everythingpossible

A Quick Take On Endava plc

Endava plc (NYSE:DAVA) reported its FQ4 2022 financial results on September 27, 2022, producing nearly 31% in revenue growth on a constant currency basis.

The company provides technology consulting and implementation services to companies worldwide.

Until we gain visibility into the global growth trajectory and in the firm’s ability to profitably diversify away from the ‘sick man’ Europe, I’m on Hold for DAVA.

Endava Overview

The London, England-based software development outsourcing company was founded in 2000 to support enterprise teams throughout the lifecycle of their projects, from application delivery and testing to support, hosting and managed services.

Management is headed by Co-Founder and CEO John Cotterell, who was previously a Managing Director at Concise Group Limited.

Endava helps companies use Distributed Agile at scale, a method in which software projects are developed in rapid cycles by teams working remotely. This results in small releases with each building on the previous one.

The company’s offerings include the following services:

-

Strategy

-

Creative and User Experience

-

Insights through Data

-

Mobile and Internet of Things

-

Architecture

-

Smart Automation

-

Software Engineering

-

Test Automation and Engineering

-

Continuous Delivery

-

Cloud

-

Advanced Applications Management

-

Smart Desk

Endava’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

Major competitive or other industry participants include:

-

Globant

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemeni

-

Company in-house development efforts

Endava’s Recent Financial Performance

-

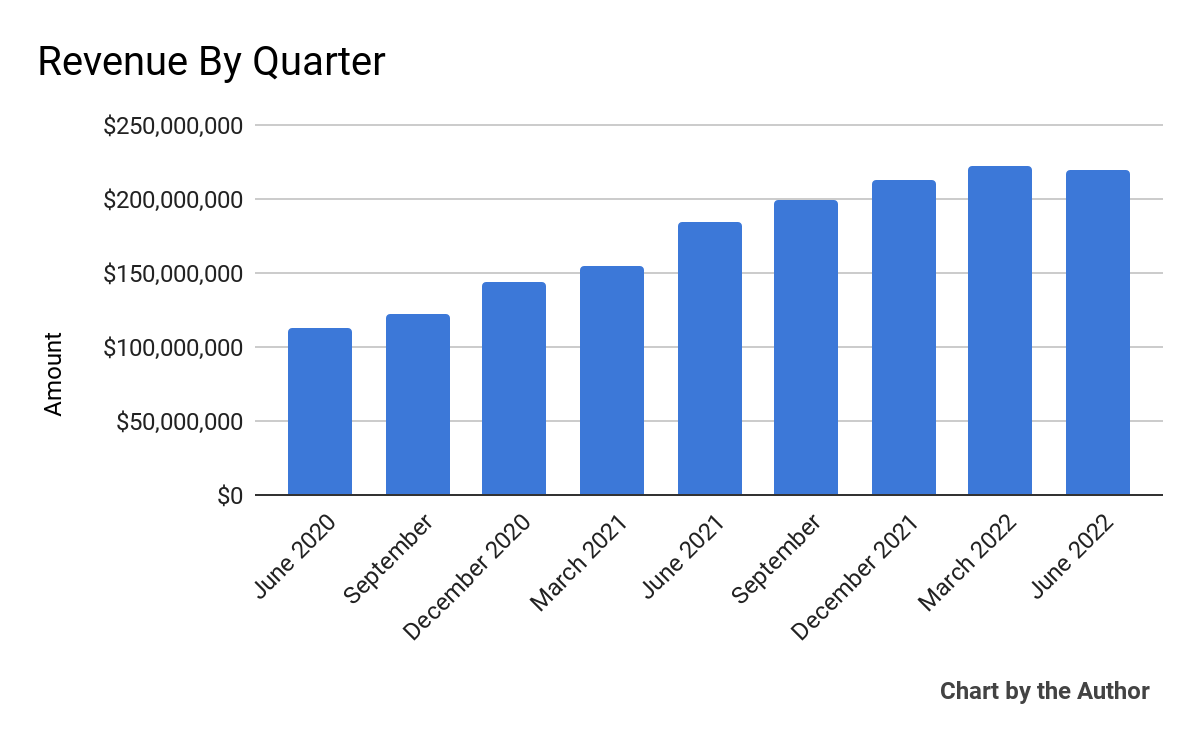

Total revenue by quarter has plateaued recently:

