designprojects/iStock via Getty Images

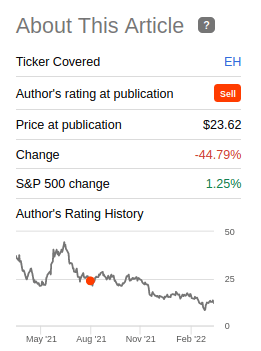

We wrote an article on EHang (NASDAQ:EH) about six months ago arguing that the valuation was ridiculous for such as speculative investment. So far we have been proven correct, with shares down 44% since then. For those wanting to learn the basics about the company, or our arguments back then we recommend reading that previous article. In here, we will focus mainly on why we believe the shares are still over-valued, and why we recommend investors continue to avoid the company.

Seeking Alpha

Q4 and FY 2021 Highlights

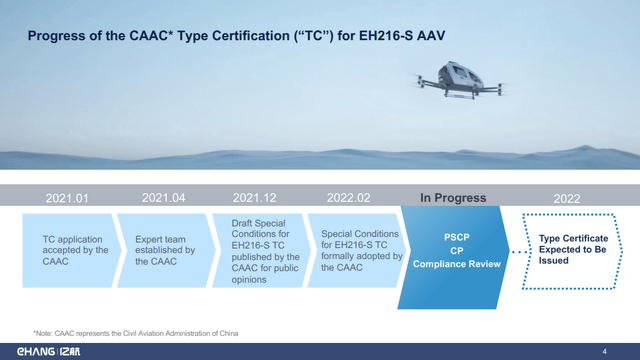

Before we delve into the financials, we’ll share some of the positive highlights the company has included in its quarterly results. One piece of good news is that the certification for the EH216 appears to be progressing well with the Civil Aviation Administration of China (CAAC). The Type Certificate is expected to be issued in 2022.

EHang Q4 and FY 2021 Earnings Highlights

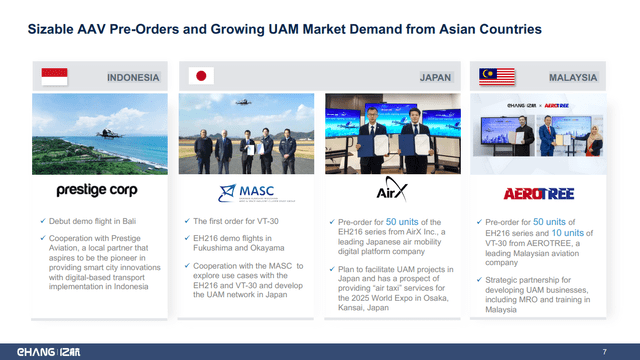

Similarly, the company shared several sizeable pre-orders from customers coming from different countries in Asia. Particularly relevant are the orders from AirX for 50 units of the EH216, and AEROTREE that pre-ordered another 50 units of the EH216.

EHang Q4 and FY 2021 Earnings Highlights

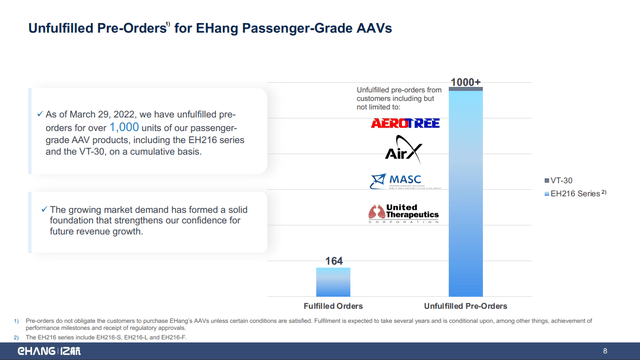

It all looks even more impressive when all the unfulfilled pre-ordered are stacked together. According to the company, it has 1,000 unfulfilled pre-orders for its passenger-grade AAV products, including the EH216 Series and the VT-30.

EHang Q4 and FY 2021 Earnings Highlights

Financials

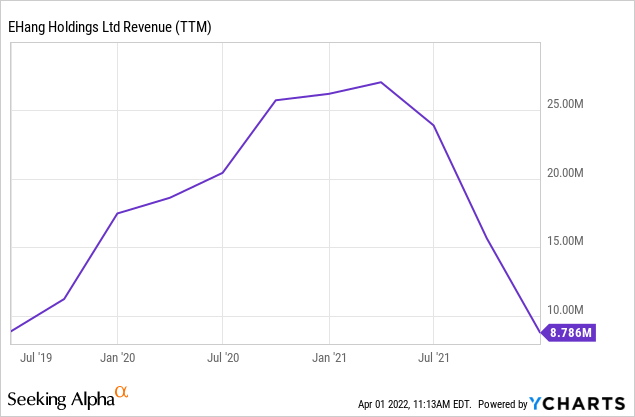

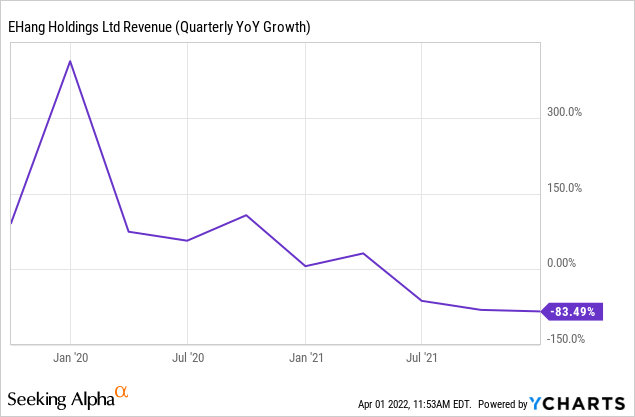

Unfortunately, when we get to the financials, things don’t look as pretty. As can be seen below, EHang’s revenue was very small at the beginning of its public life. But at least it was growing quickly until the start of 2021, then it started decreasing.

