Florent Molinier/iStock via Getty Images

Competition for precious metals royalties and streams has become fiercer over the past couple of years, and valuations have increased noticeably. Royalty companies have reacted in different ways to the changing market conditions, some even adapting their business model to suit the taste of the moment. Sandstorm Gold (SAND) for example has turned to financial engineering to enhance the appeal of some of its assets; Wheaton Precious Metals (WPM) seems to agree with this scribe in that this is currently a sellers’ market for royalties and streams, and has already divested two assets in the last few months; and Altius Minerals (OTCPK:ATUSF) is applying a counter-cyclical approach and has ceased buying new assets altogether, exercising patience while waiting for the next downturn to start buying again.

Royal Gold (NASDAQ:RGLD) on the other hand has stuck to its tested and proven business model, apparently willing to pay up for assets that arguably only come to market under conditions favoring the seller. In this vein, the company has added two significant assets to its portfolio of precious metals royalties this summer, paying significant premiums on both.

We would like to provide some commentary on these two acquisitions in the following, arriving at our updated investment thesis for Royal Gold.

Great Bear Royalties Acquisition

On July 11 Royal Gold announced the ~$150M (C$200M) acquisition of Great Bear Royalties, the company holding a 2% royalty over the Great Bear project, under development by Kinross Gold (KGC). Great Bear Royalties had been spun out by Great Bear Resources, the junior explorer that discovered and developed the Great Bear project in the Red Lake district prior to selling itself to Kinross for ~$1.2B. The Great Bear project has all the trimmings of a future world-class mine, and Kinross plans to bring it into production by 2027. I admit to scratching my head when the royalty was spun out back in 2020; but in hindsight, this move looks like a stroke of genius as Royal Gold just served up a nice financial afterthought for Great Bear shareholders.

The Great Bear royalty was a prized asset and one can safely assume fierce competition among the larger precious metals royalty plays from which Royal Gold has emerged as the highest bidder. One has to keep in mind, that there is neither a resource estimate nor an economic study available in the public domain. Given the scarcity of public information about the Great Bear project any valuation of the royalty soon turns into speculation, from which we will abstain. However, it will take a minimum of 4.5M mineable ounces for Royal Gold to claw back the purchase price (at the current spot gold price, and before applying a discount rate), a number to keep in mind when the maiden resource estimate is released later this year.

Kinross will initiate a PFS in early 2023, and any educated judgment on the merits of this acquisition will have to wait until the release of the results of this study. Until this time, investors are left with little choice but to trust the management’s judgment on the value of the Great Bear royalty. Royal Gold has apparently been granted access to Kinross’ data room as part of the due diligence for the royalty acquisition, and has presumably formed an up-to-date idea about the potential of this future mine and the royalty on it. In exchange for data room access, Kinross has been granted the right to buy down 0.5% of the 2% royalty for the same conditions as Royal Gold has agreed to.

As for our two cents, we look to Royal Gold’s track record and we believe that the Great Bear royalty is set to become yet another long-lasting and profitable source of cash flow, all in the fullness of time. This acquisition has a long time horizon, and it will require patience for its value to become truly apparent. To us, this deal looks like a win-win-win situation. Royal Gold gets a royalty on a potential tier-1 asset at a fair price, representing long-term value. Great Bear investors can book yet another return on their investment. And Kinross gets to reduce the royalty on arguably the most valuable mine in its portfolio.

Cortez turn-off, Nevada. (Author’s archive.)

A Top-Up On The Cortez Royalty

Royal Gold already owns a large royalty package on the Cortez gold mining complex, operated by Nevada Gold Mines, the joint venture formed by Barrick Gold (GOLD) and Newmont (NEM). In fact, Royal Gold transformed from a junior explorer into a royalty company on the basis of its original, and arguably company-making, royalty on portions of the Cortez mining complex. Royal Gold proceeded to add several additional royalties on portions of this large gold camp over time, building a cornerstone asset within Royal Gold’s portfolio of royalties and streams which has yielded revenues totalling $417M so far.

Rio Tinto (RIO) used to own a 40% stake in the Cortez camp, and when it sold this stake to Barrick Gold back in 2008, another royalty was created in favor of Rio Tinto to serve as part of the consideration. This royalty was structured to become cash-flowing later this year, and effectively works out as a 1.2% gross royalty over an area projected to yield production of ~1.1M ounces per year. When Rio Tinto put this royalty up for sale Royal Gold emerged as the winning bidder, paying $525M for the opportunity to double down (or up?) on its already considerable exposure to the Cortez Mining complex.

