DarioGaona

The Q3 Earnings Season for the Silver Miners Index (SIL) has finally come to an end, and for the most part, the results weren’t very pretty. This is because most producers saw significant margin compression due to the impact of inflationary pressures on their cost structure combined with much weaker metals prices. Unfortunately, Endeavour Silver (NYSE:EXK) was one of the names that saw the most significant margin compression, with its all-in-sustaining cost [AISC] margins plunging from $7.10/oz to [-] $0.85/oz, and these costs don’t even include growth capital & growth exploration/evaluation costs.

Fortunately, the silver price has rebounded sharply since the Q3 reporting period, currently trading hands above $23.00/oz, which has set Endeavour up for margin expansion on a sequential basis. The issue is that on an all-in cost basis, the company continues to see deeply negative margins even at current silver prices, and with the potential for a weaker production profile next year, it won’t benefit from the same elevated denominator to help keep a lid on unit costs. Hence, with the stock trading at over 1.10x P/NAV with industry-lagging margins, I continue to see far more attractive opportunities elsewhere.

Guanacevi Operations (Company Presentation)

Q3 Production & Sales

Endeavour Silver released its Q3 results last month, reporting quarterly production of ~1.46 million ounces of silver and ~9,200 ounces of gold, translating to an 11% increase in silver production offset by a 13% decline in gold production. The lift in silver production was attributed to steadily increasing grades at Guanacevi that are well above its reserve grade + increased purchases of third-party ore, while the dip in gold grades resulted from the sale of El Compas and lower gold grades than planned at Bolanitos. The result is that Endeavour is likely to beat the upper end of its guidance (8.0 million silver-equivalent ounces), with 6.3 million silver-equivalent ounces already produced as it heads into its final quarter of the year.

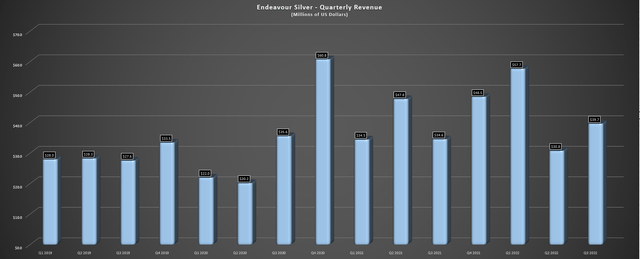

Endeavour – Quarterly Revenue (Company Filings, Author’s Chart)

From a revenue standpoint, Endeavour’s results were much better year-over-year, reporting revenue of $39.7 million in Q3, a 15% increase from the year-ago period. However, it is worth noting that the company was up against very easy year-over-year comps in the prior-year period, given that it withheld considerable inventory in Q3 2021 (it sold just ~700,000 ounces of silver in Q3 2021). That said, revenue was once again impacted in Q3 2022 by withholding some inventory to sell in the future at higher prices, and this decision looks to have paid off, with the silver price now 20% higher than Endeavour’s average realized silver price in Q3 ($19.24/oz).

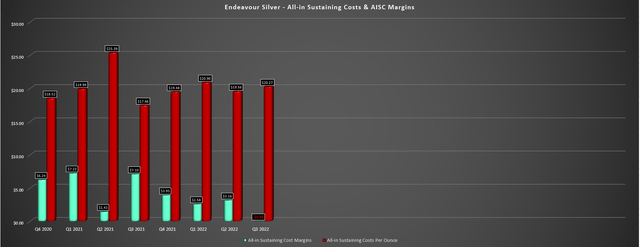

Endeavour Silver – All-in Sustaining Cost & AISC Margins (Company Filings, Author’s Chart)

While these higher silver prices combined with increased sales volumes (assuming it sells some of its inventory into strength) will boost its Q4 results, Endeavour’s margins have suffered considerably. As the chart above shows, margins continue to trend in the wrong direction, declining from $7.10/oz in Q3 2021 to [-] $0.85/oz in its most recent quarter. The company noted that it continues to see inflationary pressures from labor, consumables, and power, which is not company-specific by any means, but certainly has a larger impact on smaller and higher-cost operations that lack economies of scale like Guanacevi and Bolanitos. This is evidenced by its cost performance, with cash costs up 27% in Q3 and AISC up 16% to $20.27/oz.