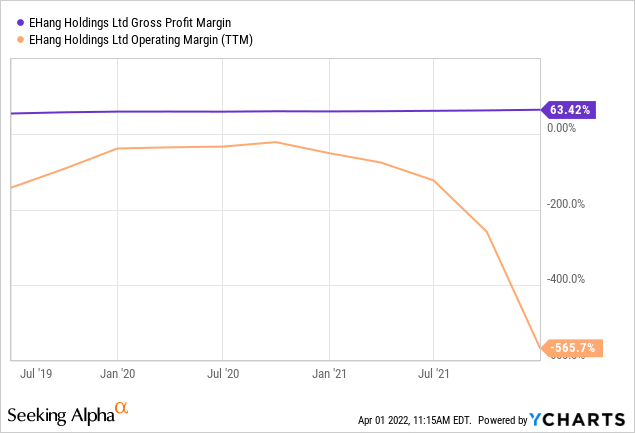

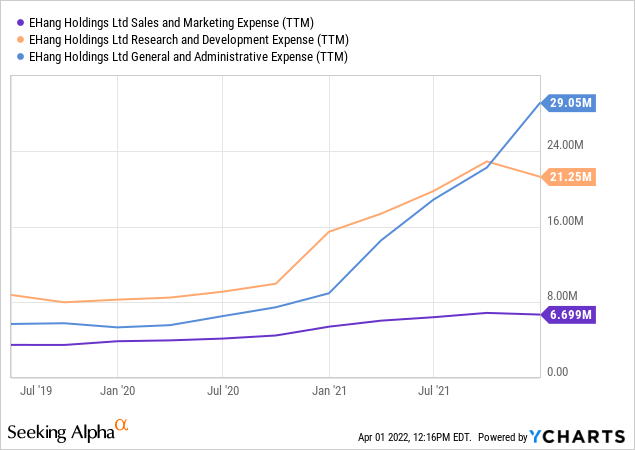

While the profit margin seems relatively healthy for a manufacturer, we are scared when we see how much the operating margin has deteriorated. Fixed costs such as general & administrative, sales & marketing, R&D, etc. must all be out of control at the company.

In fact, it appears the segment that is most out of control is general & administrative, which is not what you want to see in a technology company. We would be a little less worried if the expenses increasing exponentially were in the R&D segment, since at least it could mean the company was investing heavily in the future. To be fair, that is the second biggest segment and the company is not spending that much in sales & marketing. But if the company does not improve its cost control we do not see how it will even reach profitability.

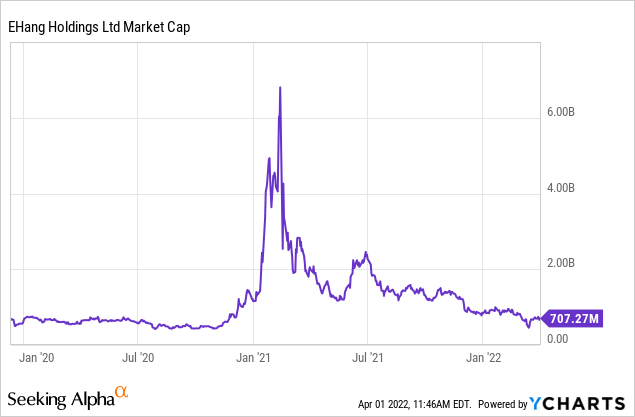

What we do not understand is how a company with trailing twelve months revenue of less than $10 million has a market cap of ~$700 million. Never-mind the time its market cap reached into the billions of dollars at the start of 2021.

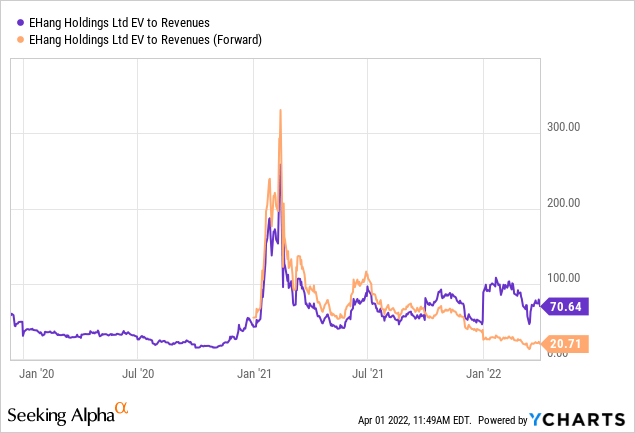

There is some optimism with all the pre-orders that revenue will significantly increase and that is why the EV/Revenues forward multiple is “only” 20x, while the trailing twelve months is above 70x.

The question is whether all the pre-orders can reverse what up to now has been a rapidly decelerating revenue growth, which actually became negative. It is understandable that the certification progress of the EH216 certainly brings some optimism and that analysts might be willing to give the company the benefit of the doubt. But the fact remains, the company is incredibly expensive for the level of sales it currently has, and it will take an impressive feat to reverse the current trends.

Conclusion

We think investors continue to be overly optimistic about the company’s prospects and that they are bound to be disappointed again. The valuation the company currently sports is too high for us to even consider a small speculative investment. We’ll continue to follow the company given the fact that we find it very interesting, but until we see significant sales and a clear path to profitability, we believe that it is better to stay away from the shares.

Be the first to comment