VioletaStoimenova

As many of you know, we are a successful trading firm. But the trades we make are designed to help individuals pad their short-term returns so that they can feed their long-term portfolio holdings. That is the secret to really getting rich in the market. At least, it’s the approach we embrace, and it works. Now, that said, we like income names to have about 20% of your long-term portfolio. Within those long-term income holdings, we endorse having dividend paying names, blended with dividend growth, or high-yield. One sector that is often volatile and has been under immense pressure with the terrible real estate market and rising interest rates, but can provide income, is the mortgage real estate investment trusts, or mREITs. One such name that we like in the low teens is Ellington Financial Inc. (NYSE:EFC).

What we like about Ellington

There are a lot of different mREITs out there. Many to choose from. All of them have been under pressure with the recent moves in interest rates and the real estate market. And while EFC stock has been hit hard, it has started coming back on. We like that the company has a diversified portfolio. The portfolio has income from several sources, including CLOs, CMBS, and non-Agency RMBS strategies.

Like many other mREITs, they also employ an Agency RMBS strategy, though investments there have been tough in recent months with volatility in rates. We like that the company has had some exposure to non-qualifying mortgages, or non-QMs, which are risky but often have high rates of returns. Overall, we like the diversified approach to the portfolio. That is one of the reason we like EFC for income, especially at the $13-$14 level.

The company just reported Q2 earnings. In the release, Laurence Penn, CEO stated:

Similar to the previous quarter, the second quarter was marked by extreme volatility, rising interest rates, and weakness in both the fixed income and equity markets. We had strong performance from our short-duration loan portfolios and non-QM interest only securities, and significant gains on our interest rate hedges and credit hedges, but these gains only partially offset net losses on our unsecuritized non-QM loans, loan originator investments, and Agency RMBS. As a result, Ellington Financial generated an economic loss of 6% for the second quarter.

So we saw a loss in the quarter. Yes, that hurts. We want the stock to fall, so we can buy it cheaper! Buy as low as you can. But there as some good revelations in the release that bodes well for the company’s future growth, per the CEO:

During the quarter, we deployed some of the dry powder that we held entering the quarter, capturing higher yields and wider spreads amid the market volatility. Our loan origination businesses provided much of our asset acquisition volume during the quarter, but we also took advantage of the market selloff through secondary market purchases of discounted non-QM loans and credit securities. At June 30, our credit portfolio stood at $2.66 billion,3 an increase of 29% from year end 2021, and we still had significant available capital and borrowing capacity to expand it further.

While the market is horrible right now, the fact the company is putting money to work to acquire better spreads should also excite prospective investors. They have funding to put to work still as well. Having funding to put to work is key because the hefty dividend of $0.15 per month needs to be covered by earnings. And the dividend coverage has been mixed. It definitely was not covered in Q2.

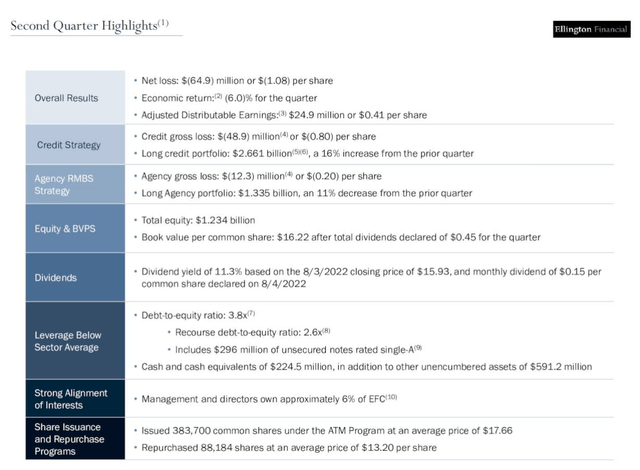

The company lost money. In fact EFC had a net loss of $64.9 million, or $1.08 per common share. Making some adjustments, the adjusted distributable earnings (a measure for dividend coverage) were $24.9 million, or $0.41 per share. What is most important is that this level of earnings did not cover the now $0.45 in dividends being paid quarterly. While the macro situation is tough, we think the dividend continues to be paid.

While the diversification of EFC’s portfolio protected the earnings power, it is tough all around. But the best thing is the company is investing in its future. We expect this diversification to continue to payoff for the company versus companies that have concentrated ports.

Value buy?

Are you getting a good value to buy here at $15.52 per share? Well, this is below the last reported book value, but we want you to wait for sub-$14. We think the market could give you this opportunity. Book value per common share as of June 30, 2022 was $16.22, including the effects of dividends of $0.45 per common share for the quarter. At this level you are getting a $0.70 discount-to-book, or a near 4% discount. When the company announced its $0.15 dividend this week, it announced book value coming into August was $16.32 which means you are still getting a $0.80 or a 5% discount-to-book. But the reason to own shares is for the income. Any share appreciation is a bonus. The annualized yield at this pricing level is 11%.

Final thoughts

The macro situation is difficult overall. The company pounced on the opportunity to add some assets to its portfolio with the recent volatility. Overall, we believe that this company’s portfolio can perform well since it is diversified. It has $225 million in cash on hand and another $591 million in unencumbered assets which can be used for future investment. The dividend is going to be maintained, and we believe that once the rate hike cycle is complete this year, the situation stabilizes and mREITs see better days ahead. For now, we should be acquiring shares on big market weakness. Sub-$14 looks good from a discount-to-book and dividend yield standpoint.

Be the first to comment