niphon

Investment Thesis

I last covered Eaton Corp. (NYSE:ETN) in July and the company has outperformed the broader markets since then with its stock gaining mid single digit versus a mid single digit decline in S&P 500 (SPY). I expect the stock’s outperformance to continue. Eaton is experiencing strong demand in the commercial, industrial, data center, electrical, and utility end markets, which has led to increased orders in the last quarter. The increased orders and supply chain challenges have led to a record-level order backlog. With the supply chain constraints easing, the revenue growth is expected to improve sequentially in 2H FY22. The strong order backlog, improvement in supply chain issues, and healthy demand should support the revenue growth in 2H FY22 and FY23. In the long term, the company should benefit from the secular trend in digitization, electrification, and energy transition and the $370 bn in funding allocated by the U.S. government under the Inflation Reduction Act to deal with the climate crisis.

Eaton’s Revenue Growth Prospects

ETN is experiencing strong demand from its end markets, with significant strength in commercial, industrial, data center, residential, and electrical markets, benefiting the company’s order book. However, due to the supply chain constraints present in the market, the execution of these orders got delayed, leading to the building of a record-level backlog at the end of Q2 FY22. The strong demand in Eaton’s electrical business led to a backlog growth of 74% Y/Y in the last quarter. Approximately 75% of Eaton’s business in the Electrical segment is project-based. In the Electrical Americas segment, the company experienced substantial growth in commercial, residential, and industrial markets, leading to 29% Y/Y growth in new orders. The end markets were up in the range of 18% to 39% Y/Y. The increase in new orders benefited the order backlog growth and the backlog grew 89% Y/Y and 20% sequentially. In the Electrical Global segment, all the regions experienced strong demand in data centers, commercial, and industrial markets, supporting order growth of 19% Y/Y and backlog growth of 38% Y/Y.

In the Electrical segment, the order rate in the data center business was up 25% Y/Y. The orders related to the secular growth trends for the segment, which include digitization, energy transition, and electrification, have started to flow through the order book.

In the Aerospace segment, orders increased 19% Y/Y and the backlog was up 12% Y/Y due to the strength in commercial aftermarket and commercial OEM businesses. In the commercial market, the improvement in both domestic and international travel markets bodes well for future growth. The increased defense spending in the U.S. and other countries across the world post the Ukraine war is also acting as a tailwind for the segment’s growth. After the acquisition of Cobham in 2021, the aerospace segment generates revenue from commercial and defense markets equally. In the commercial market, both aftermarket and OEM businesses are well below the pre-COVID levels, which indicates further recovery potential for Eaton’s sales as the market normalizes.

Within the Vehicle segment, Eaton experienced strength in North America’s light vehicle markets and South America businesses last quarter, partially offset by the flat performance in Europe and the impact of COVID-related lockdowns in China. A sizeable portion of the Vehicle segment’s revenue comes from Chinese operations. With the reopening of the Chinese economy, the Vehicle segment’s revenue growth should improve in 2H FY22.

In July, Eaton completed the acquisition of a 50% stake in Jiangsu Huineng Electric, which manufactures low-voltage circuit breakers in China for the renewable energy market. This will be Eaton’s third electrical JV in China over the last eight months, allowing the company to expand in the region by offering a multi-tiered portfolio of products. This increases Eaton’s addressable market by about $17 bn, supporting the future growth of the company in the region.

Looking forward, I believe that as the supply chain constraints in materials (especially semiconductor chips) moderately improve, the company should be able to convert its backlog into revenue. The strong demand in the end markets, order backlog, and improvement in the supply chain should drive revenue growth in 2H FY22 and FY23. Last quarter, Eaton’s management raised its revenue guidance range for FY22 from 9% to 11% to 11% to 13% based on these strong near term trends. In the long term, ETN should benefit from the secular trend in digitization, electrification, and energy transition. Further, the $370 bn in funding allocated by the U.S. government under the Inflation Reduction Act should also benefit the company’s key end markets.

