Ethan Miller

EHang Holdings Limited (NASDAQ:EH) is arguably the world’s foremost eVTOL company. It was the first to go public when it was listed on the NASDAQ in 2019 and has completed more flights than any competitor. It remains the only eVTOL to have sold any aircraft (more than 100). Earlier this year, EH became the first to be granted special-conditions approval from a regulator. EHang expects to receive complete type certification for its autonomous aircraft next quarter and to begin commercial operations this year.

This is the third article I have written on eVTOL companies. I believe the market for this product is going to be huge, and that some of the companies involved are going to bestow outsized returns on investors.

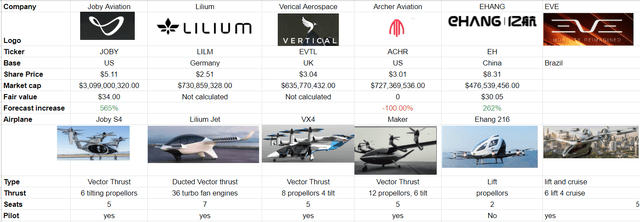

Below you can see some of my research as I look at each company in turn and make a decision on investing.

eVTOL companies COmparison (Author)

I first wrote about Joby (JOBY) and recommended buying.

My second article, about Archer (ACHR), was very bearish.

I do intend to complete this series of articles writing about the remaining eVTOL companies.

In this third article, I am recommending buying EHang.

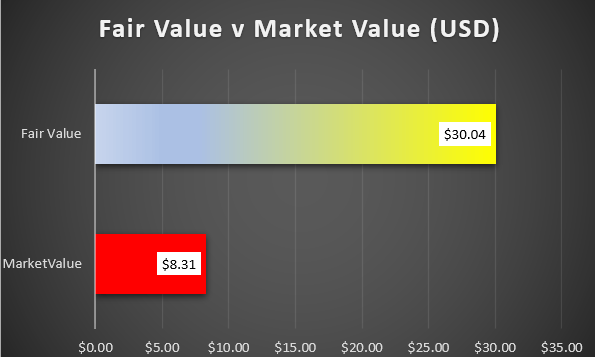

EHang stock is cheap

I think EHang is significantly undervalued, I give it a fair value of $30 per share against a current price of $8.31 (13th July). I will look at why I think it is so cheap and then explain my fair value calculation.

Fair Value EHang shares (USD) (Author Model)

In February 2021, Wolfpack Research released a short-seller report claiming that EHang:

is an elaborate stock promotion, built on largely fabricated revenues based on sham sales contracts… EH has perpetuated its story with a collection of lies about its products, manufacturing, revenues, partnerships, and potential regulatory approval of its purported main business, an “autonomous” aerial vehicle

It used expert witness testimony to denigrate the EHang aircraft saying they were using hobby drone engines, were poorly made, and without autonomous capability. The stock fell 60% on the report’s publication and has never recovered.

I believe that the Wolfpack document is full of biased and misleading commentary, untruths, and unsupported accusations that do not stand up to scrutiny. As a result of the short-seller attack, EHang shares are trading at a considerable discount just as the company is moving into its rapid growth phase. I believe EH is a bargain not to be missed.

The Aircraft

EHang is developing two aircraft, the multicopter EH-216 available in three variations, and the tilt and thrust VT-30. Both planes are autonomous two-seaters and have multiple pre-orders in place. The VT-30 has wings and uses tilting rotors that provide both lift and thrust, it has a much longer range than the EH-216 and is aimed at the air taxi market.

EHang 216 in flight (TNNThailand) EHang VT30 (EHang website)

In February, EHang received special conditions approval from CAAC, which clears the way for the CAAC to issue type certification for the 216S. EHang is expecting type certification next quarter. If they get it, it will be another world first and justify the more than 40,000 trial flights EHang has operated since 2014.

Growing Flight Momentum

EHang now benefits from the CAAC (Chinese certification board) special conditions approval, allowing it to carry out operational trial flights during the certification period. As a result, the EH-216 flew more than 4,000 times in practical scenarios in 8 different locations. The EH-216 comes in three variants:

- The 216S or the standard model for passenger transport

- The 216L for aerial logistics

- The 216F for fire fighting (the video is pretty neat).

EHang has delivered more than 100 aircraft and has secured large numbers of pre-orders in Asia from companies based in China, Malaysia, Thailand, Japan, and Indonesia. It is the only eVTOL with an autonomous vehicle and is the only one expecting type certification this year. EHang expects a commercially available product towards the end of 2022, several months ahead of Joby, who is next in line.

EHang deployed the L and S variants and its Falcon drones in Guandong starting on June 4th to aid the Covid response. They flew multiple contactless relief missions inside the containment zone, perhaps the only company to benefit from the Chinese zero covid-19 policy as they were able to show their products’ value and safety profile once again.

The Shenzen Express Way Development Company uses all three variants to provide emergency rescue and bridge/road inspection services. The EH216S is operating as a tourist vehicle at several sites, and the current operators plan significant expansion. The Aizhai wonder site is one example.

Growing Geographical Momentum

China is not the only market moving forward with EHang, in 2018 Japan established a public-funded body to look into air mobility. The body (PPCAMR) has set 2023 as a target date for evtol operations in Japan and, in June, granted the first license of an evtol aircraft to EHang. Since that demonstration flight, EHang has received orders for more than 50 aircraft from two customers in Japan.

Indonesia has ordered 100 aircraft and intends to use the EH-216S for tourist sightseeing. This video from the Indonesian tests gives an idea of how the EH-216 will be used for tourism, there are hundreds of such videos available.

The Wolfpack Research Report

You can read the full report by following the link:

EHang: A Stock Promotion Destined to Crash and Burn.

Wolfpack alleges that the EH-216 uses hobby-grade motors, is poorly manufactured, and of low quality and that EHang has not invested enough money in research and development to have autonomous flying capability.

These allegations were made by a leading expert in the eVTOL market Dr. Mark Moore, a 32-year veteran NASA engineer who also worked for UBER elevate (see P3), and backed up by an employee of Xianxuing, a company that Wolfpack says is involved in this elaborate stock promotion scheme.

The report neglects to mention that Dr. Moore is the CEO of Whisper Aero, a direct competitor of EHang that is trying to develop a competitive advantage based on the advanced quality of its engines. His comments are entirely biased. Dr. Moore makes the allegation that EHang uses engines from the Chinese company T-Motor, I am not sure if Dr. Moore has looked at an EH-216 in person (EHang says he has not) or just looked at a photograph, but both EHang and T-Motor have denied this allegation.

Dr. Moore’s assertion that they have not invested enough to have an autonomous capability may well be his opinion but the EH-216 has flown autonomously in 40 cities spread over 8 countries including the U.S. and Canada.

The 216 has never crashed and it flies autonomously; the Wolfpack report is more rumor and opinion than fact.

Wolfpack alleges that the primary customer (Kunxiang) is in on the stock promotion scam and is not actually a customer. P6 of the report explains where they got this information. An investigator entered an office in China, where only one employee was present and introduced themselves as prospective buyers of an EHang-216. The employee told them that the EHang-216 was not very good, that they should buy one of his company’s drone products, and that Xunxiang had invested some money in EHang. So obviously, that is all true, the product is not good, and Xunxiang is a shareholder. Although Kunxiang does not make any drones, the employee and the office are not identified.

EHang has since provided the details of sales to Xunxiang.

EHang lists 22 sales, I have tried to find corroborating evidence for these sales. The internet provides plenty, videos from Xunxiang, Articles from newspapers.

I was able to verify 6 of the sales listed (using the internet to find a newspaper/video of a flight in the area mentioned).

Xunxiang is a real customer and is paying its bills. If Xunxiang does own any shares in EHang, then they own less than 0.06% of the company and are not one of the top 25 shareholders. EHang says it was not a shareholder pre IPO.

Not a real Company?

P3, Similar to frauds we have exposed in the past EHang’s headquarters was practically empty, with no security and no advanced manufacturing equipment.

Wolfpack provides some evidence in the form of various photos.

Many photographs on p6-9 show EHang parts in storage in some buildings, P12 and 13 photographs of a facility under renovation, and some photographs of unrelated company production lines. We get a photo of what looks like a swimming pool with an EHang logo and some derelict buildings.

In truth, the EHang Yunfu production facility is approximately 24,000 square meters in gross floor area. You can see a walk-through video of it here.

Having investigated the Wolfpack report, I believe it to be entirely false. However, it is easy to see how Wolfpack arrived at their view.

The EHang corporate structure is a big red flag for many

EHang is a Cayman-Island registered holding company conducting operations in China through a range of subsidiaries with opaque ownership, and contractual arrangements with related parties. The enforceability of these contracts is hard to understand. Its ADRs are traded in the U.S. and are on the SEC list for possible delisting. It just sounds like it might be a scam, and if you start from that viewpoint, the rest of the report is easier to understand.

The 20F annual report Page 4 covers the corporate structure and the risks therein. The quote below gives a flavor of the complexity of the structure.

Our WFOE has entered into a series of contractual arrangements with the VIE and its shareholders. These agreements enable us to:

• exercise effective control over EHang GZ;

• receive economic benefits from EHang GZ that potentially could be significant to EHang GZ; and

• have an exclusive option to purchase all or part of the equity interests and assets in EHang GZ, when and to the extent permitted by PRC laws.

These contractual arrangements among our WFOE, the VIE and its shareholders include shareholders voting proxy agreements, exclusive consulting and services agreements, exclusive option agreements, loan agreements, and share pledge agreements.

