gorodenkoff/iStock via Getty Images

The discovery of the CRISPR gene-editing tool has helped medical companies develop immunological defenses and curative systems against pathogens. Notable companies using this technology include CRISPR Therapeutics (CRSP), Intellia Therapeutics (NTLA), and Editas Medicine (NASDAQ:EDIT). Editas has an expansive pipeline under research. It includes Vivo gene-edited medicine such as EDIT-101, Ex-vivo gene-edited cell medicine such as EDIT-301 for sickle-cell treatment, and cellular therapy medicine.

Thesis

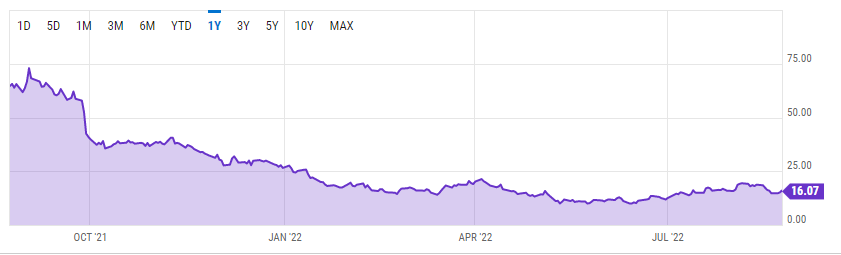

Editas Medicine announced the successful engrafting of a patient in the EDIT-301 Ruby trial for sickle cell anemia. With the lifting of the FDA’s partial clinical hold, the management expects to disclose top-line data for the trial before the end of 2022. This will not only give the engraftment outcomes but also provide the hematological parameters. However, EDIT has declined close to 75% in the past year as the stock is still far from commercializing its products

Q2 2022 saw Editas Medicine exceed earnings per share (EPS) estimates by $0.03 after hitting -$0.78 up from -$0.81. Despite quarterly revenue declining 5.88% to $6.4 million from $6.8 million in Q1 2022, it still managed to outshine consensus estimates by 49.18%. However, the stock has been on a perpetual downtrend since hitting its 52-week high of $73.03.

YCharts

For a better part of Q1 2022, EDIT’s shares traded above $16 after the U.S. Patent and Trademark Office ruled in favor of the company’s license provider. Broad Institute of MIT and Harvard were embroiled in a dispute, Emmanuelle Charpentier (founder of the gene-editing technique) over the patent owner of the CRISPR gene-editing technology. The patent office determined that Broad was the original inventor of the CRISPR/Cas9 used to make medicine by editing a particular human cell. Editas’ gene-editing methodology is licensed from Broad meaning that the ruling helped to secure the company’s business model.

Trial Experiment Success

EDIT’s engraftment trial experiment made positive headway in Q2 2022 after a patient was successfully treated for sickle cell disease. This announcement was a crucial development in the company’s CRISPR-based treatment technology. Towards, the end of 2021, the US FDA approved the supplemental New Drug Application (sNDA) for Oxbryta tablets. The drug produced by Global Blood Therapeutics (GBT) is used for the treatment of sickle cell disease in children aged 4 to less than 12 years old.

Using EDIT-301, Editas is attempting a similar methodology applied by its rival CRISPR Therapeutics. In partnership with Vertex Pharmaceuticals (VRTX), CRSP has advanced its sickle-cell treatment drug dubbed, CRISPR/Cas9 Gene-Editing Therapy or CTX001 which uses gene-edited stem cells.

Exa-Cel is CRSP’s lead candidate. It is currently being evaluated in two different phase III studies. They are CLIMB THAL-III and CLIMB SCD-121. Under this trial, Exa-Cel is under development for treating transfusion-dependent beta-thalassemia (TDT) and sickle-cell diseases (SCD). As stated earlier, CRSP is working in collaboration with VRTX to accomplish this end. Investors of CRSP expect the company to submit its therapy regulatory framework by late 2022.

