4kodiak/iStock Unreleased via Getty Images

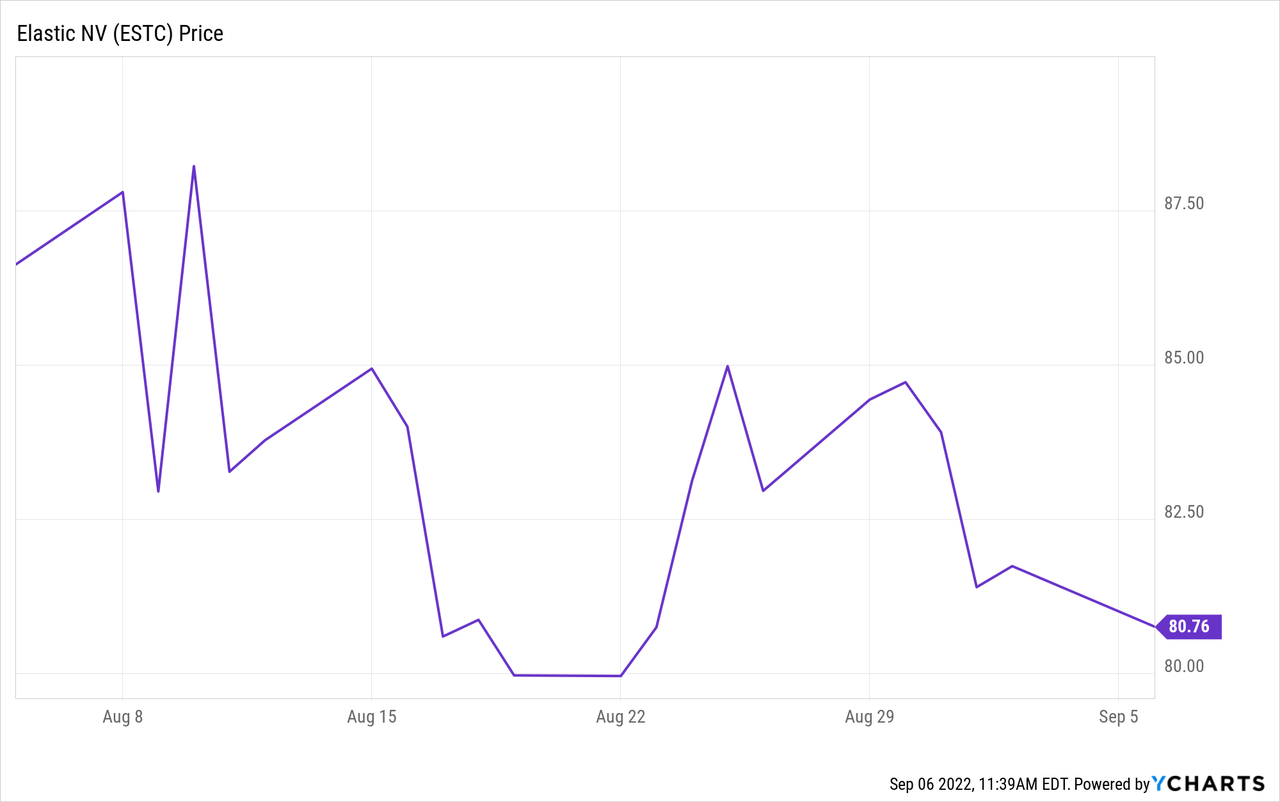

Elastic N.V. (NYSE:ESTC), the IT company behind products such as Elasticsearch, Elastic Observability, and Elastic Security, has suffered from an above 50% fall during the last year as part of the wider downside impacting tech stocks. The stock dropped even more on August 26 despite the company announcing both a revenue and earnings beat for its first quarter 2023 results which ended in July.

Normally, this sort of market behavior is caused by a company missing expectations, and my aim with this thesis is to provide more insights into the financial results before assessing the profitability in a tougher macroeconomic where inflation is high and the strong dollar is creating headwinds for companies with earn income from abroad.

Equally important, I will also provide insights into how deeper integration with hyperscalers, especially after the company resolved its contention with Amazon (NASDAQ:AMZN), should drive more adoption.

