tiero

Summary

Minnesota-based Electromed, Inc. (NYSE:ELMD) develops, manufactures, markets and sells airway clearance therapy products for patients with compromised pulmonary functions. ELMD’s key product is the SmartVest® Airway Clearance System (“SmartVest”), which is a High Frequency Chest Wall Oscillation (“HFCWO”) device that is worn like a lifejacket by patients who need mucus cleared from their lungs on a regular basis. The device works by pumping air into the vest in such a way as to simulate a series of coughs. The main airway clearance alternative for patients is manual chest physiotherapy, where a physical or respiratory therapist will regularly clap a patient’s chest and back to help clear the patient’s lungs.

HFCWO devices are used by patients who suffer from cystic fibrosis, or other chronic diseases and conditions that fall under the COPD (chronic obstructive pulmonary disease) umbrella, including bronchiectasis (“BE”). BE is a disease in which there is permanent enlargement of parts of the airways (bronchi) of the lung, and for which there is no cure. While tens of millions of people in the United States suffer from COPD, only a few hundred thousand have been diagnosed with BE. However, BE diagnoses are on the rise, and recent industry initiatives are helping to grow awareness of this disease.

The domestic market for HFCWO devices is approximately $230 million, and has grown at a rate of roughly 10% per year over the last several years, largely due to the growth in BE diagnoses, growth which we believe will continue for the foreseeable future. Four companies make up 100% of this market, with ELMD in the #3 slot with close to 20% market share. Significant barriers to entry should prevent others from entering the space. Furthermore, our conversations with both ELMD management and territory managers for two of ELMD’s competitors have led us to conclude that the intensity of rivalry among competitors in this industry is less fierce than it is elsewhere, which should help give all industry participants a good chance at continuing to achieve strong returns on invested capital.

Under CEO Kathleen Skarvan, ELMD’s revenues have steadily increased from $14 million in 2013 to over $41 million last year. At the same time, the company has transitioned from one with negative earnings to one that regularly posts positive EPS and free cash flow. ELMD generates enviable gross margins of close to 80%, and both ELMD’s streamlined business structure and the relative technological simplicity of all HFCWO vests typically allows ELMD’s SG&A and R&D to grow at a slower rate than gross profit dollars.

Attractive valuation

As any serious health care investor knows, the entire raison d’être for most small cap medical device companies is to get to a revenue level where it hits the radar screens of larger acquisitive companies, and then to get bought out at an attractive valuation multiple.

Considering this, these companies are often more properly valued using enterprise value to sales (EV/S) or enterprise value to gross profit (EV/GP) ratios than price-to-earnings ratios. That is because acquirers that buy small cap device companies often do so in order to get a new set of products to “put in the bag” of their existing salesforce. When this happens, the acquirer will seek to dramatically reduce the acquiree’s SG&A by laying off sales representatives (and reducing other costs), and then to benefit by adding the new products’ gross profit dollars to its income statement.

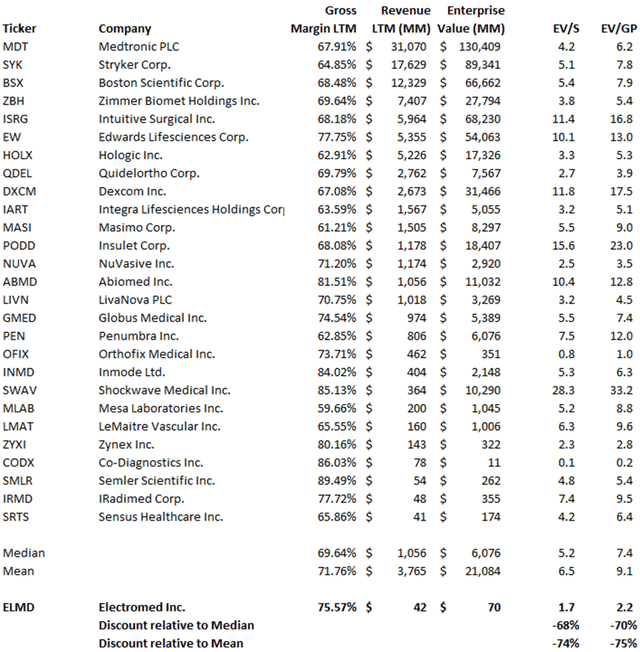

To demonstrate how dramatically undervalued ELMD currently is along these measures (as of September 2, 2022), we created the table below of all US-listed companies classified as medical equipment companies (according to the GICS classification methodology) that had gross margins in excess of 60% over the past year and that have positive expected earnings per share in the coming twelve months.

