AscentXmedia/E+ via Getty Images

Enel Americas (OTC:ENIAY) is one of the several listed Enel (OTCPK:ENLAY) subsidiaries that investors can choose from to de-conglomerate their utility exposure in Enel. The company operates in most South American countries except for Chile, while Enel Chile (ENIC) exists. As a substantial regulated utility with exposure to Brazil, they are benefiting from key elements of regulated remuneration as rates rise. On top of that, the generation business is managing to perform well as projects come online and the Colombian hydrology situation recovers. While the dividend isn’t particularly attractive based on FCF, and investors should also be aware that the ADRs are delisting with the stock now only available on the Santiago Stock Exchange, the company is performing well.

Q1 Note

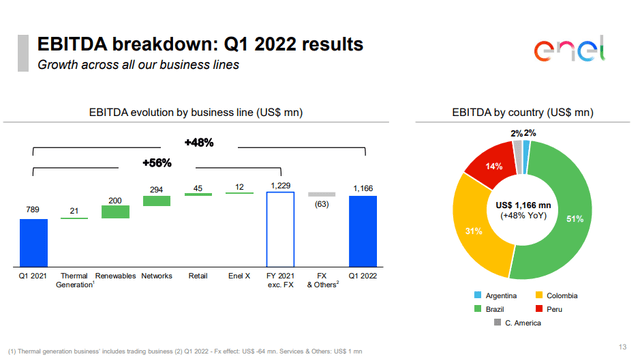

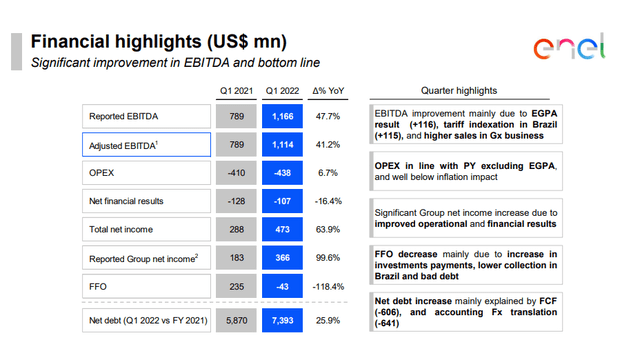

The Q1 results are highlighted as below, and bear in mind that much of the EBITDA growth is coming from the consolidation of Enel Green Power’s (‘EGP’) South American assets from the Enel parent company.

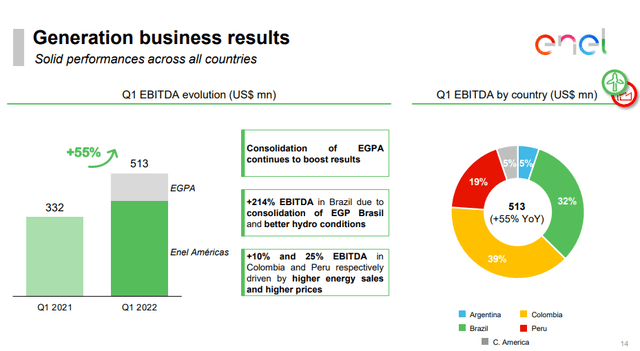

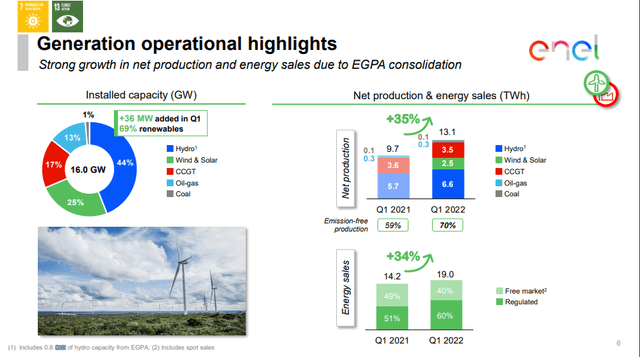

The rest of the growth has come from operational improvements in generation, and favorable tariff indexation in networks. The generation results have benefited from new projects coming online, but also higher electricity prices and far improved performance in the hydropower assets, focused mostly in Colombia, as the hydrology situation recovers.