EHang Price Forecast and Financials

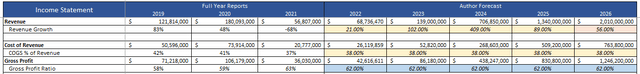

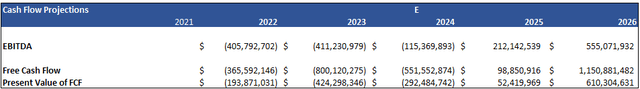

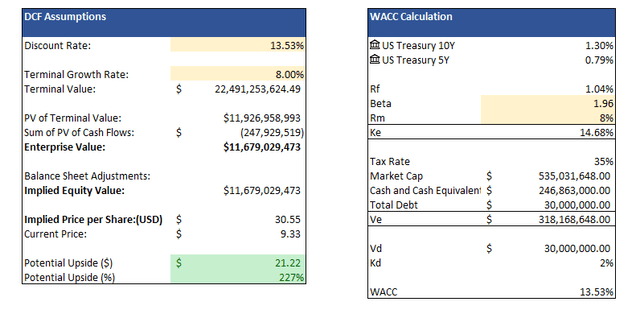

My portfolio shows that companies with a calculated high fair value (DCF from a model) relative to their current value have performed better this year than my other holdings. It has proven to be a robust measure during the more volatile times we are currently experiencing. Modeling of companies is a key part of my trading plan; I will present some key elements here that lead to my fair value calculation for EHang (EHang report in CNY, the model is in CNY).

EHang’s fair value comes out at $30 per share v. a current price of $8.310.

Revenue forecast comes from Wallstreet analyst and the author. I have assumed that type certification arrives next quarter, production begins in 2022, and that all existing orders are filled in 2023. Margin is from company guidance.

Revenue Forecast (CNY) (Author Model)

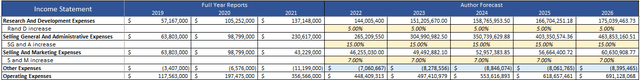

Major costs have been forecast to grow as follows (all by author in line with 10Q equivalent and management discussions)

Cost forecast (CNY) (Author Model)

Finally, I assumed that inventory and receivables would reduce to aerospace stock averages over the forecast period in a straight line. With these assumptions in place, the Model gives the following Cash Flow Forecast. (CNY)

EH Cash Flow Forecast (CNY) (Author Model)

In the final step of calculating the enterprise value, only the share price is in $U.S.

DCF calculation (Author Model)

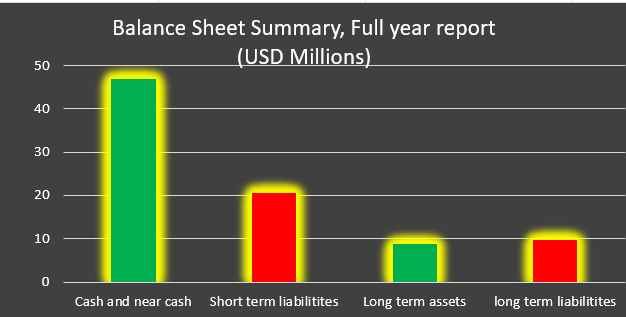

EHang Balance Sheet

EHang Balance Sheet Summary (USD) (Author Model)

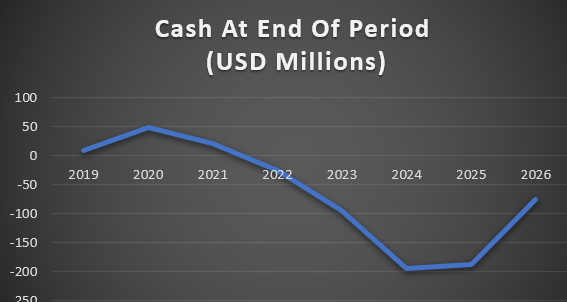

The balance sheet looks quite good. However, the model does suggest EHang will be unable to meet the revenue forecast without raising additional cash.

End of year cash forecast (USD Millions) (Author Model)

Earlier this month, EHang announced a $149 Million USD loan facility from a Chinese bank to help fund its move to full commercialization. This goes a long way to meeting the cash needs and will certainly be enough for the next 12 months. However, additional capital will still be needed and we can expect further dilution (following on from a 2.7% dilution this year).

Conclusion

EHang has a corporate structure that adds significant risk to any investment. It is at risk of delisting from the U.S. with 150 other Chinese operations, and exactly what you own when you buy an ADR in EHang is complicated. EHang will likely need to raise fresh capital in the next two years, adding further risk.

On the positive side, EHang has a unique product, it is leading the race to be the first company to have a fully certified eVTOL aircraft, and it is the first to have a commercially available product.

EHang has made multiple sales throughout Asia following successful test flights in 8 different countries.

Holding a position in EHang is likely to be a very bumpy ride. Ccertification, commercial production, and operations will all cause the stock to jump higher. However, the first aircraft accident will cause a share price collapse, and the ADR delisting issue will be an ongoing saga.

Be the first to comment