Mohamad Faizal Bin Ramli

Brookfield Asset Management (NYSE:BAM) is going to spin off its asset management business before the end of the year (following BAM, we will call it the Manager). Since I published my previous post about the spin-off, Brookfield Asset Management issued its Management Information Circular and Proxy for the coming special shareholders’ meeting on Nov 9, and BAM’s shares dropped even further. While the Q3 earnings report will bring more data, the new information is sufficient for our final review before the BAM shareholders’ vote. As the spin-off is almost certain, I will not consider the alternative.

To make this post logically inclusive, I cannot avoid some repetitions with my previous post and apologize for it. I will also assume that my readers are familiar with BAM and will not review the company. If not – please read a company’s description in my older publications or elsewhere to be comfortable with the content.

What we know

- BAM shareholders and Brookfield Reinsurance (NYSE:BAMR) unitholders will receive one share of the Manager per 4 shares of BAM/BAMR. Upon the closing, the Manager, a Canadian corporation, will be called Brookfield Asset Management and trade as BAM on NYSE/TSX. Whatever is left will be called Brookfield Corporation trading under the symbol BN.

- Only 25% of the Manager will be spun-off to shareholders while Brookfield Corporation will retain 75%. The spin-off will be tax-free at least in the US and Canada.

- The Manager will include all asset management business and the minimum amount of capital. Its cash flows will almost exclusively (at least initially) consist of fee-related earnings (FRE).

- All other assets and liabilities, including debt, preferred stocks, and deferred tax liabilities will stay with Brookfield Corporation.

- Carry from the currently existing private funds will belong to Brookfield Corporation. For future private funds, two-thirds of the carry will belong to the Manager and one-third to BN.

- 90% of the Manager’s earnings will be paid out in dividends. The BN’s first dividend will be reduced (as compared to BAM today) by an amount payable by the Manager, i.e., if a shareholder decides to keep both BN and the Manager upon the spin-off, her first quarterly dividends from both BN and the Manager combined will be approximately equal to the quarterly dividend she is receiving from BAM today. After the first dividend, each company will declare dividends independently.

The dividend policy and Manager’s valuation

On June 30, 2022, there were 1638M diluted shares of BAM including shares of BAMR exchangeable to BAM. Thus, Brookfield will spin off 1638/4 shares of the Manager and retain 3*1638/4 of the Manager’s shares (in millions). Hence, the total number of the Manager’s diluted shares will be 1638M as well.