If we stick with our assumed $1,700/oz gold price this royalty will pay ~$22.5M per year. The current reserve life for this production base is until 2030, for an NPV(5%) of $145.4M attributable to RGLD. If we reasonably assume reserve replacement until 2040 the NPV(5%) rises to $263M – or almost exactly half of what Royal Gold is paying for the royalty.

Quite clearly, the purchase price includes a significant bet on future production not yet considered in the long-term mine plan for the Cortez Mining complex. And this bet presumably revolves around an expansion of the Goldrush deposit, and even more importantly, the integration of the Fourmile deposit into the Nevada Gold Mines JV. The Fourmile deposit is currently still under 100% Barrick ownership, and it is shaping up as the next large high-grade gold deposit on the Cortez trend. There is talk it might be connected to the Goldrush orebody, and mineralization has been traced three kilometers to the North of the original discovery hole 427. Royal Gold doesn’t say so explicitly in the news release accompanying the Cortez royalty acquisition, but to us this deal is first and foremost a bet on the Fourmile deposit — it’s future integration into the Nevada Gold Mines JV, and it’s potential to add another decade of high-grade production to the current mine plan. And given Royal Gold’s intimate long-time involvement with the Cortez Mining complex, this is a bet we are willing to support.

Diversification is obviously not something this deal achieves, as it expands the already substantial exposure to this particular asset. However, adding to a comparatively safe asset one has intimate knowledge of also has its advantages.

Business Performance

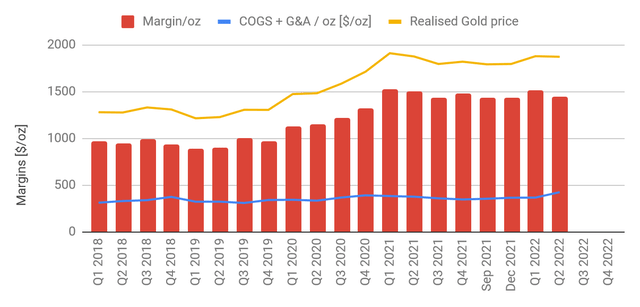

Royal Gold has enjoyed margins around $1,500/oz for the past two years, and plenty of this cash had been accumulating on the balance sheet. And it was this reliable cash in-flow that has helped allow the company to fund both acquisitions without issuing additional shares.

Margins. (Company filings & author’s data base.)

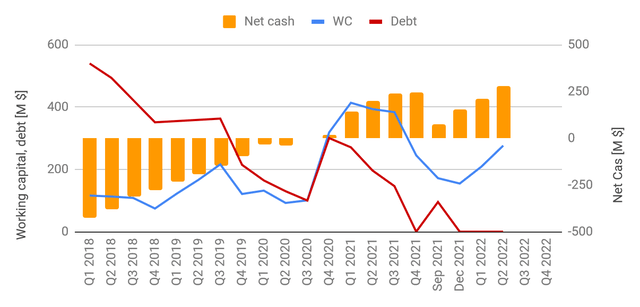

Both acquisitions were funded from the company’s cash position and a $500M draw-down of the company’s $1B revolver. According to the news release “the Company expects to repay this outstanding debt from future cash flow“. Royal Gold has been accumulating around $50M per quarter on its balance sheet. At this rate, the company will be debt-free again in 2.5 years (ignoring the weakening gold price, and the additional cash flow from the Cortez royalty).

Balance sheet. (Company filings & author’s data base.)

Second quarter revenues were below the recent average, and slightly weaker than we had modeled thanks to lower contributions from the Cortez, Peñasquito and Voisey’s Bay royalties. Nevertheless, Royal Gold reaffirmed its guidance for attributable production of 315,000 to 340,000 gold-equivalent ounces, implying a projected uptick for the second half of the year.

Summary & Investment Thesis

Ignoring short-term fluctuations, we see a solid business generating strong free cash flow from high-quality precious metals royalties and streams. The company doesn’t mess with its tried and proven business model, and we suspect, this approach will pay off in the fullness of time.

At a share price of $88 at the time of writing the company trades at 12.3x trailing cash flow, and 11.5x forward cash flow – the lowest this metric has dropped in over three years. It also trades at just over 2xNAV, which sits at the lower bound of the long-term range (it hasn’t traded below 2xNAV since dark days of early 2016). These metrics not only look cheap by themselves, they are also cheap in a peer comparison – Wheaton Precious Metals as well as Franco Nevada (FNV) trade at significantly higher multiples.

This doesn’t mean the share price can’t drop lower from here, especially since the weakening gold price is putting pressure on valuations across the board of gold-related investments. However, in the long-term the current share price looks like a buying opportunity, and we are buyers below $90.

Be the first to comment