andresr

EDAP (NASDAQ:EDAP) is a French medical device company that was known for its ESWL (extracorporeal shock wave lithotripsy) but it developed a HIFU (high-intensity focused ultrasound) robotic device, the Focal One, which is FDA approved for treating prostate cancer.

HIFU works through soft tissue ablation through ultrasound, a minimally-invasive alternative for intermediate-risk prostate cancer and salvage treatment.

The company got a bump in reimbursement, improving the attractiveness of the device, and there are still plenty of markets to pursue in the US and elsewhere.

In the coming years, the Focal One could be approved for multiple additional indications while the company is also successfully selling the ExactVu from strategic partner Exact Imaging, which is actually responsible for most of its revenue.

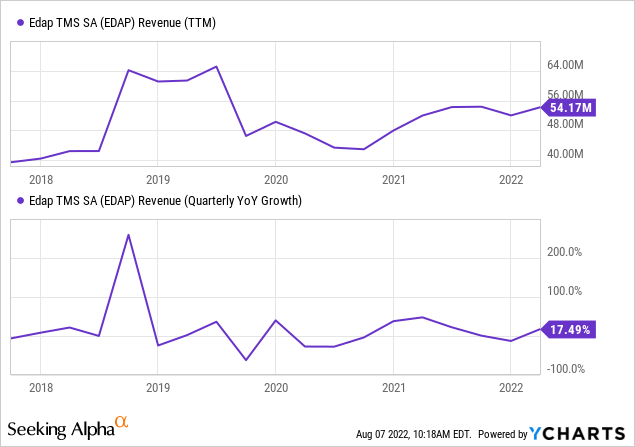

Growth

There was, not surprisingly, a dip in the early quarters of the pandemic but apart from the last two quarters of 2021, growth has returned:

The most important growth vectors are:

- Placing more machines

- Increasing procedures

- Improving reimbursement

- Additional indications

Placing more machines

Q1 was a pretty good quarter for placing new machines, with four Focal One Robotic HIFU units sold, three of which were sold in the US at prestigious academic hospitals.

Management argues that there is a growing pipeline, consisting of large academic hospitals but also increasingly community hospitals. Increasing the installed base also generates a tail of recurring revenues in the form of service contracts ($80K per year after year 1) and consumables (handpieces at $1800).

They had a very successful presentation at the AUA, the American Urological Association, the largest annual gathering of neurologists worldwide where they showcased the Focal One and supported an accredited AUA course with hands-on training. Management argued they received additional interest as a result of the AUA.

The company also sold nine ExactVu units (versus 5 in Q1/21), five of which were in the US, and one lithotripsy device for their legacy business (versus 6 in Q1/21).

Increasing usage

Management argued that the recently hired clinical sales managers had an immediate impact on usage within their existing customer base. They also engage in training programs for doctors to familiarize them with the Focal One.

They didn’t provide much detail on the CC about usage apart from noting that there was good usage momentum.

Reimbursement

The company does have a CPT (Current Procedural Terminology) code but management was disappointed when they were not bumped up to APC level 6, despite a unanimous conclusion from the advisory board.

However, as expected, this all changed in July when the company finally achieved the APC level 6 code and this almost doubled the reimbursement from $4506 to $8711 (on average, there are slight variations determined by local wage levels) per procedure for Medicare patients.

This not only increases the company’s revenues from Medicare patients, it also furthers market adoption; from the company PR:

The increase to APC level 6 has positive implications for patients beyond Medicare since many commercial payors have begun to cover focal HIFU for their members. Commercial payment and access policies are influenced by Medicare policy and reimbursement decisions.

Additional indications

- Endometriosis

- BPH treatment

- Pancreatic cancer

- Liver cancer

- Breast cancer

Endometriosis is furthest along as the company embarked on a (fairly small) P2 stage clinical trial which will end in September, with the first data expected before the end of the year. Other indications are further out.

Financials

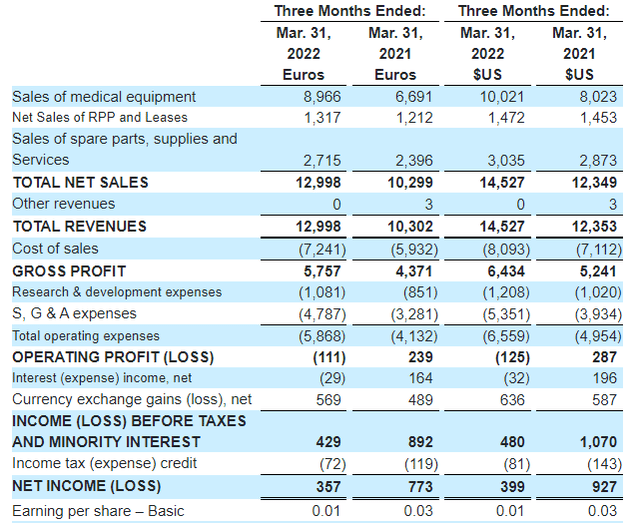

From the 6-K:

Results expressed in USD for Q2 will have some headwinds as the rate used in Q1 ($1.1177 euro per dollar) has come down considerably. Recurring revenues increased 17.5%, considerably less than the 44.4% rise in revenue from equipment.

