yuelan

Credit Suisse Group AG (NYSE:CS) recently reported its 2Q2022 earnings. As my fellow Seeking Alpha contributor Mare Evidence Lab correctly put it, “Credit Suisse’s accounts were in the red.” It turned out to be worse than many analysts had expected. However, some new measures were announced to cut the costs. The fact the CEO was replaced does not mean as much – only time will tell how effective he will be in his new role. Most importantly, the bank in the past has suffered from long periods of losses, but its stock never was as cheap as it is now. But let me explain this in some more detail.

The recent results and Credit Suisse’s news

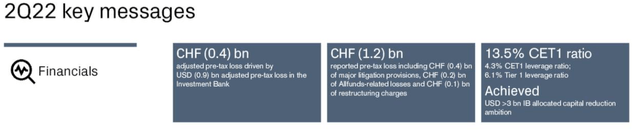

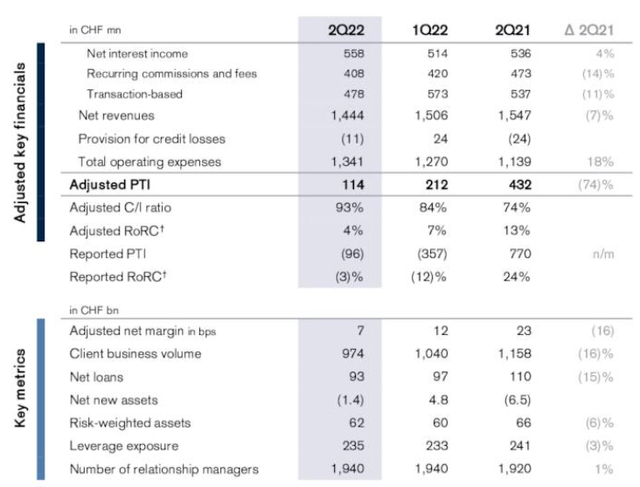

The bank reported a net loss attributable to shareholders of CHF 1.6 bn, compared to net income attributable to shareholders of CHF 253 mln in 2Q21. Credit Suisse’s pre-tax loss totaled CHF 1.2 bn, quite a poor result compared to a pre-tax income of CHF 813 mln in 2Q21. This is significant – most of the loss was due to poor revenues but also due to CHF 0.4 bn in litigation provisions, CHF 0.2 bn Allfunds-related losses and CHF 0.1 bn of restructuring charges. In the past quarter, the bank’s net revenues totaled CHF 1.15 bn, down from the value of CHF 2.02 bn reported for the previous quarter.

Credit Suisse’s earnings presentation

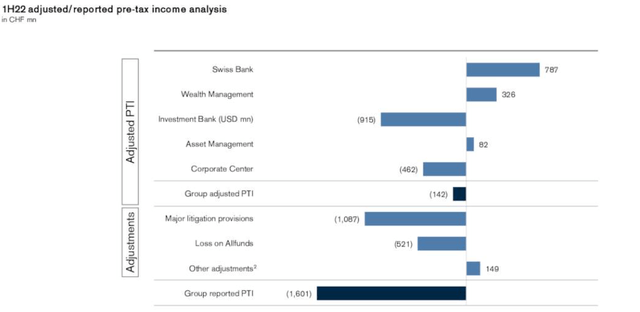

The bank provided investors with a graph covering the major sources of losses for the past quarter.

