gorodenkoff/iStock via Getty Images

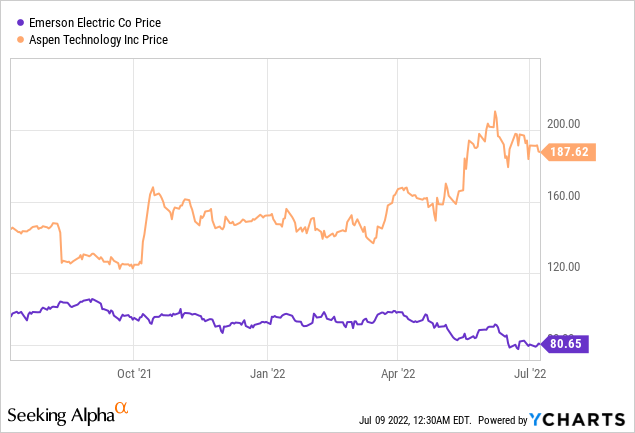

As a global player in automation, Emerson Electric (NYSE:EMR) which supports manufacturing companies in optimizing their production and improving competitiveness is already well known. Lesser known is AspenTech (NASDAQ:AZPN) with whom Emerson did a software deal back in October last year which saw the latter shares skyrocketing as shown in the orange chart below.

In contrast, Emerson’s shares have been on a downtrend as shown in the blue chart below, and, at a P/E of 15.5x, compared to 33.67x for AspenTech, many investors must be wondering whether it is time to buy the stock of the electric control play. Thus, the aim of this thesis is to assess valuations for both companies in view of Emerson’s software divestiture which formed part of the deal having been completed in May.

First, I elaborate on how the electric company is navigating through supply chain-related bottlenecks by going through its second quarter 2022 financial results.

Revenue Growth And Profitability

Emerson’s control systems have a lot of embedded electronics ranging from sensors to control devices, and the company has over 20 plants in China. Despite being impacted by supply chain disruptions resulting from Covid-related lockdowns, the company posted an 8.12% revenue growth.

However, since the restriction measures were enforced on March 27 and lifted only at the beginning of last month, it is Emerson’s third-quarter results lasting from April to June that should be more impacted. There could be a shortfall in production volumes in case logistics delays have impeded components from reaching assembly plants. Alternatively, the company could achieve sales targets, but at the expense of profitability due to the payment of additional expedited shipping charges. Additionally, the war in Ukraine has led to an inflationary commodity environment.

Thus, margins could suffer, only to improve in the second half of the year thanks to higher sales volumes and better pricing for the products sold. More sales for Q3 are supported by the fact that inventory reached a high of $2.4 billion in Q2, compared to only $2 billion in the same period last year.

Looking at pricing power, Emerson is able to pass on the majority of additional expenses it incurs to customers including large power companies, who depend on it for their control systems, right from implementation and throughout the product life cycle till decommissioning. This is also an industry where switching costs (to competitors) remain high, and companies are usually locked in multi-year contracts with Emerson for both maintenance and upgrades.

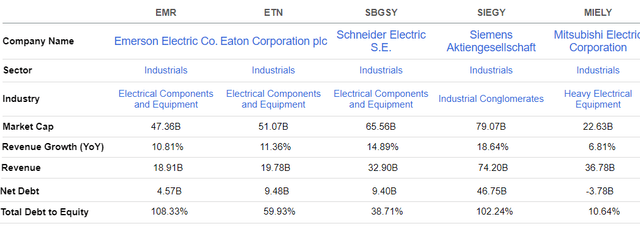

Still, this remains a competitive market with other big players like Schneider (OTCPK:SBGSY), Siemens (OTCPK:SIEGY), Eaton (ETN), and Mitsubishi Electric (OTCPK:MIELY) as shown in the table below.

Comparison with peers (www.seekingalpha.com)

Tight competition implies relatively slower organic growth and Emerson’s solution to this problem has been to buy smaller competitors, but this has resulted in a higher debt to equity ratio, as shown above. This is the reason the cash and equity deal, which also saw Emerson contribute its industrial and geological software businesses to the “new AspenTech” needs to be applauded. It is noteworthy to mention that the U.S. company’s move is in the opposite direction to Schneider, which instead acquired Rib Software in 2020.

Unlocking Value Through AspenTech

In exchange, Emerson received a 55% stake in AspenTech. At that time, valued at around $8.3 billion, the software company now has a market cap of nearly $12.5 billion. During this period, there have been about $4.2 billion (12.5-8.3) of value gains, out of which roughly $2.1 billion (55%) goes to Emerson. For investors, this represents a way to unlock value without necessarily selling an asset.

As for AspenTech, together with Emerson’s asset optimization, grid modernization, and industrial AI software, it now has an end-to-end product offering that can be proposed to its existing customer base. This signifies less marketing expenses and, conversely, more profitable growth. Additionally, building on Emerson’s life sciences portfolio of over 3000 installed controlled systems and 1,000 engineers and consultants, AspenTech has the possibility to optimize annual spending with less need to recruit in the tight labor market.