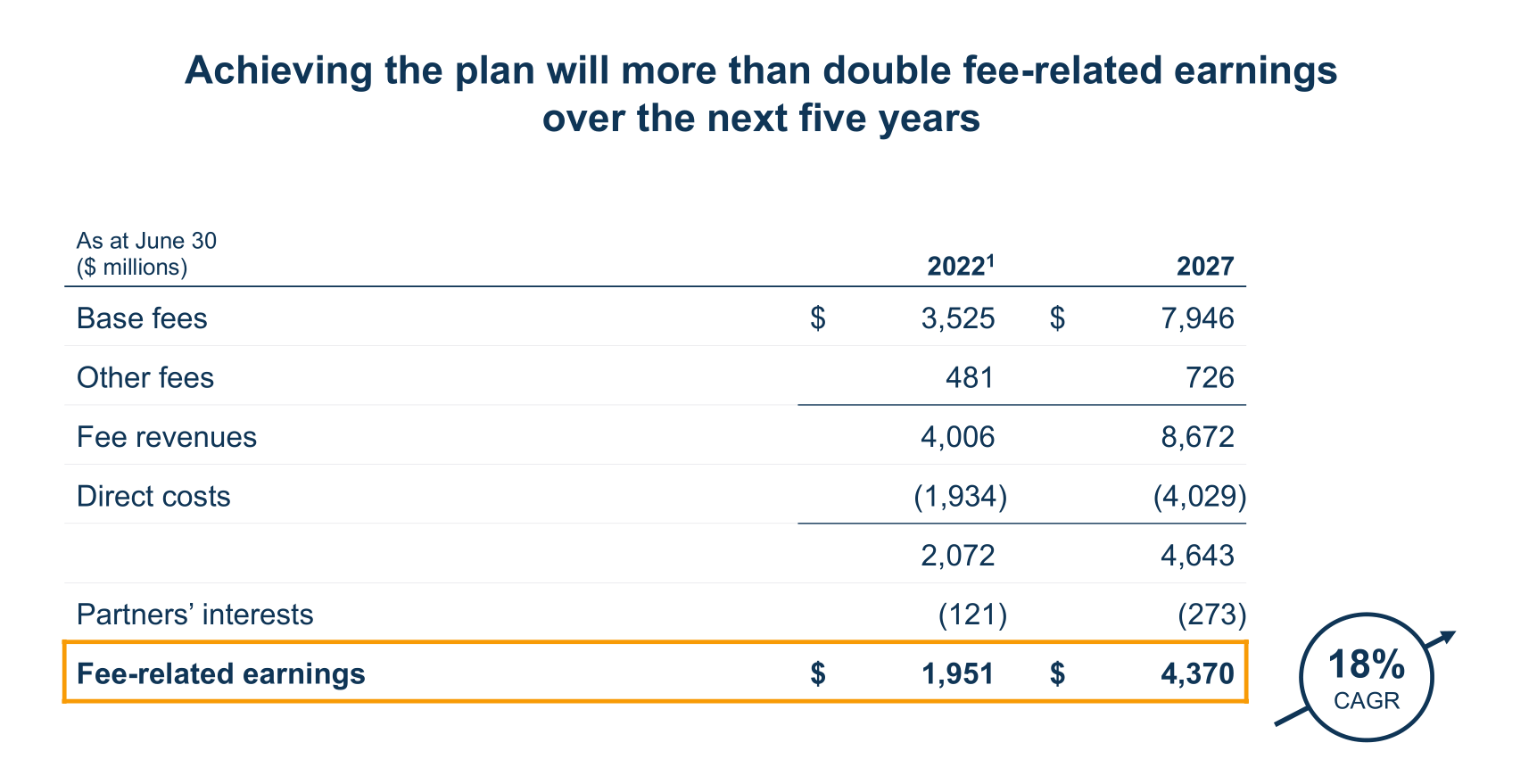

During the Investor Day, Bruce Flatt showed the slide below with the FRE for TTM that can be used for the dividends:

Company

The first Manager’s dividend annualized can be calculated using simple math: 1951*90%/1638=$1.07 (this figure is expected to change somewhat after Q3). The current BAM annual dividend is $0.56 and it allows us to estimate the first BN dividend annualized: 0.56-1.07/4 ~$0.29.

Mr. Flatt expects FRE to grow at 18% annualized and it implies the same 18% growth for its dividend. While aggressive, this figure is in line with the FRE growth BAM has achieved for the last 10 years (please see my previous post for details).

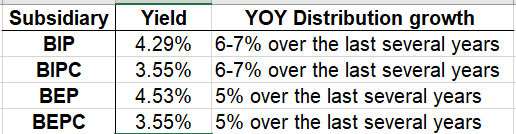

Since 90% of earnings will be paid out in dividends, I expect the Manager to be trading on yield. BAM’s existing subsidiaries Brookfield Infrastructure (BIP) (BIPC) and Brookfield Renewable (BEP) (BEPC) are paying almost all their cash flows in distributions and it is instructive to check their yields today:

Author

Corporations (BIPC and BEPC) are consistently trading at a lower yield than partnerships. BIPC is the best comp based on its corporate status, growth rate, and payout ratio. The faster-growing and unleveraged Manager should be trading at a yield at least comparable with BIPC. Please also note that all four companies are typically trading at a lower rate than today, during the stock market slump. In my previous post, I estimated that the Manager should be trading at a 3-4% yield which corresponds to ~$27-36 for its trading range. I also stated that the Manager might be eventually trading at yields below 3% (at the time of that publication, BIPC was trading precisely at a 3% yield). For your reference: BIP (that has a multi-year record while BIPC does not) has been trading at 2.8-5.3% yields over the last 10 years.

Let us imagine that the Manager will be really increasing its dividends at ~18% per year in line with Mr. Flatt’s predictions, these dividends will be sourced from stable FRE, and there will be no debt on its balance sheet and no capital expenses. Moreover, let us assume that within several years the Manager will have established its track record without exhausting its growth potential. Would you be particularly surprised to see it trading at a 2.5% yield?

Let us further fantasize that the Brookfield management will be regularly using the Manager’s high-flying stock as a cheap currency for global acquisitions of other investment managers with relevant profiles to further accelerate growth. This vision, still uncertain and remote but not improbable, makes the spin-off quite compelling.

There is a strong counterargument to this line of thought. If you consider Blackstone (BX), an asset-light alternative asset manager similar to the Manager, it is currently trading at a 6% yield despite growing dividends at ~20% annually over the last 5 years. But first, alternative managers are unpopular now and typically BX is trading at a lower yield. Secondly, the BX dividend, being sourced from both carry and FRE, is very unstable as seen below:

Yahoo! Finance

The unpredictable dividends are not that valuable. In BX’s case, it can be easily understood why. Carry is highly vulnerable to market slumps because a private equity company cannot profitably execute enough exits. If the carry’s input is comparable to FRE’s, a dividend can even go down in a bad year. This is unacceptable for an income-dependent investor. The Manager will not have carry at all during the first several years and hopefully, it will make quarterly dividends more stable but still variable – the Manager intends to pay in dividends 90% of distributable earnings for the preceding quarter.

Since we have not seen all this financial machinery in action yet, I would stick to my valuation of the $27-36 range for the Manager for now with a possible upside. There are two important caveats: this range may materialize after some initial stabilization period and is dependent on the actual dividends declared (we are based only on our preliminary estimates).