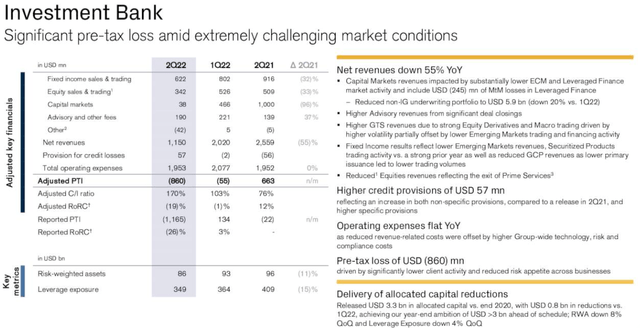

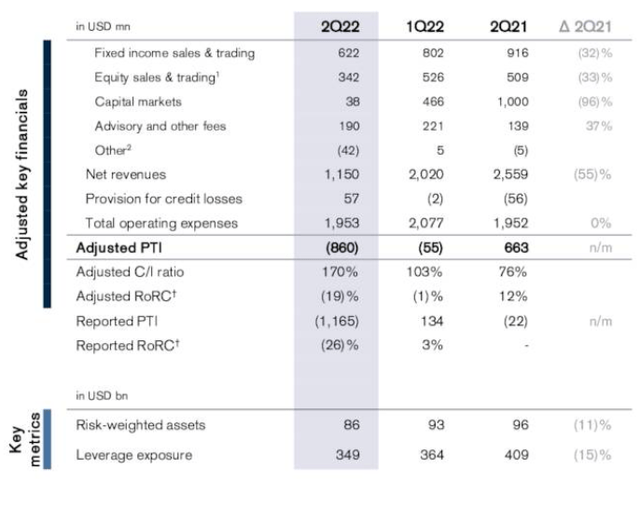

These were the major litigation provisions (CHF 1.067 bn) and the investment bank (CHF 915 mln). The loss incurred by the investment bank was due to a fall in the value of revenues, namely lower fixed income trading, equity trading but most importantly capital markets. In other words, there was a substantial fall in the clients’ activity levels. But the investment bank was not the only division that reported losses.

Credit Suisse’s earnings presentation

Credit Suisse’s earnings presentation

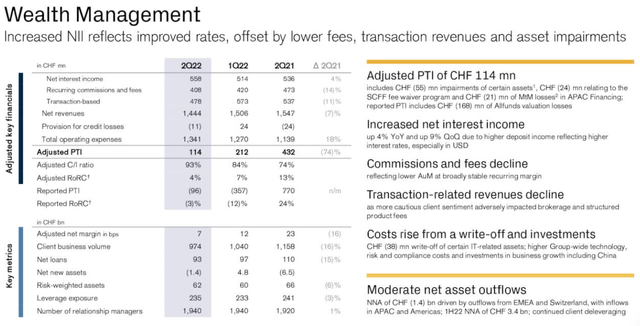

The wealth management division also performed quite poorly. And again, most of the division’s loss was due to lower revenues – declining commissions and fees, lower transaction-related sales. There was also a negative impact of CHF 168 mln related to Allfunds.

Credit Suisse’s earnings presentation

Credit Suisse’s earnings presentation

The earnings were obviously affected by the poor revenues, especially in the investment bank division. But even more important were the major litigation provisions, Allfunds, and the corporate center. The latter is a department that has never been profitable but has always been associated with indirect banking costs. The lower levels of client activity and high capital outflows are really bad for the bank since they are likely to persist for a while. At the same time, litigation provisions and losses related to Allfunds are not here to stay but can be considered one-offs.

What is more, the bank also planned to sufficiently cut the costs. The cost base should total CHF 15.5 billion over the medium term, which is CHF 1-1.5 billion lower than the CHF 16.5-17.0 reported. This will be in addition to lower litigation expenses and losses related to Allfunds. That is why it is possible for Credit Suisse to break even this year if nothing unexpectedly bad happens this year.