Assessing Growth of Elastic Cloud

First, the main cause behind August’s drop seems to be cloud revenues of $97.7 million in Q1 (out of the total revenue of $250.1 million) increasing by 59% on a year-on-year basis after accounting for currency headwinds. This compares to an 80% growth from the fiscal year 2021 to 2022, and amounts to a deceleration.

Now for investors, the company basically provides services that are used for functions like observability with search-based tools getting traction across different sectors, namely for data analytics in IT companies and security monitoring in banks, among many other use cases.

In this respect, and in contrast to the standard SQL-enabled relational database searches, the ones done by Elasticsearch are much faster and are therefore used in real-time search engines, namely for searching documents almost as soon as they are uploaded into the data store. This makes Elastic’s products suitable to analyze large volumes of data efficiently and quickly.

Now, these services were initially provided by Elastic in an on-premises fashion, namely by installing its search application on corporate servers in what can be termed a self-managed approach. With Elastic Cloud came the managed version of the application, which saw great success as it meant less management overhead by the customer. Going into details, it freed IT teams from the hassle of handling the deployment part together with certain functions like performance tuning which can be time-consuming. Equally important with the cloud flavor, comes Managed Security whereby items like data encryption, software updates, and strengthening of IT controls to protect against malicious cyber attacks are handled by Elastic Cloud itself.

As a result, corporations are happy to trust these management activities to Elastic and, in this way, cloud revenue has been growing despite competing offers from other companies. To provide investors with an idea of the degree of competition, the company spent an average of 63% of revenues on SG&A which includes sales and marketing expenses in Q1.

The competition, Hyperscalers, and AWS

Looking deeper, one strong driver for the adoption of Elastic Cloud is that it is available as a managed service on the clouds of all of the three major public cloud providers like Microsoft’s (NASDAQ:MSFT) Azure, Google’s (GOOG, GOOGL) GCP, and Amazon’s AWS. These three are also called hyperscalers because of their massive scale spanning all continents.

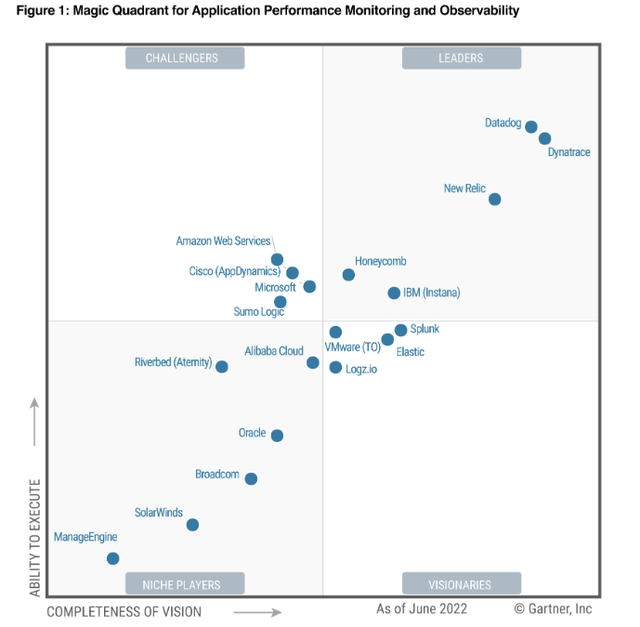

Such a type of partnership enables Elastic to have a global scale instead of having to market its products directly to customers in what is a highly competitive industry including companies like Datadog (NASDAQ:DDOG) and Dynatrace (DT), who are the leaders according to the Gartner Magic Quadrant for APM (Application Program Monitoring) and Observability as shown in the table below.

As for Elastic, it has been named a visionary alongside some big names like VMware (VMW) and Splunk (NASDAQ:SPLK).

Gartner Magic Quadrant (www.elastic.co)

This recognition certainly enhances Elastic’s competitive positioning. However, another development that should be even more helpful is the settlement of its dispute with Amazon in February of this year after initiating a lawsuit against the cloud giant for trademark infringement about three years back after the cloud giant started using the Elasticsearch brand in 2015 to distribute an offer based on Elastic’s entry-level open source edition.