ETN Margins

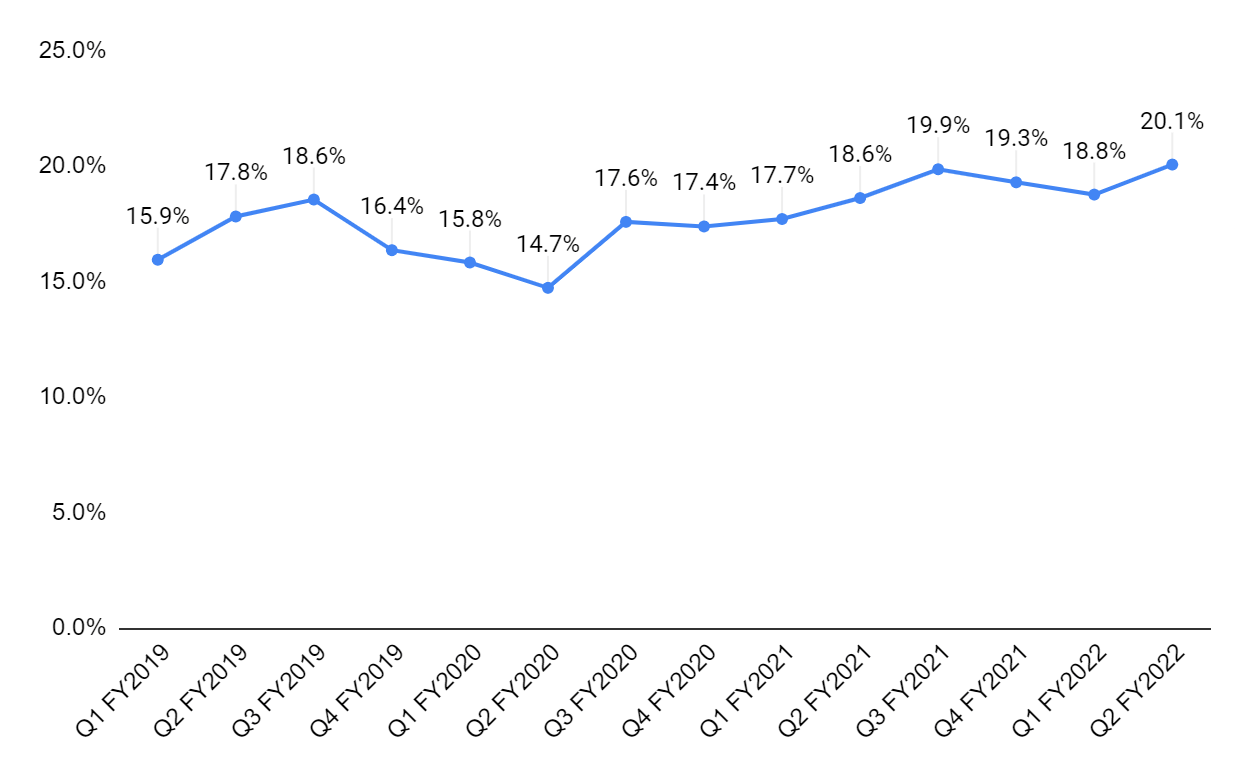

Eaton has been able to manage inflation through price hikes, which is reflected in its improved segment operating margin for Q2 FY22. The segment operating margin of the company in the quarter was up 150 bps Y/Y to 20.1%. The company’s margin is expected to improve sequentially with the improvement in sales and moderation in higher input costs. The segment operating margin is expected to be in the range of 20% to 20.4% for FY22, up 130 bps Y/Y at the midpoint of the range.

ETN’s segment operating margin (Company data, GS Analytics Research)

Valuation & Conclusion

The stock is currently trading at 17.68x FY22 consensus EPS estimate of $7.55 and 16.04X FY23 consensus EPS estimate of $8.32, which is close to its five-year average forward P/E of 19.11x. The revenue growth of the company in 2H FY22 and FY23 is supported by improvements in the supply chain, a strong order backlog, and strong demand in the end markets. The long-term growth should benefit from the secular trends in digitization, electrification, and energy transition along with the U.S. government funding to deal with the climate crisis. Hence, I have a buy rating on the stock.

Be the first to comment