Hispanolistic/E+ via Getty Images

Investment summary

With the latest sector rotation favouring healthcare names, we look to Encompass Health Corporation (ASX:NYSE:EHC) and note it displays many of the characteristics that are conducive to further upside in the future investment landscape. This is a high probability name that is executing well on its growth strategy, all whilst retaining an annualized 10.2% return on its invested capital and adequate liquidity. With profitability trends a standout feature, along side the defensible business model, we rate EHC a buy on a $84.75 valuation, seeking a return objective of 64% to that level.

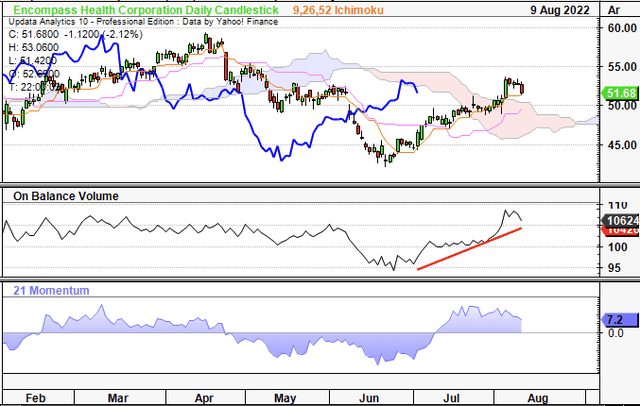

Exhibit 1. EHC 6-month price action, ichimoku cloud overlay. The price line and the lag line (in blue) have each punched up through cloud support, whilst on balance volume signals the longer-term trend is in situ. This price chart is bullish by estimate.

Data: Updata

Q2 earnings provide insights for FY22 exit momentum

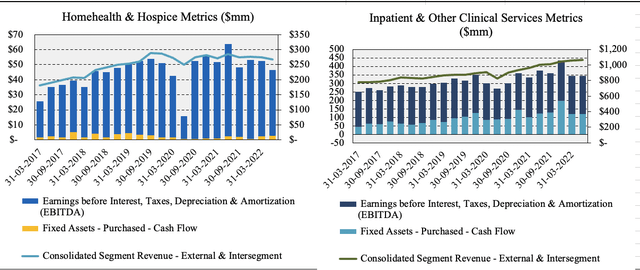

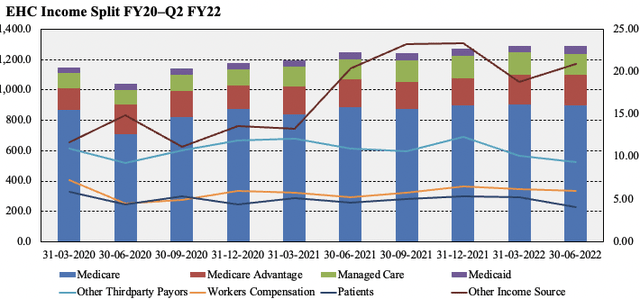

Second-quarter earnings came in strong although printed below consensus estimates from top-bottom. Total sales were $1.33 billion, constituting ~310bps YoY growth. Of this, the inpatient rehab franchise (“IRF”) business contributed ~80% or $1.06 billion to the top, bringing this to $196 million in quarterly EBITDA. As seen in Exhibit 2, income derived from each segment has been seasonal with growth trends normalizing to the single digits in recent quarters.

Exhibit 2. Segment-specific income mix, trends normalizing back to range

Data: HB Insights, EHC SEC Filings

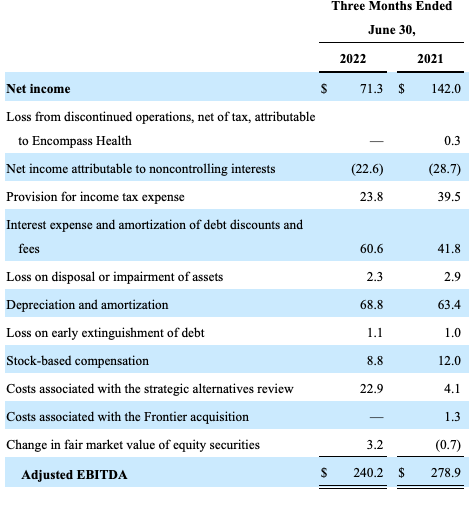

It recorded non-GAAP EBITDA as $240 million, and explains the adjustment is necessary to gauge the company’s liquidity profile. Exhibit 3 illustrates the reconciliation of net income to adjusted EBITDA. On examination we agree with most of the adjustment except we’d subtract stock-based compensation of $8.8 million and the change in fair market value of its equity positions at $3.2 million. As such, we’ve adjusted EHC’s EBITDA to read $228.2 million.