While this is permitted as part of licensed open source projects, Elastic viewed it as unfair competition as Amazon was not contributing any money to development efforts. Thus, the search engine play had to restrict the way third parties could use its open source projects. This resulted in Amazon subsequently renaming its offer as the OpenSearch service. Currently, the only Elasticsearch service commercialized on the AWS marketplace is Elastic Cloud (by Elastic).

After the deal and as part of an expanded collaboration, the company’s goal is to have Elastic Cloud integrate more deeply with AWS like a native cloud service instead of an add-on feature, with customers having the option to buy, and renew it directly just as they do with, Azure or GCP consoles. In this case, the recruitment of Ken Exner with three decades of product and engineering leadership in Amazon, as the new Chief Product Officer, should help tremendously.

Discussion and Key Takeaways

With Amazon’s AWS marketplace being so huge, this would mean more sales for Elastic, which bodes well for the company in order to achieve or even beat the revenue forecast of $1.08 billion- $1.086 billion for FY-2023. This forecast represents a 26% year-over-year growth over 2022.

However, at a time when inflation is so high together with the associated recession risks, it is important to look for factors that could lead to profitability for a company that is spending 63% of revenues just on SG&A.

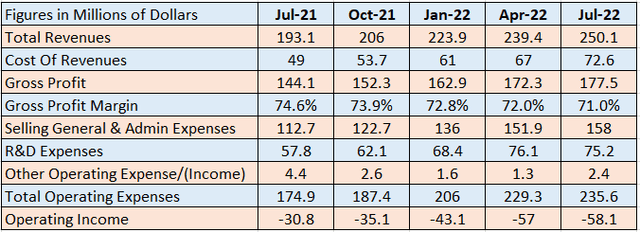

In this respect, with the company focused on growth, do not expect it to be profitable in FY-2023. In fact, Elastic Cloud is expected to create “an approximate 2% to 3% headwind to gross margin in this fiscal year which ends in April 2023. Second, traveling costs should add about $8 million to $12 million to operating expenses. Now, the company did achieve operating margin breakeven, but that was on a non-GAAP basis in FY22 and it delivered free cash flow on an adjusted basis of $1.7 million in the first quarter of 2023.

Assessing its ability to weather adverse economic conditions, it has relatively low capital expenses, and with $849 million of cash and equivalents, it should not find it difficult to finance operations during this fiscal year. As a matter of fact, it spent $235.6 million on operating expenses and only $6.4 million of interest payments during Q1 to service the $593.7 million of debt.

Still, being overvalued, it is better to avoid the stock as this is a market where the value strategy prevails unless the Federal Reserve suddenly adopts a dose of dovishness, which should be favorable for tech stocks in general.

Looking at the longer term, Elastic’s ability to hitch a ride on the back of the cloud of hyperscalers signifies that it can benefit from their global scales, without necessarily having to inflate its marketing budget. Thus, it should be on investors’ watchlists. One of the metrics I will be watching for is the gross margins, which are key for software companies. A level of around 73% to 74% from the current 71% (table below) will help to skew Elastic on the path of GAAP profitable growth faster.

Noteworthily, while I am not against non-GAAP, which does not account for some exceptional expenditure items, GAAP or Generally Accepted Accounting Principles include all recurring expenses as well and is a better metric to use when doing a comparison against peers.

Quarterly Income Statement (www.seekingalpha.com)

Another factor that should help in achieving profitable growth is the way Elastic is managing currency headwinds due to the fact that it obtained 42% of revenues outside of the U.S. in the latest reported quarter. For this matter, Elastic uses the local currencies obtained in other parts of the world to make payments in the respective countries, thereby achieving a sort of natural hedge against a stronger dollar.

Furthermore, it is fascinating to follow companies like Elastic which have been able to profit from their open source innovations and have also been able to partner with the large hyperscalers, while at the same time managing to settle a dispute with the one who forked (modified) its Elastic product stack.

Finally, together with new products like cross-cluster search and replication tools which help customers shift to the cloud, there should be more cloud revenues. At the same time, the company’s balance sheet is also positive in view of interest rates moving higher, but, it is more Elastic’s ability to increment gross margins to achieve profitable growth which matters in current macroeconomic conditions.

Be the first to comment