mi-viri/iStock via Getty Images

Investment Summary

We continue our medtech earnings coverage with Apollo Endosurgery, Inc. (NASDAQ:APEN), manufacturer of bariatric surgery systems. It was a strong Q2 FY22 for the company with upsides in revenue versus consensus, although it missed estimates below the bottom line. Despite this, fundamental momentum continues brewing for the company, and we note it’s caught a bid in H2 FY22 alongside the broad sector. Valuations are supportive and we are paying ~4x book value for a company that grew its top 10 accounts by more than 53% YoY last quarter. With this in mind, we rate APEN buy with price target of $7.97.

Exhibit 1. APEN 6-month price target

Data: Refinitiv

Q2 earnings illustrate current investor challenges

Second-quarter earnings were mixed with upsides versus consensus in revenue but a miss in EPS. Worldwide revenue was 16% higher YoY at $19 million with ~310bps of forex tailwinds. Turnover increased due to an 18% increase in US product sales and 15% ex-US, adjusted to 23% on constant currency.

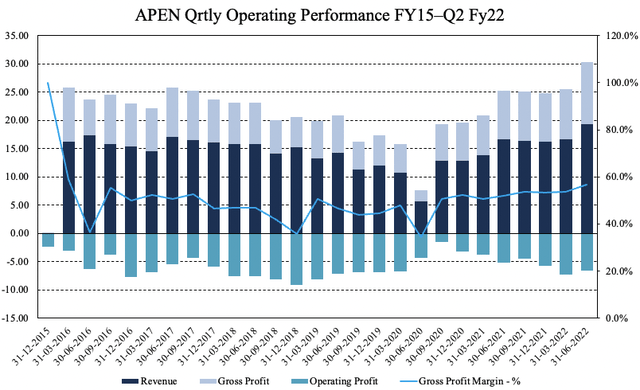

The company’s top 10 accounts saw a 53% YoY increase. Segmentally, Endoscopic Suturing System (“EES”) sales stretched up 23% YoY to $2.4 million backed by demand for OverStitch and X-Tack. Meanwhile, its intragastric balloon (“IGB”) segment grew 6% YoY. As seen in Exhibit 2, it was an above-average performance for the company, with its strongest quarterly result in years.

Exhibit 2. Quarterly operating performance has been ratcheting up across FY21 to date, with share price and top-line fundamentals starting to converge

Data: HB Insights; APEN SEC Filings

Gross margin on these revenues lifted ~180ps YoY to 56.8% from higher product sales. As seen above, it continues to curl up alongside top-line performance. This is a bullish factor seeing the company is strengthening margins into a weakening global economic outlook. Moving down the P&L, OPEX increased to $17.6 million as the company increased its salesforce headcount in H2 FY21, plus the marketing spend with this. Operating loss on this was ~$6.5 million.

It carried this down to a net loss of $10.4 million for the quarter, versus a net loss of $3 million the quarter prior. The delta was attributed to the forgiveness of the Paycheck Protection Program (“PPP”) loan a year beforehand.

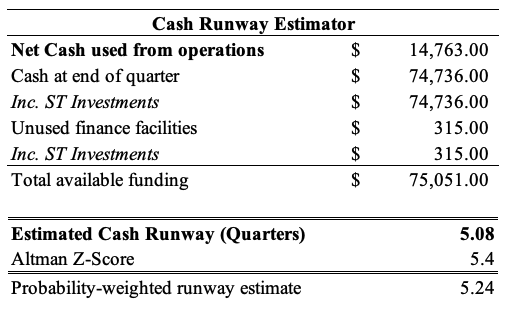

The company left the quarter well capitalized with $140 million in “committed cash” despite a net loss on CFFO of $14.7 million, worse than the loss of $6.4 million in Q2 FY21. Ex-committed cash, it had ~$75.5 million in cash on the balance sheet. As seen in Exhibit 3, on its net cash spend of $14.7 million and ending balance of $~$75.5 million for the quarter, we estimate the company has ~1.5 years of runway left before having to re-evaluate the situation.

Exhibit 3.

