JimVallee/iStock via Getty Images

Medicare’s open enrollment season has recently started for 2023, extending from mid October to the first week of December, which has big implications for some health insurance companies. When you see the television ads featuring celebrities of a certain age encouraging viewers to sign-up for Medicare plans start to play more frequently, you know the season is here, though some of that marketing practice is getting a dose of scrutiny. Over the span of a few weeks, Medicare-eligible Americans can make multiple changes to their coverage for next year. The biggest fundamental choice is whether to use traditional Medicare or Medicare Advantage, which delivers Medicare benefits through private insurers. There are range of factors that Medicare participants might weigh in their decisions, such the potential for broader coverage (for example, basic dental) in some Advantage plans, versus the possible provider network restrictions in those plans. So how does a typical Medicare customer come to a decision?

The Difficult Business Model Of The Brokers

Stepping into the middle of this open-enrollment process are insurance brokers, who help consumers find a good fit within the Medicare Advantage options. The brokers do this by offering a range of channels for people to enroll, from completely unassisted online enrollments to having live agents available to walk people through the process over the phone. Regardless of how a customer elects to enroll, the broker who signs up the customer receives a commission from the insurance companies based on enrollments that they generate. The major brokers include SelectQuote (SLQT), GoHealth (GOCO), and eHealth (NASDAQ:EHTH), with the acknowledgment that there is more to these brokers than purely Medicare Advantage enrollments, though it is a highly significant part of their businesses. In terms of market value, all three are relatively comparable: SelectQuote has a market cap of $101 million, GoHealth’s is $158 million, and eHealth is at $110 million. Each company has reported third quarter results since the beginning of November, all of them reporting losses per share, though somewhat less severe than anticipated, while generally reaffirming their guidance.

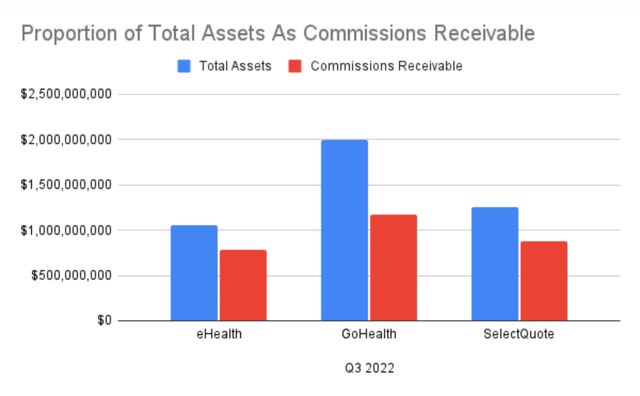

The business model for these brokers is not an easy one, with high customer acquisition costs and difficulty predicting the lifetime value of each enrollment earned. The uncertainty over exactly how much a customer will be worth to a broker over his or her lifetime has made for accounting difficulties, as the ultimate value to the brokers is the accumulated future commissions they will earn. As a result, the assets on these brokers’ balance sheets are dominated by commissions receivable.

Proportion of Total Assets As Commissions Receivable (Author’s Spreadsheet)

In simple terms, it costs the brokers large sums up front in marketing to reach customers, as well as the labor costs of agents to assist in the enrollment process for those who do not take care of the process fully online. A hypothetical enrollee during this open enrollment season then starts a plan the following year. The commission revenue owed to the brokers generated for an enrollment will then come in slowly but steadily over the lifetime of the policy. This sort of mismatch of one-time cash outlays for customer acquisition and the slow and even uncertain inflows of cash on commissions spread over a much longer period is the core difficulty of the business model. On the flip side, however, there is the potential for strong demographic trends to underpin support for these brokers, as Medicare enrollment is growing at a rapid clip due to the wave of retiring baby boomers, and half of the Medicare population is electing Medicare Advantage. With fixed costs spread out over more customers, in theory the customer acquisition costs could be kept in check.

eHealth: Can It Be Fixed?