EV/S and EV/GP ratios of profitable US-listed medical device stocks with gross margins in excess of 60% (SEC filings)

Depressed earnings

Even though EV/S and EV/GP measures are very important for companies like ELMD, investors do still care about earnings and earnings growth. Unfortunately, despite 28% sales growth over the past two years (from $32 million in fiscal 2020 to $42 million in fiscal 2022), ELMD’s diluted earnings per share fell 44% from $0.47 to $0.26. This is the primary reason, in our opinion, why ELMD’s stock price has been cut in half since two summers ago, and is now valued at a tremendous discount relative to most other profitable medical device companies.

There are several reasons why earnings per share have fallen, and fortunately, we believe three big ones are about to be reversed in the coming quarters.

First, research & development (“R&D”) costs increased from $1.05 million in fiscal 2020 to an average of $1.54 million in fiscal 2021 and 2022, as ELMD has been working on the development of its “next generation” SmartVest product that should be launched some time before the end of this year. According to ELMD’s CEO Kathleen Skarvan, “the new SmartVest will have multiple value-added innovations to enhance the patient experience. It will be smaller and lighter weight while maintaining the same performance differentiation as [ELMD’s] current SQL model, which allows patients to breathe more easily during therapy and provides patients and physicians with more information about treatment outcomes through [ELMD’s] SmartVest Connect technology.” ELMD’s elevated R&D costs have averaged 4.0% of revenues over the last two years, and the company has guided this expense to fall to between 2-3% over the coming four quarters – this reduction alone should increase the company’s EPS by $0.02, or close to 10%.

Second, ELMD’s gross margin fell from 77.6% in fiscal 2020 to 75.5% in fiscal 2022, driven largely by higher raw material and shipping costs. With the upcoming next generation SmartVest being smaller than ELMD’s existing HFCWO product, the manufacturing cost per unit is expected to decrease. As well, a significant Medicare allowable rate increase took effect on January 1, 2022 – as Medicare accounted for more than 50% of ELMD’s revenue over the last year, this will have an ongoing positive impact on gross margins. If ELMD increases its gross profit margin by a mere 2% through cost reductions and increased Medicare reimbursement, this should increase the company’s earnings per share by another $0.07 to $0.08 (or 25-30%).

Finally, ELMD’s professional and legal fees in its latest fiscal year increased $875,000, or $0.08 per share after tax. The primary reason for this increase was costs associated with a shareholder activism matter with the company’s largest shareholder, Summers Value Partners LLC (which we will discuss in a moment). We estimate that a reduction in these costs going forward will positively impact EPS in the coming year by roughly $0.04 (or 15%).

Adding all three together, and earnings per share will likely increase 50% to roughly $0.40 in ELMD’s 2023 fiscal year, without even considering the positive impact of continued sales growth or other items.

Confusing accounting choice has depressed EPS

Besides heightened professional fees and R&D expenses, there is one other curious accounting issue that has had a depressing effect on ELMD’s earnings per share, that being the manner in which the company has accounted for share-based compensation expense. We will expand on this issue in some detail next.

A company always has considerable discretion when it comes to the accounting assumptions it uses in the preparation of its financial statements. Most of the time, company managers err on the side of conservatism in the application of accounting rules, and attempt to have their financial statements properly reflect the underlying health of their businesses. However, over the years, we have identified numerous examples of companies that use what we believe to be improper accounting assumptions.

Something we have seen many times is companies using, in our view, unjustifiable assumptions in the valuation of stock options. As an example, in 2018 we highlighted how footwear distributor Weyco Group (NASDAQ:WEYS) regularly used unusually low (and in our opinion, incorrect) expected volatility assumptions to undervalue millions of dollars’ worth of granted options.

ELMD, on the other hand, has done the opposite of what WEYS did. For years, ELMD used expected volatilities that were many times greater than what we believe they should have used. This served to amplify the value of options the company granted to its employees, and thus understate the company’s earnings per share.

According to the accounting rules (FASB ASC 718-10-55-21), companies estimating the fair value of stock options must use a proper valuation technique that takes into account “the expected volatility of the price of the underlying share for the expected term of the option.”

Since 2015, all options that ELMD has granted have had an expected term of six years. Therefore, to calculate the value of each option when it was granted, ELMD should have first calculated the volatility of daily stock price changes for the six-year period that had just ended.