The bank’s earnings history

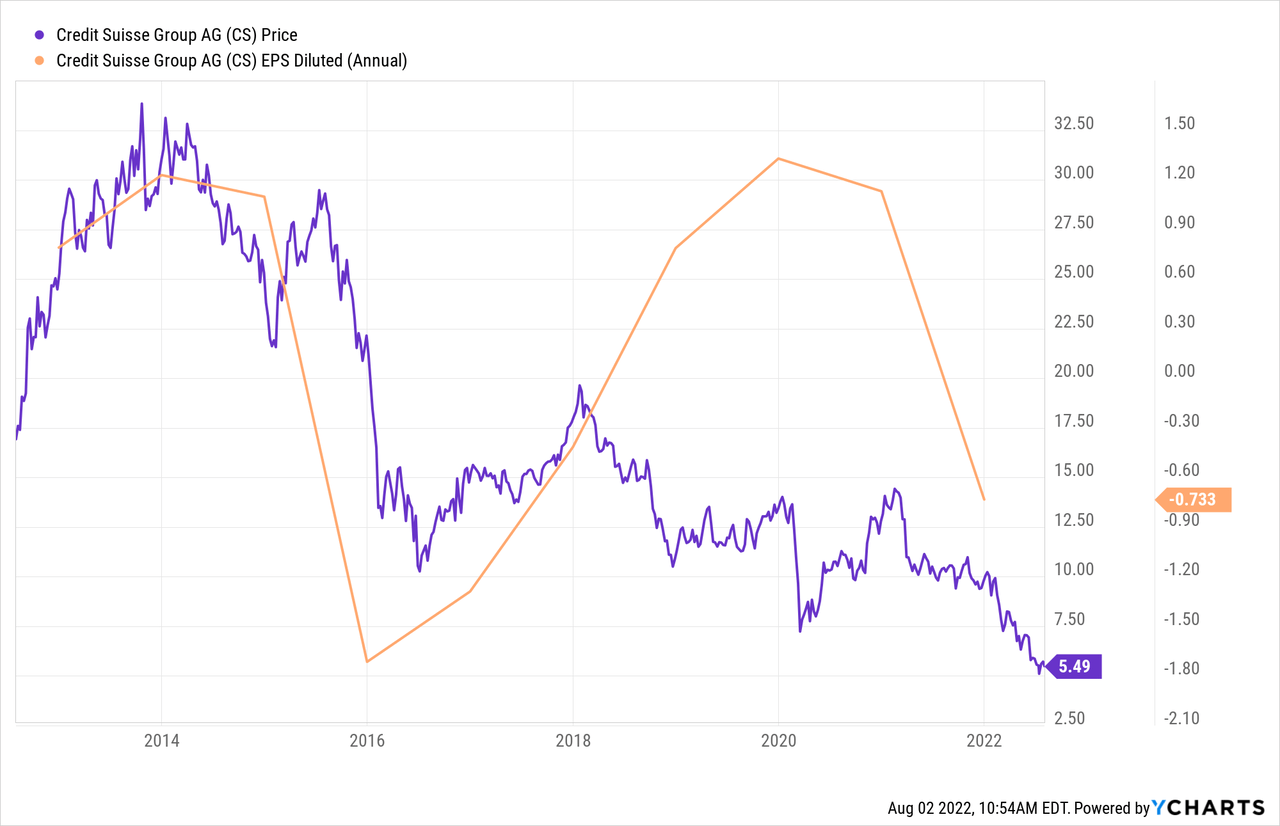

Credit Suisse reported losses in the past, but its stock price has never been as attractive as it is now.

I will just state the history of the bank’s annual revenues and earnings.

Credit Suisse – Annual revenues, earnings

|

Year |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

|

Net revenues (in CHF million) |

22,696 |

22,389 |

22,484 |

21,628 |

21,786 |

21,594 |

23,286 |

24,404 |

|

Income before taxes (in CHF million) |

(600) |

3,467 |

4,720 |

4,753 |

3,928 |

3,493 |

230 |

6,734 |

|

Net income (in CHF million) |

(1,650) |

2,669 |

3,419 |

2,024 |

(983) |

(2,710) |

(2,944) |

1,875 |

Source: Prepared by the author, based on Credit Suisse’s reports

As can be seen from the table above, Credit Suisse faced hard times even before the Archegos scandal. It is true that 2021 was the first time in 8 years when the bank reported a negative income before taxes. But years 2017, 2016 and 2015 were marked with substantial net losses. In years 2016 and 2015, there were losses of CHF 2.71 bn and CHF 2.94 bn, respectively. These figures are substantially worse than the net loss of CHF 1.65 bn reported for 2021. It is possible that Credit Suisse might face poor revenue growth in the following several quarters. However, the cost-saving initiative, a fall in the litigation provisions, and the Allfunds-related expenses should make the bank’s results improve.