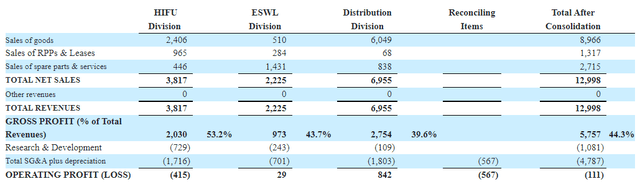

This isn’t all that surprising as the newly sold devices do not earn any service revenue for the first year. Disaggregated revenue looks like this:

It’s quite remarkable that the distribution division is still by far the biggest revenue generator, this is the sales of the ExactVu, which is a device made by Exact Imaging, not EDAP.

It’s also the division that turns what would otherwise be an operating loss into an operating profit. That exclusive distribution deal is doing both companies wonders, no doubt about it.

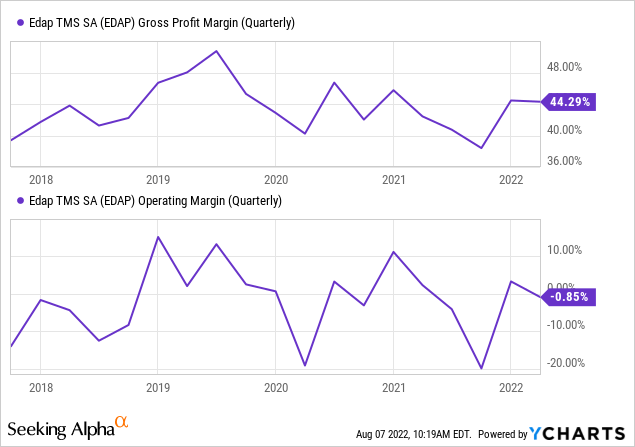

Margins

Since most of the sales come from the ExactVu, gross margins have suffered a bit since the start of 2021, but in the last two quarters, gross margins have recovered on economies of scale.

They had mixed messages about OpEx, on the one hand arguing its sales force has the right size but on the other hand arguing they will hire more salespeople.

We take the latter and clinical trials for additional indications will also add costs in the future.

There was already considerable operational leverage in non-GAAP with operating profit at EUR2.5M compared to just EUR0.3M in Q1/21.

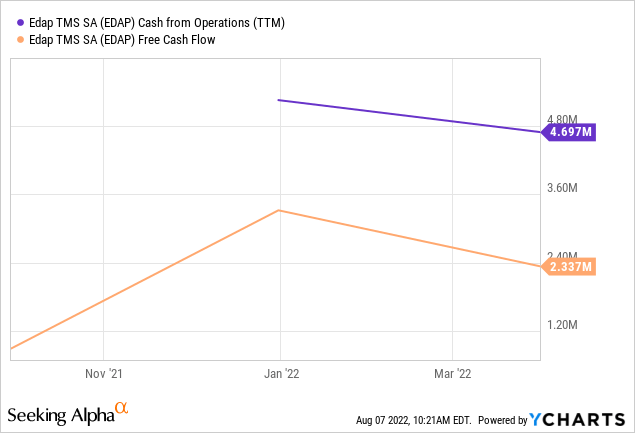

Cash

YCharts

The company has been generating cash lately and has plenty of cash left with EUR46.4M at the end of Q1 ($51.6M).

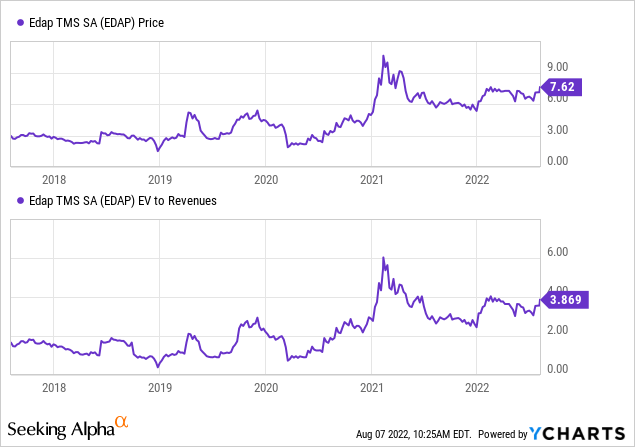

Valuation

(For some reasons only known to YCharts the graph will only show when the price is included).

In previous articles, we argued that the shares were modestly valued, but in investing all is relative and the valuation of EDAP has remained relatively stable, contrary to most other growth stocks.

Earnings multiples are likely to remain mildly negative with EPS estimates from analysts at -$0.10 this year and -$0.07 next year.

Conclusion

There is a lot to like:

- The company is making significant progress and the placing of Focal One devices is accelerating.

- Finally achieving APC level 6 reimbursement for Medicare patients not only nearly doubles revenues per procedure from Medicare patients, it also accelerates reimbursement from other payers and therefore significantly increases the incentives for adoption of the Focal One by hospitals.

- The company cleverly plugged the revenue gap with distribution sales of the ExactVu devices, but now the elements are in place for Focal One revenues to increase significantly.

- The economics of the Focal One should also considerably improve with the new level 6 ACP code.

The shares are not overvalued and they have held up pretty well during the small-cap growth share slaughter, most likely as investors expected the level 6 ACP code to emerge sooner rather than later.

Be the first to comment