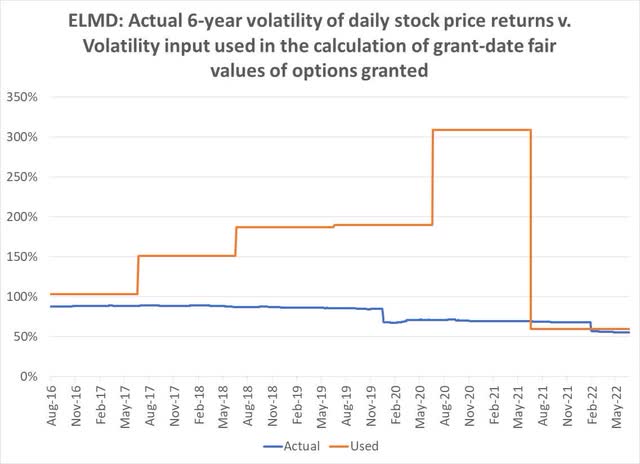

Over its entire existence as a publicly-traded company, the rolling six-year annualized volatility of ELMD’s stock, using daily observations, has been between 55% and 89%. However, for five years, ELMD used peculiarly high volatility assumptions:

Volatility assumptions used by ELMD v. ELMD’s actual stock price volatility (SEC filings, Yahoo! Finance)

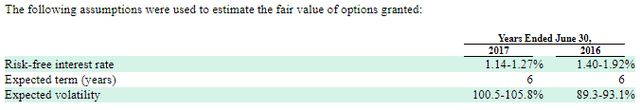

Starting in ELMD’s 2017 fiscal year, the company used expected volatilities between 100.5% and 105.8%:

Assumptions Used by ELMD in the Valuation of its Stock Option Grants – FY16 & FY17 (SEC filings)

While not a lot greater than the historical six-year volatility of about 88% that ELMD’s stock had experienced up until the time of those stock option grants, the use of this assumption did serve to overstate the value of these options somewhat. The value of these option grants would then be spread over the subsequent six-year period as additions to ELMD’s compensation expense.

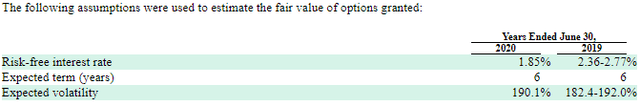

The next fiscal year, ELMD used an even higher volatility number, which would have had an even bigger impact on future compensation expense. In ELMD’s 2019 and 2020 fiscal years, the volatility expectation increased to almost 200%:

Assumptions Used by ELMD in the Valuation of its Stock Option Grants – FY19 & FY20 (SEC filings)

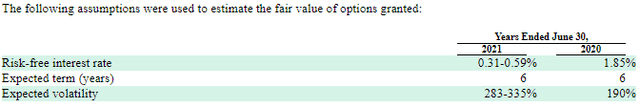

And then in the 2021 fiscal year, ELMD used a truly absurd set of volatility expectations of between 283% and 335%:

Assumptions Used by ELMD in the Valuation of its Stock Option Grants – FY21 (SEC Filings)

To put that in perspective, if a $10 stock had an annualized volatility of daily stock price returns of 283%, that would mean that roughly once every four days, the stock would climb or fall at least $2.

We have puzzled over why ELMD would use such unusual assumptions that cannot be supported by the stock’s actual volatility history, and have formally asked Ms. Skarvan multiple times about this oddity (she has thus far declined to provide a response). The conclusion we have come to is that this was simply an oversight that nobody at either the company or ELMD’s auditor, RSM US LLP, noticed until recently. In ELMD’s latest Annual Report on Form 10-K filed with the SEC on August 23, the company did disclose that “[d]uring the year ended June 30, 2022, the Company had a change in estimate related to its expected volatility used to estimate the fair value of options granted”, but neglected to provide an accounting of how much the company’s prior assumptions impacted ELMD’s operating expenses or earnings per share.

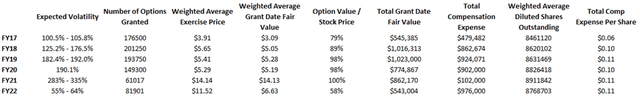

So we calculated the approximate impact. The following table demonstrates how these strange volatility expectations amplified the values ELMD assigned to its granted stock options:

ELMD’s Expected Volatility Assumptions Underlying the Valuations of Past Stock Option Grants (SEC filings)

For those of you who do not understand stock option valuation very well, consider a hypothetical $10 stock. What would you rather we give you – one share of that stock, or the option to buy one share of that stock for $10. Obviously, you would rather be given the share, because it is worth $10. On the other hand, the option is worth something above $0, but how much above $0 will depend on how long the option is good for, and the volatility of the underlying stock. The more volatile the stock is, the more valuable the option is, because a more volatile stock has a greater chance of hitting, say, $15 during the option’s life (thus making the option to buy it in the future at $10 more valuable) than a less volatile stock does.

