Falcor/E+ via Getty Images

It was a mixed Q1 Earnings Season for the Gold Miners Index (GDX), with elevated absenteeism denting productivity and driving costs higher for many miners. Fortunately, this did not seep into EMX Royalty’s (NYSE:EMX) results, with the company reporting a solid Q1, with adjusted revenue/other income north of $2.6 million. Looking ahead, this number will increase dramatically in 2023, with three major assets set to begin contributing. Given EMX’s solid growth profile, I see the stock as a Speculative Buy, but the buy zone has dipped to US$1.80 to reflect additional share dilution after quarter-end.

All figures are in Canadian Dollars unless otherwise noted.

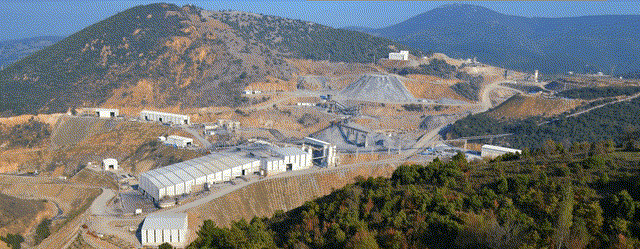

Akarca Project Gold Mineralization (Company Website)

Q1 Results

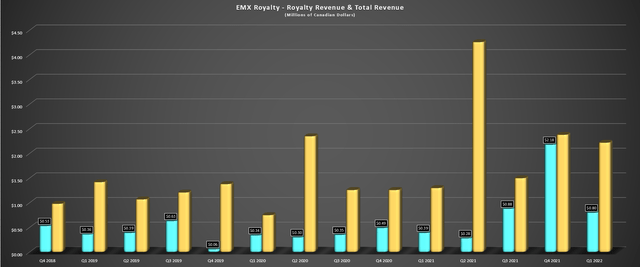

EMX Royalty released its Q1 results last month, reporting quarterly royalty revenue of ~C$796,000, a more than 100% increase from the year-ago period. This was related to a more than 100% increase (259 ounces vs. 120 ounces) from its Leeville royalty interest in Nevada and other advance minimum royalty payments. On a total revenue basis, which includes interest income and option and other property/dividend income, revenue & other income increased to ~C$2.2 million, translating to a 70% increase on a year-over-year basis. The increase was attributed to increased interest income and a more than 20% increase in option and other property income (C$790,000).

EMX – Royalty Revenue & Total Revenue (Company Filings, Author’s Chart)

Meanwhile, on an adjusted revenue & other income basis, which accounts for the company’s ~0.42% net smelter return [NSR] royalty on the Caserones Mine in Chile, this figure increased to ~C$3.37 million. This represented a significant improvement from the year-ago period, with this asset generating C$1.15 million of income in Q1. Overall, this has set the company up to generate over C$14 million [US$11.2 million] in adjusted revenue and other income this year, making the stock’s valuation more palatable vs. an industry-high triple-digit price-to-sales ratio as of 2020.

Recent Developments

Regarding recent developments, EMX noted that mined material had been stockpiled from Balya North, and processing is expected to occur this month. This is a positive development, suggesting that we will see a contribution from Balya before year-end, where EMX holds a 4% NSR royalty on mine production from the Turkish asset. Meanwhile, at Gediktepe, the operator Lidya Madencilik has begun mining and expects to hit the 10,000-ounce milestone by Q3 2022. Once reached, EMX’s 10% NSR royalty on oxide metals production will be in effect, providing a major boost to EMX’s annual revenue.

Balya Property – EMX Royalty Partner (Company Presentation)