9 Quarter Total Revenue (Seeking Alpha)

-

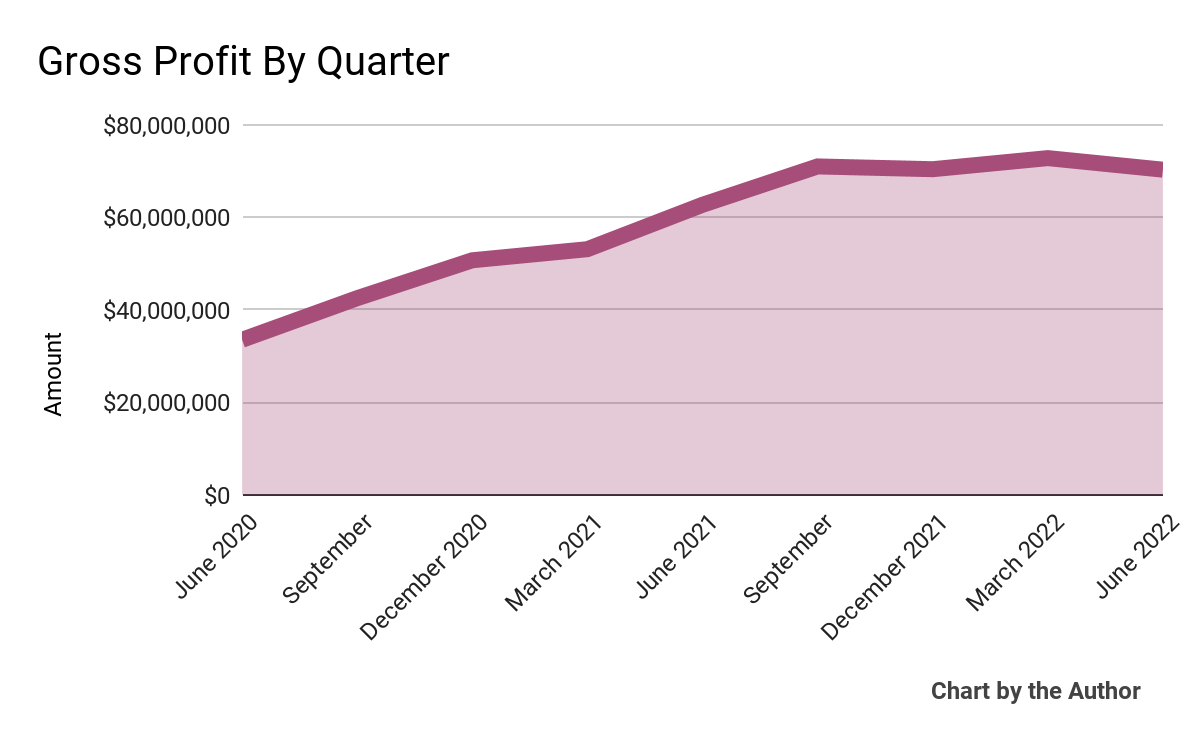

Gross profit by quarter has also reached a peak:

9 Quarter Gross Profit (Seeking Alpha)

-

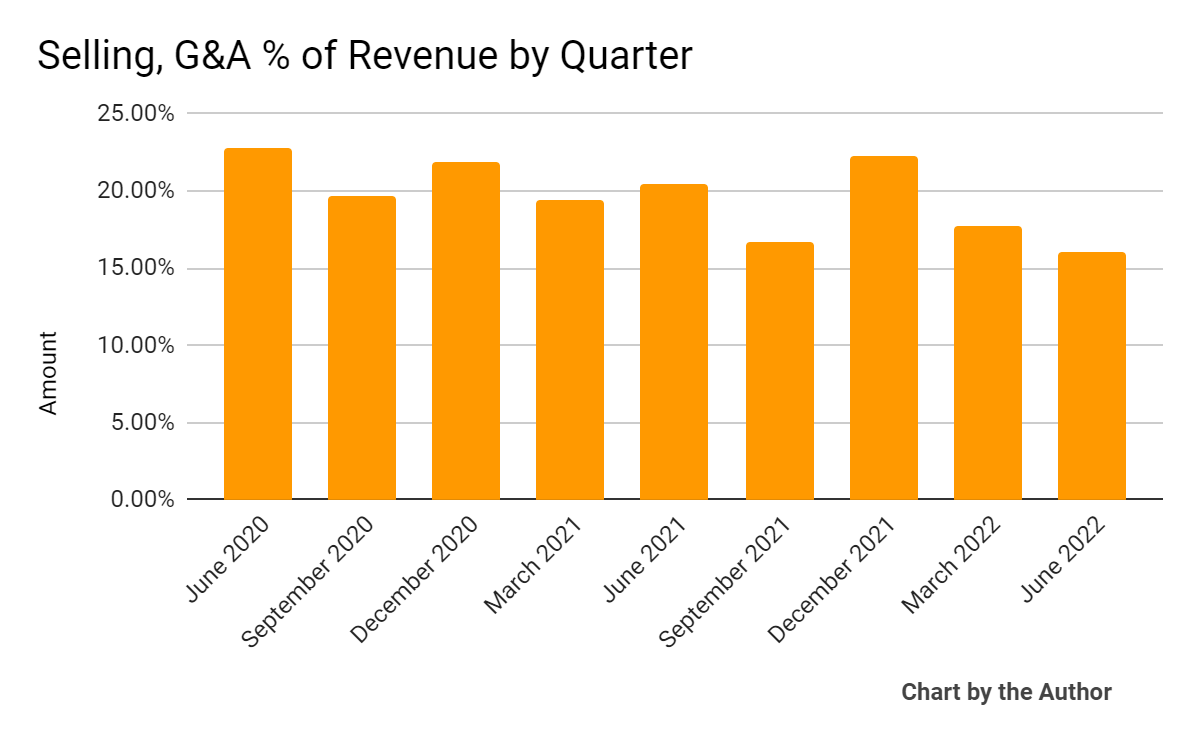

Selling, G&A expenses as a percentage of total revenue by quarter has produced the following trajectory:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

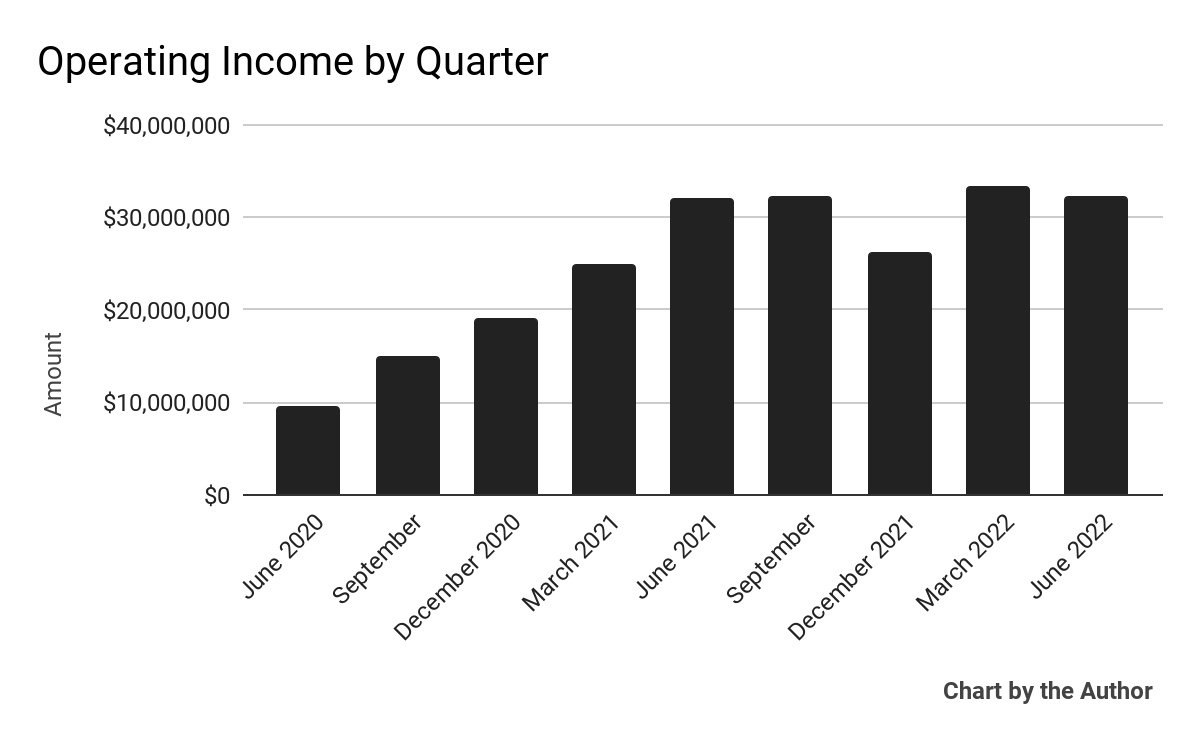

Operating income by quarter has leveled off recently:

9 Quarter Operating Income (Seeking Alpha)

-

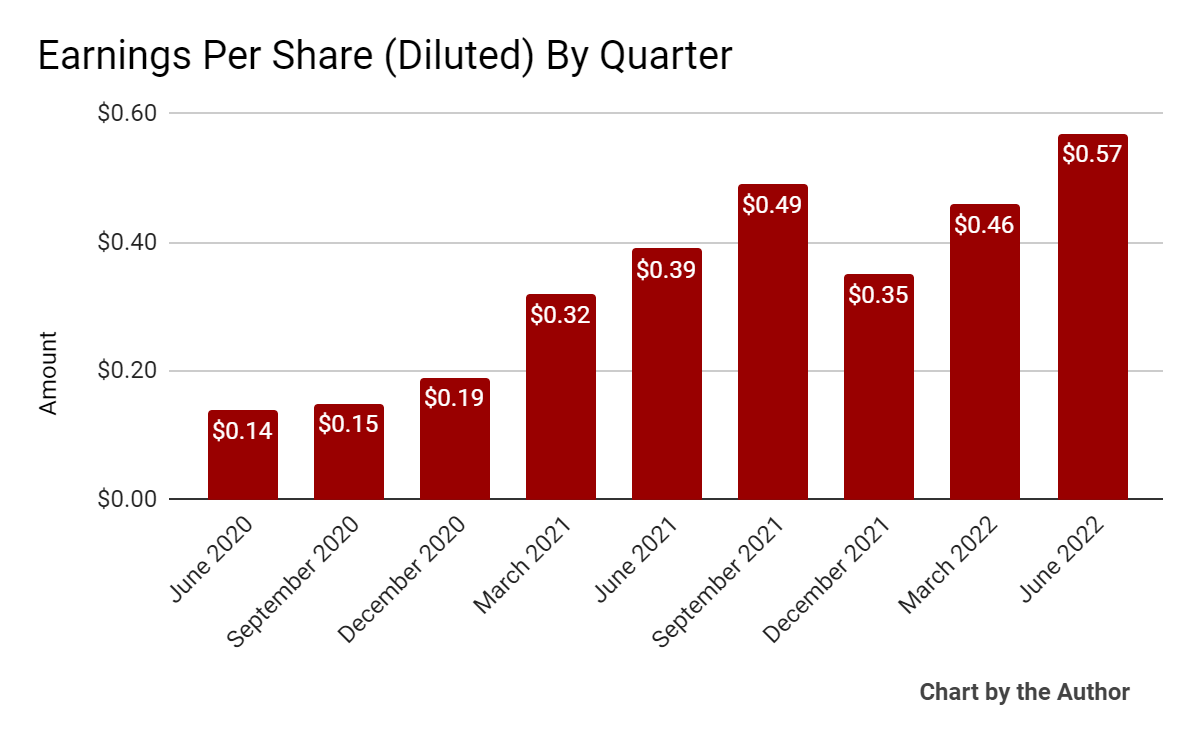

Earnings per share (Diluted) have risen according to the following chart:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is IFRS)

