Burak Ceyhan/iStock via Getty Images

By Alberto J. Boquin, CFA

When looking at emerging markets, the inflation issue is not one that Chile alone faces. However, with one of the most respectable central banks in the world among emerging markets, Chile not only serves as a good case study for the challenges being faced by many others but as a potential test case for what comes next when interest rates are raised monumentally. And when compared to developed markets, it stands in sharp contrast to other central banks that have acted much less proactively.

Facing rising inflation, the Central Bank of Chile moved quickly, responsibly, and substantially. It began a rate hike cycle earlier than most, starting with a 25 basis points (bps) hike in July of last year. Rate increases have now reached a substantial total of 650 bps. Yet despite Chile doing a decent job to address inflation, an inflection point may still be a long way off – which suggests significant implications for lagging global monetary policy normalization.

Just when you thought we were done with rate hikes…

In January, we started to think that as one of the first to raise rates, Chile might again be a bellwether for emerging market central banks as the first to pause or even the first to cut. Unfortunately, macroeconomic developments have led us to reassess. In short, both strong growth and high inflation have proved to be more persistent than anyone anticipated. For context, the central bank’s forecasts back in December included a 1.5 to 2.5% forecast range for Chile’s gross domestic product and year-end inflation of 5.9%. The central bank just lowered its growth forecast slightly to a range of 1.0% to 2.0% but also stated that annual inflation would likely reach 8.2% this year. Despite the central bank’s efforts to contain it, the level of inflation remains well above the bank’s 3% target.

…more are needed to head off second-round effects

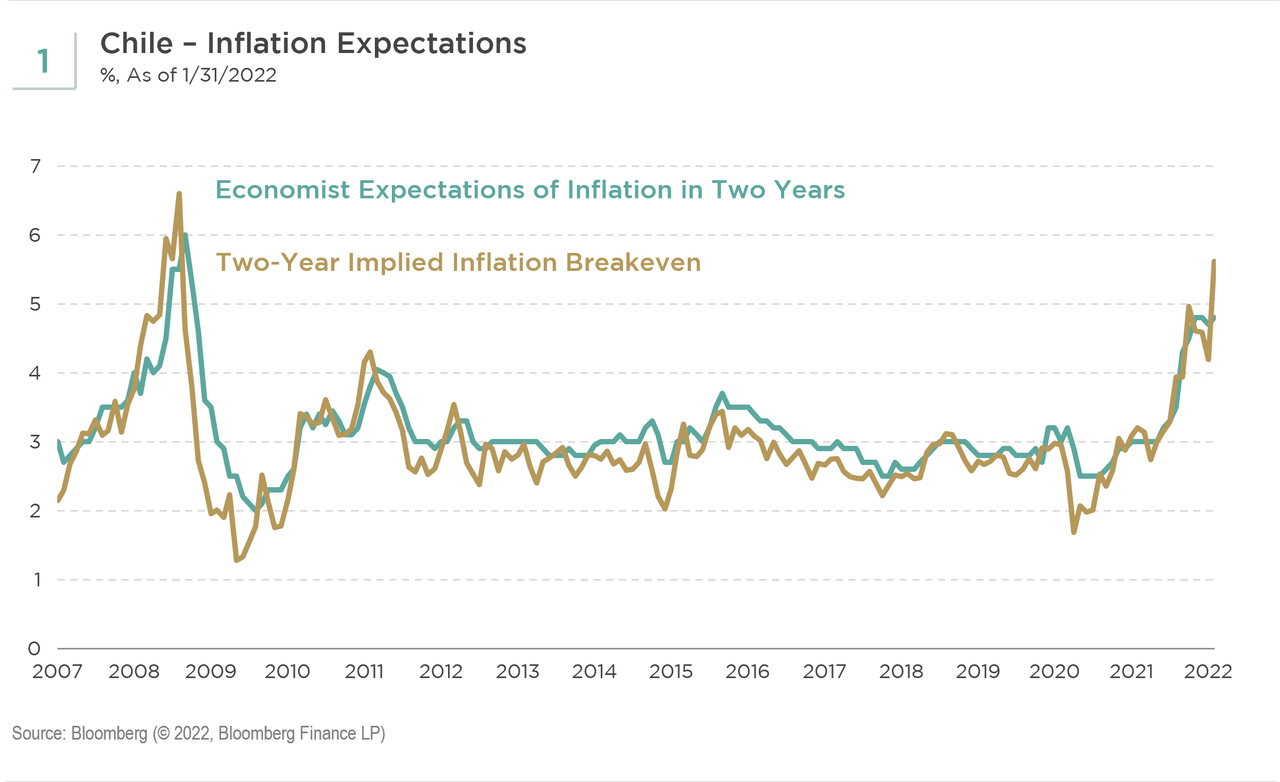

The global outlook has become more uncertain over the last few weeks, but central banks have little leeway to adopt a wait-and-see approach. The most recent inflation print in Chile pushed annual inflation to 7.8%, the highest reading in a decade. Notably, 10 of 12 inflation components contributed positively to the monthly reading, indicating widespread pressures. A measure of core inflation that excludes volatile items printed a high of 6.5%. Most worrisome, inflation expectations are deteriorating. When surveyed, economists generally assume that Chile’s central bank will achieve the 3% inflation target over the two-year policy horizon. As a result, the average answer to the survey is usually 3%. Lately, the average survey estimate has climbed to the highest level since 2008. Two-year inflation breakevens, a measure of market expectations, are similarly elevated (see Chart 1).