Brookfield Corporation and its valuation

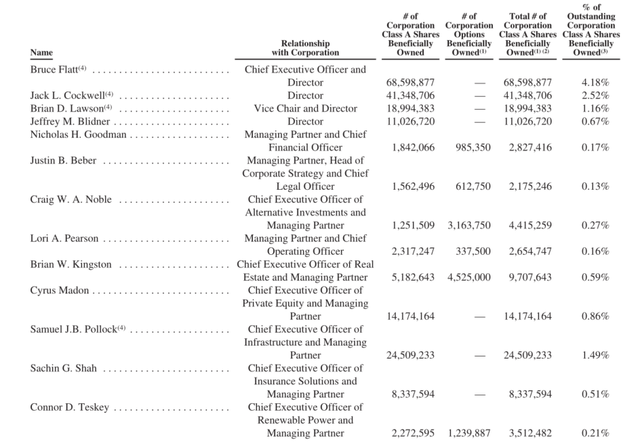

The successful growth of the Manager cannot be achieved without equally successful Brookfield Corporation. BN’s capital will be used to grow the Manager’s assets under management (‘AUM’) in a smart way. Namely, BN will provide seed capital for different investment vehicles which will attract other people’s money achieving leverage. These vehicles will include various private funds, public companies such as BIP or BEP, and, most importantly, BAMR. Insurance will become a centerpiece of AUM’s growth. In addition to owning 75% of the Manager and splitting carry, BN will enter into agreements with the Manager focused on the best alignment of interests and mutual benefits. The same people, with Bruce Flatt at the helm, will be navigating both companies and they will remain heavily invested in both as seen in the table below copied from the Management Circular:

In addition to people in the table, Howard Marks (who is a Director) is a significant owner and beneficially owns 1,019,715 Class A shares.

The growing influence of Sachin Shah (who is currently BAM’s Chief Investment Officer and BAMR’s CEO and used to run BEP) combined with an age gap between him and other top officers makes him a candidate to eventually replace Bruce Flatt.

And now back to valuations: BN will consist of three parts: 75% of the Manager (that we have already evaluated), carry, and invested capital. I wrote many times that carry is not that significant and valued it at ~$5B in one of my older posts (or ~$3 per share). This figure is conveniently close to the current unrealized net carry though I derived it from different considerations. Splitting of future carry makes it even less important for either company. To complete the picture we need only to estimate invested capital.

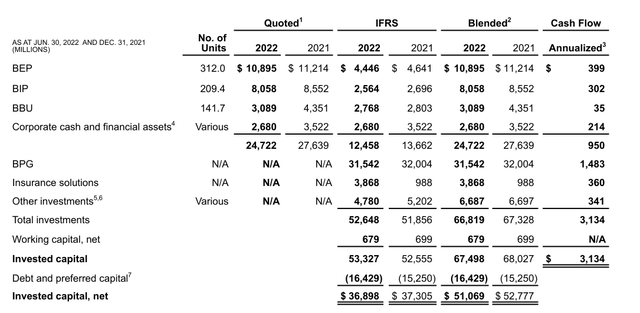

We can use Q2 Supplementary data for this:

The column “Blended” is a reasonable but fluctuating estimate of invested capital since BEP, BIP, and Brookfield Business (BBU) are publicly traded, however, we need to adjust for Brookfield Property Group (BPG), former (BPY). BPY was always trading at a significant discount to its IFRS value and the situation has become even worse since the pandemic. I would roughly estimate BPG as 50-75% of its IFRS value or ~$16-24B. The total invested capital becomes equal to ~$36-44B (instead of indicated ~$51B), or $22-27 per share.

Our estimates of invested capital and carry are significantly below those by Brookfield.

Now we can estimate BN value per share: 0.75*(27-36)+3+(22-27) ~$45-57.

Correspondingly, today’s BAM value per share should be about ~$52-66.

Conclusions

For convenience, here are our estimates of the fair values per share again:

BAM today assuming the spin-off will occur: $52-66

The Manager (new BAM): $27-36

Brookfield Corporation (‘BN’): $45-57

We suggest the following two-step strategy:

1. Investors should load up on BAM stock right away. While some other alternative asset managers are trading at discounts as well, Brookfield is better positioned to unlock the value because of the upcoming spin-off. Nothing is certain in the stock market, and another drop can negatively affect BAM price but the chances are strongly on your side.

2. Upon the spin-off (or even before it on a when-issued basis using the BAM.WI ticker on NYSE or NBAM ticker on TSX), investors should reallocate money between the Manager and BN comparing their trading quotes with our estimates of their fair values.

Q3 results may or may not cause adjustments and I may respond with a short post if these adjustments are material for our estimates and strategy.

And the last unrelated comment: SA and some of my readers suggested I start the Marketplace service. I am not sure I want it but would be interested in your opinions regarding it. Thank you!

Be the first to comment