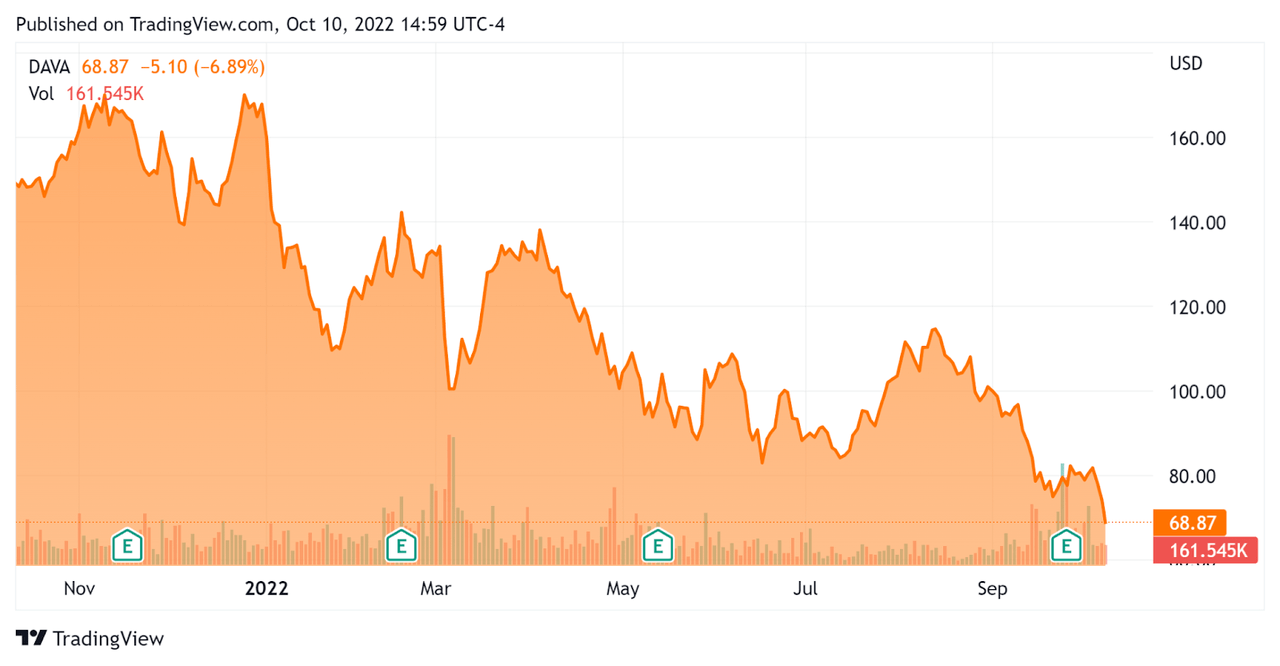

In the past 12 months, DAVA’s stock price has fallen 54.2% vs. the U.S. S&P 500 index’ drop of around 17.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Endava

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.00 |

|

Revenue Growth Rate |

46.7% |

|

Net Income Margin |

12.7% |

|

IFRS EBITDA % |

20.7% |

|

Market Capitalization |

$4,120,000,000 |

|

Enterprise Value |

$3,990,000,000 |

|

Operating Cash Flow |

$146,950,000 |

|

Earnings Per Share (Fully Diluted) |

$1.87 |

(Source – Seeking Alpha)

Commentary On Endava

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted its further efforts at diversification, both as to technology services offered and to geographic footprint.

The company seeks to expand its focus to Latin America and Asian markets in an effort to broaden its footprint and reduce its reliance on the European region.

On the technology front ,management is increasing its focus on 5G technologies, the ‘Metaverse’, artificial intelligence & robotics and frictionless payments.

As to its financial results, quarterly revenue rose by 35% year-over-year, while before tax adjusted profit increased by 23.5%.

The company’s client base rose by 19%, with an increase in larger clients to 134. These larger clients pay at least GBP 1 million per year.

Notably, the firm’s ten largest clients accounted for 32% of its revenue, so the company does have a certain amount of customer concentration risk.

While earnings per share rose, operating profit dropped sequentially.

For the balance sheet, the firm finished the quarter and fiscal year with cash and equivalents of $198.2 million and no debt.

Over the trailing twelve months, free cash flow was $129.9 million, and the firm spent $17.0 million on capital expenditures.

Looking ahead, management guided revenue for fiscal year 2023 to a constant currency growth of 23.5% at the midpoint of the range, with adjusted EPS at GBP 2.365 at the midpoint.

Regarding valuation, the market is currently valuing DAVA at an EV/Revenue multiple of 5x while revenue growth appears to be moderating.

The primary risk to the company’s outlook is continued poor economic prospects in Europe notwithstanding management’s efforts to diversify away from Europe.

Management is also aggressively hiring, which may see continued inflationary aspects somewhat ameliorated by hiring in lower cost regions.

Given the uncertainty in macroeconomic terms, while Endava appears to be diversifying its footprint, I’m not convinced the company is going to prosper when faced with a worsening economic environment, to varying degrees, on a global basis.

Until we gain visibility into the global growth trajectory and in the firm’s ability to profitably diversify away from the ‘sick man’ that is Europe, I’m on Hold for DAVA.

Be the first to comment