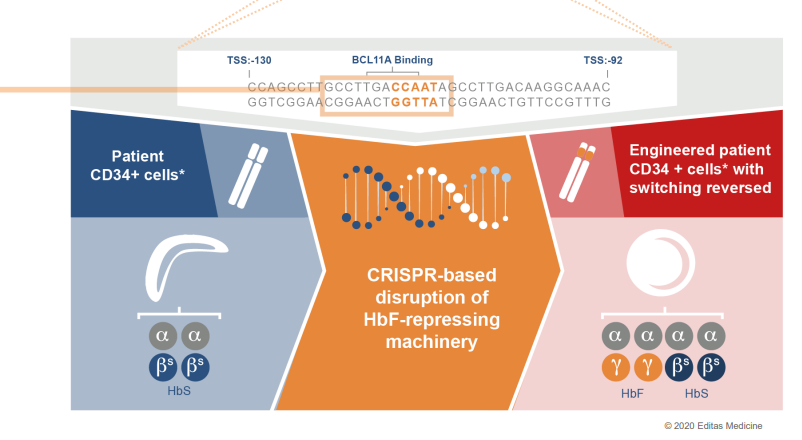

On its part, Editas is far behind CRSP in that it is still in Phase 1/2 of the RUBY Clinical Trial. This open-label clinical trial is testing the safety and effectiveness of the EDIT-301 in patients (with sickle-cell disease) aged 18 to 50. It began recruitment in 2021 and is expected to enroll up to 40 participants in the U.S. and Canada. Of importance is that the company’s EDIT-301 uses the AsCas12a proprietary enzyme engineered by Editas. Since the first patient dosed in the RUBY Trial showed successful signs of engrafting, it will be a wonderful position to benchmark their future commercialization process. To put it into perspective, the stem cell engineered by Editas (that is now under intellectual property rights) appeared to survive in the dosed patient thereby leading to the reproduction of new blood cells as expected by the company.

Editas

The company stated that it had successfully edited CD34+ cells from patients as it prepared to infuse them. Hopefully, after the reinfusion we expect Editas to announce the top-line clinical results by the end of 2022.

Additionally, the partial hold removed by the FDA for the RUBY Trial of EDIT-301 will allow Editas to include the efficacy data from the trial in marketing EDIT-301. Since the announcement of the partial hold removal by the FDA in July 2022, the stock has surged past 2% in the one-month analysis.

Aspects to Consider between EDIT-301 and CTX001

As stated earlier, CRISPR Therapeutics and Vertex launched two Phase 3 trials for CTX001 to determine its safety and efficacy back in May 2022. In essence, investors appear to consider the fact that CTX001 (as a potential treatment for SCD and TDT), will be launched in the market sooner thereby disparaging EDIT-301 (a possible reason for the declining share price). Still, shareholders will have to wait since enrolment is yet to be opened and the companies have not announced the study sites. The two trials are expected to finish in May 2026. This period will prove a pivotal time frame for EDIT to also develop its lead candidate.

Further, the Phase 3 trials for CTX001 are enrolling children aged 2 to 11. The first study the VX21-CTX001-151 will recruit children with severe Sickle-cell disease (SCD) that either fail to respond to hydroxyurea or are intolerant to it. The second trial, VX21-CTX001-141 will consider children with beta-thalassemia (TDT) – a blood disorder that lowers the production of hemoglobin. This aspect differs from the trial dynamics of EDIT-301 as it deals with adults aged 18 years to 50 years of age. The Phase 1/2 study trial of the EDIT-301 that started on May 4, 2021, is scheduled to end in August 2025.

After the studies are conducted and with CRSP scheduled to complete its phase 3 study in 2026, it will be the first to take its SCD and TDT product candidate to the market (upon approval by the FDA at the time). However, it can be argued that the pull-through from the approval of CTX001 will not address market concerns to a larger extent before Editas launches its commercialization process for EDIT-301.

In its earnings release for Q2 2022, EDIT stated that there will still exist a possibility for an increased number of untreated patients in case CTX001 is approved by the FDA. This is necessitated by challenges concerning site capacity (common in gene therapeutics) and negotiations of access and reimbursements.

Market Size

According to the Centers for Disease Control (CDC), up to 100,000 Americans are said to be affected by sickle cell disease. Analyzed racially, SCD affects one out of every 365 African-American births with a lower rate reported of 1 out of 16,300 Hispanic-American births. The increase in medicinal research has caused a continual decline in the mortality rate. The report shows that the global SCD treatment stood at $414.2 million in 2021. It is estimated to reach $593.4 million in 2028 growing at a CAGR of 5.3%. On a global scale, SCD is said to affect up to 20 million people.