Data: HB Insights Estimates; APEN SEC Filings

With the exit momentum leaving Q2 management reiterated FY22 full-year guidance. This expects to land between $73-75 million with potential 400bps of forex headwinds.

Regulatory tailwinds

The company also received the nod from the FDA for De Novo marketing authorization for Apollo ESG and Apollo REVISE. Apollo ESG is an interesting segment with favourable economics tied into the mix. It is used in bariatric surgery, or treatment of patients with obesity. Both systems are the first FDA-authorized systems for “endoscopic sleeve gastroplasty”. This is a minimally invasive procedure to help obesity patients in reduction of body mass. APEN indicates it for those with BMI range of 30–50kg/m2 who require bariatric surgery.

Both systems and the gastroplasty procedure were also featured in the publication of the MERIT study in late July, in the LANCET journal. Per the company’s investor presentation yesterday, from the study readouts:

The MERIT study proves that ESG is scalable and can be offered in outpatient endoscopy practices by surgeons or gastroenterologists, with an excellent safety profile, without mortality, and with predictable conservatively managed adverse events.

Intra-operative hardware used in the Apollo ESG and Apollo REVISE procedures.

Image: APEN

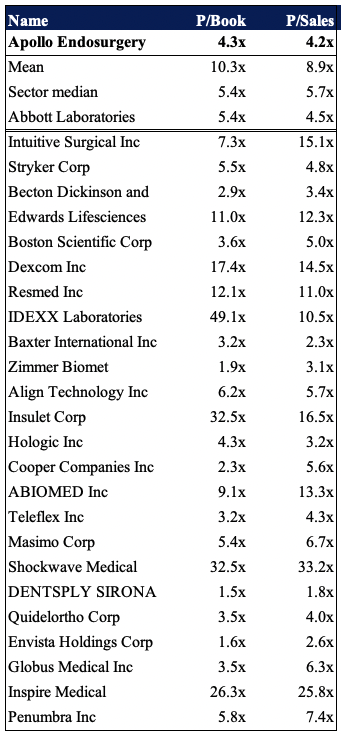

Valuation

Shares are trading at around 4.2x book value and 4x sales, both below the GICS Industry median respectively. The peer group is a strong one and Apollo’s lack of profitability makes it difficult to assign a concrete valuation. It printed a quarterly ROA of -8.6% and this is in line with longer term trends. Investors also realize a negative 22% ROE from the most recent quarter’s results.

Exhibit 4. Multiples and comps

Data: HB Insights

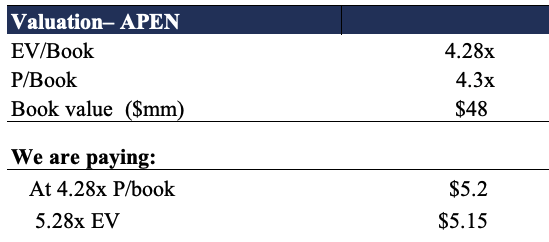

Valuations are attractive and we’d be paying a fair and reasonable price at ~4.3x book value (this also equates to ~4.28x enterprise value (“EV”) to book value as well). As seen below, if we were to pay this multiple we’d theoretically be paying ~$5.20 per share, a 23% discount to the current market price. Therefore, we value APEN at $7.97 and believe the share could re-rate to this level.

Exhibit 5. We look to be getting shares on the cheap here relative to book value and this could present a mispricing opportunity up to ~$8 on estimation

Data: HB insights Estimates

In short

APEN continues to strengthen its top-line fundamentals which is encouraging on a forward-looking basis. The fact it is lifting gross margins in the current climate is a standout, by estimate. The key downside risk to this thesis is that investors don’t reward the company on the back of this, as the market has turned to rewarding bottom-line fundamentals in FY22. We note that, if the US were to mirror a recession, this could be a substantial risk to our investment thesis that wants to see APEN grow its top line at an above-market pace. Moreover, there are also geopolitical risks impacting global supply chains that must be considered into the investment debate.

Valuations are also supportive and we look to be getting APEN at a discount to its book value at current multiples. Nevertheless, with a combination of new product launches last quarter, growth throughout the P&L and management reiterating guidance, we rate APEN a buy.

Be the first to comment