Management of all three are fully aware of these difficulties and are attempting to turn things around, issues that I’ve addressed in previous coverage of eHealth specifically. The plan of CEO Fran Soistman is to essentially “right-size” the organization’s expenses with broad reductions in marketing spend and trimming the fat on the number of agents working the phones. To that end, annualized cost reductions on the order of $90 million in 2022 are on track, while at the same time he is attempting to create more alignment of incentives between the interests of the insurance carriers and eHealth, specifically in regards to lower churn. He recognizes the lower marketing spend will shrink the number of customers served, but is hoping to walk the tight-rope of smartly cutting the right costs at a higher clip than the resulting loss in customer enrollments. With the recent earnings release, the timing is good to check in on management’s execution on its cost-cutting measures.

Third quarter revenues were down over the same period in 2021, as was expected, to $53.4 million from $63.9 million, down 16.5% year over year. This reduction was intentional, to be less aggressive on customer acquisition and more focused on controlling costs. On the smaller revenue, SG&A expenses were also drastically less than a year ago, from $113.0 million to $77.3 million, or 31.6% lower. Specifically, in her prepared remarks on the Q3 earnings call, CFO Christine Janofsky reported that:

through our transformation program, the improvement to our sales and marketing operations resulted in a year-over-year decline of 35% in per member acquisition costs. As we enter the AEP [annual enrollment period, starting in early Q4], we expect to see a meaningful drop in our acquisition cost per approved Medicare member.

This sort of meaningful expense reduction and expectation for continued improvements going into the busy 4th quarter is a hopeful sign that the ship is turning in the right direction. Considering how this all flows through to cash generated or used in operations, the improvements come through clearly. A year ago, in Q3 of 2021, eHealth used $71 million in cash for operations; a year later, that figured dropped to $29.6 million. Getting to cash-flow positive for a twelve-month period year will require another hard push, but year-to-date the cumulative use of cash stands at $8.3 million. For comparison, that figure was a use of cash of over $60 million over the first three quarters in 2021, undoubtedly a sign of running a much tighter operation.

Assessing The Valuation

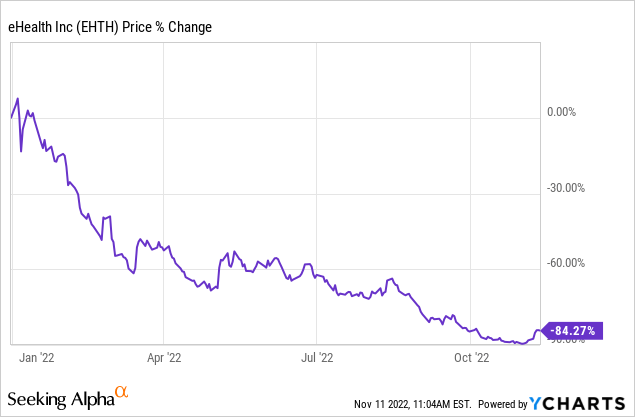

Though eHealth appears to be moving solidly in the direction of being operationally cash-flow positive, it is not there yet, and could still be a year or more away. When I first looked at eHealth in late April 2022, I attempted to get a handle on the valuation by discounting the value of its commissions receivable as way of thinking about the company’s tangible book value. Since that time, discount rates have been rising dramatically as central bank efforts to reign in inflation have not relented, and the stock has been crushed. Investor risk appetite has moderated, and as a higher risk investment, eHealth’s investors have lost a lot of ground.

The question now is not about the past, but trying to understand what sorts of assumptions the market might be making in order to arrive at the present value.