Exhibit 3. Reconciliation of net income to adjusted EBITDA – the variance between reported and adjusted EBITDA is ~22%

Data: HB Insights; EHC 10-Q; Q2 FY22

It brought this down to pre-tax operating income of $95 million, down from $181 million the year prior and net income of $71 million. The change YoY stemmed from higher operating costs at the SG&A line, and a 44% increase in interest expense. As such, it converted FCF at a margin of 12.5% to ~$177 million, itself up ~21% year on year.

Moreover, Q2 contract labour (including sign on and shift bonuses) came to ~$57 million, down ~$7 million sequentially, with the mix split ~62% and ~38% to contract labour and sign ons/bonuses, respectively. Impressively, amid the current labour market, EHC actually reduced contract labour full-time equivalents (“FTEs”) 20% down from a peak of ~750 in March to 597 by June.

A 130bps increase in revenue per discharge complimented; however, this was offset by continued cost-challenges due to “staffing challenges” per the earnings call. Despite this, it saw some leverage from Q2 agency rates for each FTE, declining from $240,500 down to $222,000 sequentially. These are good trends to see because agency rates peaked for the company in February at $243,000, and there was uncertainty on the ability of this to level back to range. Alas, by June, overall agency rates had reduced more than 40% to ~$209 million.

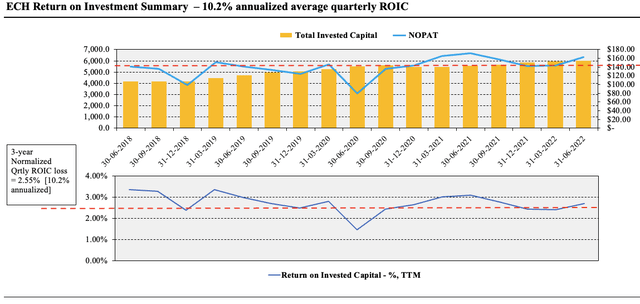

With the spike in sales and operating income the company’s return on investment curled up to an above-average 2.69% for the quarter. Here we examined how much NOPAT EHC generates from the previous year’s invested capital, and determined this as the return on investment (“ROIC”). As seen in Exhibit 4, 4-year ROIC normalizes to 2.55% (10.2% annualized), well above the company’s annual WACC of 6.1%. This adds a heavily bullish tilt to the investment debate. These are immovable, defensible and cash-rich investments on EHC’s books. It therefore ensures the company can continue compounding cash at an average ~10% per year – attractive features in the forward looking climate.

Exhibit 4. ROIC trends curling back to the upside along with NOPAT conversion

Image: HB Insights, EHC SEC Filings

Guidance affirmed from top-bottom

Q2 earnings came in line with internal expectations, management says, prompting it to reaffirm FY22 guidance. It has increased the provisions allocated to bad debt from 200bps, up to a range of 200–220bps. Management also projects $280 million–$380 million in FCF from the IRF segment. Noteworthy, however, is that YTD FCF from the segment is already at $290 million, and this points to a higher CAPEX schedule in H2 FY22, in line with seasonal trends.

It had released a separate set of accounts and forward-looking guidance back in June, following the spinoff of Enhabit. It now released accounts forecasting EHC revenue of $4.25–$4.3 billion, with adjusted EBITDA of $820–840 million and non-GAAP EPS of $2.77–2.91. It also declared a $0.15cps quarterly dividend, although this is negligible in our analysis as the forward yield is 0.3% on this.

Exhibit 5. EHC quarterly operating income trends

Data: HB Insights, EHC SEC Filings

Additional takeouts of consideration

Same-store RN hires came in more than 135% higher YoY to 276, thereby stretching sign on and shift bonuses higher throughout the quarter as well. As the company continues hiring more RNs, whilst industry turnover continues to be high, plus given the current state of the US labour market, EHC envisions both of these costs to remain buoyant over the remainder of FY22.

As a result, the company looks to be shifting away from contract labour towards this segment, and forecasts agency rates to continue declining in unison with last quarter. However, vision is murky here, because there’s still no clarity on the Covid-19 situation, plus, there are ongoing staff shortages for a myriad of other reasons too (sick days, resignations, etc.) meaning agency rates might stay higher longer than EHC predicts.

Aside from that, CMS issued the FY23 final IRF rules in the final week of July. CMS established a ~4% update for the final rule in the IRF basket. EHC will therefore recognize a 4% in Medicare payments from October this year, when the new rule takes effect.

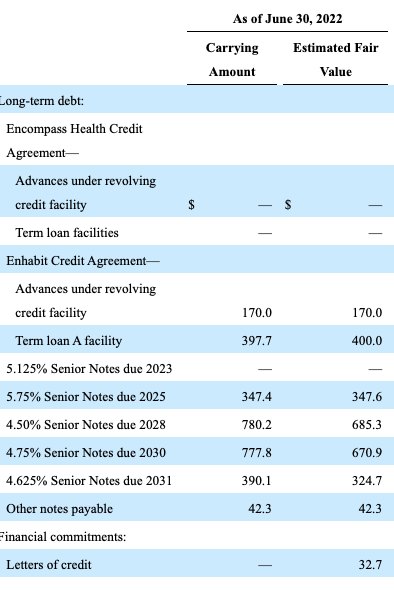

However, the key point is that the 400bps increase isn’t enough to overcome its surging operating expenses, and increasing interest expense. It has primary outstanding variable rate debt of $170 million and ~$398 million under its term loan A facility. The spread of its issued notes is shown in Exhibit 6, below, with coupons ranging from 4.6%–5.75%, and tenor’s from FY23–FY30. Sensitivity analysis on the company’s credit structure illustrates that 1% increase in commercial interest rates translates to an incremental negative cash flow of ~$3 million for EHC. The same is true to the downside.

Exhibit 6. EHC Credit Structure with spread of issued notes observed

Each 1% spike in interest rates to the upside/downside totals a $3 million cash flow outflow/inflow on this profile

Data: HB Insights, EHC 10-Q

Valuation

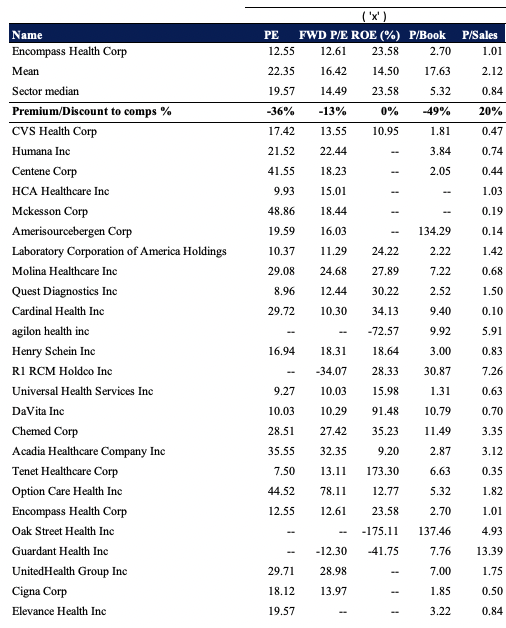

Shares are trading at a discount to peers across all multiples used in this analyses bar sales multiples. Alas, it trades at a 13% discount to GICS Industry peers at 12.6x forward P/E, suggesting the market is pricing in a below-sector performance for the stock. This creates the optimum setup for the company to surprise to the upside at earnings.

Exhibit 7. Multiples and comps

Data: HB Insights

At 12.6x the company’s FY22 EPS estimates of $9.30, this prices the stock at $117, incredible upside potential should it pull through at this rate. However, we’re also cognizant that the company has a negative tangible book value, yet, it trades at 2.6x total book value and 6.8x cash flow, both respective discounts to the sector of 50% and 60%. EHC does, however, trade at more than 15x estimated FY22 FCF and this prices the stock at just $52.50. With the wide variance in distribution outcomes we aren’t confident in estimating the mean valuation, and will use the median of all calculations to price EHC at $84.75.

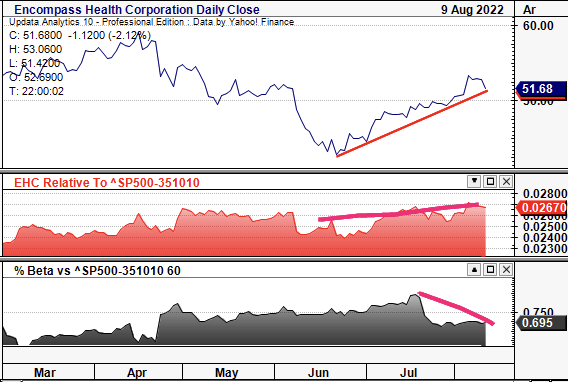

Additional data points:

- The stock has caught a bid since June, curling up off 52-week lows in the process.

- At the same time, it has strengthened against the medical technology and health care providers sector

- To illustrate this is likely an idiosyncratic driver we see EHC’s covariance structure relative to the benchmark shift downwards after staying level across this time.

- Investors are rewarding idiosyncratic risk premia in FY22 and by pushing off lows whilst reducing equity beta is evidence of this in EHC, we estimate.

- This exhibits the technical momentum that is supportive of further upside on the charts.

Exhibit 8.

Data: Updata

In short

EHC presents with the quality characteristics investors are paying a premium for in FY22. The company averages an annualized 10.2% ROIC and is growing profitability into a weakening economic outlook. It has also been active in addressing cost blowouts related to labour management. This, with the latest sector rotation back into healthcare in H2 FY22 keeps us bullish on the name. We rate EHC a buy with $84.75 price target.

Be the first to comment