VioletaStoimenova

A Quick Take On eGain

eGain Corporation (NASDAQ:EGAN) reported its FQ1 2023 financial results on November 15, 2022, beating expected revenue and EPS estimates.

The company provides medium and large enterprises with customer engagement and success software.

Given the effects of slowing sales cycles that are already creeping into the firm’s results as well as higher customer churn in Europe, I’m on Hold for EGAN stock in the period ahead.

eGain Overview

Sunnyvale, California-based eGain was founded in 1997 to enable businesses to improve their customer-facing results via its integrated offerings.

The firm is headed by co-founder, Chairman and CEO Ashu Roy, who was previously co-founder of WhoWhere? and of Parsec Technologies.

The company’s primary offerings include:

-

Collaboration

-

Insight

-

Knowledge + AI

-

Services

- Marketplace

The firm acquires customers via its direct sales and marketing team as well as through channel partners and its marketplace.

eGain’s Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global market for customer engagement solutions was an estimated $15.5 billion in 2020 and is forecast to reach $30.9 billion by 2026.

This represents a forecast CAGR of 12.65% from 2021 to 2026.

The main drivers for this expected growth are a growth in technology solutions to improve the customer journey via any device they use to connect with businesses.

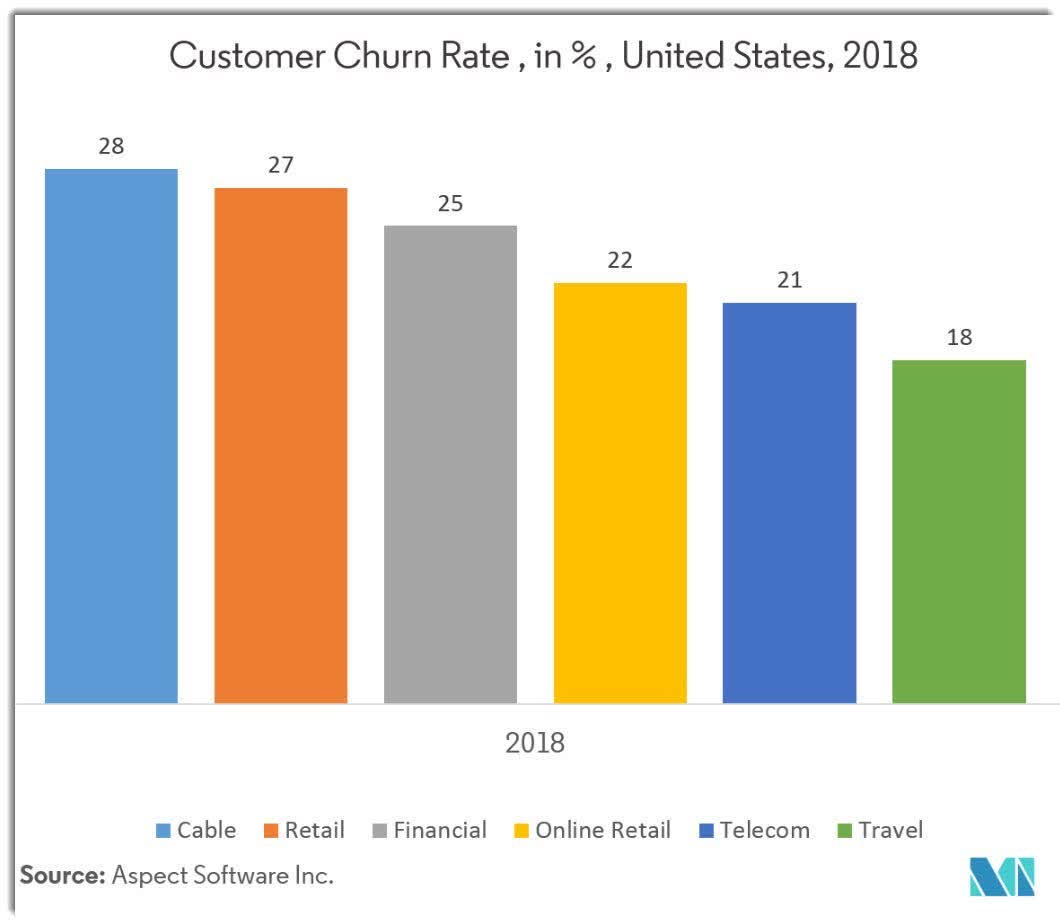

Also, a desire to reduce customer churn rate results in improved business financials and growing valuation.