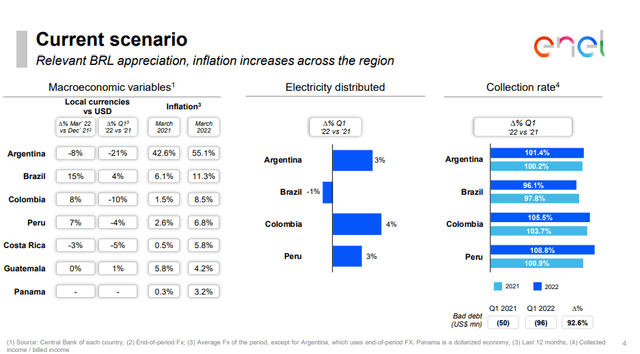

Even accounting for the EGP consolidation, EBITDA has incrementally improved from ENIAY’s original assets in generation, and this is all in spite of quite substantial devaluation of the local currencies against a raging dollar.

EBITDA Generation (Q1 2022 Press)

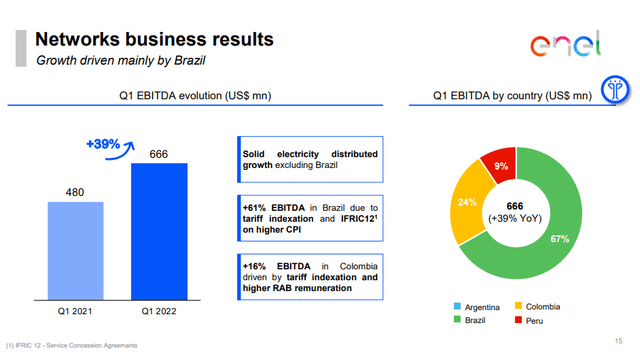

Focus on Networks

The way regulated utility businesses work is that they are remunerated according to a scheme decided in negotiation with the government authorities on regulation of utilities. In the UK it’s Ofgem, in Spain it’s the CNMC, and in Brazil for example it is ANEEL. Regulated utilities were a little exposed in an inflationary environment. To grow networks revenues, in most systems the regulated asset base, i.e the base of assets developed by the regulated utility post-approval from the utility authorities, must grow, and remuneration rates are paid on the basis of that. The remuneration rates, or the regulated WACC, are indexed to interest rates. So in countries like Brazil and other emerging markets, where interest rates are generally higher due to risk premia in the country from the FX effects, the WACCs are generally higher, usually double-digit. With rate increases in Brazil, which is the major network concession for Enel Americas, taking effects soon after the Fed made their interest rate hike, the tariff agreement became slated for even further improvement on top of CPI indexation that happened throughout Q1. This means that we should expect continued improvement in networks results in Q2. Similar effects were observed in Colombia.

Networks accounts for the majority of the company’s EBITDA, so this moves the needle, and the EBITDA waterfall demonstrates the important networks contribution that stands up to even the consolidation effects from EGP in generation.

EBITDA Waterfall (Q1 2022 Press)

Conclusions

The other news is that the company has delisted its ADRs, and it came into effect just now on the 20th of June. Shareholders had the option to cancel their ADRs or to be exchanged shares that still trade happily on the Santiago Stock Exchange or OTC with the ENIAY ticker with plenty liquidity. There are really no financial effects here.

While networks are going to continue to benefit from tariff revisions in connection with interest rates and to some extent CPI, they are also levered to some extent to demand, where more demand on the system means more remuneration for operators of the distribution or transmission assets. A recession could be a bit of an issue for demand, so tariff increases on the back of rate increases could be somewhat mitigated. Also be aware that while quite a small networks exposure, Peru will have a new tariff system in place by November. Usually new tariff negotiations are not something we like, especially when recessions are looming, because the government will advocate for consumers and try to make things more affordable and less profitable for the operator. Nonetheless, the effects of rate indexation will surely remain. Finally, risks related to FX shouldn’t be ignored. The dollar is rocketing right now and this is detrimental to ENIAY’s cash flow where they are paid in local markets and report in dollars. However, at least depreciating local currencies does mean that generally speaking the credit environments are comparatively favorable and tightening isn’t as rapid. You’ll notice that in Brazil, which is engaging in similar rate hiking, the Real is not performing badly at all.

Overall, the dividend continues to be weakly covered on a FCF basis as we explained in our last article and maybe shouldn’t be relied upon. But besides that, there is resilience in ENIAY and we continue to look on it favorably, although we’re in no rush to buy.

Be the first to comment