As an example, on September 2, 2022, Apple (AAPL) shares closed at $155.81. The option to buy one share of AAPL for $155 anytime up until June 2024 was priced at $31.55 (or about 20% the value of AAPL stock).

Now, consider the above table. In ELMD’s fiscal 2017, both the weighted-average price of ELMD’s stock when its 176,500 options were granted and the weighted-average exercise price of the granted options were $3.91. The granted options were valued at $3.09 each ($545,385 total), or 79% of the value of the stock. This high ratio was because the expected volatility assumption was over 100%. However, by fiscal 2021, the value of the at-the-money options granted ($14.13) was almost the same as the underlying stock price ($14.14), which to us makes no logical sense!

During its latest fiscal year, ELMD started using a more reasonable volatility assumption, which valued its 81,901 granted options at roughly 58% the value of underlying stock. If we apply that same 58% to the previous five years, we can estimate that ELMD’s cumulative overvaluation is in the neighborhood of $1.6 million, or $0.19 per share before tax.

Now, $1.6 million may not seem like a lot, but considering ELMD has had an average annual pre-tax profit of $3.4 million over the past five years (or $0.39 per share), that’s fairly significant.

We believe there is a highly likelihood ELMD is sold

Having discussed all of the above, quite frankly, we think there’s a high probability that none of it matters. The reason is that we believe ELMD is close to being sold.

First, as mentioned earlier, ELMD operates within an oligopolistic market structure, and all three of its competitors have been sold in recent years. In 2017 Royal Philips (PHG) acquired Minnesota-based Respirtech. In September 2021, Tactile Medical (TCMD) acquired Afflovest, and then in December Baxter International (BAX) bought Hillrom. With ELMD being the last remaining independent company within this space, we believe it only makes sense for the company to eventually sell itself to a larger organization, especially with ELMD now needing to compete against companies with deeper pockets than before.

While the high likelihood of ELMD being sold eventually isn’t a terribly insightful observation, we believe the following information provides some clues as to the near-term timing of an acquisition.

Actions of largest shareholder

Andrew Summers manages Summers Value Partners LLC (“SVP”), a small Denver-based hedge fund management company with $25.0 million under management as at April 30, 2022. SVP’s primary investment vehicle, Summers Value Fund LP (“SVF”), represented $22.0 million of that.

According to both SVP’s regular quarterly investor letters and recent SEC filings, SVF began acquiring ELMD shares in 2018 and has spent a total of $3.2 million buying 323,124 shares in the company (3.8% of current shares outstanding) over the years. Based on ELMD’s April 30 share price of $12.67, this position was valued at $4.1 million, or 18.6% of SVF’s capital. To say that ELMD is a high conviction investment of Andrew Summers is probably an understatement.

Mr. Summers has written multiple times about ELMD in his letters over the years, and has consistently expressed his belief that the company will be sold. Most recently, his October 2021 letter expressed his belief that ELMD could be worth up to $25 per share in an acquisition scenario.

Not content to have ELMD be his fund’s largest holding, in May 2021, Mr. Summers created two new legal entities with the Colorado Secretary of State: the SVP Deal Fund 1 LP (“SVP Deal Fund”) and a general partner for this vehicle, SVP Deal Fund 1 GP LLC. These entities appear to us to have been created solely to purchase shares of ELMD in anticipation of the company being sold, as SVP Deal Fund has subsequently acquired 198,569 shares of the company for $2.2 million. Based on ELMD’s April 30 share price, this position was valued at $2.5 million, or 84% of the value of this vehicle.

Last September, due to pressure applied to the company by Mr. Summers, ELMD entered into a Cooperation Agreement with SVP that included ELMD adding two new directors to its board and establishing a Finance and Strategy Committee to “make recommendations to the Board with respect to…opportunities to enhance shareholder value, including…buy- and sell-side M&A transactions.”

Then, in July of 2022, ELMD entered into a new Cooperation Agreement with SVP that provided for the addition of Mr. Summers to the company’s Board of Directors, and his appointment to the role of Vice Chair of the Finance and Strategy Committee.

Mr. Summers, through SVF and the SVP Deal Fund, is currently the largest shareholder of ELMD.