Below is a chart showing the variation in customer churn rates in different industries in the U.S. in 2018:

U.S. Customer Churn Rate – 2018 (Mordor Intelligence)

Major competitive or other industry participants include:

-

IBM (IBM)

-

Microsoft (MSFT)

-

Nuance

-

Oracle (ORCL)

-

Salesforce (CRM)

-

Avaya (AVYA)

-

Calabrio

-

Aspect Software

-

Genesys

-

Verint Systems (VRNT)

-

NICE Ltd. (NICE)

-

Open Text (OTEX)

-

Pegasystems (PEGA)

-

EngageSmart (ESMT)

eGain’s Recent Financial Performance

-

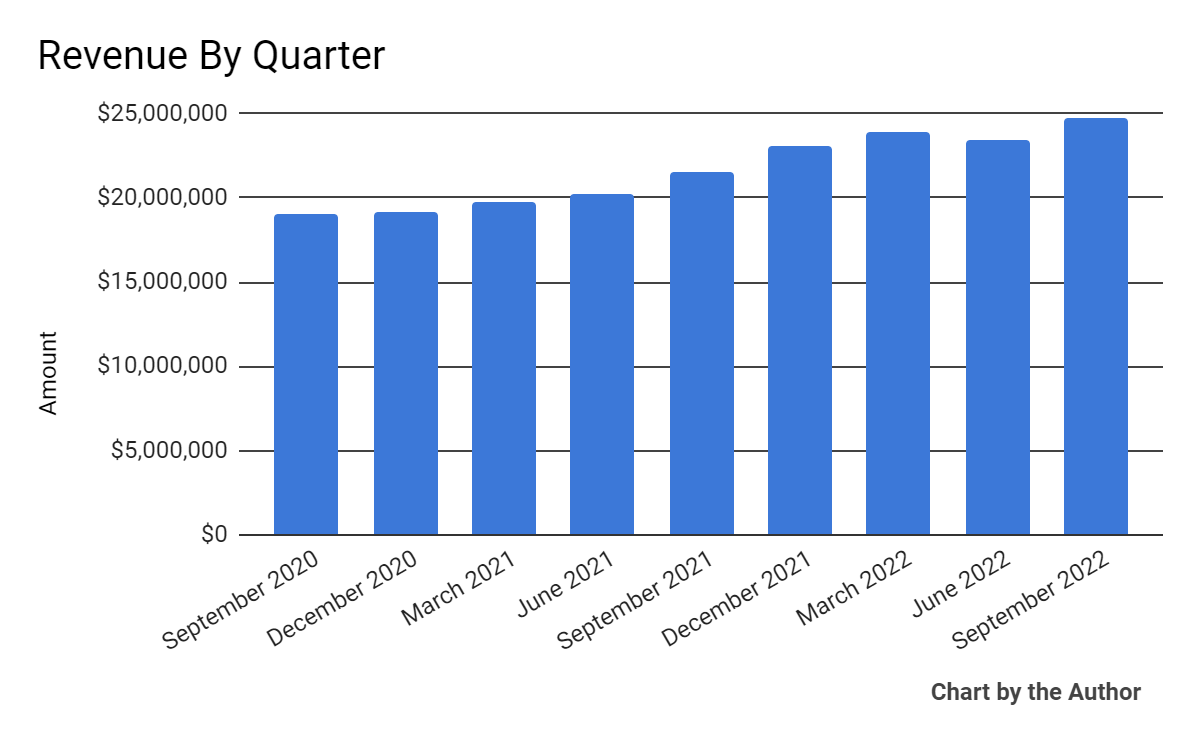

Total revenue by quarter has grown per the following chart:

Total Revenue (Seeking Alpha)

