the company manages to buy out the intended 44% minority of EDP Brasil, then the company’s actions will be accretive to EPS by a 2-4% rate, by my current calculations.

The fact is that EDP has a better history and fundamentals than many of its peers. EDP never cut its dividend, not even during GFC, not during the debt crisis. The dividend may be unchanged for several years, but it has been held at the floor, which is the one that’s set to increase to €0.2.

The company is BBB-rated – its debt is somewhat elevated in part due to its renewable projects and a recent set of capital actions, but overall, this is a very attractive investment potential.

Let’s look at the risks & upsides for the business.

EDP – Risks & Upside For The Company

So, the primary risks are what I would consider somewhat operational in nature due to the company geography, is among other things, the Portuguese regulator. Utility appeal hinges on cooperation with the regulator and the returns that are allowed for the company – and it’s easy for a regulator to tell a private company like EDP that they need to make do with less returns, due to political and societal pressure. This is by far the largest risk for the company here, as I see it – that regulators change something and allow for the business a lower RoE. For the time being, the company’s earnings also remain exposed to the Brazilian Real, not exactly the most stable currency out there.

Aside from those two things, though, not many major risks exist here. Not operational, at least.

On the positive side, we have several things. First off, EDP is without a doubt one of the earliest renewable adopters in Europe. This makes it one of the best renewable investments, provided you can get it at a good valuation and upside. I now believe this to be possible. Its asset age and expertise and current project IRR/WACC means also that the company is likely to deliver one of the highest earnings growth rates in Europe – even higher than Enel (OTCPK:ENLAY).

Also, if the company manages to buy out Brazil (the EDP Brazil), this will further add to the appeal because it will reduce volatility for the common shares listed in Lisbon.

Let’s look at company valuation.

EDP Valuation

Will this company make you rich? No, it’ll, if anything, make you richer. If you already have a fair amount of capital, then I would argue that your investment is safely invested in this company, and able to provide you with a good yield and a good upside.

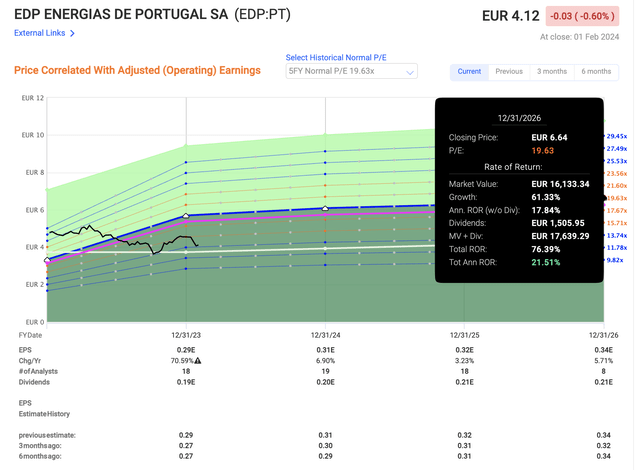

EDP tends to trade at around 20-25x P/E, which is a significant premium for a utility, but owing somewhat to its renewable exposure – which tends to allow for higher multiples.

But the good news, it’s now down to 14x P/E.

Let’s say that the 5-year premium of around 20x P/E is valid, which would entail an upside of over 20% per year inclusive of dividends, or 76% in less than 4 years.

Why would this P/E be valid?

Companies with this sales mix of renewables trade at premiums. And while the company cannot due to its geography be argued to be in the same division as say, NextEra (NEE), it’s still a company that works primarily with renewables and is expected to expand this. If you think NEE is worth 16-20x, then it’s reasonable to think that EDP, which yields more, and has what I believe to be a better upside, can conceivably be valued at the same or similar multiple.

EDP valuation upside (F.A.S.T graphs)

That is a very good upside, protected by a 4%+ yield in a segment where high yields aren’t uncommon, but safe higher yields are. The company also has a decent record of hitting estimates, managing this around 70%+ of the time. Overall, in the company’s future, I see several catalysts for a 4-5% EPS growth annually, from the Brazil transaction to the company’s upside in renewables that are already around and operate at much more attractive IRRs and WACCs than the competition.

I would say that the path to at least a 15-17x P/E is very clear here because I do not believe the company will do “bad” during a trend where earnings are in actuality set to grow, not decline.

That is the reason I’m generally positive here – the valuation is at a level where even the 10-year or 20-year averages would in every way indicate that it is not a bad idea to invest in EDP here.

Something that could invalidate the bullish thesis here and cause me to change my stance on the company would be a material change in fundamentals for renewables, both for future projects for the company or in some other part of the company. EDP still has exposure to riskier geographies in South America – this needs to be taken into consideration prior to investing in this business – though again, I would argue the exposure next to some other peers is comparatively low, especially if the sale of the stake goes through.

20 analysts from S&P Global follow the company here. Out of those, 19 have the company at either a “BUY” or “Outperform” rating, making it clear that conviction here is extremely high. Morningstar, as an example, goes to €5.8/share as a PT (Source: Morningstar). A range of €4.65 to €6.1 with an overall average of €5.46. I go somewhat lower, to a conservative 17.5x P/E of €5.2 normalized, impacting growth to around 4% on an annual forward basis until 2026E due to inflation, wage growth, and macro.

Still, this company remains a convincing “BUY” to me here, and I’m going to be adding more to EDP.

Thesis

- EDP is a fundamentally attractive integrated utility, and the largest renewable utility play in all of Europe, in terms of percentage of renewable assets. This makes the company, with a solid credit rating, a 4.5%+ yield that’s well covered and set to grow to around 5%, a very solid income play for someone looking for a solid 5% with the potential for a double-digit annual CAGR with capital appreciation.

- I view EDP as an attractive “BUY” at anything below €5.2/share, and the company currently trades well below this, at €4.12. That is why I as of today have started buying the company shares.

- The company comes in at a PT of €5.2/share and with a “BUY” rating here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company fulfills every single one of my investment criteria at this time and constitutes a “BUY” from me as an introductory rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment