Daniel Balakov/E+ via Getty Images

Published on the Value Lab 21/6/22

Feeling has definitely changed in the markets, with rates breaking the TINA (“there is no alternative”) conditioning and sending stocks lower, despite the likelihood of rate increases having been well understood by most sophisticated market players and news outlets like Seeking Alpha. With Energias de Portugal, S.A. (OTCPK:EDPFY)(OTC:ELCPF) (“EDP”), we take some learnings about regulated utilities that remind us of a whole slew of ideas that could protect us from market dangers. We also see that hydrology is now an area that must be regarded with greater inherent risks, contrary to the opinion that hydropower is the most viable and solid source of renewable power. While EDP fares well in the face of adverse effects from impossible-to-control factors, the share price doesn’t reflect the economic direction and issues that could come from downstream.

Quick View Of Q1

Q1 was pretty recent, and while EDP usually doesn’t surprise, typically providing a stalwart performance typical of a high quality portfolio of generation assets and an otherwise solid utility, this quarter showed some serious issues coming from issues with hydropower.

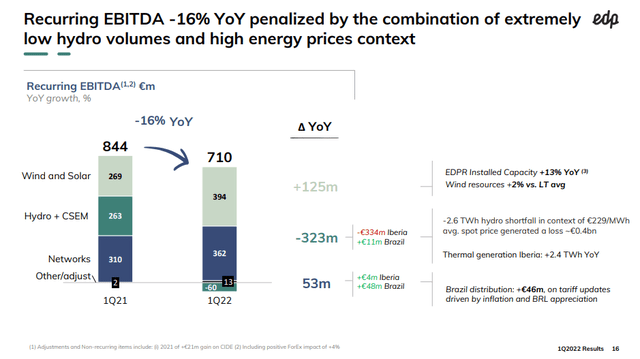

EBITDA Evolution (Q1 2022 Pres)

What happened is that droughts, about which we’ve been hearing a lot, have affected the EDP hydropower asset portfolio in Iberia. Where results from hydro usually dominate the EBITDA at attractive, rates, it has gone into negative territory YoY, masking some otherwise strong performances in the other segments.

What has happened here is that, due to droughts causing a shortfall in produced power, EDP has had to supplement the promised power offtakes with purchases on the wholesale market, essentially going short electricity prices, just when they are at record highs. It demolished profits from the segment. This was similar as to what happened with Enel Chile (ENIC) when it had its droughts, except they had CCGT assets to compensate. Running on high-priced gas, the input inflation similarly hurt EBITDA.

Looking At Regulated

What’s interesting are the results from the networks segment, which quietly grew substantially, helping EDP deal well with the total disappearance of a segment’s contribution. The reason networks performed well is that when companies like EDP operate a regulated utility concession such as distribution and transmission, which they operate in various regions including Spain and Brazil, they are remunerated according to a metric called regulated WACC that is paid from their regulated asset base (RAB). The RAB is the value of assets from government sanctioned projects that the regulated utility must CAPEX to develop once proposed and approved. Growing the RAB means growing regulated utility revenue, but also a higher regulated WACC. The regulated WACC grows automatically as interest rates rise, which they are as a consequence of inflation, and this improvement in the tariff structure helps hedge regulated businesses against inflation once interest rates finally rise.

Conclusions

Regulated utilities support excellent dividends, and are very reliable income except when tariff agreements expire and are subject to revision. With exposure to the Spanish authority, the CNMC, EDP don’t have an ideal counterparty, but tariff agreements are slated to last for several more years, so the deadline for potential change is far off. With the green agenda pushing more projects to upgrade electricity systems and support electrification, regulated utilities are a pretty good place to be knowing that the raising rates hedge their exposure to inflation. Moreover, EDP should see a recovery in hydrology. However, investors should consider droughts as a major hydrology risk for portfolios skewed towards hydropower, and while on a day-to-day hydro might be more reliable, solar and wind are in less structural danger.

EDP is currently hovering at the same levels since mid-2021. With the market taking a general discount, and risk premiums needing to be revised upwards on the rate increases, a utility like EDP shouldn’t sustain their levels when they might have bad debt risks to deal with as interest rates put pressure on households. Hydrology issues will likely persist into summer, and perhaps be a more common occurrence related to climate change. With a very selective approach right now, we pass on EDP on account of its levitating price.

Be the first to comment