-

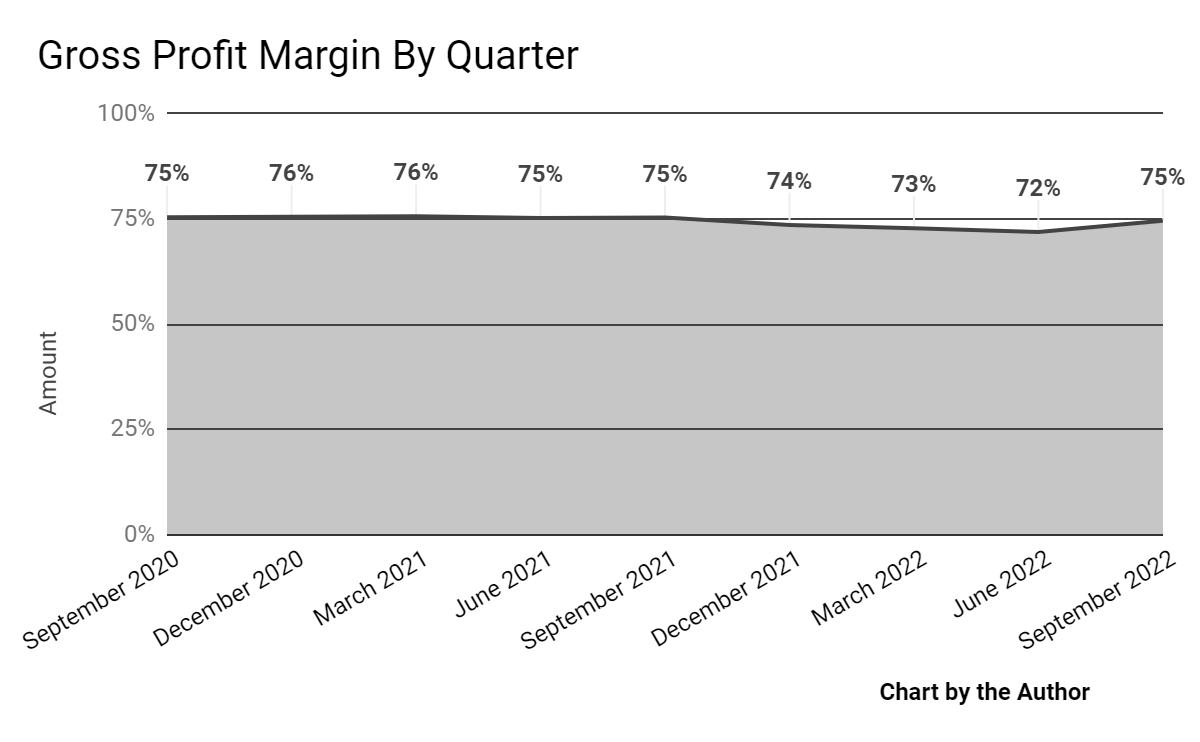

Gross profit margin by quarter has trended lower in recent quarters:

Gross Profit Margin (Seeking Alpha)

-

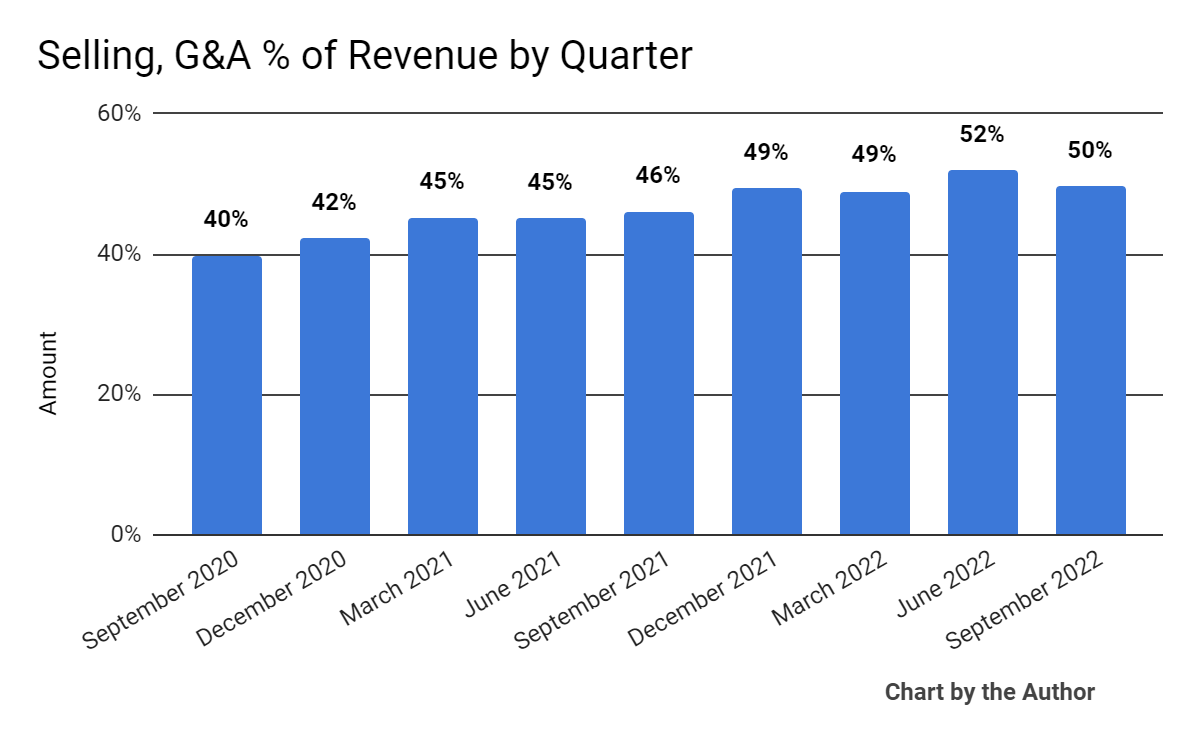

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher more recently:

Selling, G&A % Of Revenue (Seeking Alpha)

-

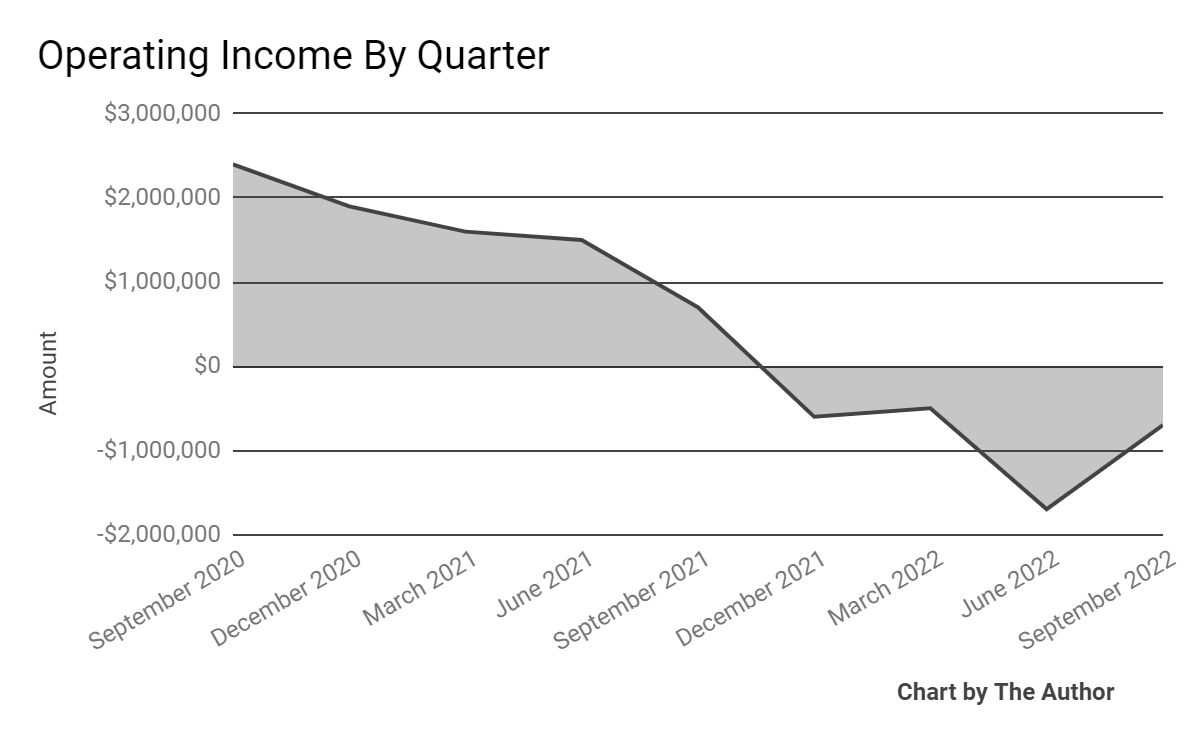

Operating income by quarter has turned negative in recent quarters:

Operating Income (Seeking Alpha)

-

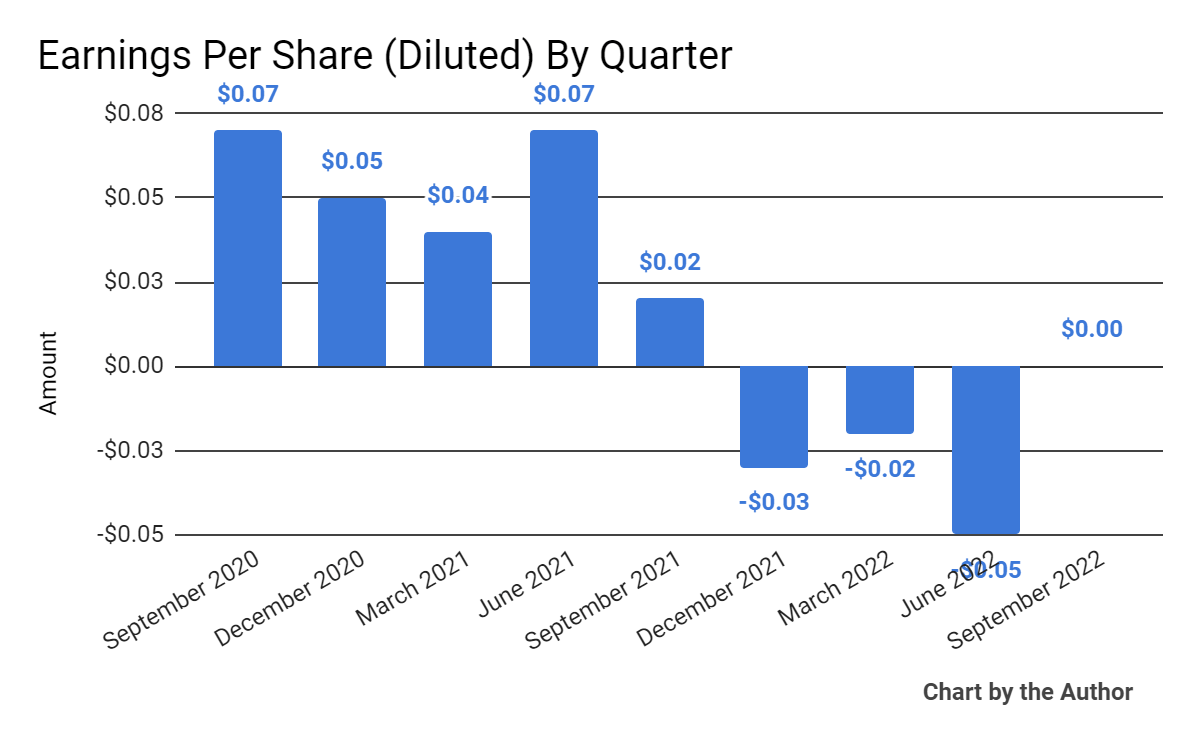

Earnings per share (Diluted) have turned negative in several recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

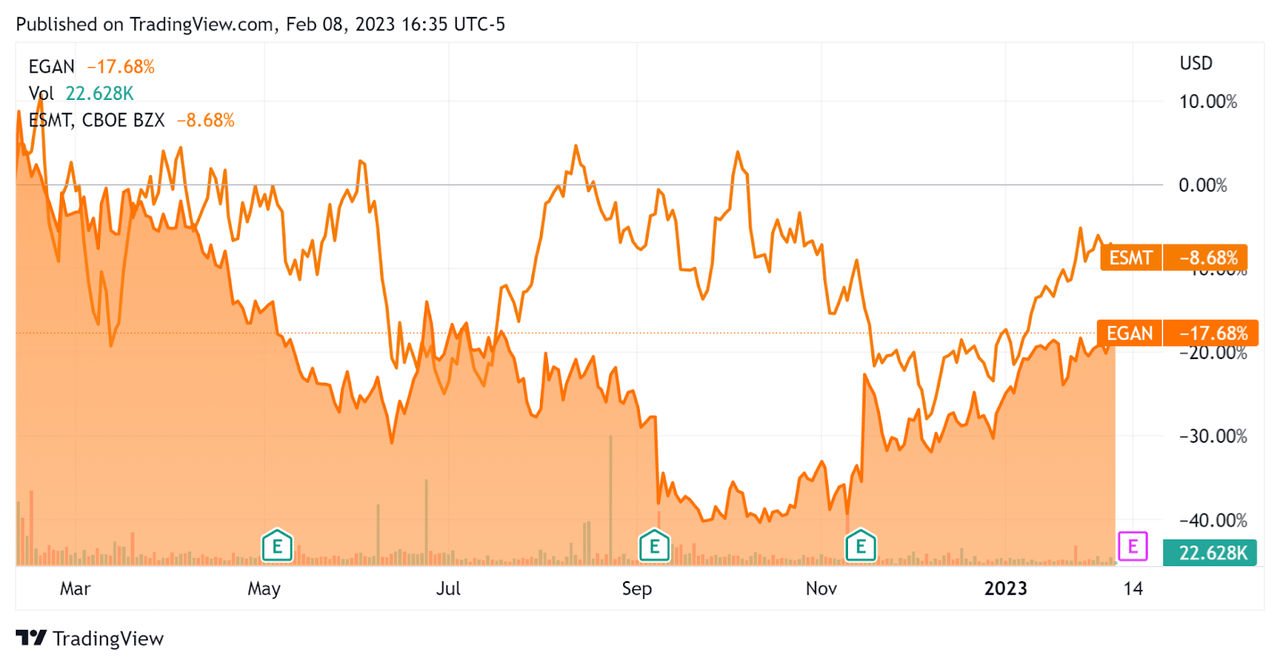

In the past 12 months, eGain’s stock price has fallen 17.7% vs. that of EngageSmart’s drop of 8.7%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For eGain

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.6 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

3.3 |

|

Revenue Growth Rate |

18.1% |

|

Net Income Margin |

-3.2% |

|

GAAP EBITDA % |

-3.2% |

|

Market Capitalization |

$311,992,224 |

|

Enterprise Value |

$243,759,216 |

|

Operating Cash Flow |

$1,711,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.10 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be EngageSmart; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

EngageSmart |

eGain Corporation |

Variance |

|

Enterprise Value / Sales |

10.8 |

2.6 |

-76.3% |

|

Enterprise Value / EBITDA |

103.2 |

NM |

–% |

|

Revenue Growth Rate |

41.1% |

18.1% |

-56.0% |

|

Net Income Margin |

5.2% |

-3.2% |

–% |

|

Operating Cash Flow |

$38,180,000 |

$1,711,000 |

-95.5% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

EGAN’s most recent GAAP Rule of 40 calculation was 14.9% as of FQ1 2023, so the firm is in need of material improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

18.1% |

|

GAAP EBITDA % |

-3.2% |

|

Total |

14.9% |

(Source – Seeking Alpha)

Commentary On eGain

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted the announcement of its eGain Marketplace and expects its partners to publish solutions for ‘gamification, compliance, analytics and much more.’

However, the firm is ‘seeing some challenges in [its] European business’, so management is pausing the hiring of the next batch of sales reps and turning its focus to making its existing sales efforts more efficient.

Also, the leadership said it plans to ‘take a more balanced approach to growth and profitability due to macroeconomic uncertainties.

As to its financial results, total revenue rose 20% year-over-year in constant currency, but only 15.3% on an as-reported basis.

The company’s LTM dollar-based retention rate was 103% versus 113% a year ago, indicating a negative environment for customer retention in its European region.

The firm’s Rule of 40 results have been in need of improvement, with a moderate revenue growth result dampened by a negative operating result contributing to a disappointing figure for this metric.

EGAN generated a GAAP operating loss and SG&A as a percentage of total revenue rose year-over-year.

At least earnings per share broke even during the quarter.

For the balance sheet, the firm finished the quarter with cash and equivalents of $71.5 million and no debt.