During the first half of 2022, SVF returned a terrible -25.9% – considering the constant pressure that small hedge funds are under to deliver positive performance for their investors, we believe a near-term sale of his largest position would be viewed very positively by Mr. Summers as it would go a long way to mitigating or eliminating SVF’s current drawdown.

Furthermore, we believe that certain data that is publicly available provide hints that the sale of ELMD could occur sooner rather than later. For instance, in November 2021, Ms. Skarvan stated that the newly formed Finance and Strategy Committee would have an approved charter; however, almost a year later, the company has still not included one in its list of corporate governance documents. We find this to be a peculiar omission, and one that suggests to us that maybe the Finance and Strategy Committee is not going to be in existence long enough to warrant the creation and dissemination of a formal charter. Also, during ELMD’s FQ422 earnings conference call on August 23, analyst Kyle Bauser (who initiated coverage on ELMD last month with a buy rating and a $20.00 price target) asked Ms. Skarvan if she could provide “any updates from the Strategy Committee,” but she completely ignored the question.

And finally (and perhaps most tellingly), according to the Colorado Secretary of State’s website, both the SVP Deal Fund and its general partner were due to file periodic reports by July 31, 2022. However, neither entity did. As a result, they have been deemed noncompliant and will be declared delinquent on September 30, 2022. We are confident that this isn’t a case of Mr. Summers simply not understanding the filing requirements, because he made sure that Summers Value Partners LLC filed its last two periodic reports within hours of being notified of them becoming due. Rather, we believe this filing noncompliance possibly signals Mr. Summers’ intention to voluntarily dissolve the Deal Fund entities due to them no longer being required.

We have asked Mr. Summers why these entities are not currently compliant with state filing requirements, but Mr. Summers has not yet responded to our questions.

Likely acquisition price

So, if ELMD does get acquired, what is the likely price a buyer would pay? The acquisition multiples of its three competitors are worth considering.

First, the price that PHG paid for RespirTech in 2017 was never disclosed. However, we do know the valuations at which the two latest acquisitions were made.

Hillrom was acquired last year by BAX for $12.5 billion. Hillrom’s trailing twelve-month revenue at the time was $3.02 billion, and its trailing twelve-month gross profit was $1.59 billion. So, Hillrom was acquired at a 4.14x EV/S multiple and a 7.87x EV/GP multiple.

TCMD acquired the Afflovest assets from privately-held International Biophysics Corporation for $86.4 million (subsequently revised up to $93.8 billion due to the revaluation of the contingent consideration portion of the deal). Afflovest’s trailing twelve-month revenue at the time was $16.4 million. We do not know what Afflovest’s gross margin was at the time of acquisition; however, if we look at TCMD’s second quarter 10-Q filing, and calculate the company’s incremental gross margin on incremental revenue, we can estimate what Afflovest’s gross margin is (since TCMD didn’t have Afflovest revenue in last year’s second quarter). We estimate Afflovest’s gross margin to be 81.7%, slightly higher than that of ELMD. Therefore, we can estimate that TCMD bought Afflovest at a 5.72x EV/S multiple and a 6.99x EV/GP multiple.

Applying the average of these multiples to ELMD’s latest trailing twelve-month revenue and gross profit figures of $41.7 million and $31.4 million, respectively, we reach potential acquisition prices of between $25 and $29 per share.

Risks

There are many risks to our thesis, and we believe the most prominent ones are 1) ELMD continues as an independent firm, and loses market share to its three larger competitors; 2) HFCWO becomes a less attractive alternative to airway clearance therapy due to new devices or approaches that enter the market; and 3) Medicare and/or third party reimbursement policies change in such a way as to negatively impact ELMD’s revenue.

Conclusion

We believe investors buying ELMD shares today have two ways to win. First, assuming ELMD continues as an independent company, there are multiple reasons to believe that the company’s earnings per share will rebound significantly in the coming quarters from its currently depressed level. This, combined with ongoing revenue growth that is being driven by a moderately growing bronchiectasis market, should lead to an expanding EV/S multiple for the stock. In this scenario, we can see ELMD trading within the next year at a 3.5 EV/S multiple on FY23 revenue of $45 million, or $19.50 per share. This would give investors a roughly 100% return over a short period of time.

In the other (and, in our opinion, more likely) scenario where ELMD is acquired, we believe reasonable assumptions would result investors will achieve somewhere between $25 and $29 per share.

Like ELMD’s end customers wearing a SmartVest, investors in ELMD can breathe easy.

Be the first to comment