tifonimages

Just a couple of days ago, I cautioned about the prospects of Brazilian electric utility Eletrobrás (NYSE:EBR) based on potential uncertainty stemming from political changes in the country. Poor performance can be added to the mix now after it reported a dismal set of numbers for the third quarter of 2022 (Q3 2022) yesterday. These add further conviction to the view that at least for now, the stock isn’t a buy, despite undeniable long-term potential in the clean energy sector.

Drag on Q3 financials

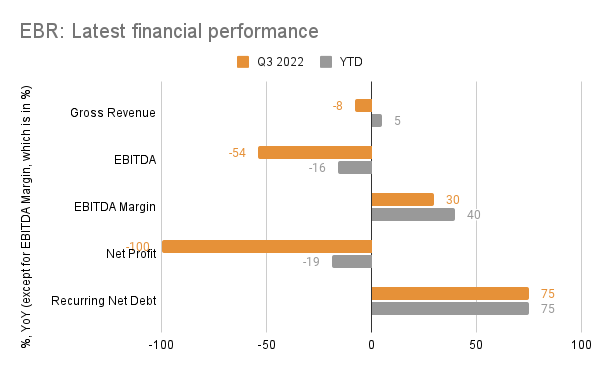

For Q3 2022, the company saw a weakening across all key financial indicators. Its gross revenue was down by 8% year-on-year (YoY) and EBITDA declined by a big 54%. A fall in EBITDA has affected its margins, with the EBITDA margin now at 30% down from 57% in Q3 2021. But the most glaring fall is visible in net profits, which essentially fell to nothing, representing a 100% decline YoY. Its debt numbers look bad too. The recurring net debt figure rose by 75% and its ratio of recurring net debt to twelve months trailing [TTM] recurring EBITDA has doubled to 1.8x YoY.

Source: Eletrobras

As a result of poor Q3 figures, the numbers for the year-to-date [YTD] have taken quite a dramatic turn for the worse as well. Gross revenue is up 5% so far compared to the same time period in 2021, which is a decline from the 13% rise seen until the first half of the year (H1 2022). At least it’s still showing positive growth though. The same can’t be said for its EBITDA, which has now fallen by 16% YTD, a sharp reduction from the 15% gains seen until the first half. Eletrobrás’ net profits had already been impacted in Q2 2022, with a 45% fall. For H1 2022, as a whole though, they were down just 1%. But after the latest fall to almost nothing in Q3, for the year so far they are down by 19%.

Why has EBR performed so badly?

There are a host of reasons for the drop in EBR’s financial performance. The biggest was the hit to its transmission revenues because of a downward adjustment for inflation. The company also brings up the consolidation of SPE Santo Antônio Energia [SAESA], which operates a hydropower plant in the state of Rondonia, more than once, in explaining the reasons for its reduced financials. Eletrobras’s subsidiary, Furnas, acquired a controlling stake of 70% in SAESA from 43%. SAESA’s numbers have now been included in the company’s financial results, impacting them negatively as it’s highly levered and depreciation and amortisation figures have also increased because of it. Besides this, the company’s provisions for loan losses have risen as have provisions for contingencies, following claims of losses and damages because of delays in transmission lines.

Implications for the stock

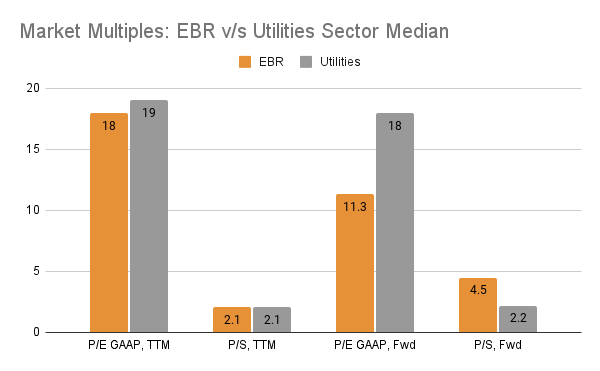

A decline in net profits is a downer in any case, but it especially impacts the relative attractiveness of the stock considering that it’s already trading at TTM multiples in line with the utilities sector. There was some case for a price increase still, considering that its forward P/E was still much lower than the sector. However, with a drop in earnings, that’s unlikely to be the case anymore either. Even if the company turned its performance around in Q4 2022, and its net profit came in at the average of the last three quarters, its P/E would still be at 26.2x at its price at the last close. By comparison, the median forward P/E for the utilities’ sector is at around 18x. And this is considering a reasonably good scenario. If the company’s net profit were to stay at its Q3 levels, the ratio would be much higher.

Source: Seeking Alpha

The fact that earnings’ weakness adds to the uncertainty around dividends is something to consider as well. The company has an inconsistent dividend record over the past 10 years, and it could cut them again. Further, political changes in Brazil can also add to the uncertainty. President-elect Lula has promised to reduce carbon emissions once he takes charge early next year, but there could be downward tariff revisions and increased taxes on the other hand. The company is still 45% owned by the government after its privatisation earlier this year reduced the stake from 72%. This move was seen as potentially improving returns, but there would be a question mark on how far that can happen now.

What next?

The EBR stock’s stellar performance so far this year has already started coming off. In the past week, it fell by almost 9%. Some of this might just be down to market rotation towards more undervalued stocks as the broader markets start picking up. The S&P 500 (SP500) for instance is still down by ~20% YTD, but over the past month, it has gained some 7%. That doesn’t take away from the very real challenges facing EBR right now, however. These, in fact, make it less attractive even compared to other utility stocks, which can still find favour in the ongoing economic slowdown. Keeping these factors in mind indicates that there could be a decline in EBR’s share price in the near term.

Over the long term, there’s undeniable value to the clean energy sector. Much of EBR’s power is generated through these sources, most notably hydropower. The policy push towards slowing down climate change, in big part from reducing dependence on fossil fuels, is only increasing. Hydropower, in particular, with a 16% share in electricity generation leads all other sources, where the company has an advantage. If it were not for this aspect, the stock would be a sell for me. But going by its ability to turn its finances around in the past and its presence in a key sector for the future, I’d hold it for now.

Be the first to comment