Uladzimir Zuyeu/iStock via Getty Images

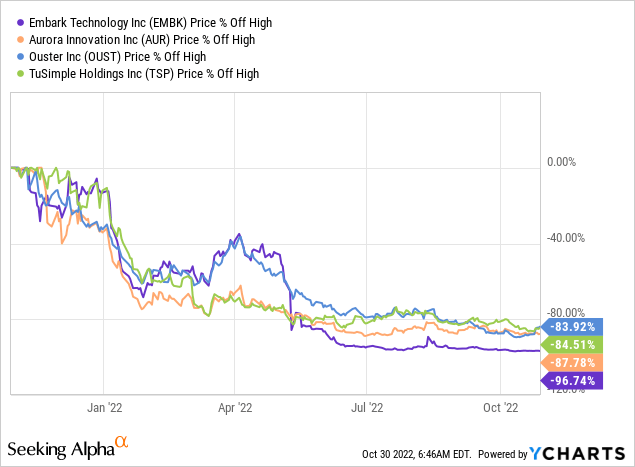

At one point last year, it really seemed as though everyone and their uncle had started a self-driving company and were going public. The sheer viscosity of autonomous vehicle startups joining the NYSE and NASDAQ was overwhelming even by the standards of the SPAC boom. This would see investors looking at gaining exposure to the sector faced with over a dozen choices with the common shares of Embark (NASDAQ:EMBK) and a plethora of other companies including Aurora Innovation (AUR), Ouster (OUST), and TuSimple (TSP) in play. Compounding the ridiculousness of the situation, most of these are and remain fundamentally pre-revenue so investors had to lean on vibes and intuition rather than hard financials to make a decision.

Hence, the relentless year-to-date collapse of the nascent industry was not unexpected. So too was Embark’s 1-for-20 reverse stock split after the company’s common shares fell below the $1 listing minimum required by NASDAQ. The scale of capital destruction is deep with a nearly 80% fall in market cap from highs across the board for all companies in the space. Embark forms one of the worst performers with its stock price down more than 95%.

Autonomous vehicle companies have collectively spent around $75 billion developing self-driving technology, but the industry remains very young and mainstream adoption is still pending the dissolution of regulatory bottlenecks and the full development of the technology itself.

What’s Next For The Self-Driving Tech Company?

Firstly, just because its common shares have collapsed does not mean that Embark’s mission to make the $700 billion a year trucking industry safer, more efficient, and sustainable is inherently dead. Investors simply got too far ahead of the adoption curve and bid up prices far in excess of intrinsic value. Indeed, Embark went public at a valuation of $5.2 billion against what is currently trailing 12-month revenue of zero. This is set against cash burn from operations of $22 million as at the end of its last reported fiscal 2022 second quarter. The company’s balance sheet is in a better state with cash and equivalents of $221 million and practically no long-term debt. Hence, set against the backdrop of shares that from first viewing call into question whether the company can remain a going concern, the balance sheet provides a more nuanced take. It should be able to support a runway extending far into calendar 2024 if managed properly.

Morgan Stanley has come out to say that the industry could be looking at 2032 at minimum before being able to realize the full potential of their stated mission. It’s no wonder that Ford (F) recorded a $2.7 billion impairment charge to close its big autonomous vehicle investment Argo AI. This was a company that was valued at $7.5 billion just two years ago and was once slated to go public at a valuation north of $12 billion.

The difficulty for Embark will be establishing a foothold against the sheer number of competing offerings not just from the plethora of other self-driving startups but from established automakers and tech companies alike. Whilst not all are in the business of autonomous trucking and are chasing different use cases from robotaxis to warehouse automation, the future is clear. The best self-driving talent will flow to the companies seemingly ahead, this will create laggards and industry leaders. The latter will likely be able to apply their talent and technology to the different use cases.

Self-Driving Cars Are Not Coming Soon

The benefits of self-driving software to heavy-duty trucking companies would be material and ranges from better fuel efficiency, a reduction in delivery time, and a contraction of variable labour costs. It would also embed greater safety across the road network and lead to fewer accidents and deaths per mile travelled.

But far too many companies like Embark have entered the public space and are all now set to operate against brutally Darwinistic conditions. Embark’s liquidity position provides a buffer against this. However, this won’t stop the company’s common shares from pulling back further. The company, after its 1-for-20 reverse stock split, was trading above $16 but has since fallen to around $6.50 per share.

The future of the industry is unclear and the sheer volume of competing offerings evokes the long list of defunct automobile manufacturers in the first half of the 20th century. This saw a rush of competing efforts to capture what was clearly going to be the future of transportation. Self-driving companies of today are mirroring this era with heavy cash-intensive R&D work set to be a continued drain on liquidity as opportunities to generate revenue remain ever beyond the horizon. Embark remains a hard avoid with its fate just like the metaverse likely to be wrapped with mystery, capital destruction, and cash burn.

Be the first to comment