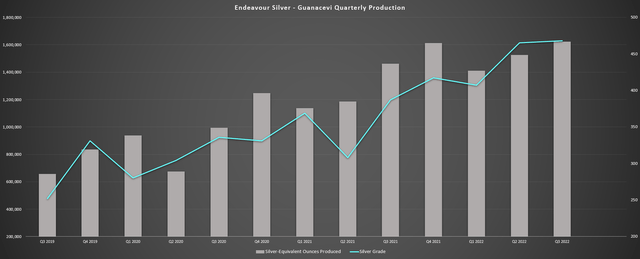

Guanacevi – Quarterly Production & Grades (Company Filings, Author’s Chart)

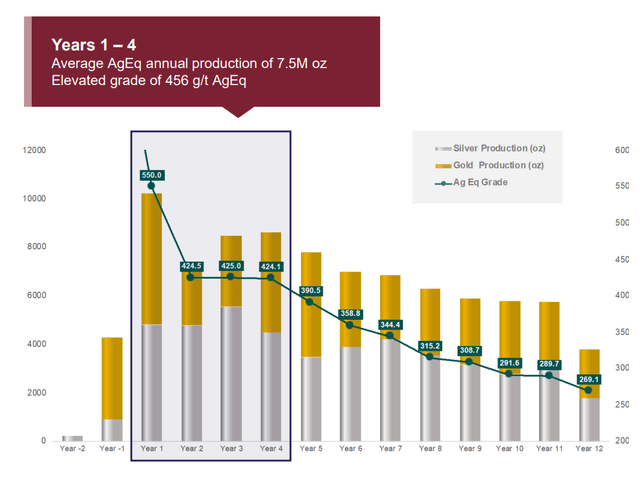

The bigger issue here, though, is that all-in-sustaining costs have actually performed better than I expected due to the incredible year that its flagship Guanacevi Mine has had, with average processed grades of ~450 grams per tonne silver and ~1.30 grams per tonne of gold. While there is an impact from third-party ore in these processed grades, they are well above the company’s average reserve grades at Guanacevi of ~394 grams per tonne of silver and 1.01 grams per tonne of gold. This is not ideal, as it suggests that we could see some mean reversion in grades next year at Guanacevi, which could put a dent in unit costs if this isn’t offset by higher throughput, which is being explored.

2023 Outlook & Recent Developments

Given the impact of a full year of inflationary pressures with the potential for some mean reversion in grades at Guanacevi, I would not be surprised to see a further increase in AISC in FY2023, with all-in-sustaining costs potentially set to creep up towards $22.00/oz. So, even if we see an average realized silver price of $23.50/oz next year vs. estimates of $22.50/oz in FY2022, this could be offset by a high single-digit cost increase vs. FY2022 levels. The result is that I don’t expect to see much margin improvement on a year-over-year basis. To summarize, margins left much to be desired this year, they performed better than expected, but this same benefit (increased production) might not be in place in 2023.

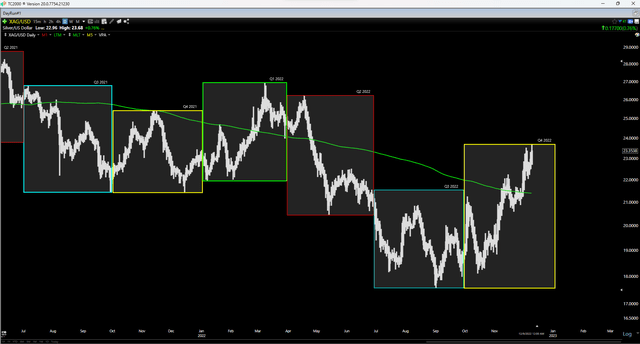

Silver Futures Price (TC2000.com)

Some investors might argue that this isn’t a big deal at all given that the company has an ultra-high-margin project in the wings (Terronera), and if silver prices head above $25.00/oz, the company will be in great shape. Regarding the first point, this couldn’t be further from the truth, with Endeavour’s all-in costs sitting at $26.40/oz year-to-date when including growth capital, which is not ideal for a company spending quite conservatively on exploration relative to its short mine life at its #2 mine, Bolanitos. As for the second point, I don’t expect Terronera to reach commercial production until April 2025 at the earliest, meaning it won’t help to evade margin compression in 2023 and 2024.

Endeavour Silver – Terronera Projected Production Profile (Company Presentation)

The silver lining is that Endeavour seems less likely to see a capex blowout at Terronera than its initial capex estimate of $175 million, with the company continuing to spend ahead of a formal construction decision to lessen the impact of inflationary pressures. This includes a ~$40 million budget this year at Terronera, and much of the mobile mining fleet is on-site; the SAG mill and crushers are expected next year, and early works have begun. Still, while positive, I wouldn’t expect a re-rating from Terronera until we’re within three months of the first pour, similar to Argonaut Gold (OTCPK:ARNGF) which has a game-changing project relative to its cost profile but has still not re-rated despite being five months from initial production.

Finally, the most recent development is that Endeavour Silver has confirmed a monster resource at Pitarilla, a newly acquired project that it bought from SSR Mining (SSRM). The project in Durango State hosts ~566 million silver-equivalent ounces at an average grade of 100 grams per tonne silver-equivalent (in-pit resource), with an underground resource of ~279 million silver-equivalent ounces at an average grade of 217 grams per tonne silver-equivalent. While this is a phenomenal resource, its priority is behind Terronera, and it won’t be cheap to build, so until we have a mine plan in place and cost estimates that suggest Endeavour can fund this project on its own, I think it’s difficult to assign a value of more than $100 million to the asset. Hence, I don’t see any reason for a re-rating from the updated resource.

Valuation

Based on ~196 million fully-diluted shares and a share price of US$3.40, Endeavour trades at a market cap of $663 million, which might seem cheap for what could be a future 12+ million-ounce producer (SEO basis). However, when we compare this valuation to some peers in the sector and Endeavour’s estimated net asset value of ~$580 million, I don’t see much of a margin of safety at all baked into the current valuation. In fact, Endeavour trades at approximately 1.14x P/NAV, which is a premium to a company like Sandstorm Gold Royalties (SAND) with superior margins, diversification, and a much better business model due to being a royalty/streamer vs. a marginal producer.

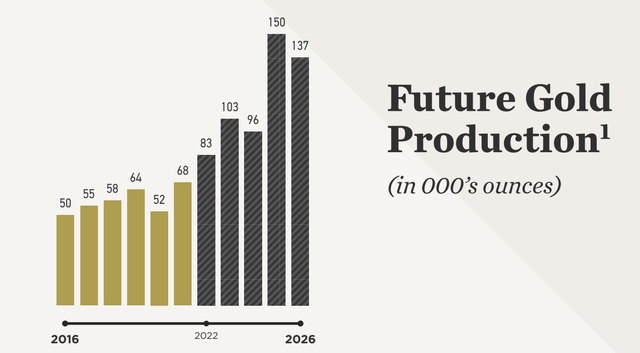

Sandstorm – Future Gold Production (Company Presentation)

One might argue that Endeavour should trade at a premium to most producers due to its strong organic growth profile, but this is not a differentiator in the case of Sandstorm, which also expects to grow production (attributable in its case) by more than 80% looking out to H2 2025. Meanwhile, from a scale standpoint, Sandstorm will have a similar production profile to Endeavour yet with much better margins/diversification, assuming 160,000 GEOs per annum, which is the equivalent of the ~13+ million SEOs that Endeavour Silver will produce post-2025 if Terronera is green-lighted promptly. So, given the opportunity to own a lower-risk business at a ~20% lower P/NAV multiple, Sandstorm is far cheaper.

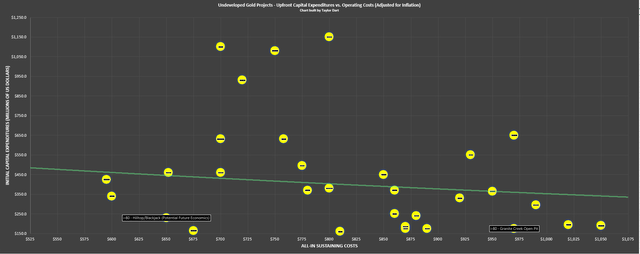

Initial Capex & AISC – Undeveloped Gold Projects (Company Filings, Author’s Chart & Estimates)

Meanwhile, if we compare Endeavour to other producers available in the market, the company is trading at a slightly lower market cap than i-80 Gold (IAUX) but over double the estimated P/NAV multiple (1.15x vs. 0.50x). This is even though i-80 Gold is on a path to increasing production to 250,000+ ounces in FY2025 in a much more attractive jurisdiction (Nevada vs. Mexico), which would be the equivalent of 21+ million SEOs per annum. Besides, the company could increase this further to 550,000+ gold-equivalent ounces by 2028 with two high-margin and relatively low capex projects in the wings: Granite Creek Open Pit and its new CRD discovery. Hence, for investors looking for growth among producers, there are more attractive bets from a valuation/growth standpoint.

Summary

Endeavour Silver has had a solid year thus far from a production standpoint, and while the cost creep is out of its control, its new CEO has done a solid job of managing investor expectations and over-delivering on promises. That said, we have continued to see steady share dilution, we’re still at least 28 months from commercial production at Terronera, and Endeavour is now staring down what will likely be lower production next year but sticky inflationary pressures. Hence, I expect further margin compression next year unless we see higher silver prices. For this reason and because Endeavour continues to trade at an expensive valuation vs. other options in the sector, I continue to see more attractive bets elsewhere.

Be the first to comment