Dimitrios Kambouris

It’s Been A Busy Month For Musk

Just one week is a long time on Twitter (TWTR), and when Elon Musk is involved it can seem like a never-ending stream of headlines in 280 characters or less.

The past 3 weeks have been no exception to the above, with the Tesla (NASDAQ:TSLA) & SpaceX (SPACE) CEO tweeting everything from SpaceX highlight reels, Tesla AI Day highlights, memes about himself, a Ukraine peace proposal, a Taiwan peace proposal, multiple surveys of his followers and even launching his own fragrance called “Burnt Hair”.

Musk’s War In Ukraine

But it’s the Ukrainian peace proposal that’s grabbed the most attention in the Twittersphere, causing fierce debate about the billionaire’s involvement in the war and accusations of being complicit in alleged Russian war crimes.

Musk and SpaceX have been involved in the Russian invasion of Ukraine since the beginning. Back in February, Elon Musk shipped $80m worth of vital communication equipment (including Starlink terminals) to the besieged country in support of the war effort shortly after Russia invaded.

But shortly after his proposed peace plan and opinion poll backfired when he angered Ukrainians with his suggestions, officials in areas recently liberated from Russia reported that Starlink terminals were suffering outages. A political analyst suggested that these terminals might have been geo-fenced by SpaceX over his fears that further territory losses would push Russia to escalate the war into a nuclear conflict.

Days later after the controversy, Musk also proposed a peace deal for China & Taiwan, striking further ire online.

(Reports have come out today that Starlink terminals are now working again in liberated areas.)

Further deepening the controversy, Ian Bremmer, head of the Eurasia Group political risk consultancy, published a mailout that stated Musk told him he had spoken to Vladimir Putin prior to his peace proposal, and that Putin was prepared to negotiate, else Putin would resort to nuclear strikes to achieve his goals.

Musk later denied the allegations.

Recall, however, Musk challenged Vladimir Putin to single combat back in March, putting forward Ukraine as the prize for the winner, so to be now chatting cordially with Putin about his plans for the war seems quite the about-turn, and perhaps a little far-fetched.

And in early October, amongst all of the above, Tesla released quarterly data that disappointed based on analyst expectations, sending the share price falling over 5% in a day.

So, did you keep up with all that?

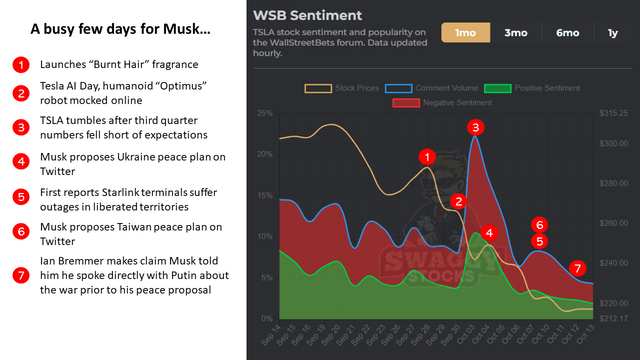

Tracking these events against the SwaggyStocks WallStreetBets Sentiment Tracker, we can see the Reddit forum WallStreetBets has been largely unimpressed with the CEO’s Twitter activity, with negative sentiment far outweighing positive amongst a list of headlines for the firm in recent weeks.

(I’ve written previously about using SwaggyStocks WSB Sentiment Tracker as an indicator for TSLA price movements, and the below seems to follow the patterns identified)

So what’s the fallout for investors?

(Pardon the pun)

Well there’s certainly an ESG (Environmental, Social and Governance) investing aspect to consider around Musk’s actions, and in his position as CEO of Tesla & SpaceX, there is certainly much to think about.

Dissenting views will rightfully point out that Musk’s actions in Ukraine have nothing to do at least with Tesla’s operations (Starlink is a SpaceX product, so we’ll need to park that thought for now).

But ESG investment ideology includes Socially Responsible Investing (SRI), which considers social justice and corporate ethics, and the firm’s interactions with both internal and external stakeholders. There’s an argument that a firm’s CEO, as a living representative of the company, their actions should be taken into account as a part of the firm’s ESG score including their public activities outside of the business.

This would also not be the first problem Tesla has had with ESG after it was booted from the ESG Index earlier this year due to a lack of low carbon strategy and poor codes of business conduct. Musk has also fired off a series of tweets about ESG rules earlier this year, calling them “a scam”.

As for SpaceX, which owns the Starlink tech, the question is a little more straightforward. Whilst I am unaware of if it has been proven that SpaceX (or Musk himself) geo-fenced the Starlink service and caused outages for the Ukrainian forces, it certainly would fall foul of the social justice considerations of SRI.

Is this outweighed by Musk donating the equipment in the first place? Hard to say.

But if Elon did speak with Vladimir Putin directly about the war in Ukraine, there are a whole host of issues to consider and many ESG-focused firms may consider too much of a gray area for investing in anything run by Musk.

SpaceX has also had issues with ESG scores after firing 5 staff in June involved in circulating a letter critical of the CEO (despite Musk declaring himself a champion of free speech), and the FAA responded by ruling SpaceX must undergo 75 mitigating actions across it’s ESG pillars.

How big is the woke issue for Tesla, SpaceX?

This all certainly represents challenging topics for ESG focused firms to consider, but investors today will probably ponder a simpler question: Does it even matter?

According to Bloomberg, global ESG assets are expected to exceed $53 Trillion by 2025, almost 20 times larger than Morningstar’s own calculations of $2.7 Trillion under management as at December 2021.

So this suggests that perhaps it doesn’t matter much today, but the importance of ESG is very quickly growing. While the impact on share prices might not be felt immediately or severely today, woe-behold Tesla & SpaceX in 3 years that if they don’t get their ship in shape.

Be the first to comment