Over the trailing twelve months, free cash flow was $1.1 million, of which capital expenditures accounted for $600,000. The company paid a hefty $11.3 million in stock-based compensation in the last four quarters.

Looking ahead, management expects revenue growth for fiscal 2023 to be 10% at the midpoint of the range and GAAP net loss of $0.085 per share.

Regarding valuation, the market is valuing EGAN at an EV/Sales multiple of around 2.6x.

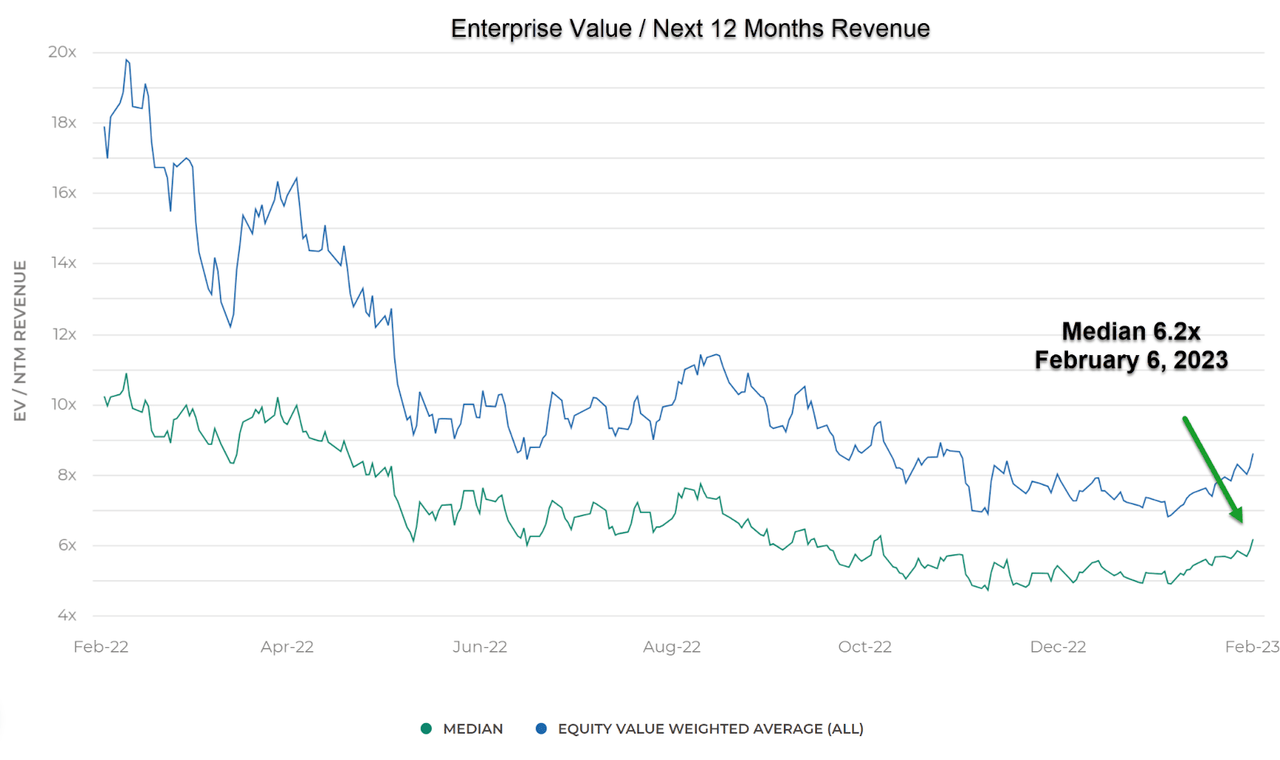

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.2x on February 6, 2023, as the chart shows here:

Enterprise Value / Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, EGAN is currently valued by the market at a significant discount to the broader Meritech Capital Index, at least as of February 6, 2023.

The primary risk to the company’s outlook is a likely macroeconomic slowdown, which may accelerate existing customer churn, produce slower sales cycles and reduce its revenue growth trajectory.

Given the effects of slowing sales cycles that are already creeping into the firm’s results as well as higher customer churn in Europe, I’m cautious about EGAN in the period ahead.

My outlook on EGAN is a Hold for the near term.

Be the first to comment