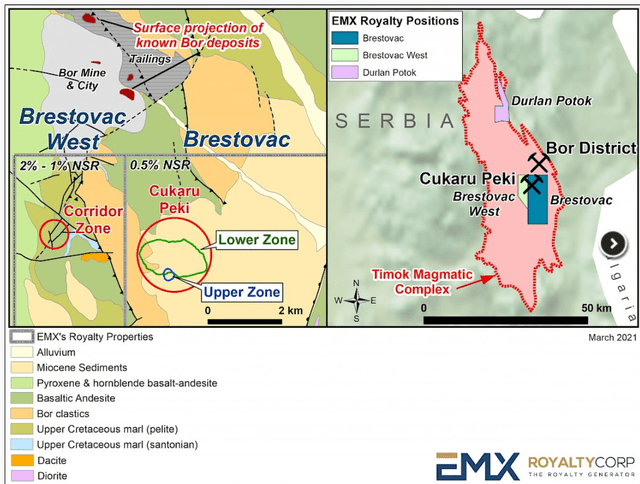

Finally, at Cukaru-Peki, EMX has suspended its plans to file a notice of arbitration. EMX and Zijin Mining are continuing to work towards a solution on the disputed 0.50% NSR royalty on the Upper Zone at the massive copper-gold mine. EMX believes that it is in the right, and there is no reason for a reduction in the royalty rate as the circumstances where this would occur have not been triggered. However, rather than a lengthy dispute that isn’t beneficial to EMX from a revenue generation standpoint, we could see the two parties settle on a slightly lower royalty rate, which would still be a needle-mover for EMX, given the size of this asset.

This is because the Upper Zone of the Cukaru Peki deposit is home to 1,950 million pounds of copper and 1.8 million ounces of gold mineral reserves. Meanwhile, while in the inferred resource category and not part of the current mine plan, the porphyry zone is home to nearly 10 million ounces of gold and 14.3 million tonnes of copper, albeit at much lower grades. Normally, a 0.50% NSR royalty on a project wouldn’t be all that material. Still, when it comes to a project of this size, this is a company-maker for a small company like EMX, assuming we see a favorable resolution. Based on recent disclosure, production is expected at 91,000 tonnes of copper and ~80,000 ounces of gold per annum.

Timok Project – EMX 0.5% NSR Royalty (Company Presentation)

Unfortunately, we are not yet seeing the benefits of the recently commissioned Balya, Gediktepe, or Cukaru Peki assets reflected in EMX’s results. This explains why the financial results are less impressive, with EMX continuing to report net losses (excluding the recent favorable Barrick ruling). However, this should change dramatically by Q1 2023, with additional help from adding a 0.31% NSR royalty at Caserones, taking EMX’s NSR royalty to ~0.73% on the Chilean copper-molybdenum mine. Hence, while it’s easy to be discouraged by the weaker revenue in H1 2021 than initially expected due to the delay at Balya, patience should pay off for investors with progressively higher revenue & income over the next 18 months.

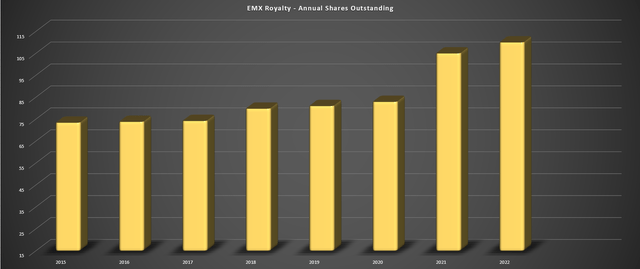

Finally, the one negative development in the period was that EMX completed a financing with ~3.8 million shares sold at C$3.30 [US$2.64]. While this appears to be well above market prices, it’s important to note that the price was much less favorable when factoring in the additional potential dilution from the full warrant at C$4.45 [US$3.56]. This has increased EMX’s fully-diluted share count to ~128 million, translating to 39% share dilution year-over-year.

EMX – Annual Shares Outstanding + Current (Company Filings, Author’s Chart)

It’s worth noting that this was largely due to the significant acquisition of the SSR Mining royalty portfolio, and EMX had a decent track record of limiting share dilution previously. However, given this considerable share dilution, the poor share-price performance should not be surprising, even if the company is much stronger due to these financings, giving it two assets that should pay off down the road (Yenipazar, Diablillos), and one that’s set to contribute meaningfully over the next several years (Gediktepe). Let’s take a look at EMX’s valuation below:

Valuation

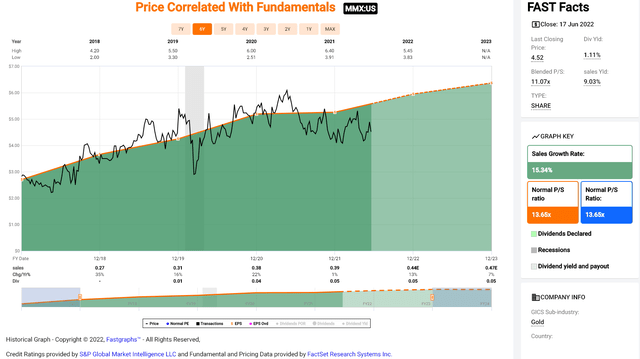

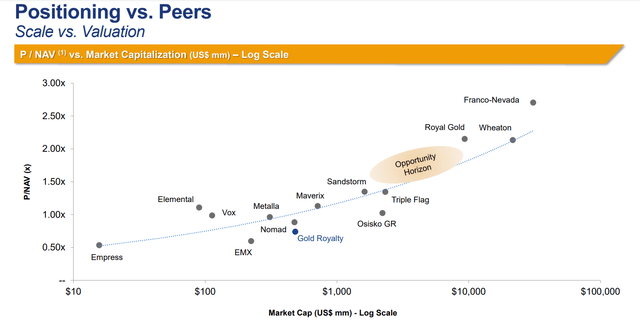

Based on an estimated year-end share count of ~128 million fully diluted shares and a current share price of US$1.90, EMX trades at a market cap of US$243 million. Assuming the company generates a conservative US$18 million in revenue & other income in 2023, the company would be trading at a price-to-sales ratio just shy of 13. This is slightly above that of some of its more established peers like Maverix Metals (MMX), which trades at a forward price-to-sales ratio of roughly 11, and also has an attractive organic growth profile. That said, EMX has a higher growth rate and trades at a much more attractive P/NAV multiple.

Maverix Metals – Price-to-Sales Ratio (FASTGraphs.com) EMX Royalty Positioning vs. Peers – P/NAV & Market Cap (Gold Royalty Corporation Presentation)

This is based on EMX Royalty trading at an estimated P/NAV multiple below 0.75x vs. Maverix at 1.1x P/NAV currently. I would argue that a deep discount is justified for EMX Royalty relative to Maverix, given that Maverix is more diversified among producing assets, has more producing assets, and is much larger in scale. Still, when it comes to a royalty company with meaningful growth, 0.75x P/NAV looks too cheap, suggesting that EMX’s valuation is quite reasonable at current levels. So, while I think the safer bet is Maverix, EMX is an interesting speculative play in the space.

So, is the stock a Buy?

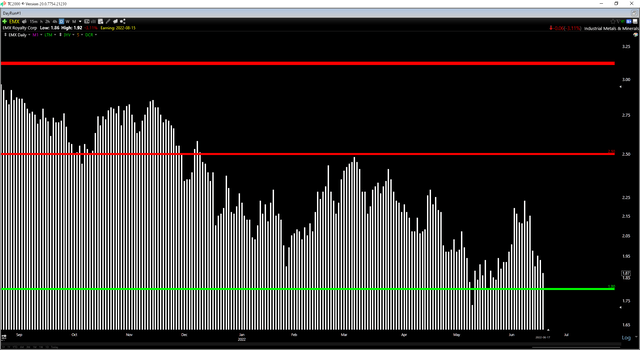

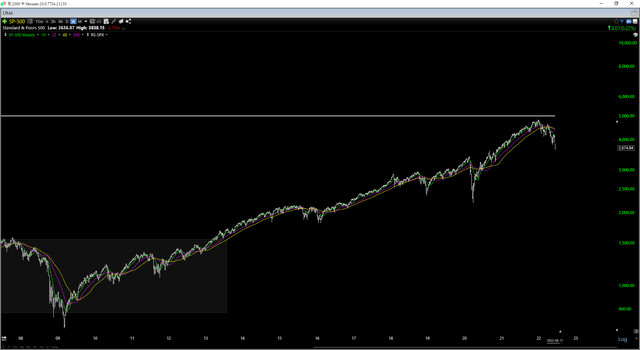

Despite the solid Q1 results, EMX trades in the lower portion of its expected trading range (US$1.80 – US$2.50), giving the stock an attractive reward/risk profile from a technical standpoint. This is because the stock currently has less than $0.10 in potential downside to support and US$0.60 in potential upside to resistance, giving it a reward/risk ratio of 6.0 to 1.0. Having said that, in a cyclical bear market for the S&P 500 (SPY), when little attention is paid to valuations, and even large-cap proverbial babies are being thrown out with the bathwater, there is a heightened risk in owning a micro-cap name like EMX Royalty.

EMX Royalty Daily Chart (TC2000.com) S&P-500 – Weekly Chart (TC2000.com)

For this reason, while I see the stock as a Speculative Buy at US$1.80, my Neutral rating reflects better risk-adjusted options elsewhere in the sector. This doesn’t mean that EMX Royalty can’t do well over the next 12 months and that it can’t outperform its peers. However, I prefer to play defense over offense, especially when the S&P 500 is trading below its weekly moving averages. Hence, while I think this is a name to keep an eye on due to its attractive valuation, I think there are far more attractive ways to get exposure to precious metals currently.

Be the first to comment