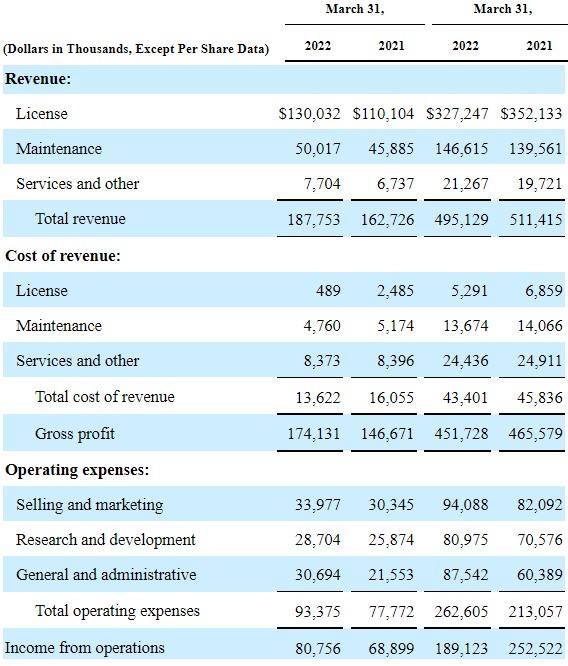

In this respect, the company generated $187.8 million in the third quarter as shown in the table below, or a 15.4% increase over the same period last year, while spending increased by only 2.4% to $655 million. Thus, non-GAAP EPS of $1.38 constituted a beat over last year by $0.03.

AspenTech’s Q3 income statement (www.seekingalpha.com)

These good results are explained by strengths across the oil refinery, chemicals, and renewable energy industries. In this respect, the company is benefiting from Capex spending by large refiners as they boost capacity both in the U.S. and Europe, and this trend is expected to last over the next 3-5 years. Talking figures, about $1.5 trillion of capital expenditure was made in the global energy sector in 2021 and this is set to continue till 2030.

Additionally, considering the added expertise brought by Emerson’s deal, AspenTech has access to the carbon capture and sequestration market, which should be worth $4 trillion by 2050.

Valuations And Key Takeaways

As I mentioned earlier, the deal has unlocked a value of around $2.1 billion for Emerson through the merging of its software unit with AspenTech. This constitutes around 4.4% of the current market cap which has not been priced in the stock considering that its shares have trended downwards. Adjusting accordingly, I obtain a share price of $84.24, and this is even before the merger synergies have kicked in.

However, I do not consider Emerson a buy at this stage as higher inventories have resulted in the operating cash flow being reduced to $442 million for Q2, or down by 45% when compared to Q1. This in turn caused a 53% drop in free cash flow, and it is important to look for improvement during the third-quarter results before buying the stock.

This said, I remain optimistic for the long term due to the additional LNG delivery mechanisms required by Europe to offset the reduction in Russian supply, needing more control systems. For this matter, automation potential from the company’s liquefaction facilities in the U.S., and regasification terminals in Europe, as well as Asia, are estimated at $1 billion over a five-year period.

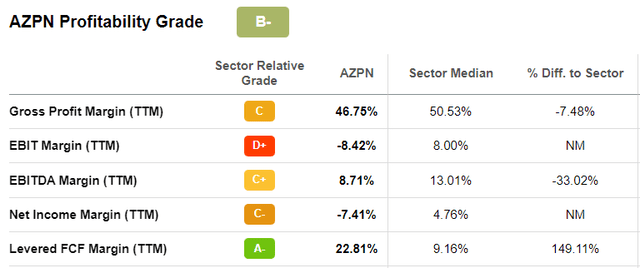

As for AspenTech, it has a levered free cash flow margin of 22.8%. This is already above the median for the IT sector as shown in the table below, and with the integration of Emerson’s software suite, the company should benefit from substantial FCF.

Profitability and cash metrics (www.seekingalpha.com)

Along the same lines, its overall profitability grade should also benefit as it expects around $110 million of total EBITDA synergies by 2026-2027, including $40 million from cost savings. By comparison, only $27.9 million of EBITDA was generated in FY-2021.

As for valuations, despite its high trailing EV/EBITDA ratio, AspenTech has gained 23% since the beginning of this year while the wider IT sector has lost more than 25% of its value as it became evident that the U.S. central bank would have to aggressively hike interest rates to tame inflation. Now, high-interest rates are synonymous with more pain for tech stocks, as they have to generate more EBITDA to justify their high valuations. Here, the fact that the industrial software play has outperformed suggests that investors are banking on the combination with Emerson to create more value for customers and shareholders.

Hence, after an 8% pullout since early June and as a high momentum stock, AspenTech’s shares could again climb back to the $200 level when fourth-quarter financial results are announced in the final week of this month. Conversely, do expect some volatility in case there is any revenue miss, as the company is now more exposed to industries that can be impacted by supply delays.

Finally, valuations show that Emerson has indeed unlocked value through the deal, but, in view of that large China exposure, do expect short-term volatility in the share price till the company is able to generate cash out of inventories. On the other hand, with software being relatively less prone to supply chain woes, an investment in AspenTech does make sense at this stage.

Be the first to comment