Valuation

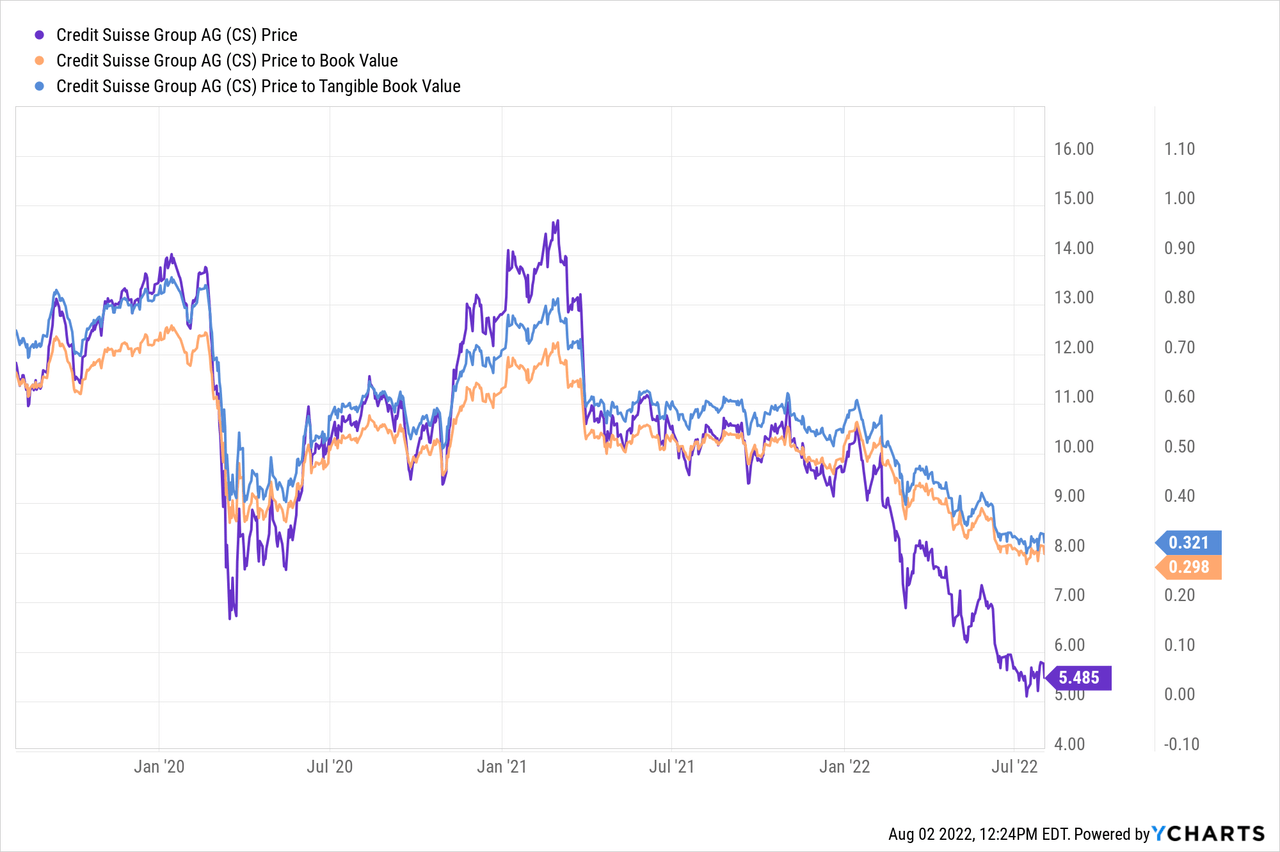

In spite of the fact that the situation with Credit Suisse’s finances is not unprecedented, the stock price is lingering near its all-time lows.

If you have a look at the graph above, you will see that the last-reported annual earnings are near the levels seen in 2015 – 2018. Between 2015 – 2018 the share price exceeded $15, whilst now as of the time of writing it is hovering near the $5.50 mark. There is a clear mismatch. Sure, the bank’s earnings potential does not look high right now. But at the time when RIG’s stock was trading for $15 just a few years ago, the bank’s earnings potential did not seem great either.

The price-to-tangible book (PTBV) and the price-to-book (P/B) ratios of Credit Suisse are 0.321 and 0.298, respectively. These indicators are really low because it is enough for an undervalued company to be worth 1 or below.

Whilst it is clear Credit Suisse is loss-making right now and is not facing its best days, it is still the second-largest bank in Switzerland and might eventually end up being worth more than it is worth now on the stock market.

Macroeconomic outlook

The macroeconomic outlook is quite grim right now. The US entered a technical recession, whilst the EU is suffering from a major energy crisis. The geopolitical situation is highly uncertain: tensions around Ukraine and China are rising. The banking sector has always been sensitive to recessions. This is not great news for Credit Suisse since it is currently a loss-making financial institution. So, if the macroeconomic outlook worsens further, Credit Suisse is highly likely to suffer too.

However, in my opinion, Credit Suisse might even benefit from higher trading fees. During recessions and stock market sell-offs there is high volatility and many banking clients buy and sell their equity.

But the situation is highly uncertain. It is hard to predict when exactly CS stock will start rising in value. And yet, CS shares are undervalued and now could be a good time to take advantage of such a price.

Conclusion

Credit Suisse shares are highly undervalued right now. This undervaluation reflects poor earnings results, numerous past scandals and investors’ uncertainty about the health of the global economy. Whilst I understand conservative people not risking to buy the shares just yet, the current situation could be used as a good buying opportunity for patient long-term investors. CS shares used to trade much higher when the bank reported poorer results. The management’s cost-saving initiatives might work and the geopolitical situation “shall pass too.”

Be the first to comment