I am revisiting the tangible book value here. In September 2021, the face-value of the TBV per share stood at $27.68, and has dropped steadily every quarter since, ending at $24.04 as of the third quarter of 2022. When Q3 of 2021 financial results were released a year ago, the stock fell dramatically, from around $40 per share to around $30, still putting shares at a value greater than 1x on a price to TBV, although it continued dropping through November last year and ended the month around $22, so distinctly at a discount to its TBV of 60 days earlier. Since then, of course, the shares have essentially gone down and only down, to the $4 range and even lower, putting the price to TBV ratio at about 0.16x. For comparison, GoHealth is 0.20x and SelectQuote is at 0.46x.

Superficially, this might look fairly absurd, but beneath the surface is some rational for what otherwise appears to be a major discount. First and foremost, the overwhelming majority of eHealth’s book value comes its commissions receivable, which stretch out well into the future. However, they are not long-lived fixed assets, but rather cash inflows of some value that have been determined with some actuarial testing.

Currently, eHealth is carrying current commission receivable of $207.5 million and long-term commissions receivable of $578.3 million, for a total value of $785.8 million, greater than the book value of the company’s equity, which is $633.5 million. The current portion represents about 26% of the total, a ratio that has stayed fairly steady over the past year, and is cash that should flow-in over the next twelve months. The rest of the commissions, however, are future cash flows, and in my opinion, should not be considered at face value, but need to discounted to a present value based on some appropriate discount rate to account for the time-value of money.

When I ran this exercise in April, I used a 15% discount rate, but as inflation has remained stubbornly high and interest rates on risk-free assets have gone up since then, 15% was clearly too generous. However, picking a discount rate is an art as much as it is a science. For this updated thought experiment, I am upping my discount rate to 25% to apply to the long-term commissions, and see what that does to the book value. Starting with tangible value of $633.5 million, back out the face value of the long-term commissions, $578.3 million, and then add back in the present value of $578.3 million divided into three equal tranches, one tranche discounted back 1 year, one tranche discounted 2 years, and one tranche discounted 3 years, which comes to $359.6 million. This produces a new book value of $414.8 million, or a per share value of around $15. The new price to TBV ratio is 0.26x. Still a large discount to book value, but one that I think is more in-line with actual market thinking, in which there is degree of skepticism around eHealth’s value; I do not think there is any justifiable reason that eHealth’s shares should be near parity with their book value at this stage in the company’s journey.

The result of the calculation obviously depends entirely on the discount rate applied, as everything else is fixed, but the investor has to grapple with question honestly. Is 25% appropriate for the risk factors? There is little positive cash flow historically but rather consistent cash burn, whereas government bonds are paying north of 4%, inflation is high, and the reliability of these commissions receivable are of a somewhat uncertain nature. There is no one and only fixed and true answer of course, but helps for putting things into perspective.

Concluding Thoughts

In my estimation, eHealth has clearly made demonstrated progress, and I give enormous credit to the management team that took over last year and has executed on its stated objectives. Shareholders have not directly benefited from the improvements in the form of capital gains, other than to say shares could have performed even worse than they did. In my view, the shares have lost value less due to the fundamentals than because of what has happened broadly to equity valuations in a rising rate environment, but this is still a company that consumes cash, and is not clear that even it turns the corner that it will be cash flow rich.

I believe that eHealth is a better run company today than it was previously, and is serving a Medicare demographic that is growing. If discount rates start coming down in the next year, shareholders today could find themselves sitting on a profitable trade. Nevertheless, I am reminded of one of Warren Buffet’s one-liners that I think has some bearing here:

When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.

Can even the best management overcome the difficult economics of the insurance broker business? The perpetual question is the near-term cost of getting an enrollee versus the inherently slower and time-sensitive nature of recouping of that cost before becoming profitable on that enrollment. Will those difficulties of the underlying model prevail over the quest for turning cash-flow positive? I don’t know the answer better than anyone else, but I am convinced that any management team in this business has a tough road. Based on the situation as it stands today, I continue to find eHealth a really fascinating case to study and analyze, but it remains a risky and speculative investment option, which I consider a hold at best.

Be the first to comment