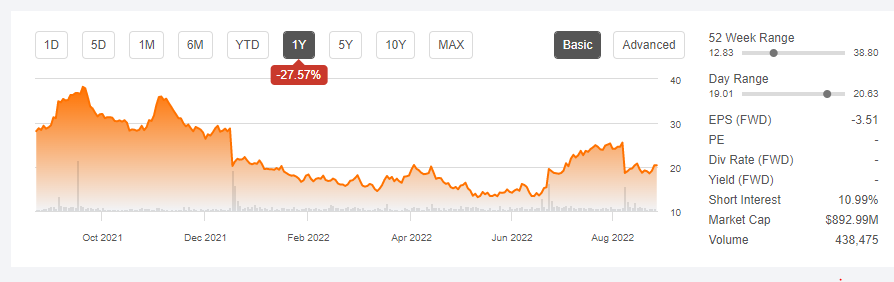

Bloomberg predicts that the gene therapy market will be worth $10 billion by 2028 growing at a CAGR of 20.4%. However, the gene therapy market is still lagging despite market participants partnering with other stakeholders to make licensing and development deals. For example, uniQure’s (QURE) is down 27.57% since August 2021 despite announcing the closure of its licensing agreement with therapeutics leader CSL Behring.

Seeking Alpha

In the long-term uniQure expects to use the license agreement to facilitate its commercialization of hemophilia B gene therapy. Revenues declined 86.67% to $0.5 million with market uncertainty hovering over the prospects of gene-editing.

Other Key Milestones Expected in 2022

EDIT announced in Q2 2022 that it had received the FDA Orphan Drug Designation to EDIT-301 for the treatment of TDT. The company is preparing to commence the Phase 1/2 clinical trial for this product candidate to test its safety, tolerability, and efficacy in TDT treatment. The company intends to dose its first TDT patient in 2022.

In the in-vivo space, EDIT announced that it had finished dosing its second patient in the BRILLIANCE trial for EDIT-101. The study is testing the efficacy of EDIT-101 as a treatment for Leber Congenital Amaurosis 10 (LCA10). It is an inherited retinal disease (IRD) that causes visual impairment or blindness in young children. There currently does not exist an approved drug to treat LCA10 meaning that this is a crucial area with an unmet medical need.

LCA10 is an autosomal recessive disease that affects 1 in 30,000 newborn children in Europe and North America. The population frequency in these two regions that are affected by LCA10 is 1 in every 50,000. Editas Medicine announced that it was expanding its adult cohorts and was on track to deliver a clinical update on the BRILLIANCE trial in H2 2022.

Risks to the Downside

EDIT reported a 16.76% decline in its cash basket from $203.52 million (as of December 2021) to $169.401 million in Q2 2022. Overall, the company’s asset balance has also decreased 14.27% to $580.8 million from an upside of $677.48 million in the six months leading to December 2021. Despite this decline, the company assured shareholders of its ability to fund its operating expenses and capital expenditures into 2024. With the company using $87 million in operating activities against a cash balance of $169.4 million, then it means it has almost 24 months to deplete its current reserve.

This assurance comes in the backdrop of a 5.89% increase in the accumulated deficit to $961.7 million from $908.2 million recorded in Q1 2022.

Editas Medicine has a history of high management turnover having appointed at least 4 CEOs since 2014. Executive Chairman James Mullen served until Q1 2022 (as CEO) before handing over to Gilmore O’Neill in the second quarter. EDIT operated without a chief medical officer after the exit of Lisa Michaels announced on Feb 7, 2022. The new CEO announced the appointment of Baisong Mei as the CMO. The company will need to work to boost investor confidence, especially in the leadership of the new management team.

Bottom Line

Editas Medicine announced the successful engraftment of a sickle-cell disease patient in the RUBY trial in Q2 2022. The company expects to release top line data for this trial before the end of the year 2022 after the lifting of the partial clinical hold by the FDA. However, with EDIT-301, Editas is still behind gene-editing clinical research leader CRISPR Therapeutics on SCD treatment currently in its third phase of the study. Additionally, the company is facing a risk of high management turnover that may affect investor confidence. On the upside, EDIT is working to capitalize on the inherited retinal disease (IRD) space that currently has no approved treatment using EDIT-101. For these reasons, we recommend a hold on this stock as we await product testing release updates before the end of the year.

Be the first to comment