Bloomberg

How high must rates go?

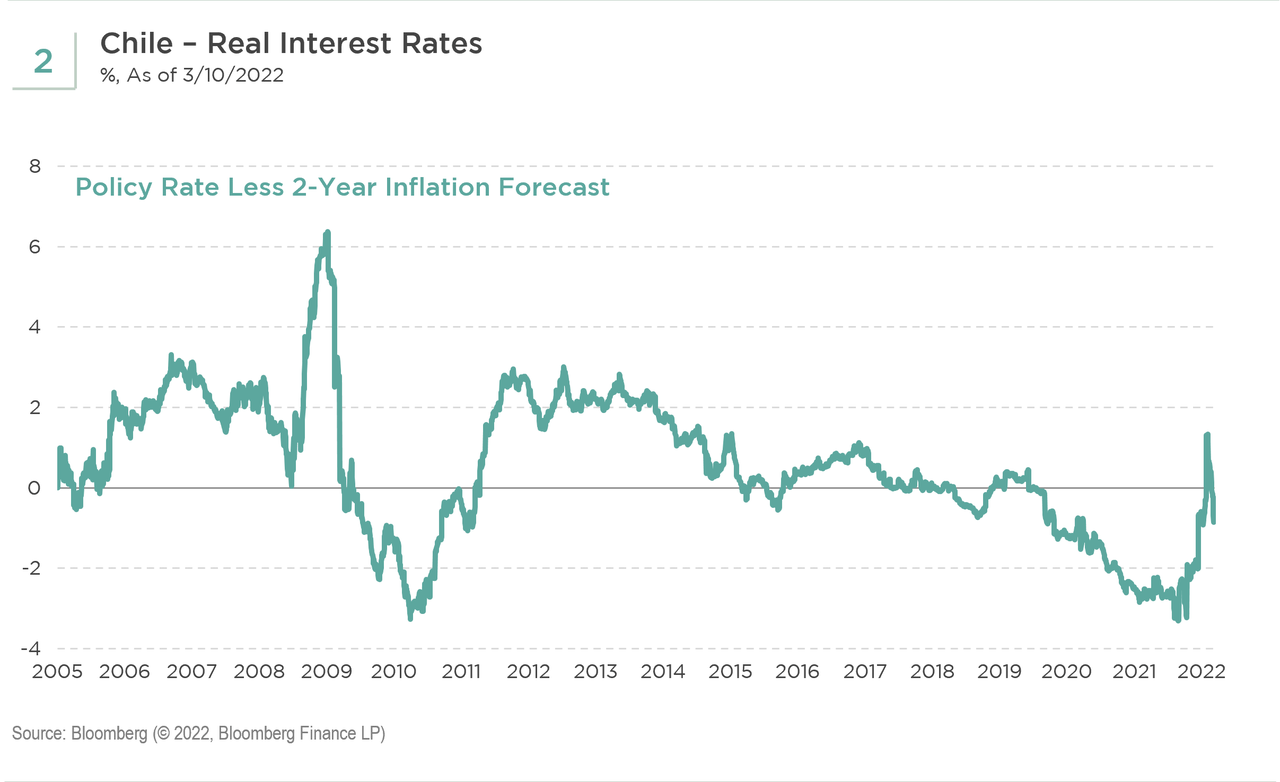

Determining the terminal rate – the level at which rate hikes will pause – in any tightening cycle is more art than science. The terminal rate is a function of r-star (r*), which is the neutral rate of interest that equilibrates an economy in the long run. However, r* is unobservable, dynamic, and the subject of much debate. One very simple way to approximate r* is to observe the history of the real interest rate using the policy rate and two-year market inflation forecasts. In Chile, most observations cluster around 0% or 2% (see Chart 2). Notably, most 2% observations happened before the oil price collapse of 2014, and most 0% observations happened after. Even after all the tightening by the central bank, Chile’s real rate is still around negative 25 bps, and could well decline if inflation expectations deteriorate further. The key question for markets is whether there is a regime change upon us. Given structurally tight oil markets and a number of cyclical inflationary forces, Chile may need to go back to a positive real rate above 2%. Given current inflation expectations, a real rate above 2% would mean a policy rate of at least 8%, if not higher. After the most recent hike, Chile’s benchmark interest rate now stands at 7%.

Bloomberg

What if the economy slows?

Unlike the Federal Reserve’s quirky dual mandate of stable prices and maximum employment, most emerging market central banks exclusively target inflation. By design, these central banks can be less focused, though not ignorant, of the growth/inflation tradeoff.

Chile’s previous rate hike cycles occurred while system-wide, inflation-adjusted loan growth was in the 5-10% year-over-year range. Current bank guidance suggests flat loan growth over the course of this year. Growth remains strong for now in Chile, but we will be watching the credit channel for signs of a slowdown – and for a possible early indication of what might come next for emerging market central banks. How much higher will Chile’s central bank need to raise rates before its economy responds? With so many other central banks much farther behind, Chile’s test case may offer important clues for the global economy and monetary policy.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment